South Dakota Plan of Merger between Micro Component Technology, Inc., MCT Acquisition, Inc. and Aseco Corporation

Description

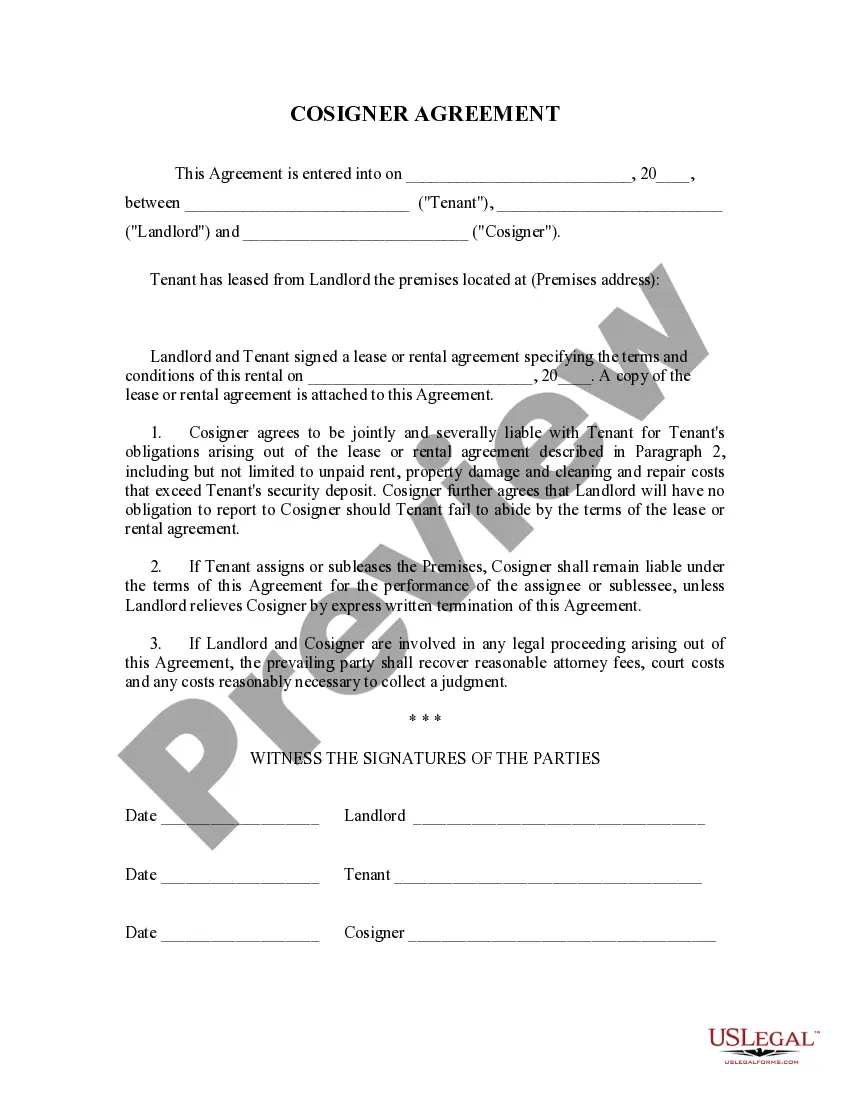

How to fill out Plan Of Merger Between Micro Component Technology, Inc., MCT Acquisition, Inc. And Aseco Corporation?

Are you within a placement the place you require paperwork for sometimes organization or individual reasons virtually every time? There are a variety of authorized papers layouts accessible on the Internet, but discovering kinds you can depend on is not effortless. US Legal Forms delivers a huge number of form layouts, much like the South Dakota Plan of Merger between Micro Component Technology, Inc., MCT Acquisition, Inc. and Aseco Corporation, which can be created to satisfy state and federal specifications.

When you are currently knowledgeable about US Legal Forms internet site and have a merchant account, basically log in. Afterward, it is possible to down load the South Dakota Plan of Merger between Micro Component Technology, Inc., MCT Acquisition, Inc. and Aseco Corporation web template.

Should you not offer an profile and would like to begin to use US Legal Forms, abide by these steps:

- Get the form you want and make sure it is to the appropriate area/county.

- Make use of the Preview key to check the shape.

- Read the outline to ensure that you have chosen the appropriate form.

- In case the form is not what you are looking for, take advantage of the Lookup area to obtain the form that meets your needs and specifications.

- Whenever you find the appropriate form, click Purchase now.

- Opt for the pricing program you desire, fill in the necessary details to generate your money, and pay for the order utilizing your PayPal or bank card.

- Choose a convenient paper file format and down load your version.

Find all the papers layouts you possess bought in the My Forms menu. You can aquire a more version of South Dakota Plan of Merger between Micro Component Technology, Inc., MCT Acquisition, Inc. and Aseco Corporation anytime, if possible. Just click the essential form to down load or print out the papers web template.

Use US Legal Forms, probably the most considerable assortment of authorized forms, in order to save some time and steer clear of errors. The assistance delivers professionally made authorized papers layouts which you can use for a range of reasons. Create a merchant account on US Legal Forms and begin producing your life a little easier.