South Dakota Expense Reimbursement Request

Description

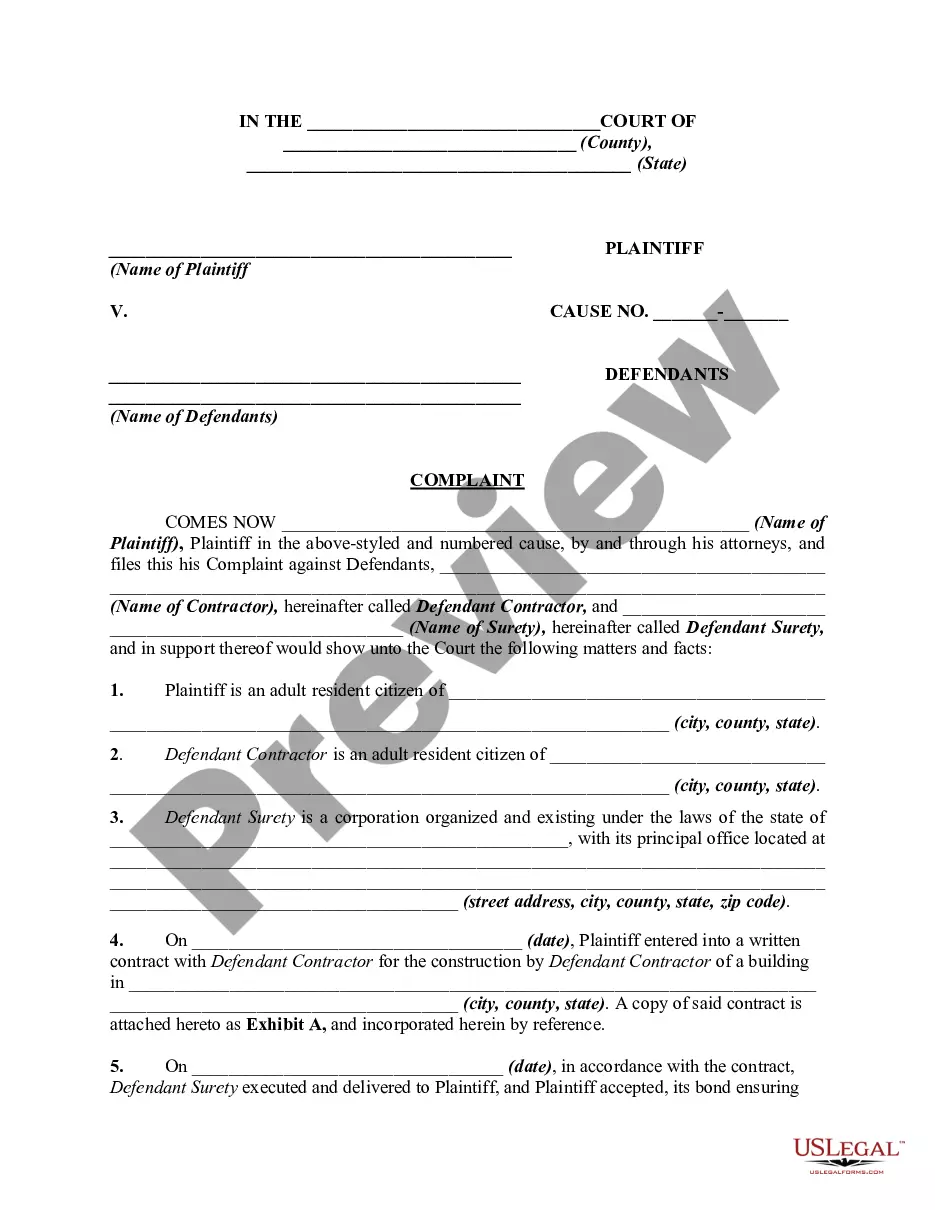

How to fill out Expense Reimbursement Request?

US Legal Forms - one of the largest collections of legal documents in the USA - provides a broad selection of legal form templates that you can download or print.

By utilizing the website, you can access a vast number of forms for both business and personal purposes, categorized by types, states, or keywords. You can find the latest versions of forms such as the South Dakota Expense Reimbursement Request in seconds.

If you have a monthly subscription, Log In to download the South Dakota Expense Reimbursement Request from your US Legal Forms catalog. The Obtain button will be visible on every form you see. You can access all previously acquired forms in the My documents tab of your account.

Complete the transaction. Use your credit card or PayPal account to finalize the purchase.

Select the format and download the form to your device. Make modifications. Fill out, edit, print, and sign the obtained South Dakota Expense Reimbursement Request. Each template you add to your account has no expiration date and is yours permanently. So, if you want to download or print another copy, simply go to the My documents section and click on the form you need. Access the South Dakota Expense Reimbursement Request with US Legal Forms, the most comprehensive collection of legal document templates. Utilize countless professional and state-specific templates that meet your business or personal needs and requirements.

- Ensure you have selected the correct form for the area/region.

- Click the Preview button to review the content of the form.

- Read the form description to confirm that you have chosen the right form.

- If the form does not meet your needs, use the Lookup field at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your choice by clicking the Buy now button.

- Then, select the pricing plan you prefer and provide your details to register for an account.

Form popularity

FAQ

Yes, an example of a reimbursement document is typically an expense report or a reimbursement form that includes the date, amount, and purpose of each expense. This document should be clearly formatted to avoid confusion and can be easily customizable with a South Dakota Expense Reimbursement Request template from USLegalForms. Such examples help guide individuals in submitting their expense reports correctly.

Is my employer required to cover my expenses if I work from home? The federal Fair Labor Standards Act (FLSA) generally does not require that an employee be reimbursed for expenses incurred while working from home.

Handling Reimbursable Expenses There are two ways to handle reimbursements: Assign money for the initial expense. Temporarily overspending, then using the reimbursement to cover it.

A necessary expense is anything required for the performance of an employees' job. This depends on the work performed, but reasonable reimbursable expenses will likely include: internet services, mobile data usage, laptop computers or tablets, and equipment such as copiers and printers.

bystep guide to employee expense reimbursementForm a policy for the expense reimbursement process.Determine what expenses employees can claim.Create a system for collecting employee expense claims.Verify the legitimacy of expenses.Pay reimbursements within a specified timeframe.

How to record reimbursementsKeep your receipts. It's important to keep an accurate record of your expenses.Add reimbursement costs to client bill. Add up all expenses for the project and add this amount to the client's bill.Bill client up to agreed-upon limits. Issue the bill promptly.Know before you go.

If you have an accountable plan, expense reimbursements shouldn't be processed through payroll. Instead, ask employees to periodically gather documentation of expenses and then issue an expense reimbursement check. These payments should be recorded as company expenses.

Some companies will provide everything a remote employee needs. They may send a computer, smartphone, printer, and more, depending on the needs of the job. This usually helps companies feel secure knowing their remote worker has everything they need in their home office to perform their job duties successfully.

Companies that don't have to pay for employees' office space and supplies can save quite a bit in a year. One study showed that if a company allowed an employee to work from home just half of the time, it would save on average $11,000 per employee, and each employee would save between $2,000 and $7,000.

Several states, including California, the District of Columbia, Illinois, Iowa, Massachusetts, Montana and New York, do require employers to reimburse employees for necessary business-related expenses.