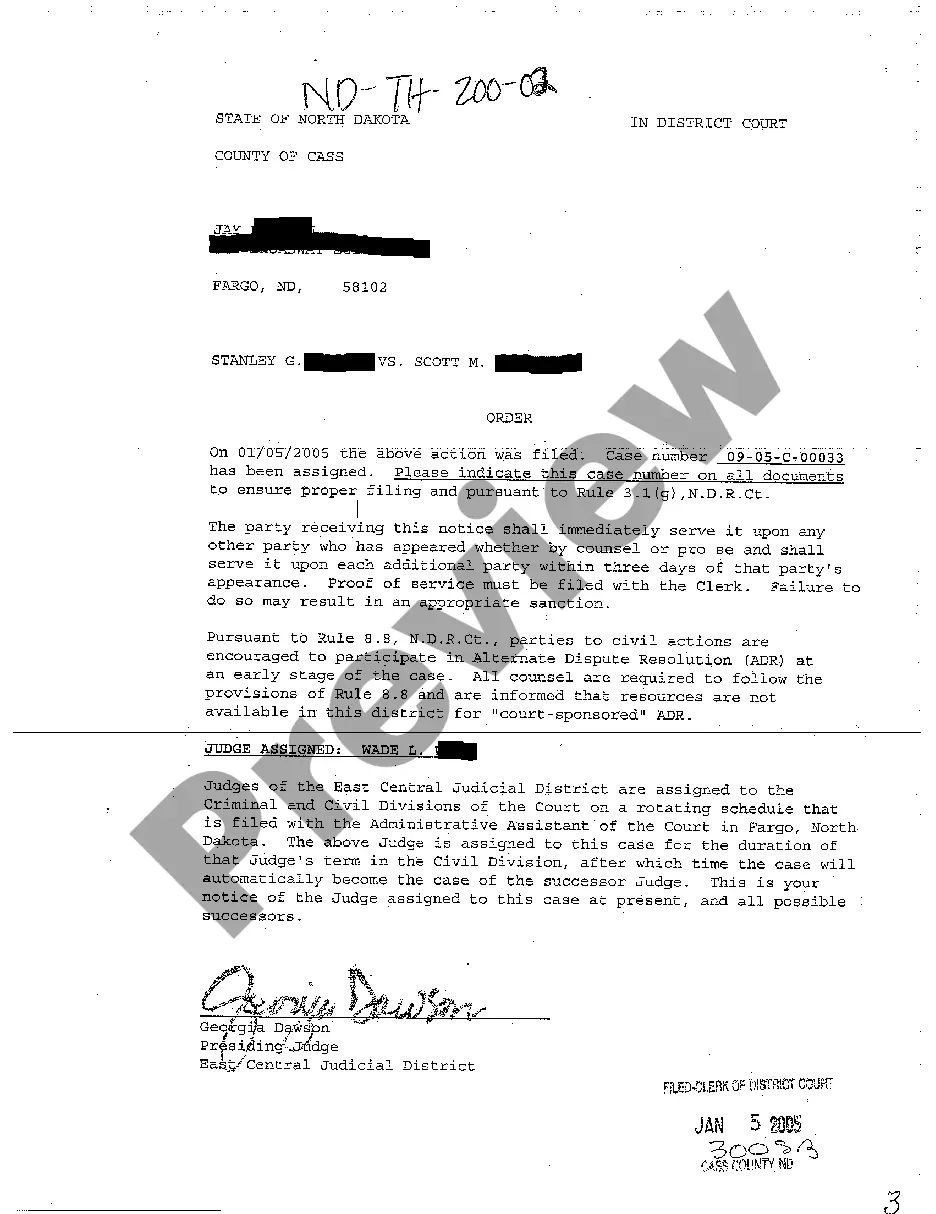

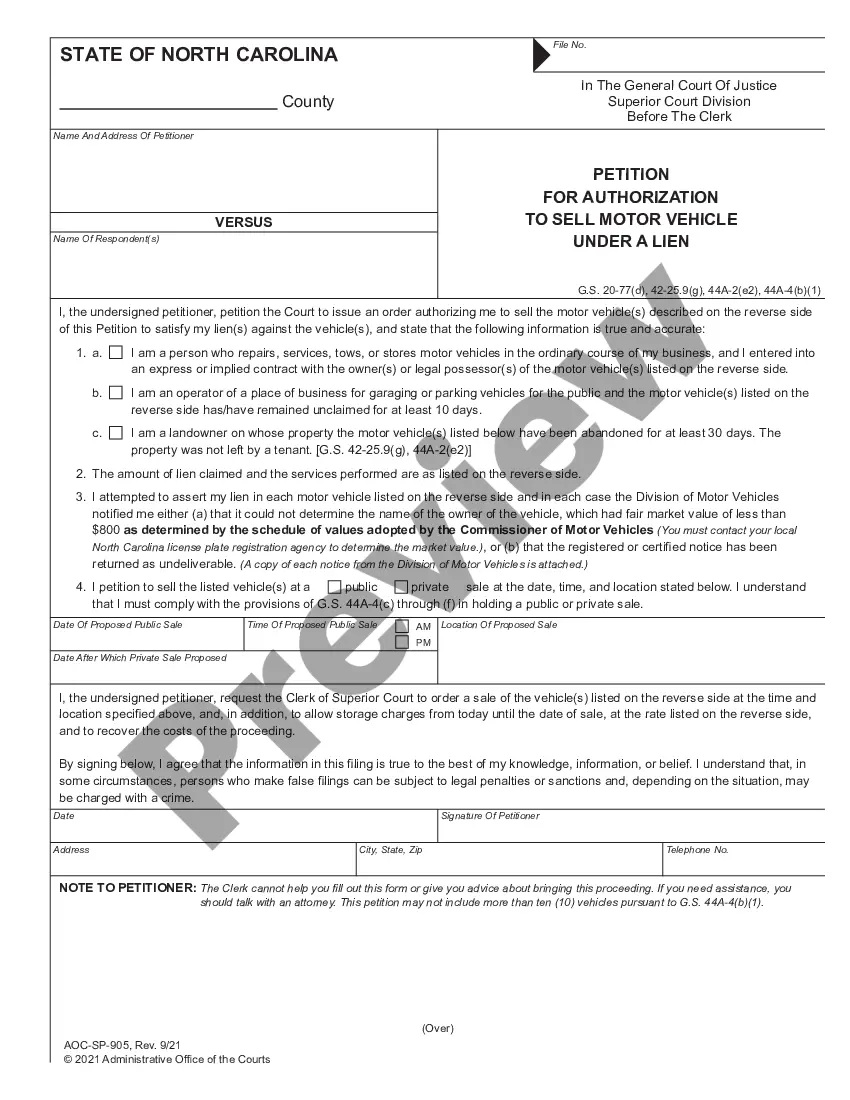

South Dakota Employment Statement

Description

How to fill out Employment Statement?

Selecting the finest authentic document template can be challenging.

Certainly, there are numerous templates accessible online, but how do you find the genuine form you require.

Utilize the US Legal Forms website.

First, ensure you have selected the appropriate form for your city/state. You can view the form using the Preview button and review the form details to confirm it is suitable for you.

- The service offers thousands of templates, including the South Dakota Employment Statement, which can be utilized for professional and personal purposes.

- All templates are reviewed by professionals and comply with federal and state regulations.

- If you are already registered, Log In to your account and click on the Download button to retrieve the South Dakota Employment Statement.

- Use your account to browse the legal templates you have acquired before.

- Visit the My documents section of your account to download another copy of the file you need.

- If you are a new user of US Legal Forms, here are simple steps you can follow.

Form popularity

FAQ

Make sure you and new hires complete employment forms required by law.W-4 form (or W-9 for contractors)I-9 Employment Eligibility Verification form.State Tax Withholding form.Direct Deposit form.E-Verify system: This is not a form, but a way to verify employee eligibility in the U.S.

5 Best Places To Find Employees OnlineZipRecruiter.Indeed.Monster.Glassdoor.CareerBuilder.SimplyHired.Ladders.Handshake.

Wrongful Termination in South Dakota Though South Dakota is an at-will employment state, meaning the employer can fire without reason and an employee can quit without reason, there are a number of exceptions. One cannot be terminated because of his or her color, race, religious beliefs or ancestry.

Steps to Hiring your First Employee in South DakotaStep 1 Register as an Employer.Step 2 Employee Eligibility Verification.Step 3 Employee Withholding Allowance Certificate.Step 4 New Hire Reporting.Step 5 Payroll Taxes.Step 6 Workers' Compensation Insurance.Step 7 Labor Law Posters and Required Notices.More items...?

Receive Your Benefit Payments It takes at least three weeks to process a claim for unemployment benefits and issue payment to most eligible workers.

If there are no issues, your first payment can take up to four weeks after the claim is filed. The first eligible week of your claim is a non-paid waiting week. If there are issues that need to be investigated before we can determine eligibility, payments will be delayed until the investigation is completed.

The UI tax funds unemployment compensation programs for eligible employees. In South Dakota, state UI tax is one of the primary taxes that employers must pay. Unlike most other states, South Dakota does not have state withholding taxes.

South Dakota reemployment assistance weekly benefit amounts range between $28 and $466 per week. Your eligibility requires a minimum amount of earnings in a base period. The specific weekly amount is determined by a formula that considers the wages earned during each quarter of the base period.

Once your application has been approved, the Department of Labor will send a Monetary Determination with information on your weekly benefit amount. After making your claim, it will take between two to three weeks to receive it. Delays may be caused if the state needs additional information before sending payment.

What is a new hire packet? A new hire packet includes forms that a newly hired employee must complete before they are officially hired. It may also include information about the company, position and anything else relevant to the job.