South Dakota Notice of Meeting of LLC Members To Amend the Articles of Organization

Description

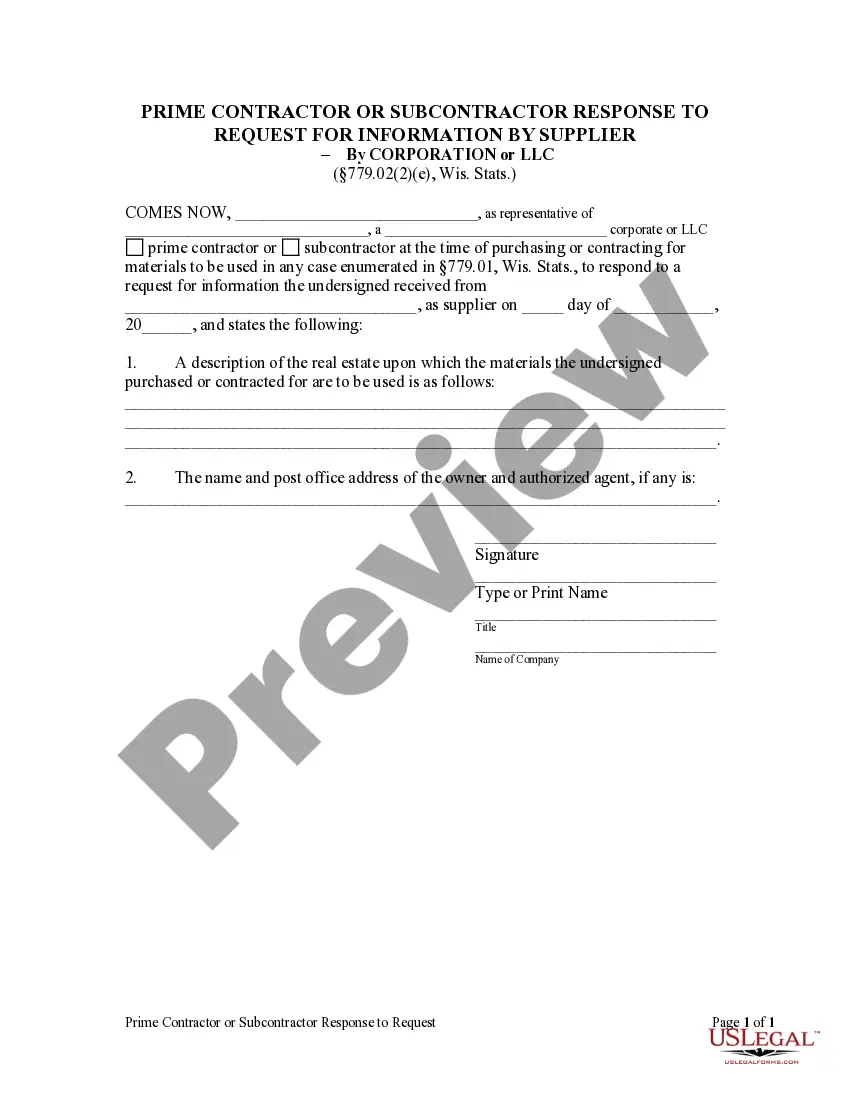

How to fill out Notice Of Meeting Of LLC Members To Amend The Articles Of Organization?

It is feasible to dedicate hours online attempting to discover the valid document template that fulfills the state and federal requirements you will necessitate.

US Legal Forms provides a vast array of legal documents that are reviewed by experts.

You can download or print the South Dakota Notice of Meeting of LLC Members To Amend the Articles of Organization from my service.

Select the pricing plan you prefer, enter your credentials, and create an account on US Legal Forms. Complete the transaction. You can use your Visa or Mastercard or PayPal account to pay for the legal document. Choose the format of the document and download it to your device. Make modifications to the document if needed. You can complete, edit, sign, and print the South Dakota Notice of Meeting of LLC Members To Amend the Articles of Organization. Download and print a multitude of document templates using the US Legal Forms website, which offers the largest selection of legal forms. Utilize professional and state-specific templates to address your business or personal requirements.

- If you possess a US Legal Forms account, you can sign in and click the Download button.

- Subsequently, you can fill out, modify, print, or sign the South Dakota Notice of Meeting of LLC Members To Amend the Articles of Organization.

- Every legal document template you obtain is your property permanently.

- To get an additional copy of any purchased form, visit the My documents tab and click the relevant button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have selected the correct document template for your county/city of choice.

- Review the form outline to confirm you have selected the right form.

- If available, utilize the Review button to examine the document template as well.

- If you wish to obtain another version of the form, use the Search field to locate the template that meets your needs.

- After you have found the template you desire, click on Get now to proceed.

Form popularity

FAQ

The bylaws establish all of the rules and functions of the corporation. South Dakota requires all corporations to adopt bylaws.

Any corporation may for legitimate corporate purpose or purposes amend its articles of incorporation by a majority vote of its board of directors or trustees and the vote or written assent of two-thirds of its members if it be a non-stock corporation, or if it be a stock corporation, by the vote or written assent of

Changing articles of incorporation often means changing things like agent names, the businesses operating name, addresses, and stock information. The most common reason that businesses change the articles of incorporation is to change members' information.

You amend the articles of your South Dakota Corporation by submitting the completed Amendment to Articles of Incorporation form in duplicate by mail or in person, along with the filing fee to the South Dakota Secretary of State.

To make amendments to the organization of your limited liability company in South Dakota, you submit the completed Application for Amended Articles of Organization form to the Secretary of State by mail or in person, in duplicate and with the filing fee.

LLC ownership percentage is usually determined by how much equity each owner has contributed. The ownership interest given to each owner can depend on the need of the limited liability company and the rules of the state where the LLC has been formed.

If there will be multiple people involved in running the company, an S Corp would be better than an LLC since there would be oversight via the board of directors. Also, members can be employees, and an S corp allows the members to receive cash dividends from company profits, which can be a great employee perk.