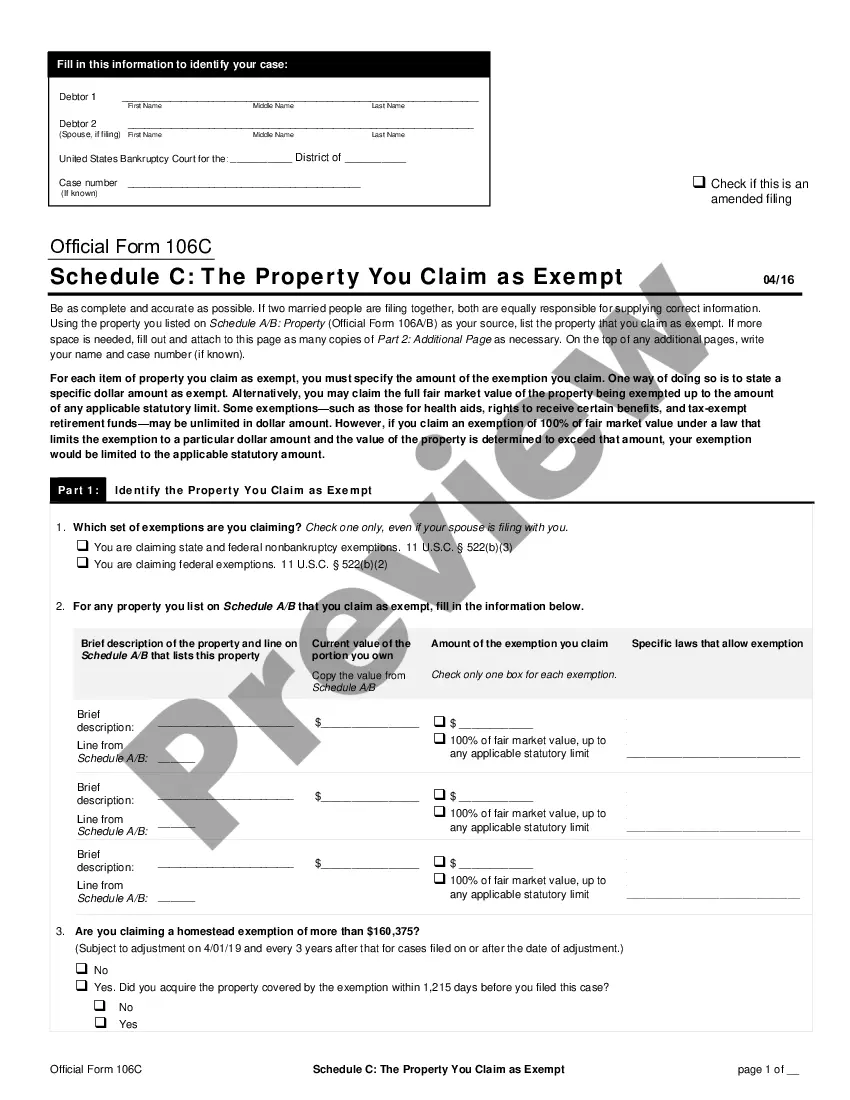

South Dakota Property Claimed as Exempt - Schedule C - Form 6C - Post 2005

Description

How to fill out Property Claimed As Exempt - Schedule C - Form 6C - Post 2005?

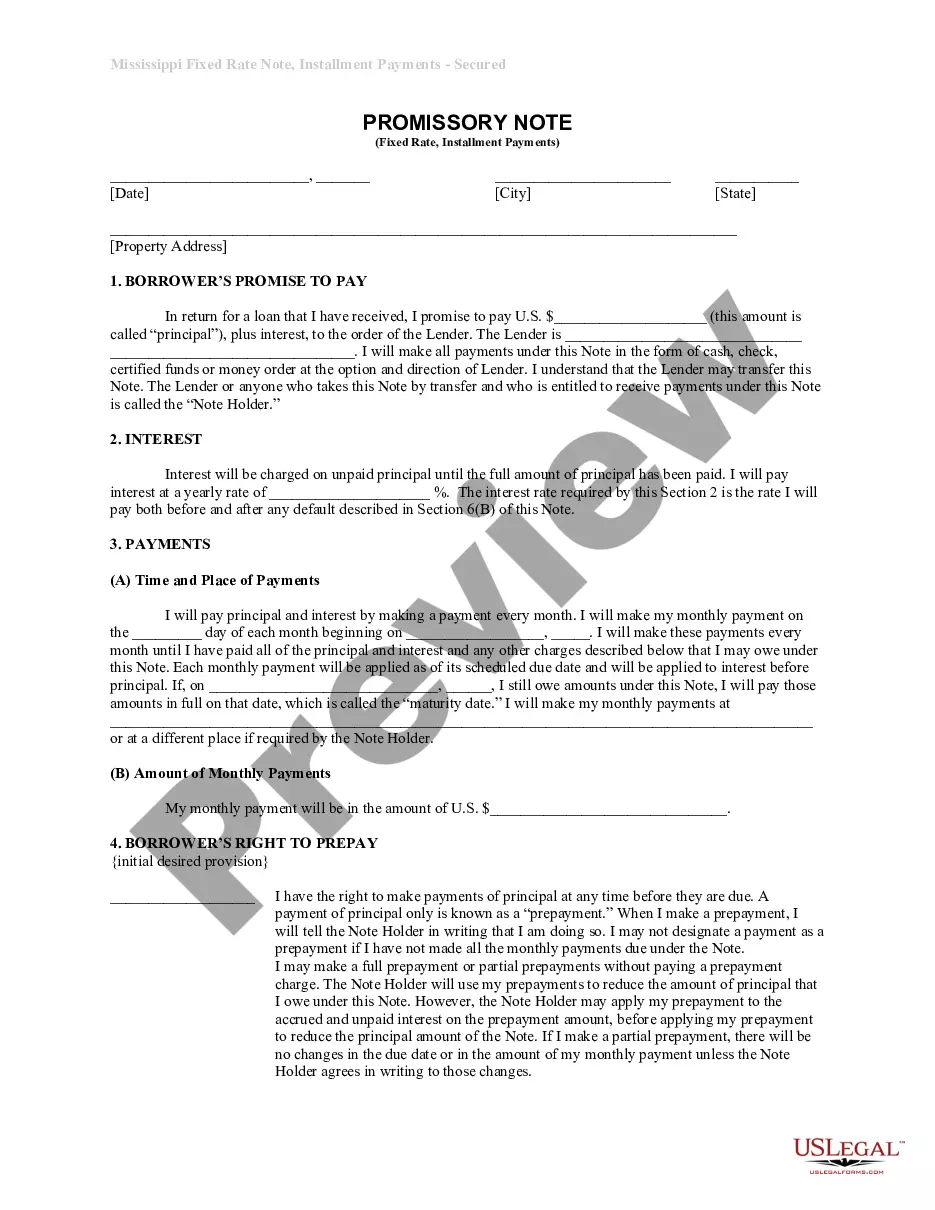

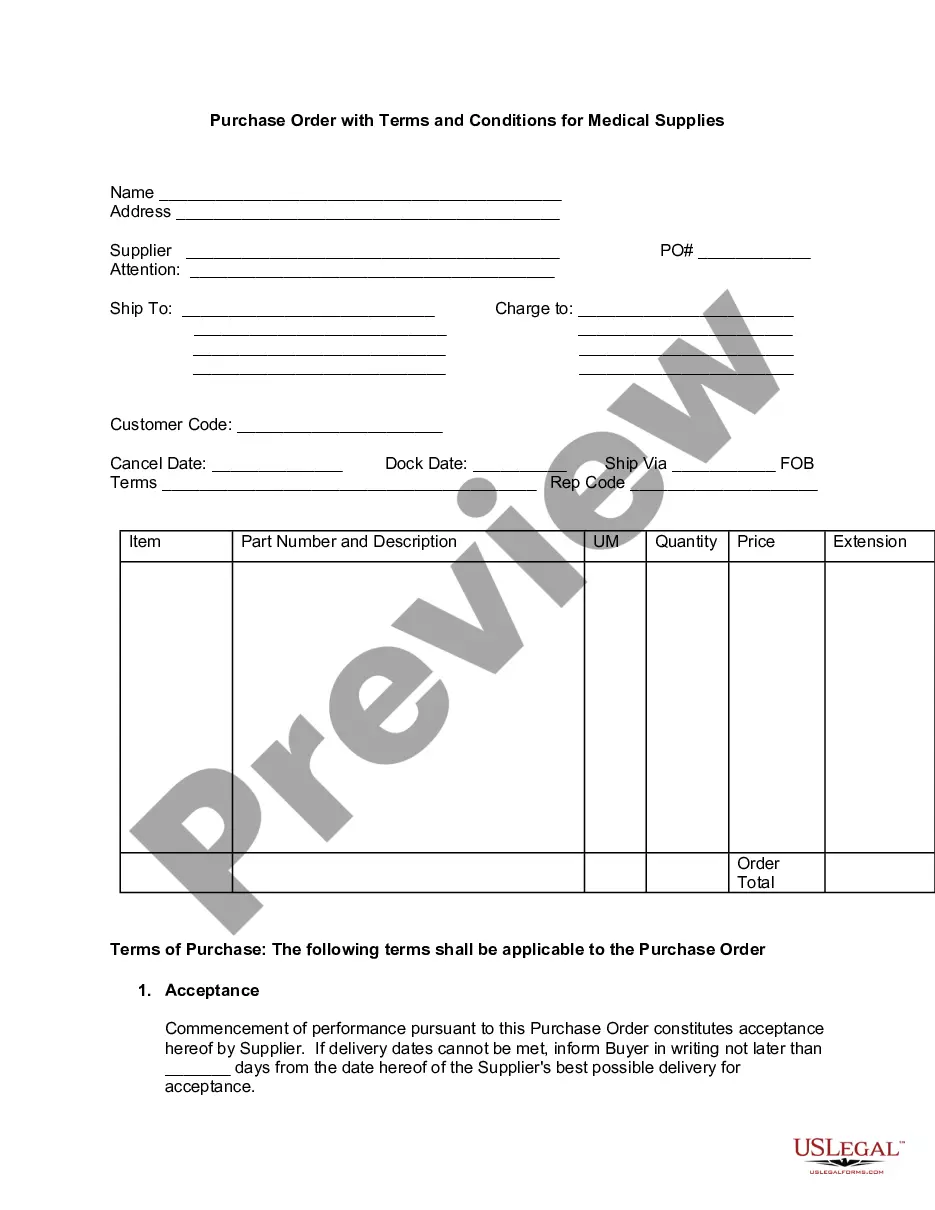

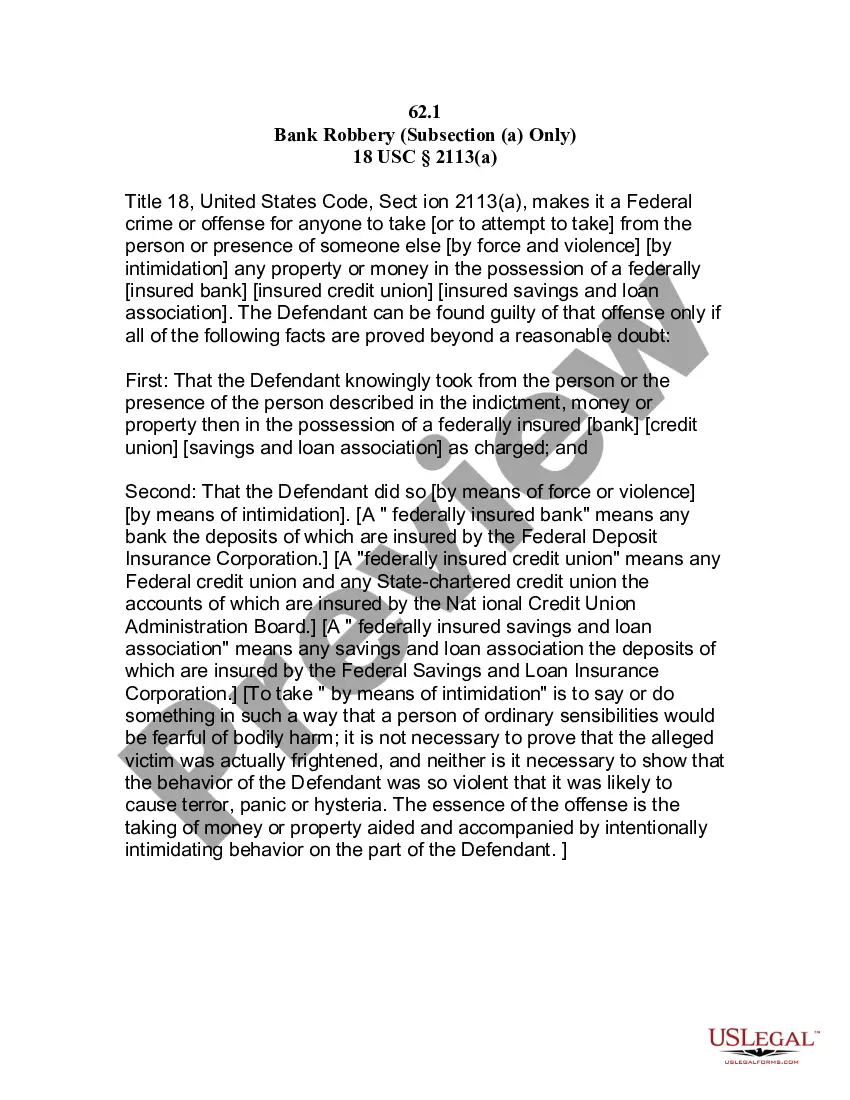

Finding the right legal file template could be a have difficulties. Of course, there are a lot of layouts available on the Internet, but how will you find the legal type you need? Take advantage of the US Legal Forms web site. The assistance gives a large number of layouts, like the South Dakota Property Claimed as Exempt - Schedule C - Form 6C - Post 2005, that you can use for enterprise and personal needs. All the forms are checked by specialists and fulfill federal and state requirements.

In case you are already signed up, log in to your bank account and then click the Down load switch to have the South Dakota Property Claimed as Exempt - Schedule C - Form 6C - Post 2005. Utilize your bank account to search through the legal forms you possess ordered earlier. Proceed to the My Forms tab of your respective bank account and obtain yet another version of your file you need.

In case you are a whole new end user of US Legal Forms, here are basic guidelines that you can stick to:

- First, ensure you have chosen the correct type for your personal city/region. You may look through the form utilizing the Preview switch and study the form outline to guarantee it will be the best for you.

- In case the type will not fulfill your expectations, utilize the Seach discipline to find the correct type.

- Once you are certain that the form would work, click on the Buy now switch to have the type.

- Choose the prices prepare you want and enter in the essential information. Create your bank account and pay money for the transaction utilizing your PayPal bank account or bank card.

- Pick the submit formatting and down load the legal file template to your gadget.

- Full, revise and printing and signal the acquired South Dakota Property Claimed as Exempt - Schedule C - Form 6C - Post 2005.

US Legal Forms may be the greatest local library of legal forms that you can find numerous file layouts. Take advantage of the service to down load professionally-made documents that stick to express requirements.

Form popularity

FAQ

Owner occupied status does not affect your assessed value. It will affect the mill levy (rate per thousand dollars of value) that you pay for taxes. A property owner with owner occupied will pay a lower mill levy. A property owner can only have owner occupied on one property, their primary residence, in South Dakota.

Owner occupied status does not affect your assessed value. It will affect the mill levy (rate per thousand dollars of value) that you pay for taxes. A property owner with owner occupied will pay a lower mill levy. A property owner can only have owner occupied on one property, their primary residence, in South Dakota.

The Homestead Exemption Program delays the payment of property taxes until the property is sold. The property taxes are added up and interest of 4% a year is accrued but the taxes are not required to be paid until the property is transferred.

Some customers are exempt from paying sales tax under South Dakota law. Examples include government agencies, some nonprofit organizations, and merchants purchasing goods for resale. Sellers are required to collect a valid exemption or resale certificate from buyers to validate each exempt transaction.

Property owners of single-family residences must meet the following requirements to qualify for owner occupied: Own and occupy the property as of November 1 of the current year. Only one property may be classed as owner occupied. The property must be your principle residence.

An easement is a permanent right authorizin-g a person or party to use the land or property of another for a particular purpose. In this case, a utility acquires certain rights to build and maintain a transmission line.

You must be 65 years of age or older OR disabled (as defined by the Social Security Act). You must own the home or retain a life estate in the property. Un-remarried widow/widowers of persons previously qualified may still qualify in some circumstances. Income and property value limits apply.

Any South Dakotan who owns and occupies a home as their primary residence can receive the owner-occupied classification. The primary benefit of the owner-occupied classification is a reduced school general fund levy (SDCL 10-13-39). Owner-occupied classification reduces only the school general levy.