South Dakota Executive Director Loan Plan with copy of Promissory Note by Hathaway Instruments, Inc.

Description

How to fill out Executive Director Loan Plan With Copy Of Promissory Note By Hathaway Instruments, Inc.?

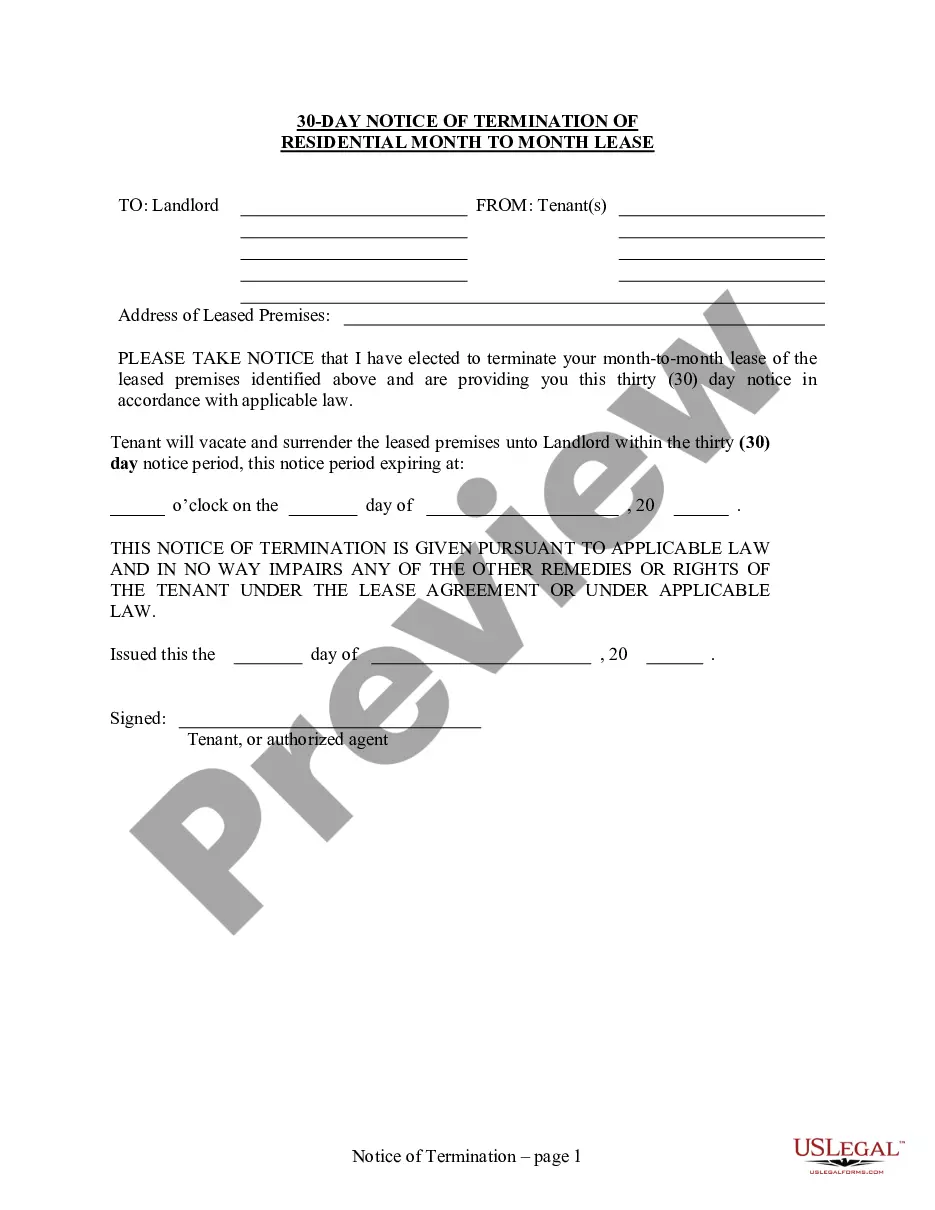

Are you currently in a placement where you need paperwork for possibly business or personal purposes almost every working day? There are a lot of authorized file templates available on the net, but getting versions you can rely on isn`t simple. US Legal Forms provides a large number of kind templates, much like the South Dakota Executive Director Loan Plan with copy of Promissory Note by Hathaway Instruments, Inc., which can be composed to satisfy state and federal specifications.

Should you be already acquainted with US Legal Forms web site and get a merchant account, basically log in. Next, you are able to down load the South Dakota Executive Director Loan Plan with copy of Promissory Note by Hathaway Instruments, Inc. format.

Should you not provide an bank account and would like to begin using US Legal Forms, adopt these measures:

- Find the kind you will need and make sure it is for the right city/state.

- Utilize the Review option to analyze the shape.

- Look at the information to ensure that you have selected the appropriate kind.

- In the event the kind isn`t what you`re looking for, make use of the Lookup industry to get the kind that suits you and specifications.

- Whenever you get the right kind, click on Acquire now.

- Opt for the costs program you desire, fill in the specified details to produce your money, and purchase an order utilizing your PayPal or credit card.

- Pick a convenient file formatting and down load your copy.

Locate each of the file templates you may have purchased in the My Forms menu. You may get a additional copy of South Dakota Executive Director Loan Plan with copy of Promissory Note by Hathaway Instruments, Inc. anytime, if needed. Just click the necessary kind to down load or print out the file format.

Use US Legal Forms, probably the most comprehensive selection of authorized kinds, to save time as well as stay away from blunders. The service provides skillfully manufactured authorized file templates which you can use for a range of purposes. Generate a merchant account on US Legal Forms and begin creating your way of life easier.

Form popularity

FAQ

In most cases, the note should be recorded with the local county clerk or recorder's office. Does recording a promissory note affect the terms of the loan? Recording a promissory note generally does not affect the terms of the loan, as the terms are already agreed upon by the parties involved.

Give the borrower the original promissory note, with a notation on it that says ?CANCELLED? or ?PAID IN FULL.? Keep a copy of this note for your records.

A promissory note typically contains all the terms involved, such as the principal debt amount, interest rate, maturity date, payment schedule, the date and place of issuance, and the issuer's signature.

At its most basic, a promissory note should include the following things: Date. Name of the lender and borrower. Loan amount. Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral? ... Payment amount and frequency. Payment due date. Whether the loan has a cosigner, and if so, who.

The promissory note journal entry is recorded by debiting the account that receives value, commonly the cash account, and crediting the notes payable account.

Detailed Information ? The note has all the required information including the name of the drawer and payee, date of maturity, terms of repayment, issue date, name of the drawee, name, and signature of the drawer, principal amount, and the rate of interest, etc.

Summary. A note receivable is also known as a promissory note. When the note is due within less than a year, it is considered a current asset on the balance sheet of the company the note is owed to. If its due date is more than a year in the future, it is considered a non-current asset.

Promissory notes may also be referred to as an IOU, a loan agreement, or just a note. It's a legal lending document that says the borrower promises to repay to the lender a certain amount of money in a certain time frame. This kind of document is legally enforceable and creates a legal obligation to repay the loan.