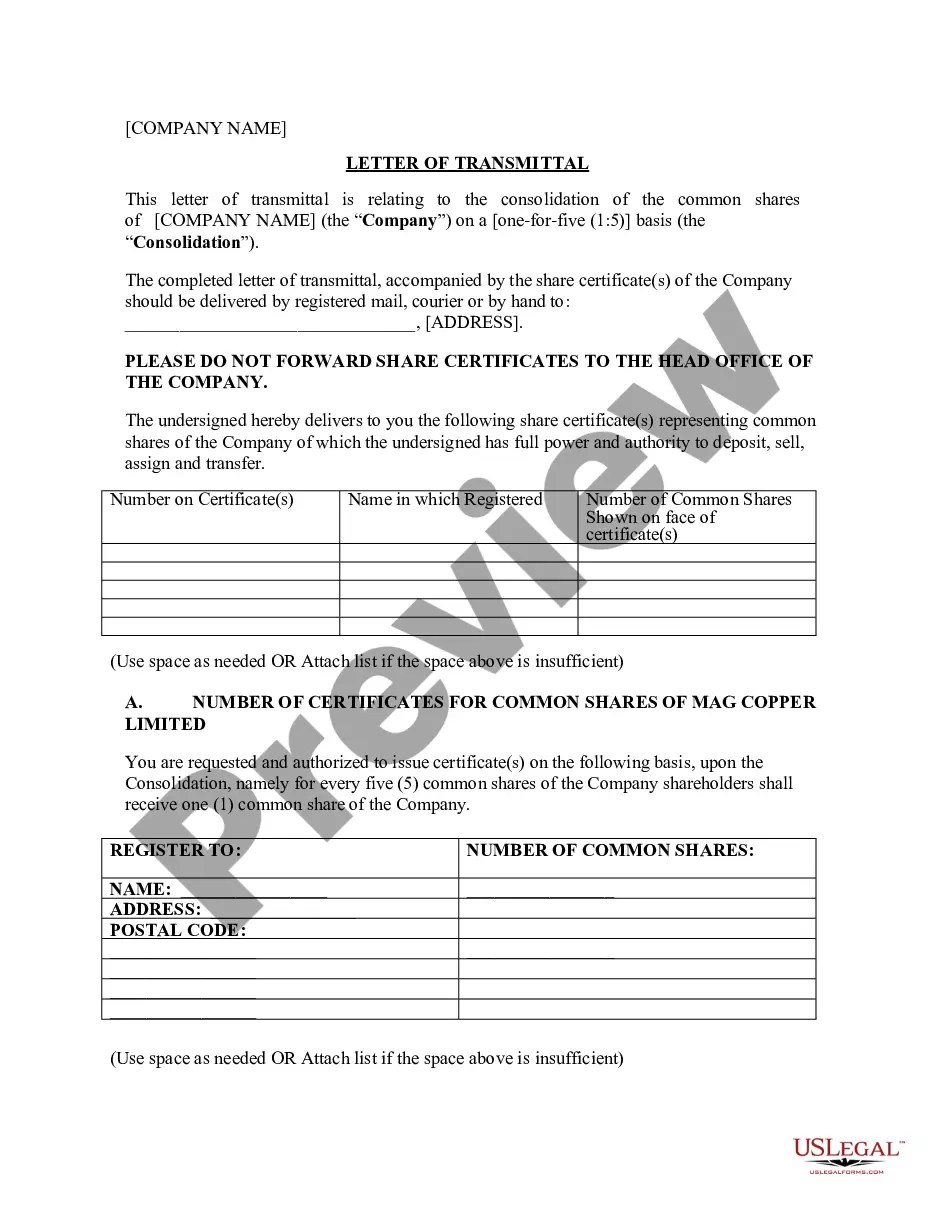

This due diligence form is a detailed summary to be completed for each acquisition or divestiture agreement performed within the company regarding business transactions.

South Dakota Acquisition Divestiture Merger Agreement Summary

Description

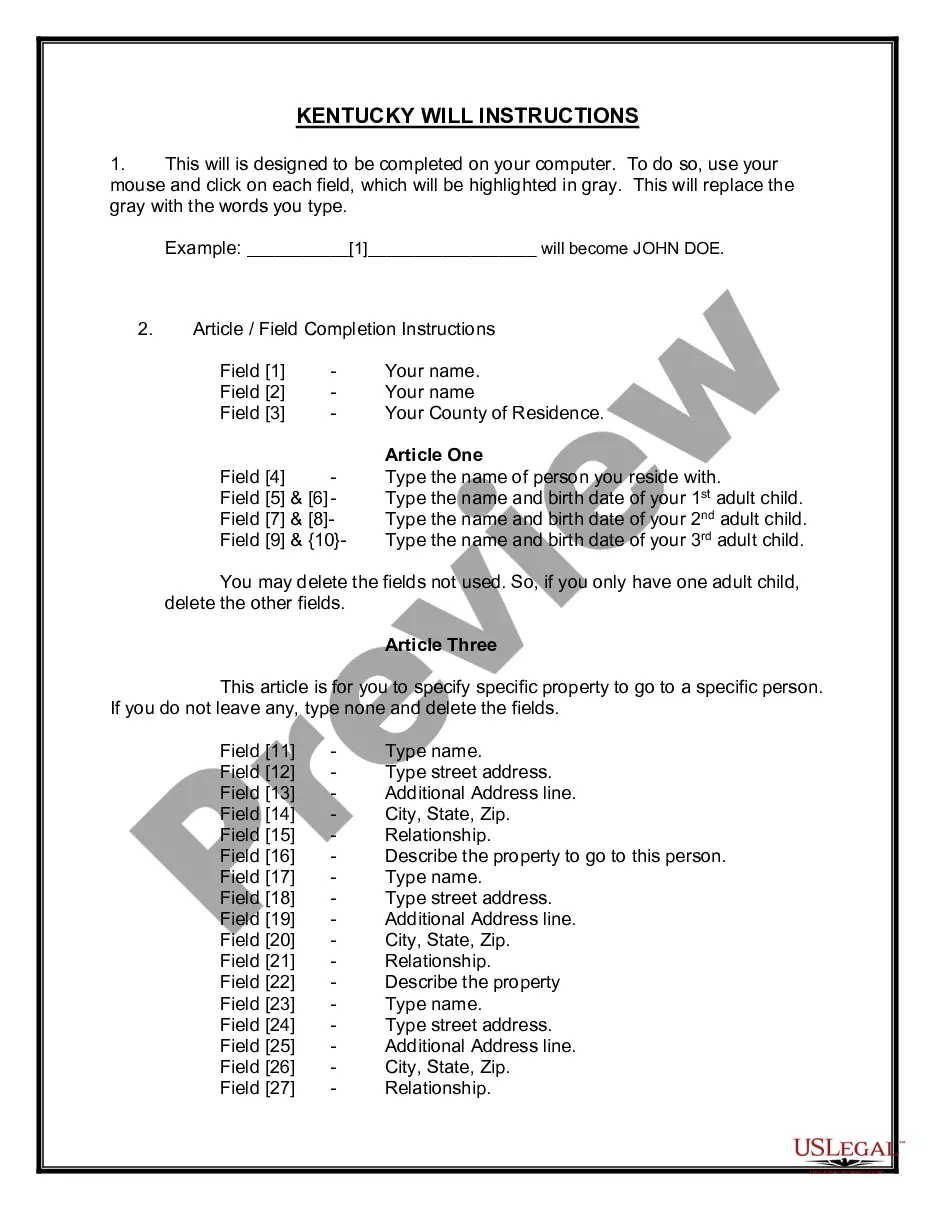

How to fill out Acquisition Divestiture Merger Agreement Summary?

Have you ever found yourself in a situation where you require documents for potentially organizational or specific reasons almost every workday? There are numerous official document templates available online, but locating ones you can trust is not simple. US Legal Forms offers a wide array of document templates, including the South Dakota Acquisition Divestiture Merger Agreement Summary, which is designed to fulfill federal and state regulations.

If you are already familiar with the US Legal Forms website and possess an account, simply Log In. After that, you can download the South Dakota Acquisition Divestiture Merger Agreement Summary template.

If you do not have an account and wish to start using US Legal Forms, follow these steps.

Access all the document templates you have purchased in the My documents section. You can download an additional copy of the South Dakota Acquisition Divestiture Merger Agreement Summary whenever needed. Simply click the appropriate form to download or print the document template.

Utilize US Legal Forms, the largest collection of legal forms, to save time and avoid mistakes. The service provides properly crafted legal document templates that can be used for a variety of purposes. Create an account on US Legal Forms and start making your life easier.

- Locate the form you require and ensure it is for your appropriate city/state.

- Utilize the Preview button to review the form.

- Examine the summary to ensure you have selected the correct form.

- If the form is not what you're looking for, use the Search section to find the form that meets your needs and requirements.

- Once you find the correct form, click on Get now.

- Select the pricing plan you want, complete the necessary information to create your account, and pay for the transaction using your PayPal or Visa or Mastercard.

- Choose a convenient document format and download your copy.

Form popularity

FAQ

To obtain a power of attorney in South Dakota, you need to draft a document stating your intentions and the authority granted to another person. It is advisable to include specific powers and limits for clarity. While notarization is not mandatory, it adds a layer of protection. For more detailed guidance on creating legal documents, refer to the South Dakota Acquisition Divestiture Merger Agreement Summary to ensure compliance with state laws.

If a power of attorney is not notarized in South Dakota, it may still be valid, but its acceptance could vary among institutions or entities. Some businesses or banks may require notarization for transactions, so it is essential to check their policies. For assurance in legal matters, consider using resources like the South Dakota Acquisition Divestiture Merger Agreement Summary to understand best practices for creating binding documents.

Closing a business in South Dakota involves several steps, including notifying employees, paying off debts, and filing the necessary dissolution paperwork with the Secretary of State. You will also need to cancel any business licenses and permits associated with your company. It's crucial to follow state laws to avoid potential legal complications. The South Dakota Acquisition Divestiture Merger Agreement Summary can further assist you in navigating this process efficiently.

Most banks in South Dakota offer notarization services, including for powers of attorney. However, the availability of this service can vary by location, so it is wise to call ahead. Notarizing your power of attorney can enhance its legitimacy and help in legal situations. For more insights into legal forms and requirements, the South Dakota Acquisition Divestiture Merger Agreement Summary provides useful information.

In South Dakota, a salvage title is issued when a vehicle is declared a total loss by an insurance company. The owner must apply for a salvage title promptly to ensure compliance with state regulations. This process typically requires proof of loss and damage, along with any relevant insurance documentation. To better understand the implications for vehicle ownership, refer to the South Dakota Acquisition Divestiture Merger Agreement Summary.

In South Dakota, a power of attorney does not need notarization to be valid, but having it notarized is recommended. This can help establish the document's authenticity and prevent disputes. Additionally, if you plan to use it for certain transactions, like real estate, notarization is often required. To learn more about legal documents and processes, consider the South Dakota Acquisition Divestiture Merger Agreement Summary for a comprehensive understanding.

The 22-42-5 law in South Dakota addresses the offense of providing false information to law enforcement during an investigation. This law emphasizes the importance of truthfulness and can lead to severe legal consequences if violated. Engaging with legal professionals can clarify this statute and its implications for those involved in acquisitions or mergers. A South Dakota Acquisition Divestiture Merger Agreement Summary could also include compliance considerations related to this law.

The one bite rule in South Dakota refers to the legal principle that dog owners may not be held liable for their pet's first bite unless there is evidence of prior aggressive behavior. This rule means that if your dog attacks someone without any history of aggression, you may not face legal repercussions. However, understanding this law is crucial for pet owners to mitigate potential liabilities. Having a clear South Dakota Acquisition Divestiture Merger Agreement Summary can help outline responsibilities related to ownership.

The Sunshine Law in South Dakota promotes transparency in government by allowing public access to meetings and documents. This law ensures that citizens can observe how their government operates, fostering accountability in public affairs. Under this law, governmental entities must provide notice of meetings and make their records accessible, which enhances public trust. Understanding this law is crucial for anyone engaging in legal processes or navigating a South Dakota Acquisition Divestiture Merger Agreement Summary.