South Dakota Insurance Agents Stock option plan

Description

How to fill out Insurance Agents Stock Option Plan?

If you want to complete, down load, or produce legal papers themes, use US Legal Forms, the most important collection of legal varieties, which can be found on the web. Make use of the site`s simple and convenient look for to obtain the files you want. Different themes for company and individual reasons are categorized by types and suggests, or search phrases. Use US Legal Forms to obtain the South Dakota Insurance Agents Stock option plan with a number of clicks.

When you are already a US Legal Forms customer, log in in your account and click on the Down load button to get the South Dakota Insurance Agents Stock option plan. You can also gain access to varieties you in the past acquired inside the My Forms tab of your account.

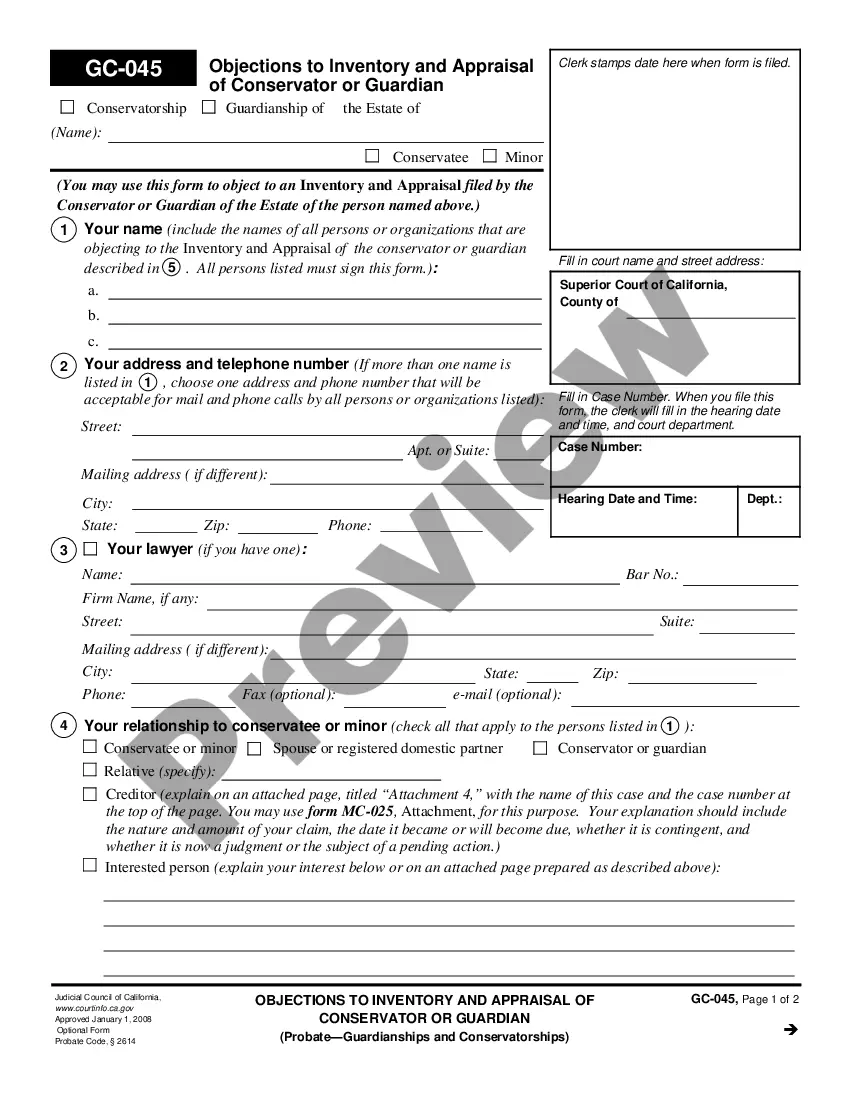

If you are using US Legal Forms for the first time, follow the instructions under:

- Step 1. Be sure you have chosen the shape for your correct area/region.

- Step 2. Use the Preview choice to check out the form`s articles. Don`t overlook to read through the explanation.

- Step 3. When you are not satisfied together with the type, take advantage of the Lookup field at the top of the display screen to locate other versions from the legal type format.

- Step 4. Upon having discovered the shape you want, click on the Get now button. Choose the pricing strategy you favor and put your accreditations to register to have an account.

- Step 5. Procedure the purchase. You can use your bank card or PayPal account to perform the purchase.

- Step 6. Pick the structure from the legal type and down load it on your gadget.

- Step 7. Complete, modify and produce or indicator the South Dakota Insurance Agents Stock option plan.

Each legal papers format you buy is your own for a long time. You might have acces to each and every type you acquired inside your acccount. Select the My Forms segment and choose a type to produce or down load once again.

Contend and down load, and produce the South Dakota Insurance Agents Stock option plan with US Legal Forms. There are many specialist and condition-distinct varieties you may use for the company or individual needs.

Form popularity

FAQ

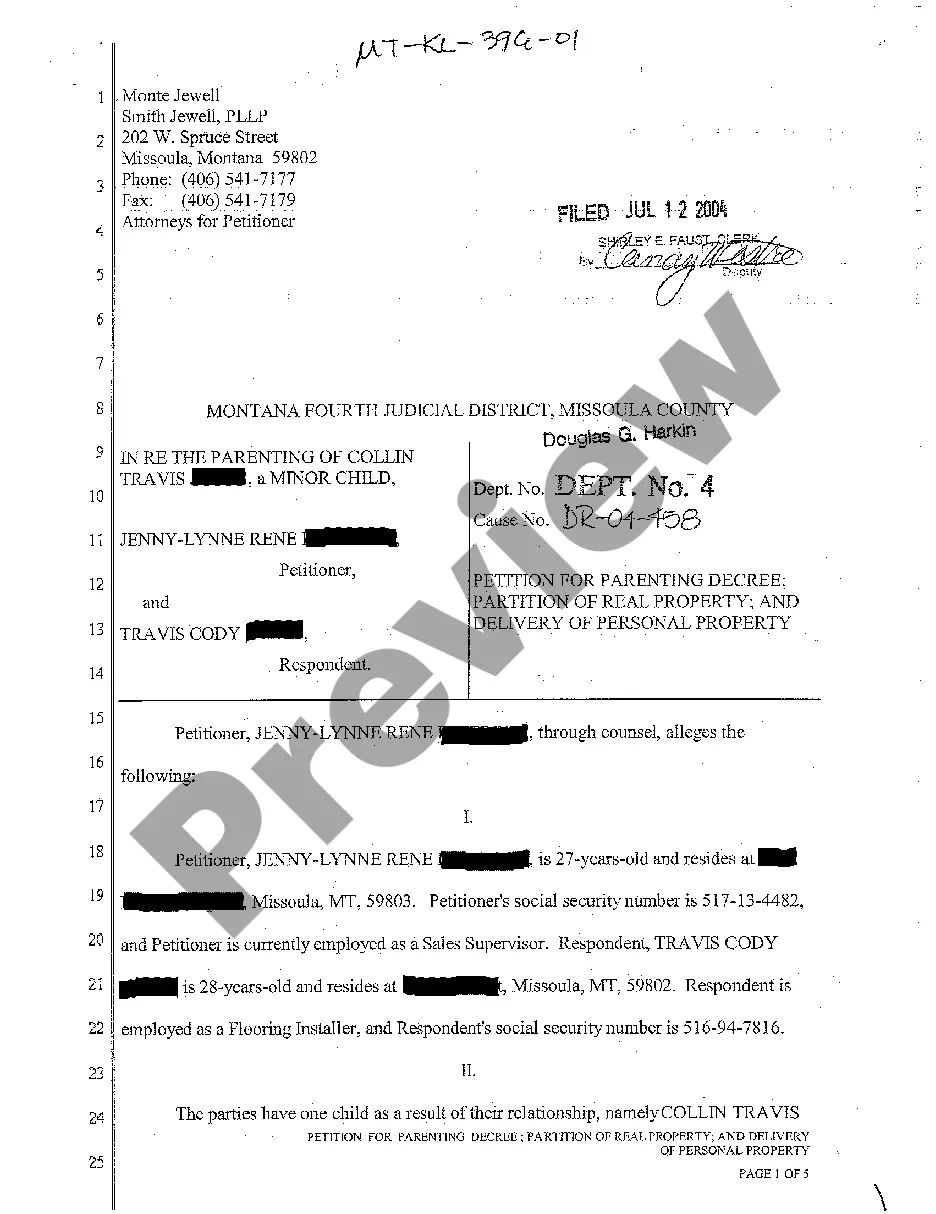

It is a written document that remains valid even if you should later become unable to make your own decisions. With a durable power of attorney, you are able to appoint an agent to manage your financial affairs, make health care decisions, or conduct other business for you during your incapacitation.

Recommendations and sales must effectively address the client's unique financial situation, insurance needs and financial objectives. Producers must meet specific "best interest" obligations regarding care, disclosure, conflict of interest and documentation.

Disclosure Obligation Prior to any recommendation, an "Insurance Agent (Producer) Disclosure for Annuities" form setting forth: The scope and terms of the producer's relationship with the consumer and the producer's role in the transaction. The products the producer is licensed and authorized to sell.

What are the four main obligations to a consumer during the sale of an annuity? The four main obligations an insurer must satisfy for a consumer purchasing an annuity are care, disclosure, conflict of interest and documentation.

Under the care obligation under subsection B of this section, the consumer profile information, characteristics of the insurer and product costs, rates, benefits and features are those factors generally relevant in making a determination whether an annuity effectively addresses the consumer's financial situation, ...

This requirement is designed to ensure consumers understand why a product is consistent with their particular financial needs, situation, and objectives. Agents and carriers are required to document, in writing, any recommendation and the justification for such recommendation.