South Dakota Employment Information Form

Description

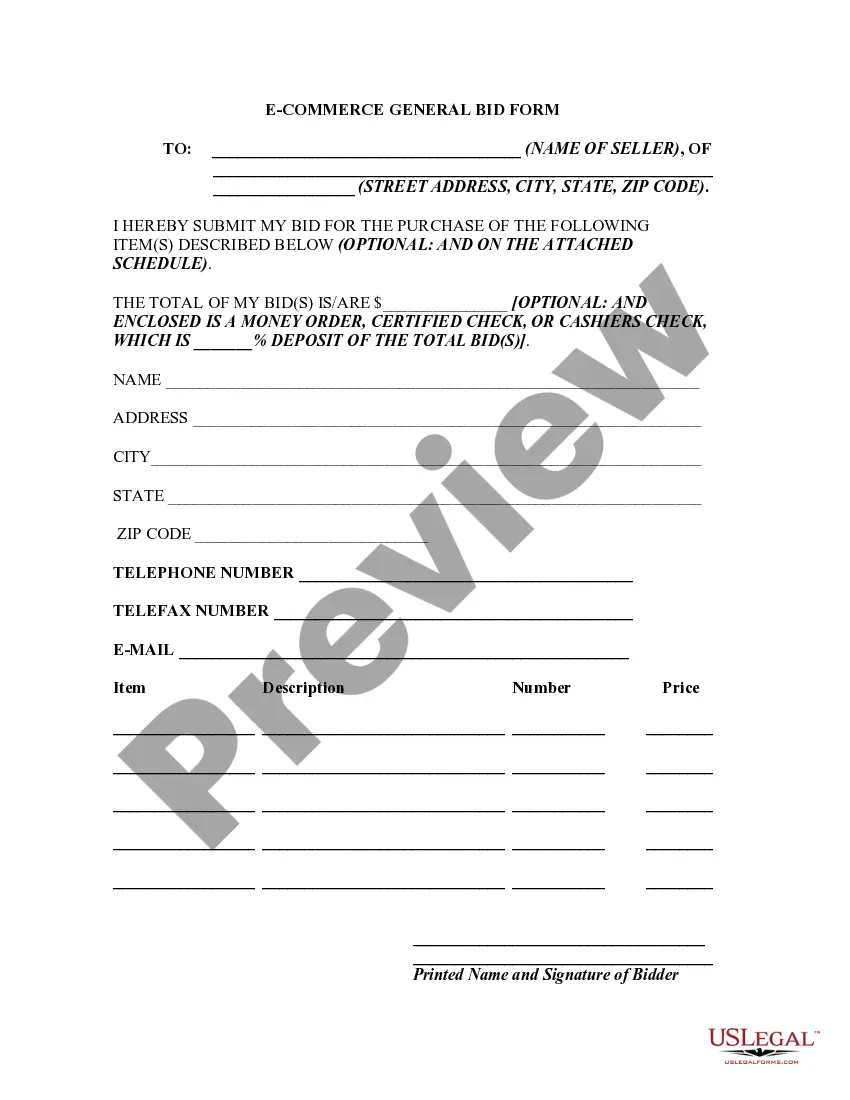

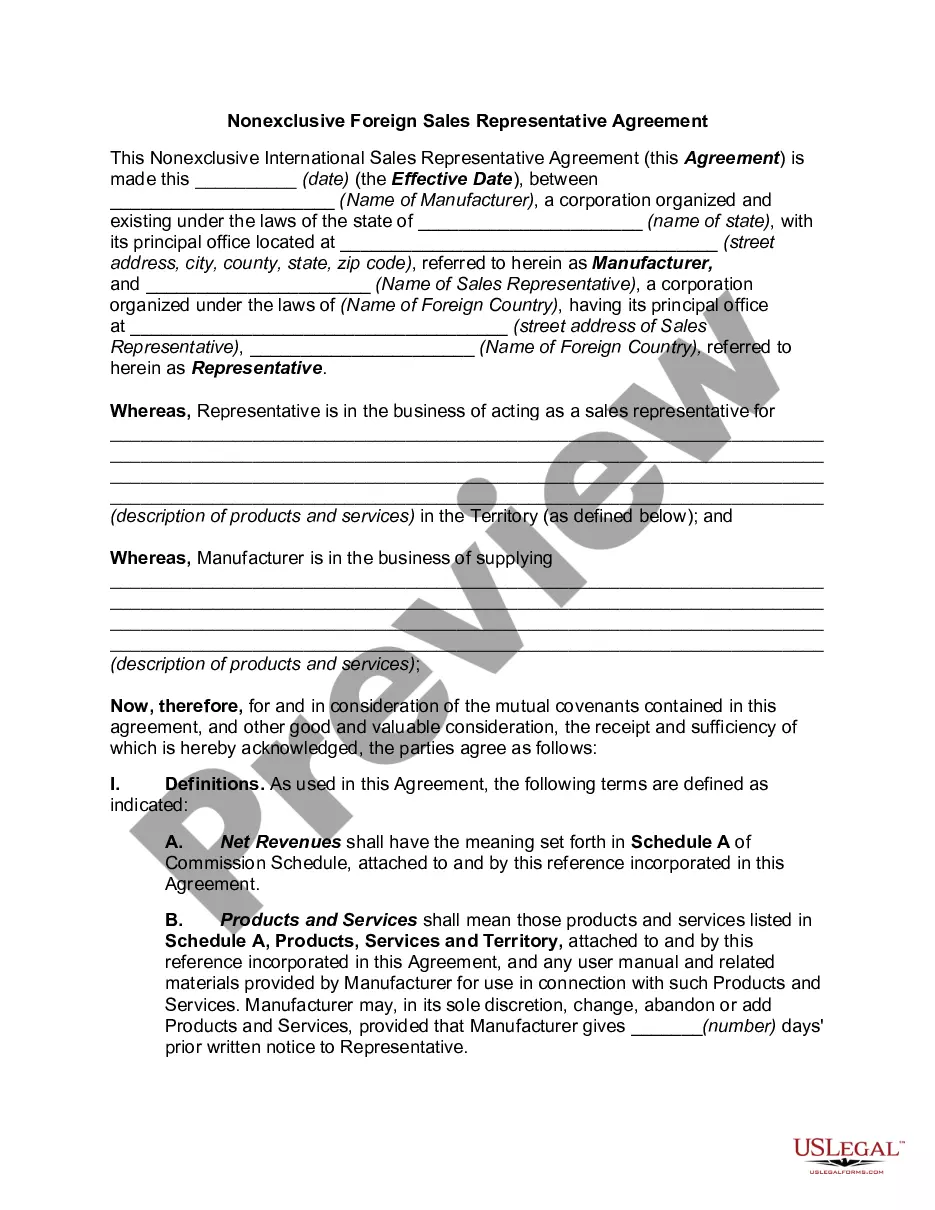

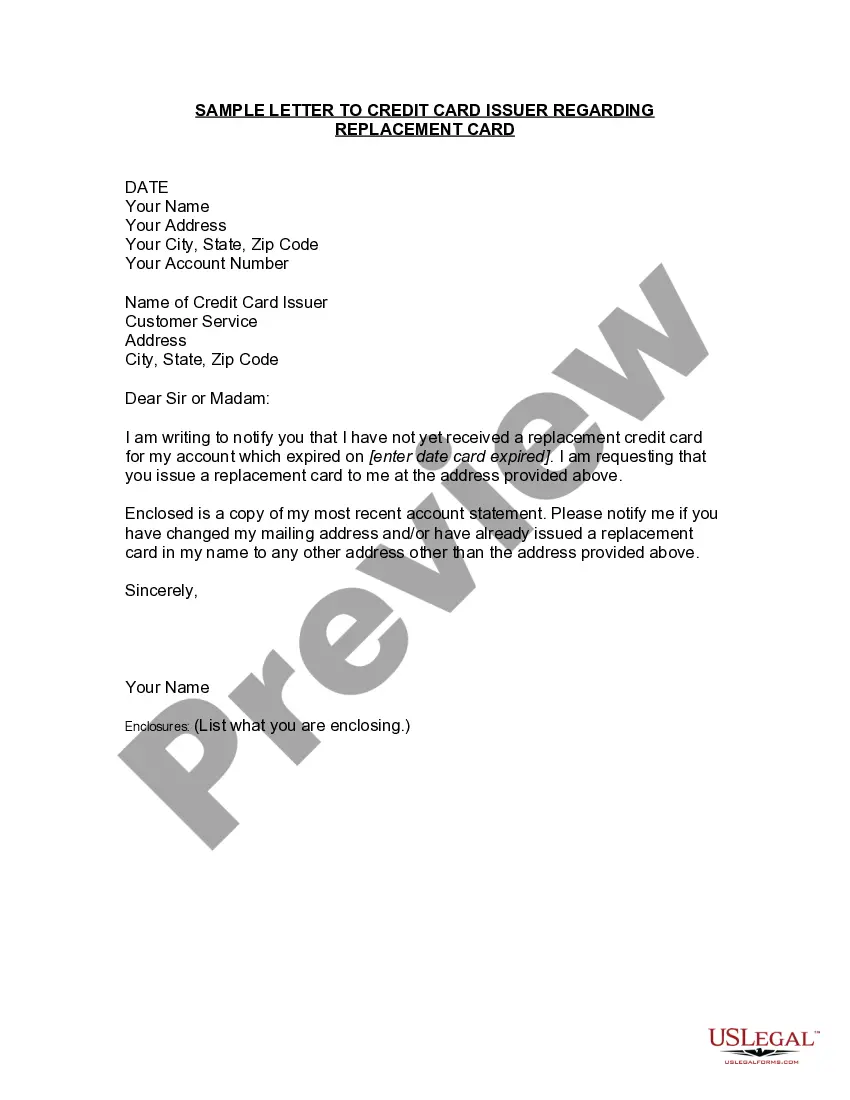

How to fill out Employment Information Form?

You might spend time online trying to locate the official document template that fulfills the national and state requirements you have.

US Legal Forms offers a vast selection of legal forms that can be reviewed by experts.

It is easy to download or print the South Dakota Employment Information Form from my services.

If available, utilize the Preview button to view the document format as well.

- If you already possess a US Legal Forms account, you can Log In and click on the Acquire button.

- Following this, you can complete, revise, print, or sign the South Dakota Employment Information Form.

- Each legal document format you purchase is yours indefinitely.

- To obtain another copy of any purchased form, navigate to the My documents tab and click on the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the straightforward instructions below.

- First, ensure you have chosen the correct document format for the area/city of your selection.

- Review the form details to confirm you have selected the correct template.

Form popularity

FAQ

If there are no issues, your first payment can take up to four weeks after the claim is filed. The first eligible week of your claim is a non-paid waiting week. If there are issues that need to be investigated before we can determine eligibility, payments will be delayed until the investigation is completed.

Employee's Withholding Ask all new employees to give you a signed Form W-4 when they start work.

Benefit Amount South Dakota reemployment assistance weekly benefit amounts range between $28 and $466 per week. Your eligibility requires a minimum amount of earnings in a base period. The specific weekly amount is determined by a formula that considers the wages earned during each quarter of the base period.

Amount and Duration of Unemployment Benefits in South Dakota You may receive benefits for a maximum of 26 weeks.

Federal Pandemic Unemployment Benefits Programs Have Ended in South Dakota. All federal unemployment pandemic programs have ended in South Dakota. The last claim week to receive federal unemployment benefits if eligible was for the claim week ending June. 26.

Before you can add an employee to your team, you are legally responsible for confirming the employee is eligible to work in the United States.Form I-9.Form W-4.State W-4.Emergency contact form.Employee handbook acknowledgment form.Bank account information form.Benefits forms.

The UI tax funds unemployment compensation programs for eligible employees. In South Dakota, state UI tax is one of the primary taxes that employers must pay. Unlike most other states, South Dakota does not have state withholding taxes.

Excessive EarningsYou reported earnings that were more than your weekly benefit amount and will not receive a payment.

Receive Your Benefit Payments It takes at least three weeks to process a claim for unemployment benefits and issue payment to most eligible workers.

The most common types of employment forms to complete are:W-4 form (or W-9 for contractors)I-9 Employment Eligibility Verification form.State Tax Withholding form.Direct Deposit form.E-Verify system: This is not a form, but a way to verify employee eligibility in the U.S.