South Dakota Administration Agreement between Neuberger and Berman Advisers Management Trust and Neuberger and Berman Management Inc

Description

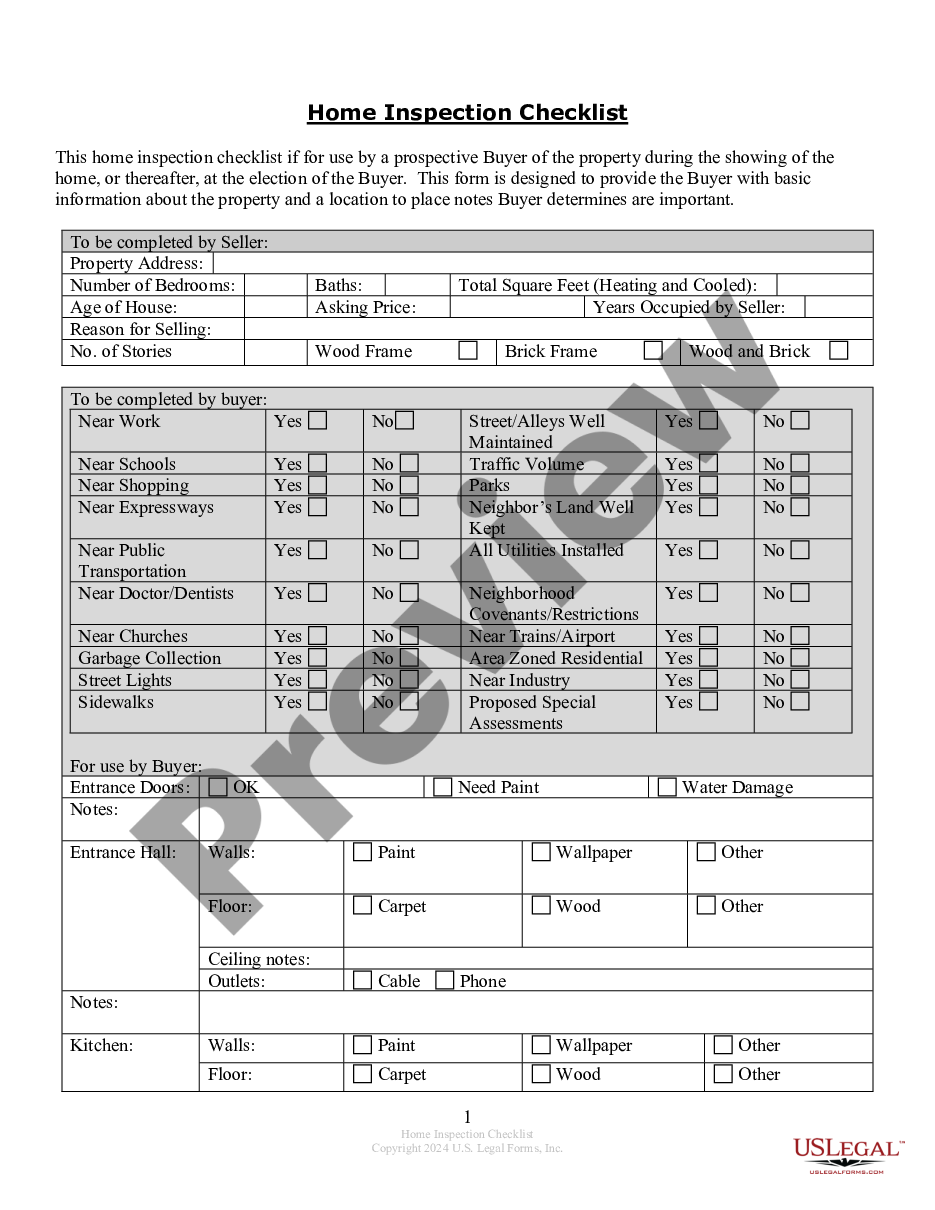

How to fill out Administration Agreement Between Neuberger And Berman Advisers Management Trust And Neuberger And Berman Management Inc?

Are you presently inside a position where you need to have files for possibly organization or individual functions nearly every day time? There are tons of authorized papers layouts available online, but discovering ones you can depend on is not effortless. US Legal Forms provides thousands of develop layouts, just like the South Dakota Administration Agreement between Neuberger and Berman Advisers Management Trust and Neuberger and Berman Management Inc, which can be written in order to meet state and federal requirements.

In case you are currently acquainted with US Legal Forms internet site and have a free account, simply log in. Following that, you are able to download the South Dakota Administration Agreement between Neuberger and Berman Advisers Management Trust and Neuberger and Berman Management Inc design.

Should you not come with an bank account and wish to begin using US Legal Forms, follow these steps:

- Obtain the develop you require and ensure it is for the appropriate area/county.

- Use the Review option to check the shape.

- Read the information to actually have selected the proper develop.

- If the develop is not what you`re searching for, take advantage of the Lookup field to discover the develop that meets your requirements and requirements.

- Whenever you find the appropriate develop, click on Buy now.

- Pick the prices strategy you need, fill in the desired details to generate your money, and pay money for the order using your PayPal or charge card.

- Decide on a practical data file structure and download your version.

Locate each of the papers layouts you possess bought in the My Forms food list. You can aquire a further version of South Dakota Administration Agreement between Neuberger and Berman Advisers Management Trust and Neuberger and Berman Management Inc at any time, if necessary. Just go through the required develop to download or print the papers design.

Use US Legal Forms, probably the most substantial collection of authorized types, to save time as well as stay away from mistakes. The support provides professionally created authorized papers layouts which you can use for an array of functions. Make a free account on US Legal Forms and begin making your lifestyle easier.

Form popularity

FAQ

Since 1939, Neuberger Berman has been a leader in the asset management business servicing the investment needs of institutional and individual investors. Neuberger Berman is an independent, employee majority-controlled global asset management firm.

Neuberger Berman is a private, independent, employee-owned investment manager?a rare structure for a large asset management firm, almost all of which are either public or owned by other financial institutions.

The Neuberger Berman Tactical Macro UCITS fund aims to achieve positive returns regardless of the market environment through identifying market pricing imbalances across a range of asset classes, markets and regions in a risk-managed framework.

Neuberger Berman is an experienced hedge fund solutions provider investing on behalf of institutional, high-net-worth and retail clients via registered liquid alternative funds, custom portfolios, and commingled products.

For nine consecutive years, Neuberger Berman has been named first or second in Pensions & Investment's Best Places to Work in Money Management survey (among those with 1,000 employees or more). The firm manages $436 billion in client assets as of March 31, 2023.

Neuberger Berman actively manages over $120bn2 of assets across its private equity platform and has been a private markets investor for more than 30 years. We believe our position within the private equity ecosystem provides differentiated access to investment opportunities as well as enhanced information.

With offices in 25 countries, Neuberger Berman's diverse team has over 2,400 professionals. For eight consecutive years, the company has been named first or second in Pensions & Investments Best Places to Work in Money Management survey (among those with 1,000 employees or more).

Neuberger Berman Investment Funds II PLC is a qualifying investor alternative investment fund available to professional investors only. KIDs/KIIDs are not produced for this fund.