South Dakota Discharge of Joint Debtors - Chapter 7 - updated 2005 Act form

Description

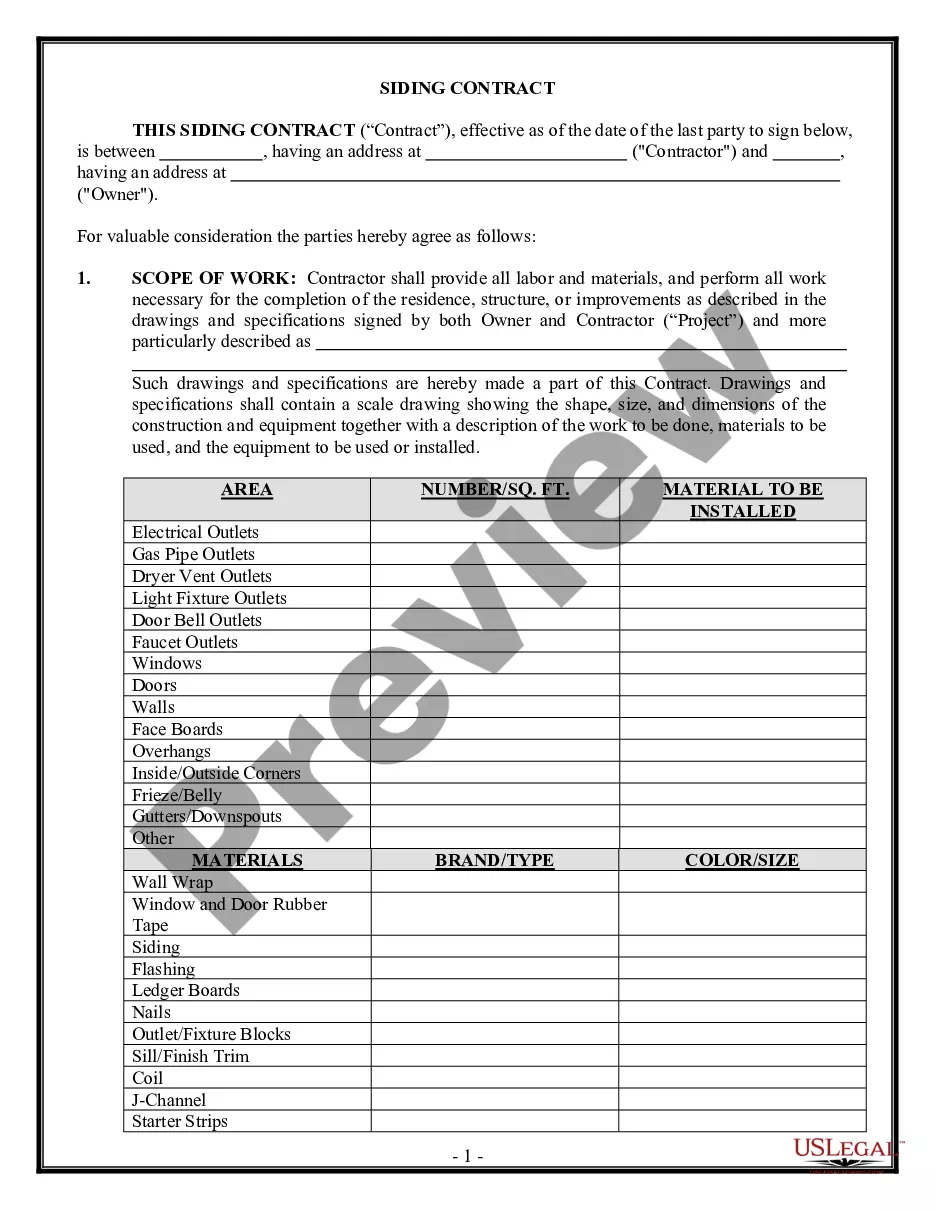

How to fill out Discharge Of Joint Debtors - Chapter 7 - Updated 2005 Act Form?

If you have to comprehensive, obtain, or print out legitimate file layouts, use US Legal Forms, the most important collection of legitimate forms, which can be found on the web. Take advantage of the site`s basic and convenient look for to obtain the files you need. Various layouts for business and individual purposes are categorized by types and claims, or search phrases. Use US Legal Forms to obtain the South Dakota Discharge of Joint Debtors - Chapter 7 - updated 2005 Act form in a number of click throughs.

In case you are currently a US Legal Forms client, log in to the accounts and click on the Download key to have the South Dakota Discharge of Joint Debtors - Chapter 7 - updated 2005 Act form. You can also entry forms you formerly downloaded inside the My Forms tab of your accounts.

If you use US Legal Forms the very first time, refer to the instructions under:

- Step 1. Ensure you have chosen the shape for that appropriate city/region.

- Step 2. Make use of the Preview solution to examine the form`s content material. Never forget to read through the explanation.

- Step 3. In case you are not happy using the kind, use the Look for area on top of the monitor to locate other types of the legitimate kind design.

- Step 4. Upon having located the shape you need, click the Get now key. Choose the pricing strategy you choose and add your credentials to register for an accounts.

- Step 5. Approach the transaction. You should use your charge card or PayPal accounts to finish the transaction.

- Step 6. Find the structure of the legitimate kind and obtain it in your product.

- Step 7. Total, revise and print out or sign the South Dakota Discharge of Joint Debtors - Chapter 7 - updated 2005 Act form.

Each legitimate file design you acquire is your own forever. You have acces to every single kind you downloaded with your acccount. Go through the My Forms area and decide on a kind to print out or obtain again.

Contend and obtain, and print out the South Dakota Discharge of Joint Debtors - Chapter 7 - updated 2005 Act form with US Legal Forms. There are many professional and express-particular forms you may use to your business or individual demands.

Form popularity

FAQ

Chapter 11 is the chapter used by large businesses to reorganize their debts and continue operating. Corporations, partnerships, and limited liability companies cannot use chapter 13 to reorganize and must cease business operations if a chapter 7 bankruptcy is filed.

After your Chapter 7 bankruptcy discharge, you embark on a new journey of rebuilding your life. There's no shortage of resources for rebuilding credit, but the support given to those just coming out of Chapter 7 bankruptcy is far less accessible.

Of the two options, Chapter 7 is more popular because filers don't have to pay back part of their debts. Chapter 13 may be a better solution if you're in arrears on your mortgage because you can keep your house in Chapter 13 and have time to get caught up on payments. Chapter 7 vs Chapter 13 Bankruptcy: What's The Difference? - Debt.org debt.org ? bankruptcy ? chapter-7-vs-chapte... debt.org ? bankruptcy ? chapter-7-vs-chapte...

The main difference between Chapter 11 and Chapter 13 is that a Chapter 13 bankruptcy requires that the debtor pay his or her debts within five years. On the other hand, Chapter 11 allows the filer to extend the five-year period unlike Chapter 13. Another difference is how much the Debtor has to pay creditors. What is the Difference Between a Chapter 11 and Chapter 13 ... finkellawgroup.com ? 2022/08/02 ? what-is-the-d... finkellawgroup.com ? 2022/08/02 ? what-is-the-d...

Background. A chapter 13 bankruptcy is also called a wage earner's plan. It enables individuals with regular income to develop a plan to repay all or part of their debts. Under this chapter, debtors propose a repayment plan to make installments to creditors over three to five years. Chapter 13 - Bankruptcy Basics | United States Courts uscourts.gov ? services-forms ? chapter-13-... uscourts.gov ? services-forms ? chapter-13-...

The discharge received by an individual debtor in a Chapter 11 case discharges the debtor from all pre-confirmation debts except those that would not be dischargeable in a Chapter 7 case filed by the same debtor. Chapter 11 Bankruptcy Reorganization FAQs arklatexlaw.com ? practice-areas ? bankruptcy ? ch... arklatexlaw.com ? practice-areas ? bankruptcy ? ch...