South Dakota Employee Evaluation Form for Sole Trader

Description

How to fill out Employee Evaluation Form For Sole Trader?

Have you ever been in a circumstance where you require documents for either business or personal purposes frequently.

There are numerous legal form templates accessible online, but finding reliable ones is not straightforward.

US Legal Forms offers a vast selection of form templates, such as the South Dakota Employee Evaluation Form for Sole Trader, designed to comply with state and federal regulations.

Once you obtain the appropriate form, click on Buy now.

Select the payment plan you prefer, provide the necessary information to create your account, and complete the transaction using your PayPal or Visa or Mastercard.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- Then, you can download the South Dakota Employee Evaluation Form for Sole Trader template.

- If you do not have an account and wish to start using US Legal Forms, follow these instructions.

- Locate the form you need and ensure it pertains to the correct city/state.

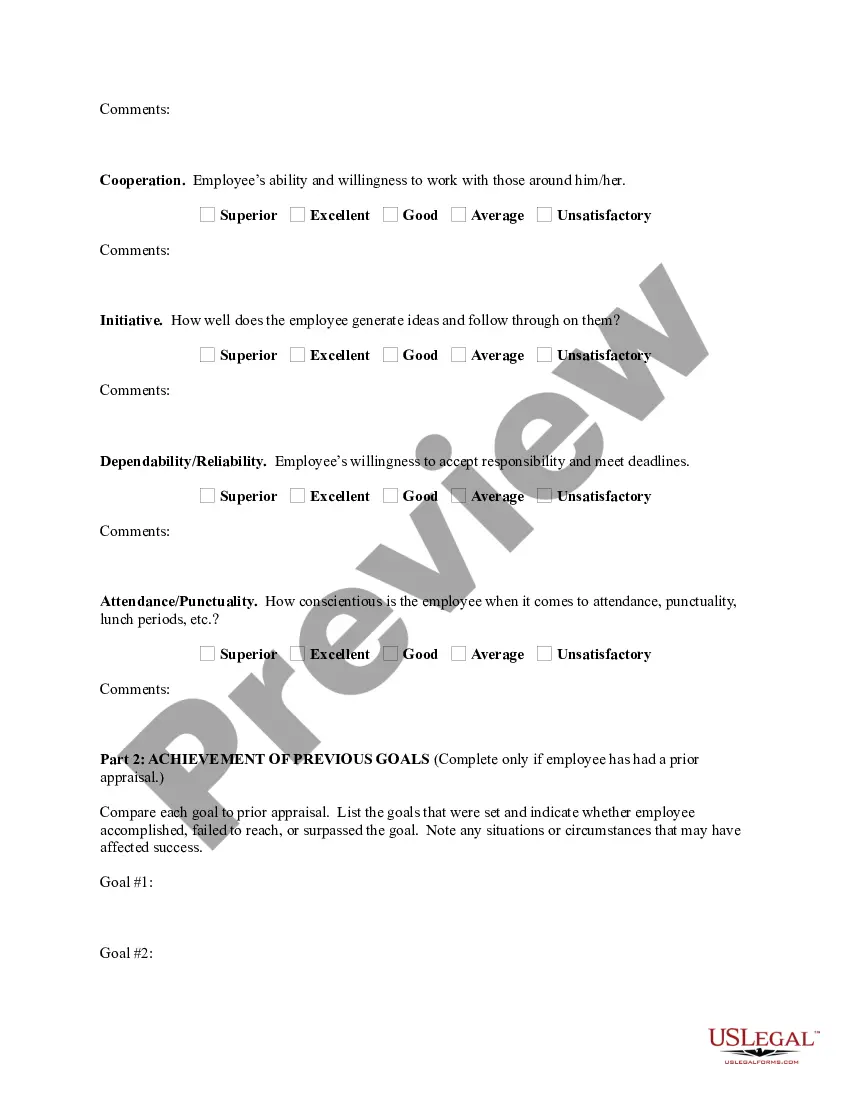

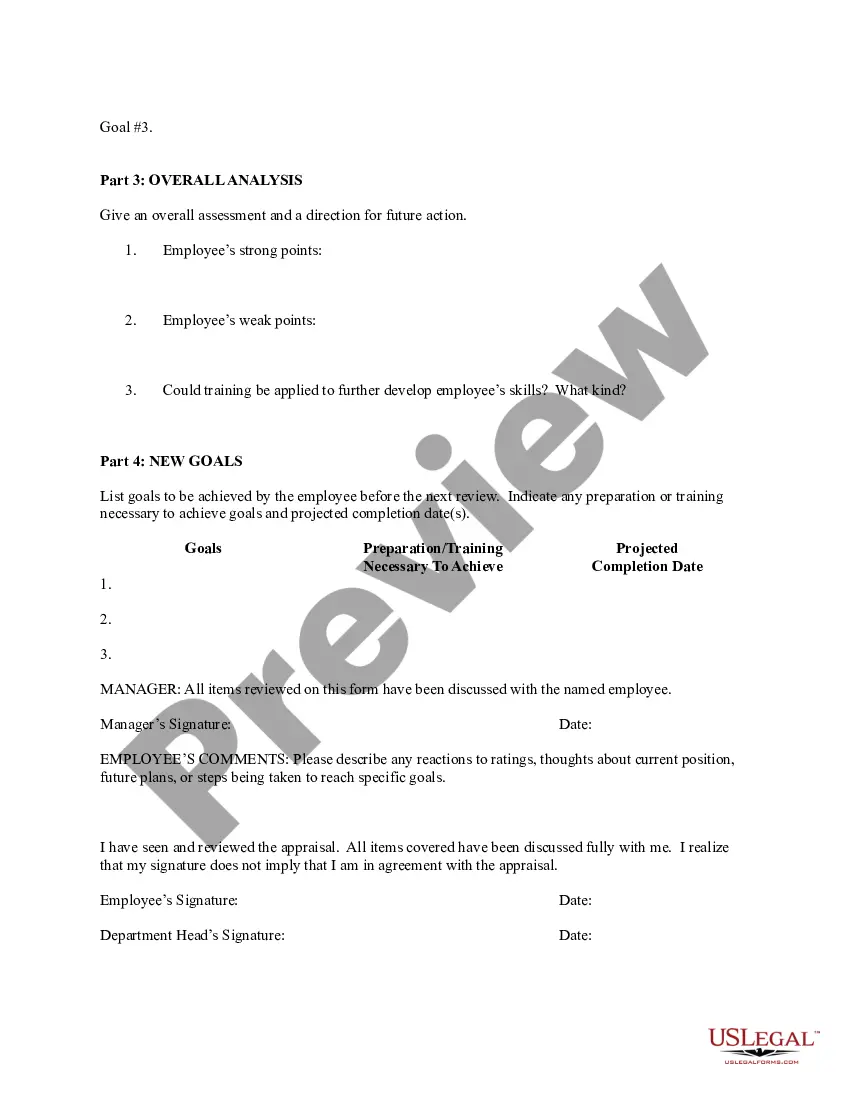

- Utilize the Preview button to scrutinize the form.

- Review the information to confirm you have selected the correct document.

- If the form is not what you're looking for, use the Search field to find the form that suits your needs and criteria.

Form popularity

FAQ

The self-employment tax rate in South Dakota is 15.3%, which includes Social Security and Medicare taxes. This tax applies to your net earnings from self-employment activities. Keeping detailed records using forms like the South Dakota Employee Evaluation Form for Sole Trader can help you calculate and manage your tax responsibilities more effectively.

An Investment Fee of 0.55% is added to newly liable employers' tax rates.

Along with the UI tax, a so-called investment fee is also assessed. In the last few years, the UI tax rate has been 1.2%, and the investment fee has been . 55%, for a total effective tax rate of 1.75%.

South Dakota does not have a personal income tax, so there is no withholding.

South Dakota does not impose a corporate income tax.

South Dakota is one of only a very few states that does not have a personal income tax or a corporation income tax. Consequently, for most LLCs, including those that may have elected to be taxed as corporations, no state income taxes are due.

If you want to avoid income taxes, you should consider relocating to South Dakota, as there's no income tax in the state. This means your income from wages, salaries, capital gains, interest and dividends are not taxed at the state level. Furthermore, taxpayers in South Dakota do not need to file a state tax return.

South Dakota also does not have a corporate income tax. South Dakota has a 4.50 percent state sales tax rate, a max local sales tax rate of 4.50 percent, and an average combined state and local sales tax rate of 6.40 percent. South Dakota's tax system ranks 2nd overall on our 2022 State Business Tax Climate Index.

South Dakota Administrative Fee 2018 The fee is 0.02% for all applicable employers.

To comply with federal and state government regulations, employers must file state unemployment insurance (SUI) reports.