South Dakota Joint Filing of Rule 13d-1(f)(1) Agreement

Description

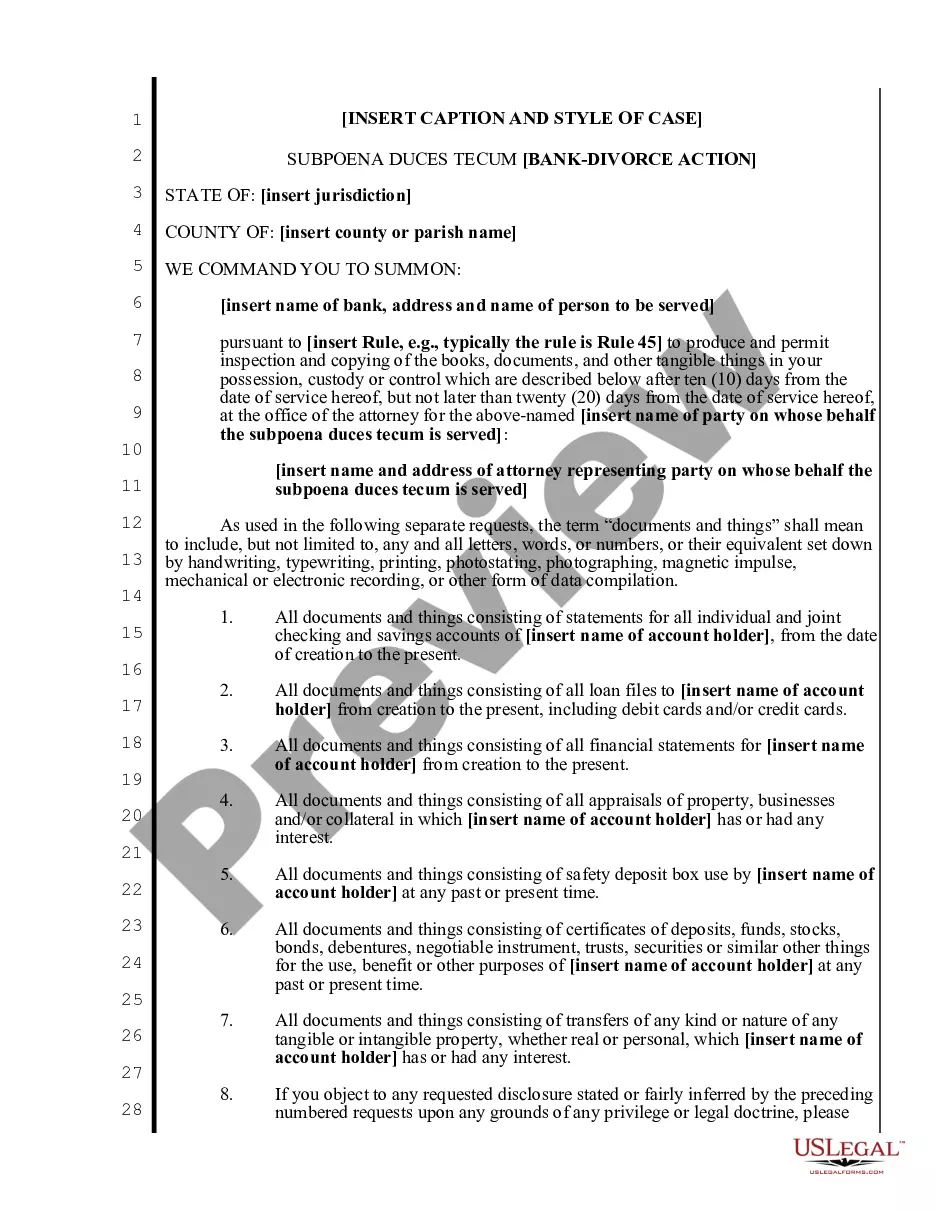

How to fill out Joint Filing Of Rule 13d-1(f)(1) Agreement?

Choosing the right legitimate record format might be a have difficulties. Of course, there are a lot of web templates available online, but how can you get the legitimate develop you need? Utilize the US Legal Forms web site. The assistance delivers 1000s of web templates, for example the South Dakota Joint Filing of Rule 13d-1(f)(1) Agreement, that you can use for business and private demands. Every one of the kinds are checked out by professionals and meet federal and state needs.

Should you be previously authorized, log in to your bank account and click on the Download option to find the South Dakota Joint Filing of Rule 13d-1(f)(1) Agreement. Make use of bank account to check from the legitimate kinds you may have ordered formerly. Go to the My Forms tab of your own bank account and acquire one more duplicate of the record you need.

Should you be a brand new consumer of US Legal Forms, listed here are straightforward instructions that you should follow:

- First, be sure you have chosen the appropriate develop for your personal area/county. It is possible to look over the form while using Preview option and read the form outline to ensure this is basically the best for you.

- When the develop is not going to meet your requirements, make use of the Seach industry to get the right develop.

- When you are sure that the form is proper, go through the Buy now option to find the develop.

- Pick the pricing program you want and enter the essential information. Make your bank account and pay for an order utilizing your PayPal bank account or Visa or Mastercard.

- Opt for the document formatting and obtain the legitimate record format to your gadget.

- Total, revise and print out and indication the attained South Dakota Joint Filing of Rule 13d-1(f)(1) Agreement.

US Legal Forms will be the most significant catalogue of legitimate kinds where you can discover various record web templates. Utilize the service to obtain appropriately-created paperwork that follow condition needs.

Form popularity

FAQ

Under the prior rule, new 13D filers, including those who previously filed a Schedule 13G, were required to file their initial Schedule 13D within 10 days after acquiring beneficial ownership of greater than 5% of a covered class of equity securities or losing 13G eligibility.

As described in more detail below, the amendments shorten the deadline for initial Schedule 13D filings from ten days to 5 business days, require that Schedule 13D amendments be filed within 2 business days, accelerate the filing deadlines for Schedule 13G beneficial ownership reports (the filing deadlines differ based ...

An investor with control intent must file Schedule 13D, while ?Exempt Investors? and investors without a control intent, such as ?Qualified Institutional Investors? and ?Passive Investors,? file Schedule 13G.

As described in more detail below, the amendments shorten the deadline for initial Schedule 13D filings from ten days to 5 business days, require that Schedule 13D amendments be filed within 2 business days, accelerate the filing deadlines for Schedule 13G beneficial ownership reports (the filing deadlines differ based ... SEC Adopts Changes to Schedule 13D and Schedule 13G wyrick.com ? news-insights ? sec-adopts-ch... wyrick.com ? news-insights ? sec-adopts-ch...

To make it easier for investors and markets to access, compile and analyze information disclosed on Schedules 13D and 13G, the amendments require that these filings use a structured, machine-readable XML-based language. This requirement applies to all information disclosed on Schedules 13D and 13G (excluding exhibits). SEC Adopts Rule Amendments to Modernize Beneficial ... White & Case ? Our Thinking White & Case ? Our Thinking

Under the prior rule, new 13D filers, including those who previously filed a Schedule 13G, were required to file their initial Schedule 13D within 10 days after acquiring beneficial ownership of greater than 5% of a covered class of equity securities or losing 13G eligibility. SEC Accelerates Schedule 13D/G Filing Deadlines and ... Shearman & Sterling ? perspectives ? 2023/10 Shearman & Sterling ? perspectives ? 2023/10

Rule 13d-1(d) is the ?Exempt Investor? exemption and provides that a person who otherwise was exempt from filing a Schedule 13D, (1) because of an exemption provided by Section 13(d)(6)(A) or (B) of the Exchange Act, (2) because the beneficial ownership was acquired prior to December 22, 1970 or (3) because the person ...

Schedule 13G is a shorter version of Schedule 13D with fewer reporting requirements. Schedule 13G can be filed in lieu of the SEC Schedule 13D form as long as the filer meets one of several exemptions. Schedule 13G: Definition, Who Files It, and What It's Used For investopedia.com ? terms investopedia.com ? terms