South Dakota Bill of Sale of Personal Property - Reservation of Life Estate in Seller

Description

How to fill out Bill Of Sale Of Personal Property - Reservation Of Life Estate In Seller?

Finding the appropriate legal document format can be a challenge. Indeed, there are numerous templates accessible online, but how do you obtain the legal type you require.

Utilize the US Legal Forms site. The platform offers a vast collection of templates, including the South Dakota Bill of Sale of Personal Property - Reservation of Life Estate in Seller, suitable for business and personal purposes. All documents are verified by professionals and adhere to state and federal regulations.

If you are already registered, sign in to your account and click the Download button to secure the South Dakota Bill of Sale of Personal Property - Reservation of Life Estate in Seller. Use your account to browse through the legal forms you might have previously obtained. Navigate to the My documents section of your account and obtain another copy of the document you need.

Choose the file format and download the legal document to your device. Complete, edit, print, and sign the obtained South Dakota Bill of Sale of Personal Property - Reservation of Life Estate in Seller. US Legal Forms is the largest repository of legal documents where you can access a variety of file templates. Take advantage of the service to obtain professionally crafted documents that comply with state regulations.

- First, make sure you have chosen the correct document for your area/county.

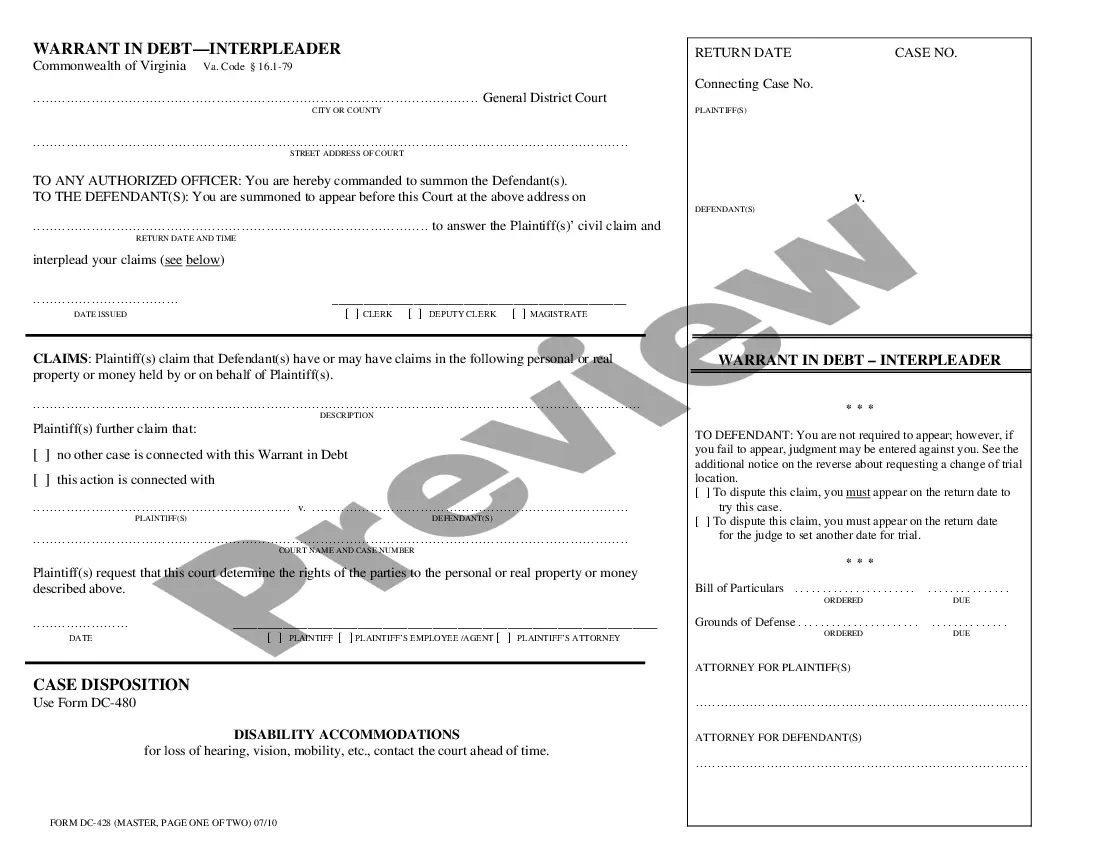

- You can review the form using the Preview button and read the form description to confirm it is suitable for you.

- If the document does not meet your requirements, utilize the Search field to find the correct document.

- Once you are confident the document is acceptable, click the Get now button to acquire the document.

- Select the pricing plan you prefer and provide the necessary information.

- Create your account and pay for the order using your PayPal account or credit card.

Form popularity

FAQ

In a nutshell, real property is anything that's immovable and attached to the house - walls, windows, blinds, light fixtures, doors, and (most) appliances. Personal property is anything that can be moved or taken from the house - furniture, artwork, above-ground hot tubs, and more.

No. A South Dakota vehicle bill of sale is not required to register a vehicle. However, South Dakota does provide a Bill of Sale (Form MV-016) for your personal use for motor vehicle sales.

As the buyer, the following list is what you will need to have to complete your private party purchase with your local county treasurer's office:Title.Title Application.Bill of Sale.Odometer Disclosure.

You should include:Land or real estate location.Property description.Sale date.Sale price for the land or real estate.Contact information for the buyer and seller.Terms and conditions of the sale (for example, the buyer accepts property as is)

Personal property may not be included as additional security for any mortgage on a one-unit property unless otherwise specified by Fannie Mae. For example, certain personal property is pledged when the Multistate Rider and Addenda (Form 3170) is used.

Legally, the items you listed are personal property because they are not permanently attached to the house. Unless specifically itemized, such personal property is not included in the home sale.

Anyone can write a bill of sale in South Dakota. As long as the bill of sale has been signed by all involved parties, it can be legally binding. Getting a bill of sale notarized can help it hold up in court.

Everything you own, aside from real property, is considered personal property. This includes material goods such as all of your clothing, any jewelry, all of your household goods and furnishings, and anything else that is movable and not permanently attached to a fixed location such as your home.

If an object is physically and permanently attached or fastened to the property, it's considered a fixture. This includes items that have been bolted, screwed, nailed, glued or cemented onto the walls, floors, ceilings or any other part of the home. A classic example of this is a window treatment.

Personal property sales involve the transfer of personal property from one party to another. This may be done either through an informal oral agreement (like at a garage sale) or through a written contract. Personal property sales involve the sale of moveable items such as: Appliances and furniture.