South Dakota Form of Indemnity Agreement by Financial Corporation of Santa Barbara

Description

How to fill out Form Of Indemnity Agreement By Financial Corporation Of Santa Barbara?

If you want to complete, down load, or printing legitimate document layouts, use US Legal Forms, the largest selection of legitimate varieties, which can be found on the web. Utilize the site`s simple and handy research to obtain the papers you require. A variety of layouts for business and person uses are sorted by categories and suggests, or key phrases. Use US Legal Forms to obtain the South Dakota Form of Indemnity Agreement by Financial Corporation of Santa Barbara with a number of clicks.

In case you are previously a US Legal Forms buyer, log in to your bank account and then click the Download switch to obtain the South Dakota Form of Indemnity Agreement by Financial Corporation of Santa Barbara. Also you can entry varieties you in the past saved in the My Forms tab of your respective bank account.

Should you use US Legal Forms initially, refer to the instructions beneath:

- Step 1. Ensure you have chosen the shape to the appropriate area/nation.

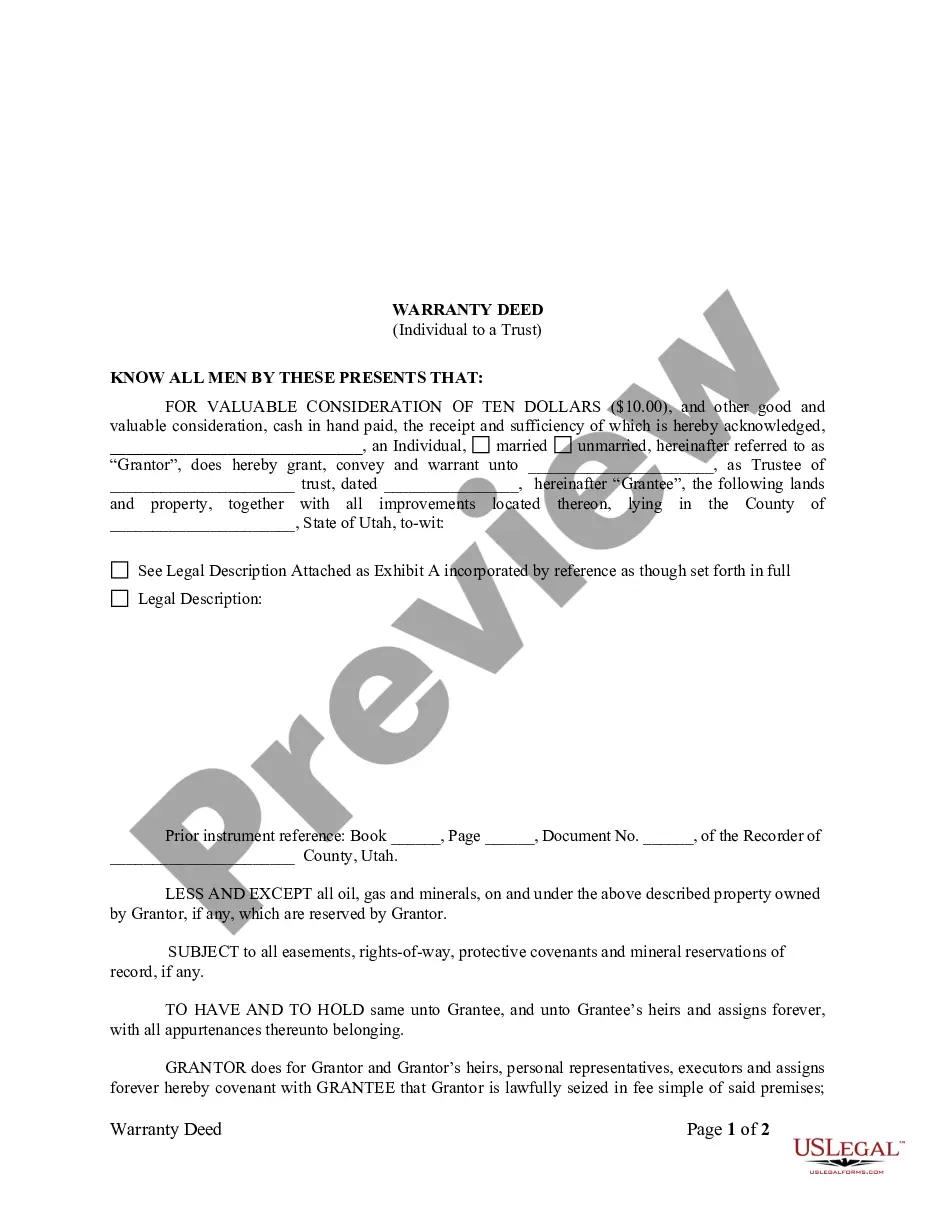

- Step 2. Take advantage of the Preview solution to examine the form`s content. Never forget about to read through the description.

- Step 3. In case you are not satisfied with all the form, make use of the Lookup area towards the top of the display to discover other types from the legitimate form design.

- Step 4. When you have found the shape you require, go through the Purchase now switch. Select the costs prepare you like and put your references to sign up on an bank account.

- Step 5. Process the financial transaction. You should use your bank card or PayPal bank account to complete the financial transaction.

- Step 6. Pick the format from the legitimate form and down load it on your own product.

- Step 7. Full, revise and printing or signal the South Dakota Form of Indemnity Agreement by Financial Corporation of Santa Barbara.

Each and every legitimate document design you get is the one you have eternally. You might have acces to each and every form you saved inside your acccount. Click on the My Forms portion and decide on a form to printing or down load again.

Contend and down load, and printing the South Dakota Form of Indemnity Agreement by Financial Corporation of Santa Barbara with US Legal Forms. There are millions of expert and express-specific varieties you may use for your business or person demands.

Form popularity

FAQ

Indemnification, also referred to as indemnity, is an undertaking by one party (the indemnifying party) to compensate the other party (the indemnified party) for certain costs and expenses, typically stemming from third-party claims.

Indemnity Agreement: Although similar to a hold harmless agreement, an indemnity agreement is an arrangement whereby one party agrees to pay the other party for any damages regardless of who is at fault.

There are three main types of express indemnity clauses: broad form, intermediate form, and limited form. Broad form express indemnity clauses require the indemnitor to hold the indemnitee harmless for all liability, even if the indemnitee is solely at fault.

Indemnification, also referred to as indemnity, is an undertaking by one party (the indemnifying party) to compensate the other party (the indemnified party) for certain costs and expenses, typically stemming from third-party claims.

Indemnity is a comprehensive form of insurance compensation for damage or loss. It amounts to a contractual agreement between two parties in which one party agrees to pay for potential losses or damage caused by another party.

Indemnity agreements, also known as indemnity clauses, play an integral role in contracts. That's because they are designed to punish the nonperforming party and reassure the damaged one they will be reimbursed for losses caused by the errant entity.

Indemnification clauses can limit the liability of one party, reducing their financial exposure in the event of a loss or damage. Limiting their liability reduces their financial exposure and protects them against potential losses.

How to Write an Indemnity Agreement Consider the Indemnity Laws in Your Area. ... Draft the Indemnification Clause. ... Outline the Indemnification Period and Scope of Coverage. ... State the Indemnification Exceptions. ... Specify How the Indemnitee Notifies the Indemnitor About Claims. ... Write the Settlement and Consent Clause.