South Dakota Stock Incentive Plan of Ambase Corp.

Description

How to fill out Stock Incentive Plan Of Ambase Corp.?

Have you been in the placement in which you require files for either company or personal purposes just about every day time? There are tons of lawful file templates available online, but locating kinds you can rely on isn`t simple. US Legal Forms provides a huge number of develop templates, such as the South Dakota Stock Incentive Plan of Ambase Corp., which can be written to satisfy federal and state specifications.

When you are presently informed about US Legal Forms internet site and have a merchant account, basically log in. Next, you can acquire the South Dakota Stock Incentive Plan of Ambase Corp. template.

If you do not come with an bank account and want to begin using US Legal Forms, follow these steps:

- Get the develop you require and make sure it is for your appropriate town/region.

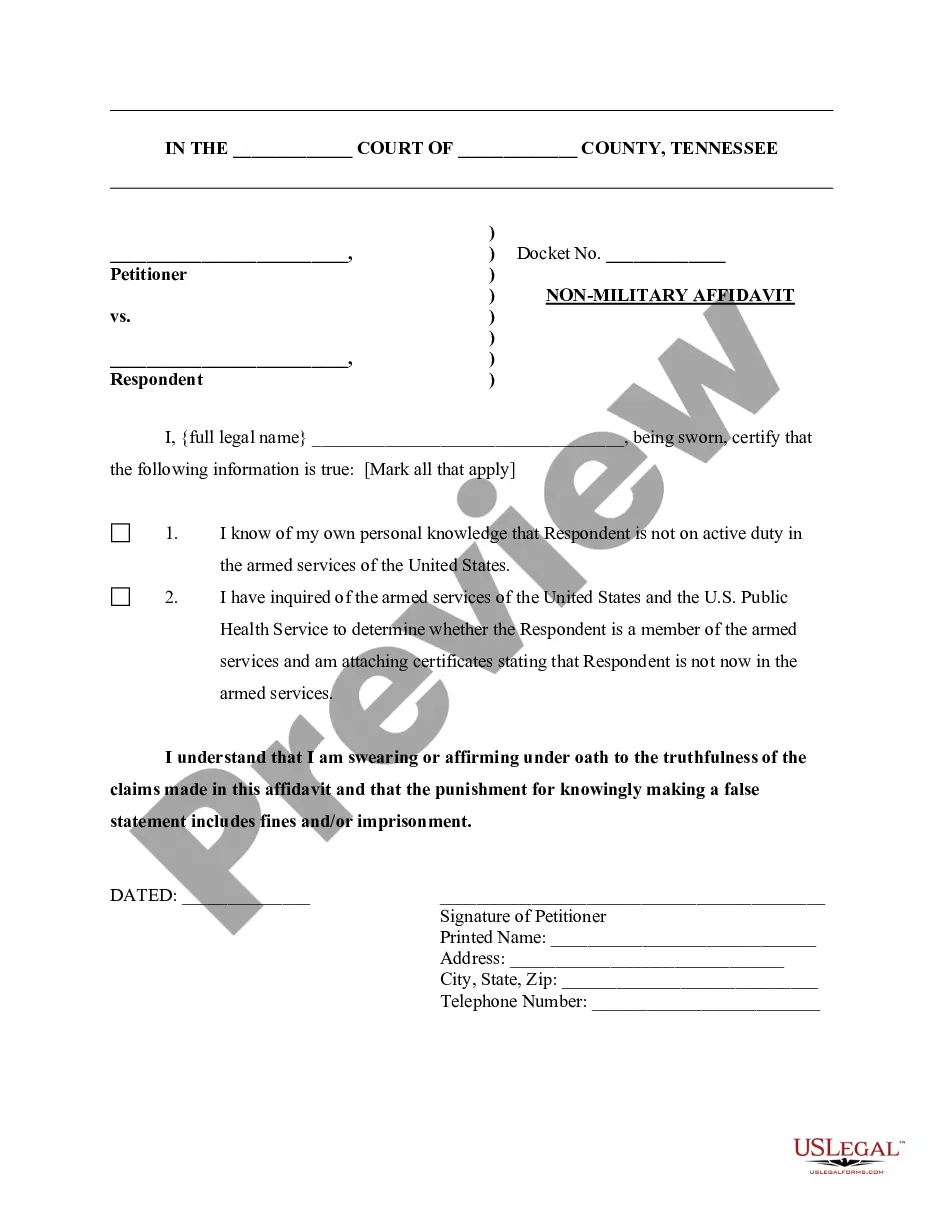

- Make use of the Review switch to analyze the form.

- Browse the explanation to ensure that you have chosen the appropriate develop.

- When the develop isn`t what you`re looking for, make use of the Research industry to get the develop that fits your needs and specifications.

- If you discover the appropriate develop, click on Purchase now.

- Choose the costs prepare you would like, fill in the necessary information and facts to create your money, and pay money for your order utilizing your PayPal or credit card.

- Decide on a practical data file file format and acquire your backup.

Locate every one of the file templates you have purchased in the My Forms menus. You may get a more backup of South Dakota Stock Incentive Plan of Ambase Corp. any time, if necessary. Just select the essential develop to acquire or printing the file template.

Use US Legal Forms, one of the most comprehensive variety of lawful kinds, to save lots of some time and prevent faults. The service provides skillfully manufactured lawful file templates which you can use for a variety of purposes. Generate a merchant account on US Legal Forms and initiate making your lifestyle easier.

Form popularity

FAQ

An incentive stock option (ISO) is a corporate benefit that gives an employee the right to buy shares of company stock at a discounted price with the added benefit of possible tax breaks on the profit. The profit on qualified ISOs is usually taxed at the capital gains rate, not the higher rate for ordinary income.

A stock incentive plan, or employee stock purchase plan, is a form of compensation by a company for employees or contractors which can be used as an alternative to cash payment. It's designed to motivate employees by offering them the opportunity for future earnings through company stocks.

By following these steps in crafting your own incentive program, you will be sure to see long-term success. Determine Goals and Objectives. ... Identify Participants. ... Establish Program Details. ... Create a Budget. ... Outline a Reward. ... Report on Results. ... Launch the Program. ... Monitor Success.

These plans are discussed below: Premium Bonus Plan. Under premium bonus plans, the time taken to complete a job is fixed based on a careful time analysis. ... Profit-Sharing and Co-ownership. ... Group Incentives. ... Indirect Incentive Plans.

When you exercise Incentive Stock Options, you buy the stock at a pre-established price, which could be well below actual market value. The advantage of an ISO is you do not have to report income when you receive a stock option grant or when you exercise that option.

Here's an example: You can purchase 1,000 shares of company stock at $20 a share with your vested ISO. Shares are trading for $40 in the market. If you already own 500 company shares, you can swap those shares (500 shares x $40 market price = $20,000) for the 1,000 new shares, rather than paying $20,000 in cash.