South Dakota Amendment to the articles of incorporation to eliminate par value

Description

How to fill out Amendment To The Articles Of Incorporation To Eliminate Par Value?

Have you been inside a position that you need to have documents for both business or individual functions nearly every working day? There are a variety of authorized papers templates available online, but getting ones you can trust is not effortless. US Legal Forms gives a huge number of type templates, much like the South Dakota Amendment to the articles of incorporation to eliminate par value, that happen to be created to meet federal and state specifications.

In case you are presently acquainted with US Legal Forms web site and also have a merchant account, merely log in. After that, you can down load the South Dakota Amendment to the articles of incorporation to eliminate par value design.

If you do not offer an bank account and wish to begin to use US Legal Forms, abide by these steps:

- Find the type you will need and ensure it is for that proper city/county.

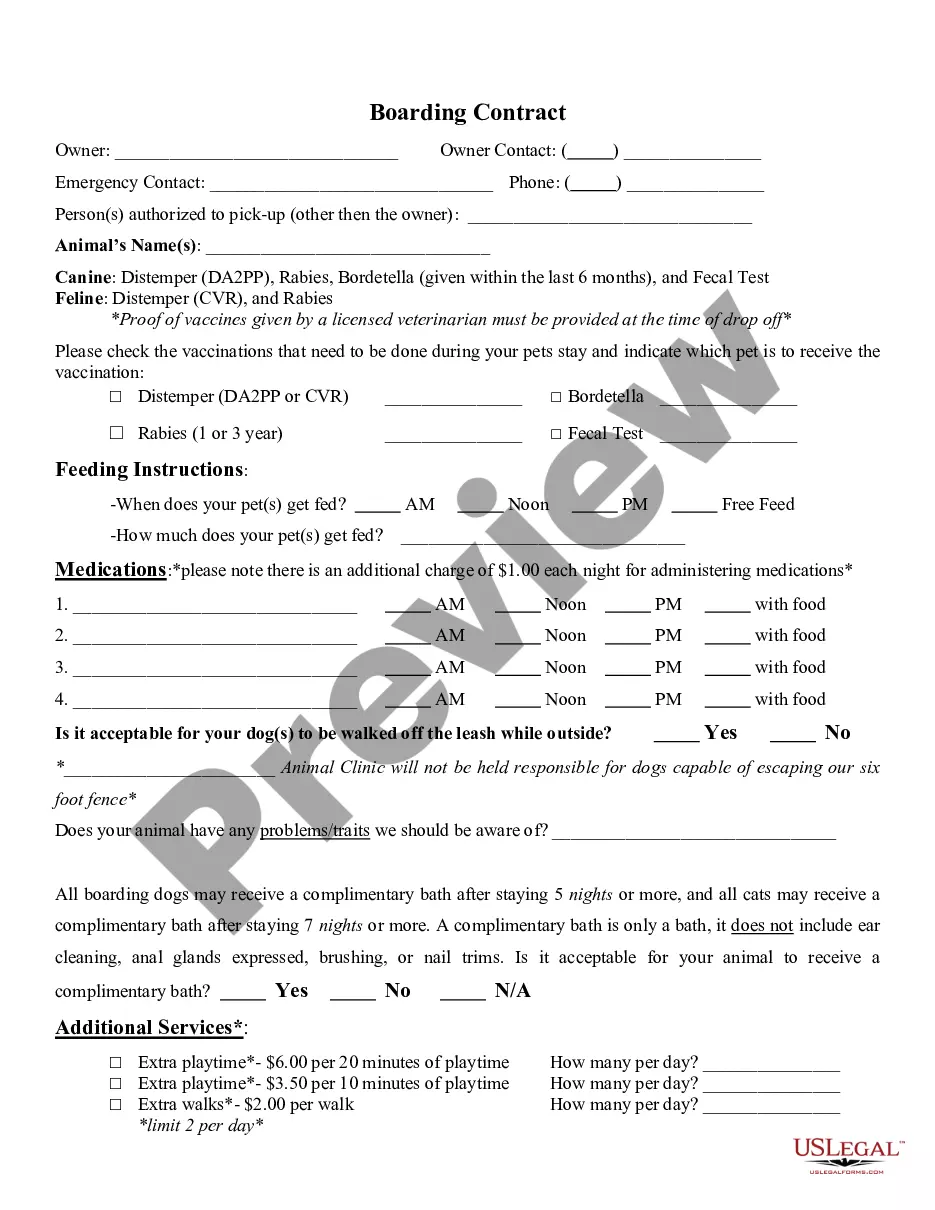

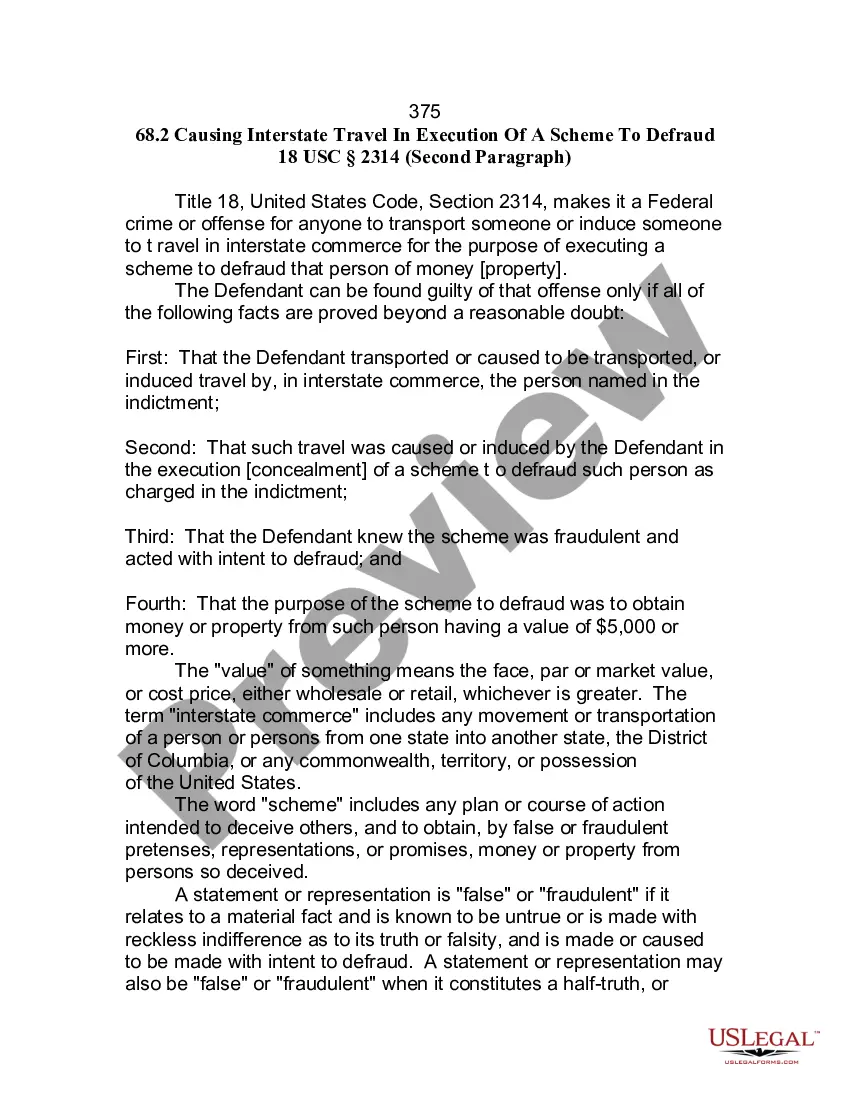

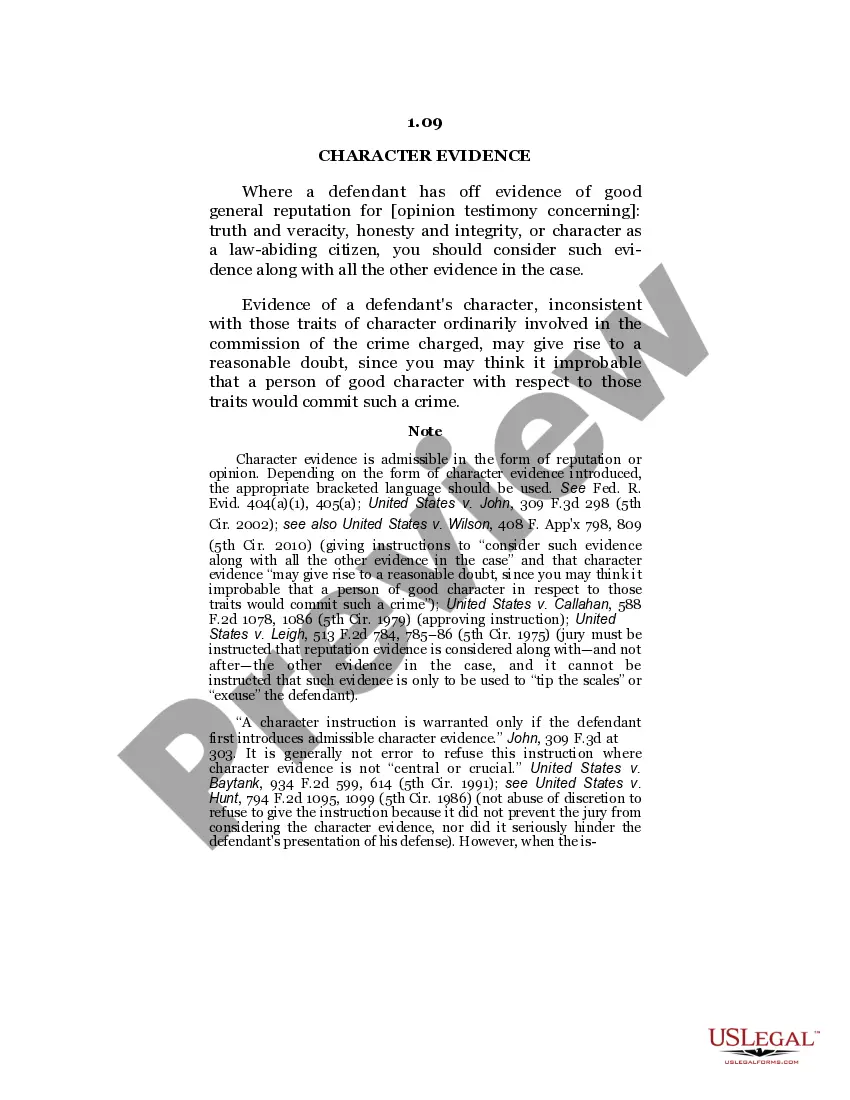

- Use the Review key to check the shape.

- Look at the outline to actually have selected the appropriate type.

- In case the type is not what you are searching for, take advantage of the Research discipline to get the type that meets your needs and specifications.

- If you find the proper type, click Purchase now.

- Pick the costs program you desire, complete the specified information to produce your bank account, and buy the order utilizing your PayPal or charge card.

- Pick a handy document formatting and down load your version.

Discover each of the papers templates you may have purchased in the My Forms menu. You can aquire a extra version of South Dakota Amendment to the articles of incorporation to eliminate par value at any time, if needed. Just select the needed type to down load or produce the papers design.

Use US Legal Forms, the most substantial collection of authorized forms, to conserve time as well as stay away from faults. The service gives professionally manufactured authorized papers templates which can be used for a selection of functions. Make a merchant account on US Legal Forms and initiate generating your lifestyle easier.

Form popularity

FAQ

Articles of Incorporation refers to the highest governing document in a corporation. It is also known known as the corporate charter. The Articles of Incorporation generally include the purpose of the corporation, the type and number of shares, and the process of electing a board of directors.

Asset Protection Trusts South Dakota was the first state to enact a discretionary trust statute designed to protect trust assets from creditors. This statutory protection also applies to self-settled trusts, these being trusts settled by a transferor of which the transferor is a beneficiary.

Dynasty Trusts can last forever (at least in South Dakota). This provides you with the opportunity to protect your loved ones for generations to come - providing long lasting security.

The primary drawbacks to establishing a South Dakota dynastic trust are the restrictions on your financial flexibility once the trust is established and the limited flexibility imposed on beneficiaries.

How to Amend Articles of Incorporation Review the bylaws of the corporation. ... A board of directors meeting must be scheduled. ... Write the proposed changes. ... Confirm that the board meeting has enough members attending to have a quorum so the amendment can be voted on. Propose the amendment during the board meeting.

South Dakota's privacy statute provides for a total seal forbidding the release of trust information, including names of settlors, beneficiaries, and the contents of a trust, to the public during litigation.

South Dakota was the first state in the nation to abolish the Rule Against Perpetuities ? which prohibited unlimited-duration trusts ? in 1983, clearing the way for the creation of the Dynasty Trust.

How do you dissolve/terminate a South Dakota Limited Liability Company? To dissolve/terminate your domestic LLC in South Dakota, you must submit the completed Articles of Termination form to the South Dakota Secretary of State by mail or in person and in duplicate along with the filing fee.