South Dakota Leased Personal Property Workform

Description

How to fill out Leased Personal Property Workform?

US Legal Forms - one of the most prominent repositories of legal documents in the USA - offers a broad selection of legal document templates you can obtain or print.

While navigating the site, you can find a vast array of forms for business and personal purposes, organized by categories, states, or keywords. You can access the latest versions of forms such as the South Dakota Leased Personal Property Workform within moments.

If you have a monthly subscription, Log In and obtain the South Dakota Leased Personal Property Workform from your US Legal Forms library. The Obtain button will appear on each form you view. You have access to all previously saved forms from the My documents tab in your account.

Make changes. Fill out, modify, print, and sign the saved South Dakota Leased Personal Property Workform.

Every template you added to your account has no expiration date and belongs to you permanently. Therefore, if you wish to obtain or print another version, simply navigate to the My documents section and click on the form you need. Access the South Dakota Leased Personal Property Workform with US Legal Forms, the most comprehensive library of legal document templates. Utilize a wide range of professional and state-specific templates that meet your business or personal needs and requirements.

- If you want to use US Legal Forms for the first time, here are simple instructions to get you started.

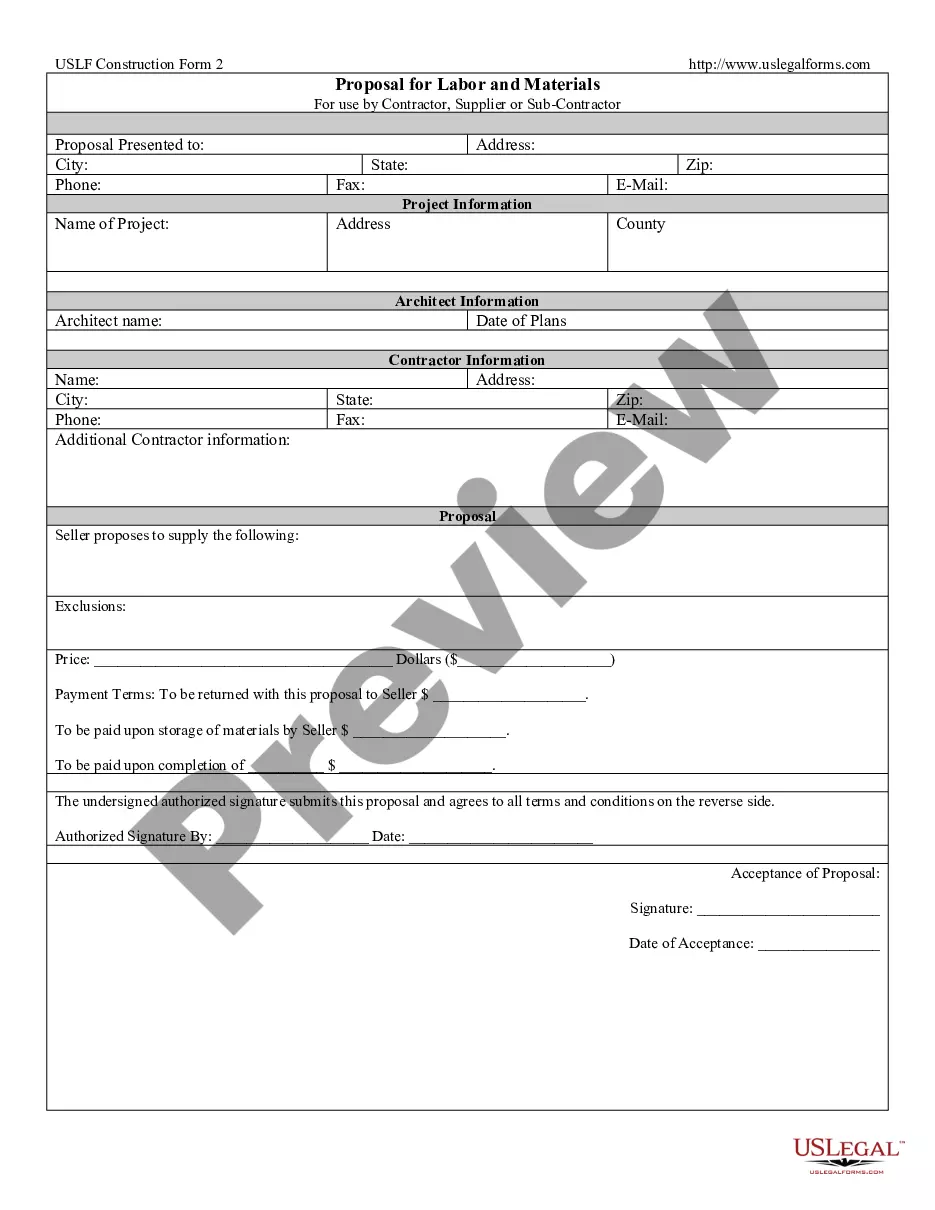

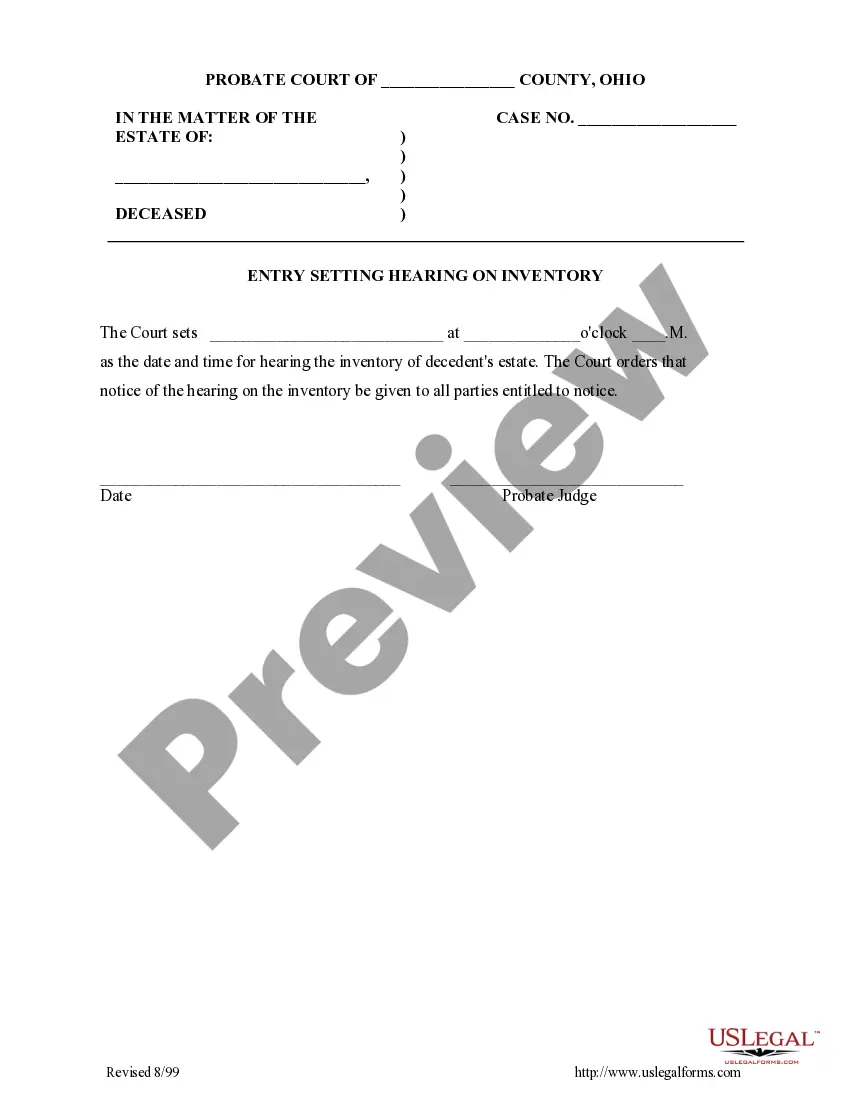

- Ensure you have chosen the correct form for your city/county. Click the Preview button to review the content of the form. Read the description of the form to confirm you have selected the right one.

- If the form does not meet your needs, utilize the Search box at the top of the screen to find the suitable one.

- If you are satisfied with the form, confirm your choice by clicking the Purchase now button. Then, choose the payment plan you prefer and provide your credentials to register for an account.

- Process the purchase. Use your credit card or PayPal account to complete the transaction.

- Select the format and download the form to your device.

Form popularity

FAQ

Self-employed individuals in South Dakota are subject to self-employment tax, which primarily funds Social Security and Medicare. The current self-employment tax rate is 15.3% on net earnings. If you're managing leased personal property, utilizing the South Dakota Leased Personal Property Workform can aid you in simplifying your tax reporting. Proper documentation ensures that your financial responsibilities are met accurately.

In South Dakota, there is no specific age at which residents can stop paying property taxes. However, senior citizens who are 65 years or older may qualify for property tax relief programs. It's important to complete the South Dakota Leased Personal Property Workform correctly to take advantage of any available exemptions. Understanding these incentives can ease the financial burden of property taxes for seniors.

Yes, South Dakota does impose a vehicle property tax. This tax is assessed on vehicles that are owned and operated within the state. To ensure compliance, you may need to fill out the South Dakota Leased Personal Property Workform. This form helps clarify the status of your vehicle and assists in determining your tax obligations.

The property tax relief bill in South Dakota aims to ease the financial burden on property owners by reducing the taxable value of leased personal property. This initiative directly impacts those using the South Dakota Leased Personal Property Workform, making it easier to manage taxes related to leased items. By simplifying the process, property owners can save time and resources while ensuring compliance with state regulations. For more details and assistance, consider using the US Legal Forms platform, which offers helpful resources and forms tailored to South Dakota homeowners.

South Dakota business owners benefit from: No corporate income tax. No personal income tax. No personal property tax.

South Dakota does not have an individual income tax. South Dakota also does not have a corporate income tax. South Dakota has a 4.50 percent state sales tax rate, a max local sales tax rate of 4.50 percent, and an average combined state and local sales tax rate of 6.40 percent.

Lease and Rental ServicesGross receipts from the lease or rental of tangible personal property are subject to the state sales tax, plus applicable municipal sales tax. Sales tax also applies to any buy-out payments at the end of a lease.

Several examples of items that exempt from South Dakota sales tax are prescription medications, farm machinery, advertising services, replacement parts, and livestock. These categories may have some further qualifications before the special rate applies, such as a price cap on clothing items.

Yes, rental income is taxable, but that doesn't mean everything you collect from your tenants is taxable. You're allowed to reduce your rental income by subtracting expenses that you incur to get your property ready to rent, and then to maintain it as a rental.

Be 65 years of age or older OR disabled (as defined by the Social Security Act). You must own the property. Income limits apply.