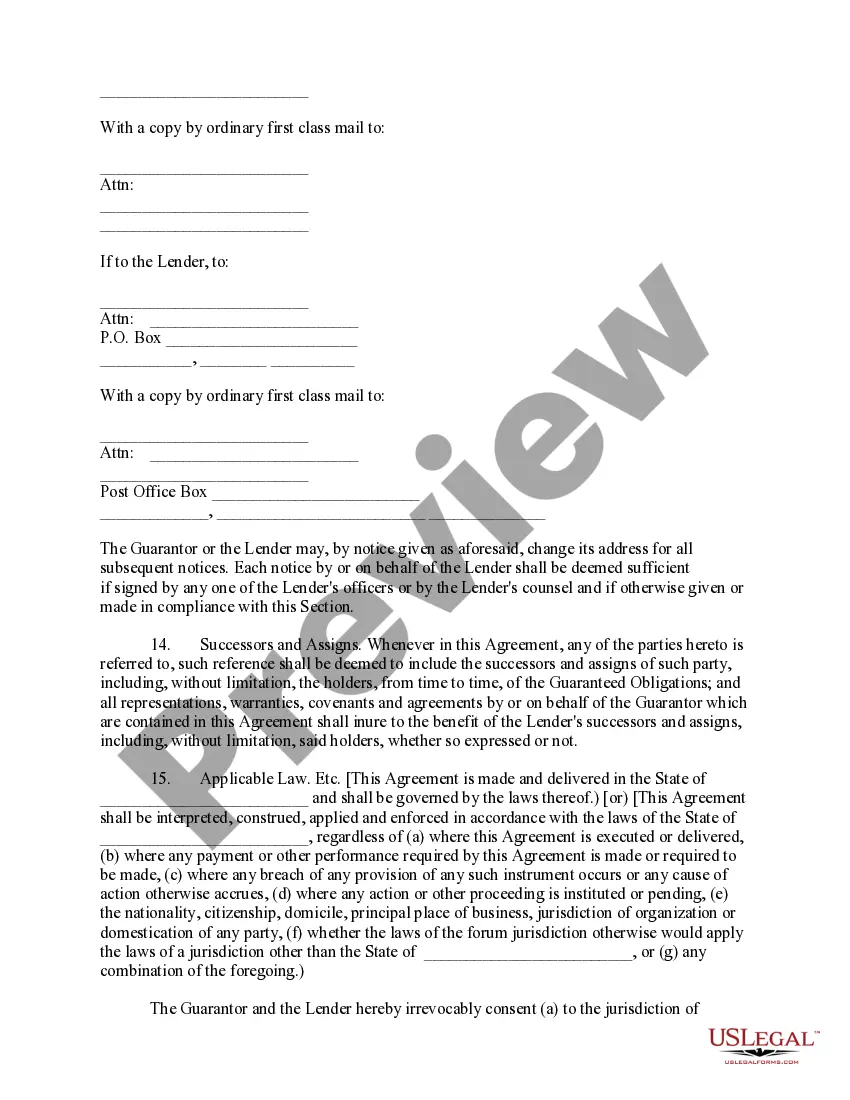

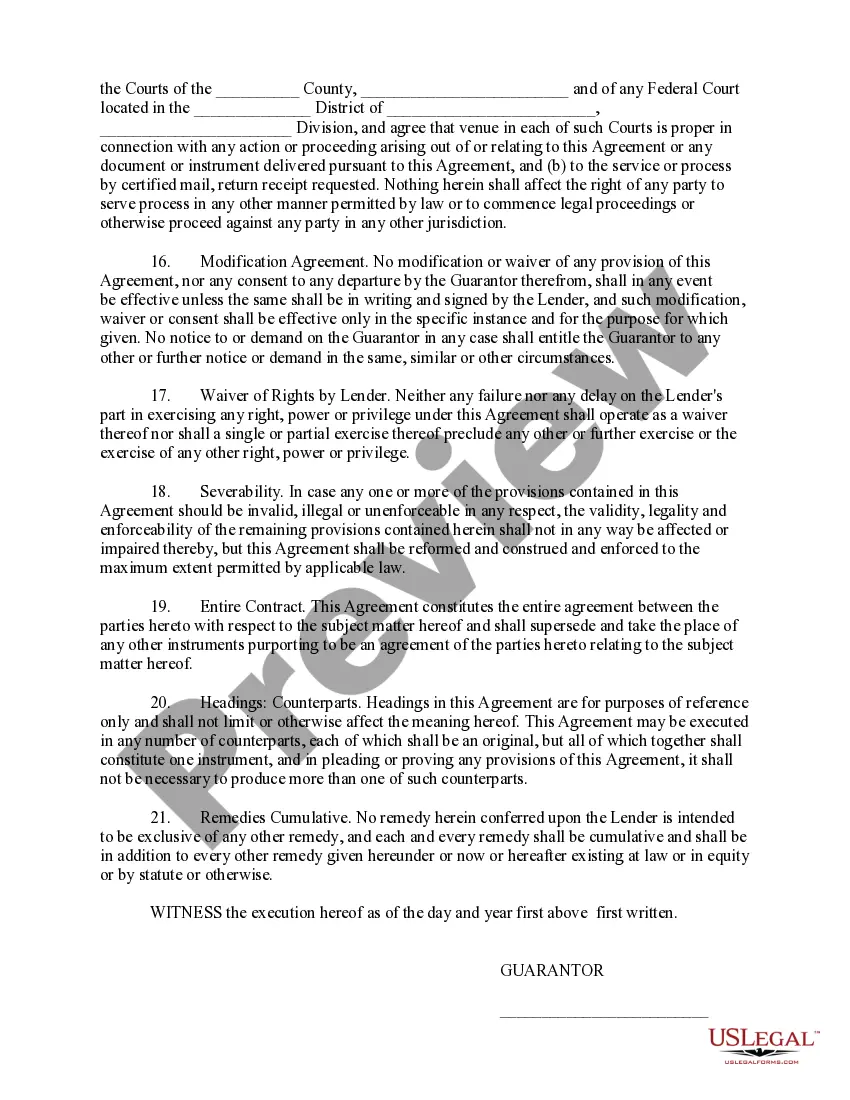

South Dakota Complex Guaranty Agreement to Lender

Description

How to fill out Complex Guaranty Agreement To Lender?

Finding the right lawful record template can be a have a problem. Naturally, there are a variety of themes available online, but how would you find the lawful kind you will need? Make use of the US Legal Forms site. The service delivers a large number of themes, including the South Dakota Complex Guaranty Agreement to Lender, which you can use for organization and personal requirements. All of the forms are checked out by professionals and meet state and federal requirements.

Should you be previously signed up, log in in your bank account and then click the Obtain option to find the South Dakota Complex Guaranty Agreement to Lender. Use your bank account to look from the lawful forms you possess acquired previously. Visit the My Forms tab of the bank account and have one more backup from the record you will need.

Should you be a brand new user of US Legal Forms, here are simple directions that you should stick to:

- Initial, make sure you have chosen the proper kind to your metropolis/county. You are able to look through the shape utilizing the Review option and look at the shape information to make sure it will be the best for you.

- In the event the kind fails to meet your needs, utilize the Seach discipline to find the correct kind.

- Once you are certain that the shape would work, click on the Get now option to find the kind.

- Pick the rates prepare you would like and type in the needed details. Make your bank account and purchase your order utilizing your PayPal bank account or credit card.

- Choose the data file structure and acquire the lawful record template in your product.

- Comprehensive, change and print out and indication the attained South Dakota Complex Guaranty Agreement to Lender.

US Legal Forms is definitely the biggest collection of lawful forms where you will find various record themes. Make use of the service to acquire appropriately-produced documents that stick to express requirements.

Form popularity

FAQ

The Guarantor agrees that, if any of the Obligations are not paid when due, the Guarantor will, upon demand by the Bank, forthwith pay such Obligations, or if the maturity thereof shall have been accelerated by the Bank, the Guarantor will forthwith pay all Obligations of the Borrower.

The Guarantor(s) agree/s as a pre-condition of the credit facility granted by the Bank to the Borrower that in case any default is committed in the repayment of the loan/advance or in repayment of interest thereon or any of the agreed instalment of the loan on due date/s, the Bank and/or the Reserve Bank of India will ...

A guaranty agreement, in the realm of commercial insurance, refers to a legally binding contract where one party, known as the guarantor, promises to be responsible for the obligations or debts of another party, known as the debtor, if they fail to fulfill their financial commitments.

Guarantor agrees to the provisions of this Guaranty, and hereby waives notice of (a) any loans or advances made by Lender to Borrower, (b) acceptance of this Guaranty, (c) any amendment or extension of the Note, the Loan Agreement or of any other Loan Documents, (d) the execution and delivery by Borrower and Lender of ...

Generally, the guarantee covers the whole loan, but it can be limited to only part of the loan. Under the contract, the guarantor promises to repay the loan (or part of the loan) if the borrower (debtor) is unable to pay. A co-borrower is a borrower. A co-borrower signs a loan with someone else who is also a borrower.

A guarantee agreement definition is common in real estate and financial transactions. It concerns the agreement of a third party, called a guarantor, to provide assurance of payment in the event the party involved in the transaction fails to live up to their end of the bargain.

A loan agreement not only details the terms of the loan, but it also serves as proof that the money, goods, or services were not a gift to the borrower.

In this clause, the Guarantor unconditionally guarantees and covenants with the Lender that the Guarantor will duly and punctually pay to the Lender all debts and liabilities, present or future, direct or indirect, absolute or contingent, matured or not at any time owing by the Borrower to the Lender upon demand ...