South Dakota Statement of Current Monthly Income and Disposable Income Calculation for Use in Chapter 13 - Post 2005

Description

How to fill out Statement Of Current Monthly Income And Disposable Income Calculation For Use In Chapter 13 - Post 2005?

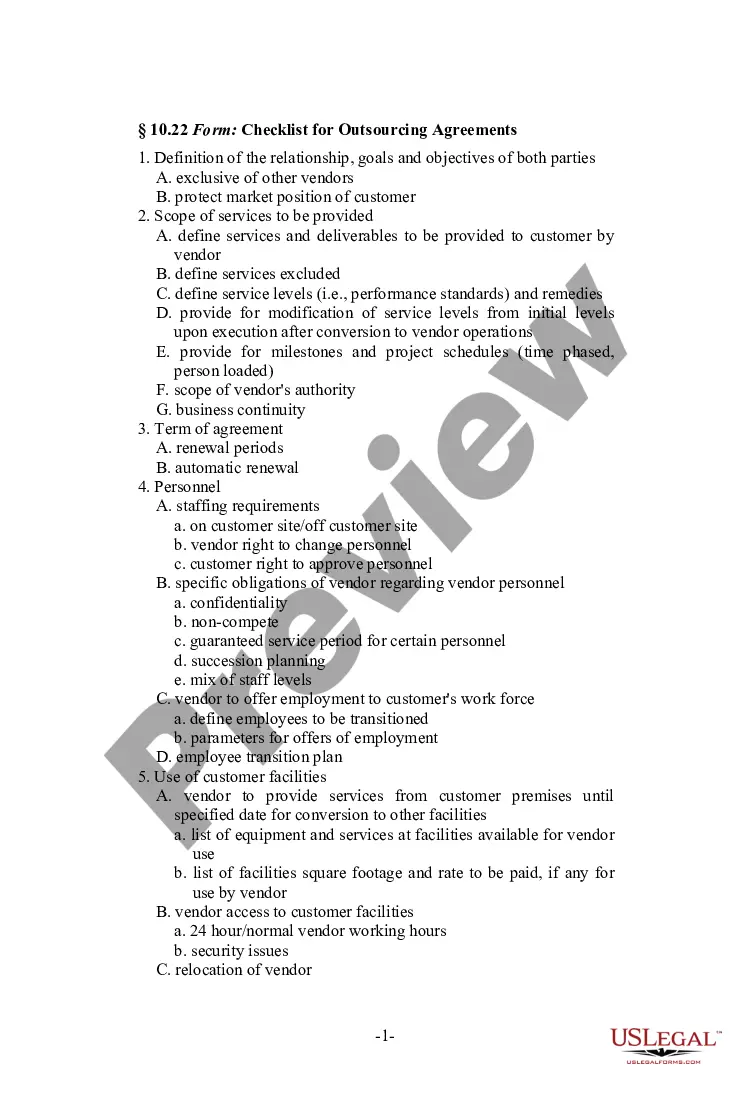

You can commit hours on the Internet attempting to find the authorized record design which fits the federal and state specifications you will need. US Legal Forms gives a large number of authorized types which can be reviewed by specialists. You can easily acquire or print the South Dakota Statement of Current Monthly Income and Disposable Income Calculation for Use in Chapter 13 - Post 2005 from my service.

If you have a US Legal Forms profile, you are able to log in and then click the Down load switch. Following that, you are able to full, modify, print, or indication the South Dakota Statement of Current Monthly Income and Disposable Income Calculation for Use in Chapter 13 - Post 2005. Every authorized record design you get is your own forever. To get yet another duplicate associated with a obtained kind, visit the My Forms tab and then click the corresponding switch.

Should you use the US Legal Forms website the very first time, stick to the easy guidelines beneath:

- Initially, be sure that you have selected the correct record design for your area/metropolis of your choice. Look at the kind information to make sure you have chosen the appropriate kind. If accessible, use the Preview switch to appear through the record design at the same time.

- If you would like locate yet another model in the kind, use the Search area to discover the design that fits your needs and specifications.

- After you have discovered the design you would like, click on Purchase now to proceed.

- Select the costs program you would like, key in your qualifications, and register for an account on US Legal Forms.

- Comprehensive the financial transaction. You should use your credit card or PayPal profile to purchase the authorized kind.

- Select the structure in the record and acquire it to your gadget.

- Make alterations to your record if required. You can full, modify and indication and print South Dakota Statement of Current Monthly Income and Disposable Income Calculation for Use in Chapter 13 - Post 2005.

Down load and print a large number of record web templates utilizing the US Legal Forms website, which offers the most important collection of authorized types. Use specialist and express-certain web templates to take on your organization or specific demands.

Form popularity

FAQ

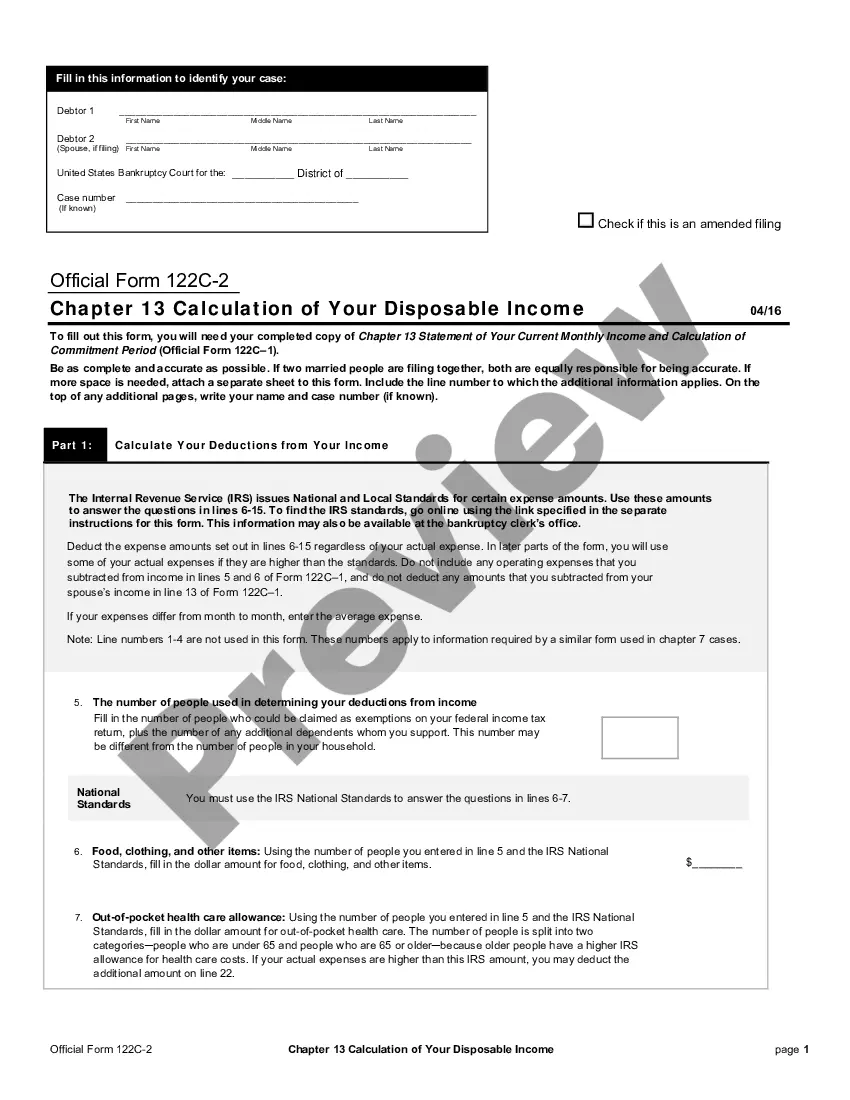

Your disposable income is what remains after you've deducted all living expenses such as food, clothing, housing, utilities, insurance, childcare expenses, medical expenses and insurance costs and mandatory payments.

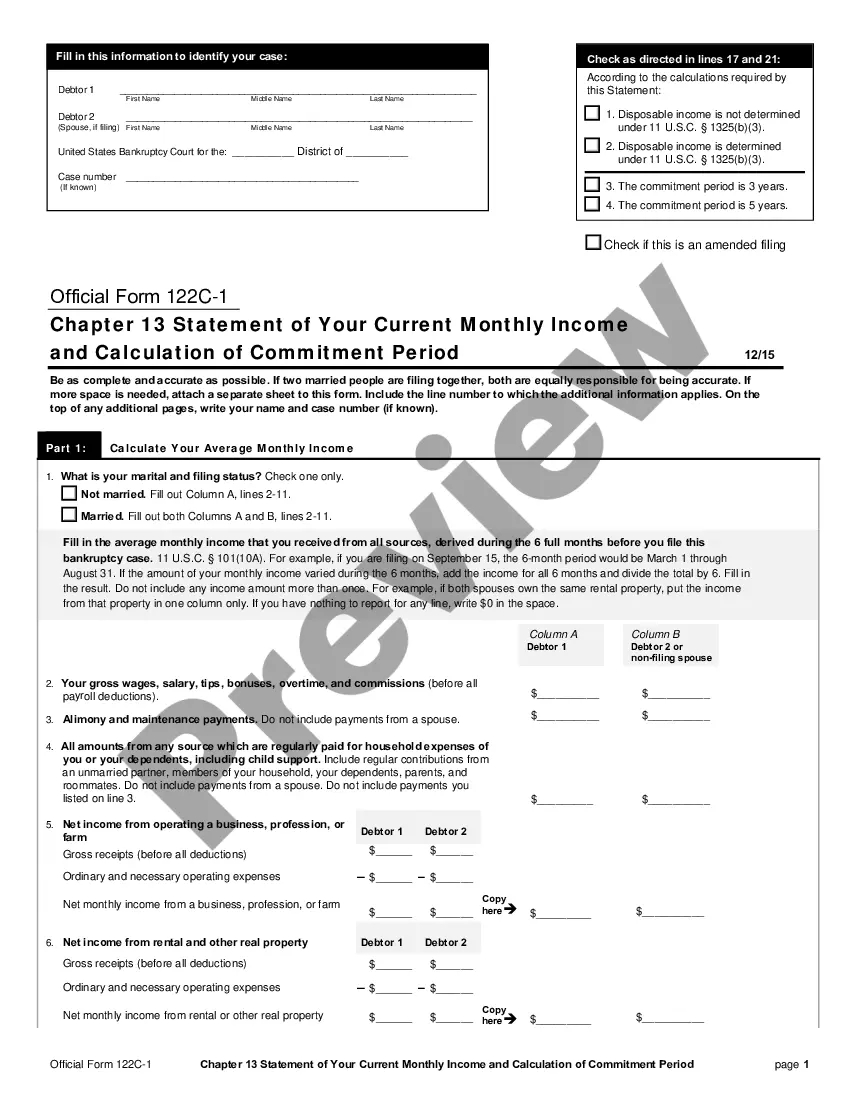

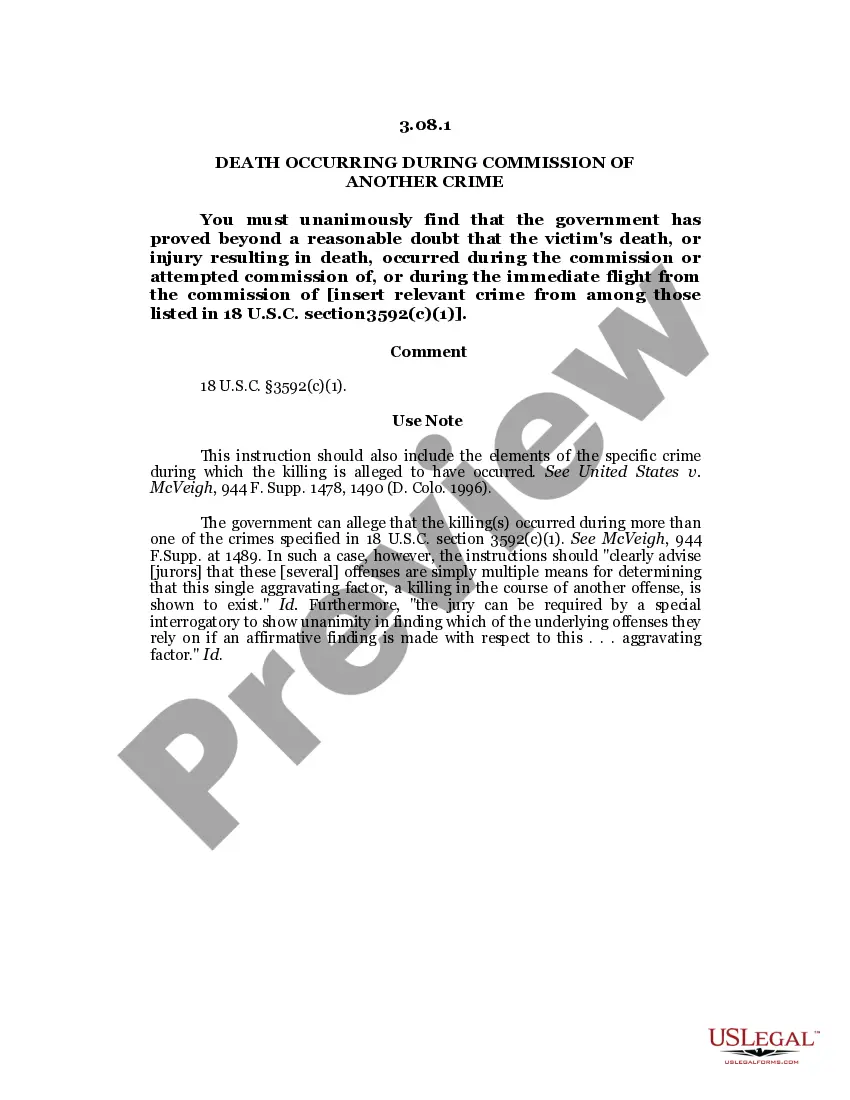

For a Chapter 13, the ?Chapter 13 Statement of Your Current Monthly Income and Calculation of Commitment Period? (Form 122C-1) tells the court your average monthly income. Your income is compared to the median income for your state, which will assist in calculating your disposable income.

What is Disposable Personal Income? After-tax income. The amount that U.S. residents have left to spend or save after paying taxes is important not just to individuals but to the whole economy. The formula is simple: personal income minus personal current taxes.

Gross (or net) national disposable income equals gross (or net) national income (at market prices) minus current transfers (current taxes on income, wealth etc., social contributions, social benefits and other current transfers) payable to non-resident units, plus current transfers receivable by resident units from the ...

To calculate your monthly payment amount in a Chapter 13 bankruptcy, calculate your income for the six months before your bankruptcy filing. Deduct allowable expenses to determine your disposable income. Pay your priority debtors and any secured debts that you want to keep after the bankruptcy.

Disposable Income = Personal Income ? Personal Income Taxes.

An employee's disposable earnings are considered to be your gross income minus any legally required deductions such as taxes and Social Security. The remaining income is eligible for wage garnishments and is considered disposable earnings.

If you earn $1,500 every two weeks, and your employer deducts $230 for taxes, your disposable income would be $1,270. Your withholdings might differ for state or local taxes withheld.