South Dakota Stock Purchase Plan with exhibit of Bancorporation

Description

How to fill out Stock Purchase Plan With Exhibit Of Bancorporation?

Are you currently within a situation where you need documents for either enterprise or specific reasons almost every time? There are a lot of legal papers web templates available on the Internet, but getting versions you can rely on is not simple. US Legal Forms gives thousands of form web templates, much like the South Dakota Stock Purchase Plan with exhibit of Bancorporation, that are composed in order to meet state and federal needs.

In case you are presently acquainted with US Legal Forms internet site and get an account, basically log in. Afterward, you are able to obtain the South Dakota Stock Purchase Plan with exhibit of Bancorporation template.

Should you not come with an bank account and wish to start using US Legal Forms, abide by these steps:

- Get the form you require and make sure it is for the correct area/state.

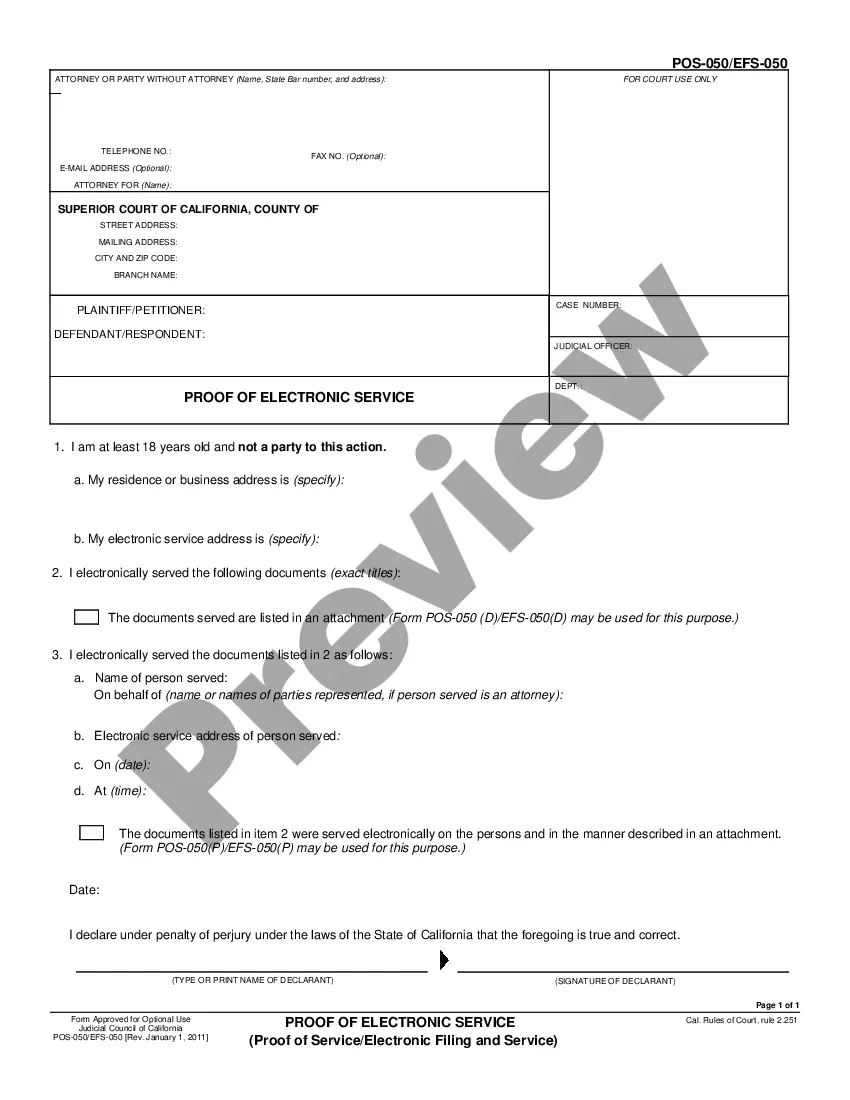

- Make use of the Review switch to analyze the shape.

- Read the description to actually have selected the correct form.

- In the event the form is not what you are searching for, use the Research discipline to get the form that meets your requirements and needs.

- Once you find the correct form, simply click Buy now.

- Pick the pricing plan you want, fill in the required information and facts to produce your bank account, and pay for your order with your PayPal or Visa or Mastercard.

- Choose a convenient file structure and obtain your copy.

Get every one of the papers web templates you have purchased in the My Forms menus. You can obtain a extra copy of South Dakota Stock Purchase Plan with exhibit of Bancorporation whenever, if needed. Just go through the needed form to obtain or printing the papers template.

Use US Legal Forms, by far the most extensive collection of legal varieties, to save time and stay away from mistakes. The services gives expertly manufactured legal papers web templates which you can use for a variety of reasons. Produce an account on US Legal Forms and initiate producing your life a little easier.

Form popularity

FAQ

Stock Match By Employer You deposit a certain amount of your paycheck into your retirement. The company will match that amount up to a certain percentage, which trails off to a lower match the more you invest in the plan. ESPPs work in a similar way but usually have a fixed match.

How much should I put in an employee stock purchase plan? You can contribute 1% to 15% of your salary, up to the $25,000 IRS limit per calendar year. The more disposable income you have, the more you can afford to put in an employee stock purchase plan. Employees contribute through payroll deductions.

The ESOP vs 401K Plan With a 401(k), the employer's contributions are tax-deferred, meaning that the money is taken out of each paycheck before taxes, and those wages are not taxed until withdrawal. Whereas with an ESOP, employees also do not pay taxes on the shares in their account until distribution.

An employee stock purchase plan, (ESPP) is a type of broad-based stock plan that allows employees to use after-tax payroll deductions to acquire their company's stock, usually at a discount of up to 15%.

The match is ?free? money provided by your employer. If it's a dollar-for-dollar match, that's a 100% return, which is significantly higher than a 15% max discount on a qualified ESPP. While the tax benefits of a qualified ESPP can be great, an ESPP does come with risks.