South Dakota Vehicle Policy

Description

How to fill out Vehicle Policy?

US Legal Forms - one of the largest repositories of legal templates in the United States - provides a diverse array of legal document formats that you can download or print.

Through the website, you can access thousands of forms for business and personal purposes, categorized by type, state, or keywords. You can find the latest versions of forms like the South Dakota Vehicle Policy in moments.

If you already hold a subscription, Log In to retrieve the South Dakota Vehicle Policy from your US Legal Forms account. The Download button will appear on every form you view. You can find all previously acquired forms in the My documents section of your account.

Make modifications. Complete, edit, print, and sign the downloaded South Dakota Vehicle Policy.

Each template you save in your account doesn't have an expiration date and belongs to you indefinitely. Thus, to download or print another copy, simply visit the My documents section and click on the form you need.

- If you're using US Legal Forms for the first time, here are straightforward instructions to help you get started.

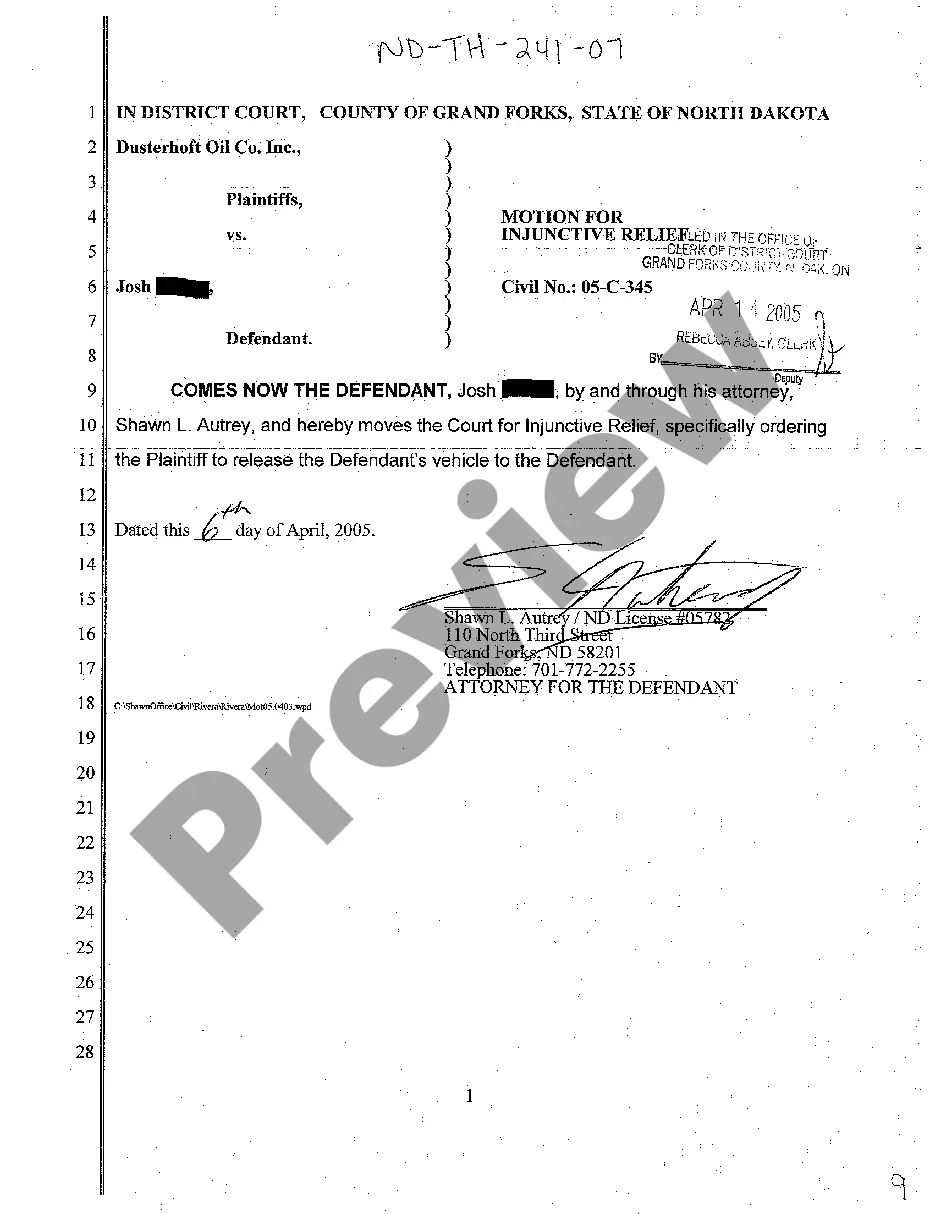

- Ensure you've selected the correct form for your city/state. Click the Preview button to examine the content of the form. Check the form details to confirm you have the right document.

- If the form does not meet your needs, utilize the Search box at the top of the screen to locate a more suitable one.

- Once satisfied with the form, confirm your choice by clicking the Purchase now button. Then, select your preferred pricing plan and provide your details to register for an account.

- Process the transaction. Use your credit card or PayPal account to complete the transaction.

- Choose the format and download the form to your device.

Form popularity

FAQ

Auto insurance in South Dakota costs, on average, $275 annually for minimum coverage and $1,642 annually for full coverage. The average minimum coverage car insurance rates in South Dakota are much cheaper than the national average, which is $565 per year.

Amongst all the states, Louisiana is the most expensive state with an average auto insurance premium of $2,839 per year, a 19% increase in rates from 2020.

Auto insurance requirements in South Dakota. South Dakota law requires that all drivers carry auto insurance. Furthermore, you must also carry proof of coverage at all times when driving.

Auto insurance requirements in South Dakota. South Dakota law requires that all drivers carry auto insurance. Furthermore, you must also carry proof of coverage at all times when driving.

In most states, including South Dakota, insurance may follow the car or the driver. The determining factor includes the type of coverage purchased and from which insurer. For example, in case of an accident, insurance coverage follows the car and the owner might pay for any injuries and damage.

All motorists are required to carry the following minimum insurance coverage levels in South Dakota: Bodily injury: $25,000 per person and $50,000 per accident. Property damage: $25,000 per accident. Uninsured motorist: $25,000 per person and $50,000 per accident.

Based on state law, driving without liability insurance is a Class 2 Misdemeanor. Violating the law can cost you over $500 in fines and reinstatement fees, up to one year of driver's license suspension and even possibly 30 days in jail.

Is South Dakota a no fault state? South Dakota is considered an at-fault state, which means drivers must take responsibility and pay for any crash they might cause. After an accident, the insurance of the driver who caused the accident must pay the other driver's costs for damage caused by the collision.