Pursuant to 15 USC 1692g (Sec. 809 of the Federal Debt Collection Practices Act), a debtor is allowed to challenge the validity of a debt that a collection agency states you owe to the creditor they represent. Use this form letter requires that the agency verify that the debt is actually the alleged creditor's and owed by the alleged debtor.

South Dakota Letter Denying that Alleged Debtor Owes Any Part of Debt and Requesting a Collection Agency to Validate that Alleged Debtor Owes such a Debt

Description

How to fill out Letter Denying That Alleged Debtor Owes Any Part Of Debt And Requesting A Collection Agency To Validate That Alleged Debtor Owes Such A Debt?

US Legal Forms - one of the largest collections of legal documents in the United States - provides a vast selection of legal template designs that you can download or print.

By utilizing the website, you can access thousands of forms for business and personal use, categorized by types, states, or keywords.

You can find the latest versions of documents such as the South Dakota Letter Refuting that Alleged Debtor Owes Any Portion of Debt and Requesting a Collection Agency to Authenticate that Alleged Debtor Owes such a Debt in just a few minutes.

Read the form description to guarantee that you've chosen the correct document.

If the form does not meet your requirements, utilize the Search section at the top of the screen to find one that does.

- If you have a monthly membership, Log In and download the South Dakota Letter Refuting that Alleged Debtor Owes Any Portion of Debt and Requesting a Collection Agency to Authenticate that Alleged Debtor Owes such a Debt from the US Legal Forms library.

- The Download button will appear on every document you view.

- You have access to all previously saved forms in the My documents section of your account.

- If you're using US Legal Forms for the first time, here are some simple steps to help you get started.

- Ensure you have selected the correct form for your city/state.

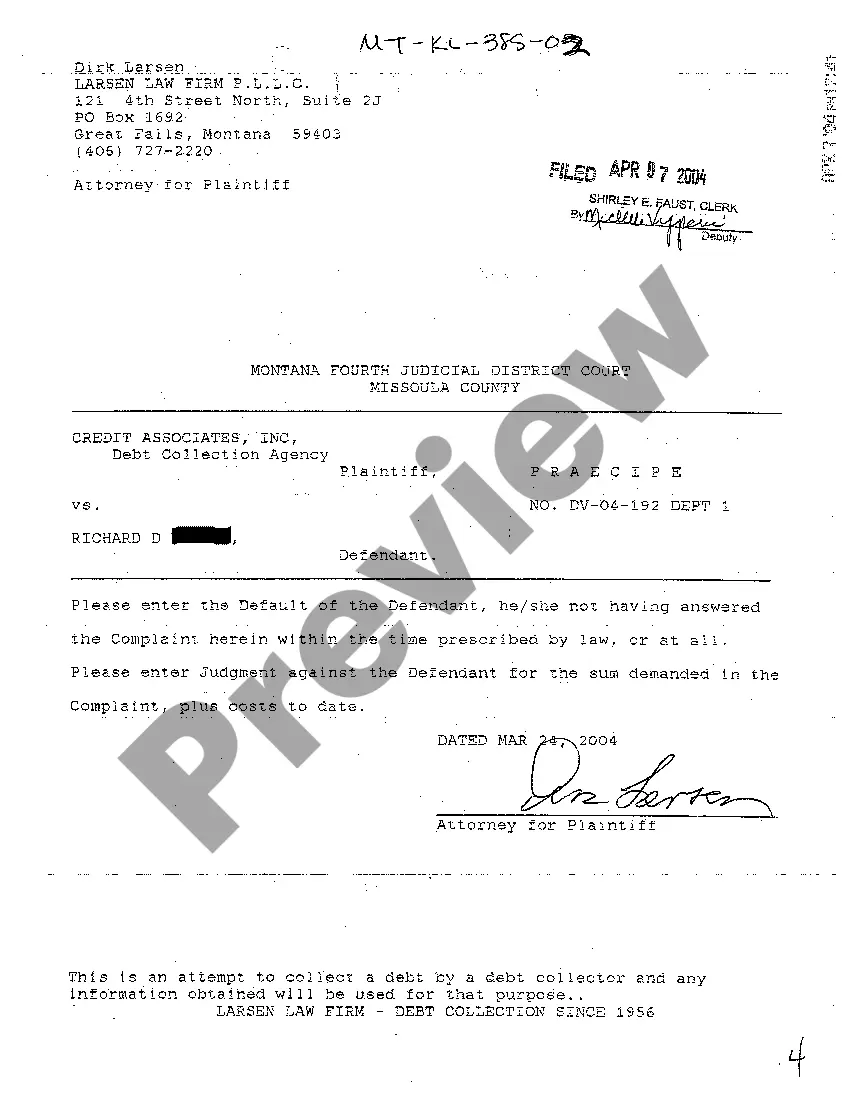

- Click the Preview button to review the form's details.

Form popularity

FAQ

The best sample for a debt validation letter includes a clear header with your information and an assertive request for validation. Ensure that it specifies the debt amount, the creditor’s name, and a request for supporting documents. Many users find templates from UsLegalForms helpful, including the South Dakota Letter Denying that Alleged Debtor Owes Any Part of Debt and Requesting a Collection Agency to Validate that Alleged Debtor Owes such a Debt.

To request verification, send a letter to the collection agency stating that you dispute the validity of the debt and that you want documentation verifying the debt. Also, request the name and address of the original creditor.

Write a dispute letter and send it to each credit bureau. Include information about each of the disputed itemsaccount numbers, listed amounts and creditor names. Write a similar letter to each collection agency, asking them to remove the error from your credit reports.

Once a debt collector receives written notice from a consumer that he or she refuses to pay the debt or wants the collector to stop further collection efforts, the debt collector must cease any further communication with the consumer except "(1) to advise the consumer that the debt collector's further efforts are being

A debt validation letter should include the name of your creditor, how much you supposedly owe, and information on how to dispute the debt. After receiving a debt validation letter, you have 30 days to dispute the debt and request written evidence of it from the debt collector.

The Fair Debt Collection Practices Act (FDCPA) The FDCPA prohibits debt collection companies from using abusive, unfair or deceptive practices to collect debts from you.

A debt validation letter is a letter a consumer sends to a debt collector requesting the debt collector validate a debt they are trying to collect. It is your first chance to assert your rights before debt collectors.

The FDCPA broadly prohibits a debt collector from using 'any false, deceptive, or misleading representation or means in connection with the collection of any debt. ' 15 U.S.C. § 1692e. The statute enumerates several examples of such practices, 15 U.S.C.

How to Write a Debt Verification LetterDetermine the exact amounts you owe.Gather documents that verify your debt.Get information on who you owe.Determine how old the debt is.Place a pause on the collection proceedings.

Debt collectors cannot harass or abuse you. They cannot swear, threaten to illegally harm you or your property, threaten you with illegal actions, or falsely threaten you with actions they do not intend to take. They also cannot make repeated calls over a short period to annoy or harass you.