South Dakota Purchase Invoice

Description

How to fill out Purchase Invoice?

Selecting the appropriate legal document format can be challenging. Clearly, there are numerous templates accessible online, but how can you locate the legal document you require? Utilize the US Legal Forms website.

The service offers thousands of templates, including the South Dakota Purchase Invoice, which can be utilized for business and personal purposes. All of the forms are reviewed by experts and comply with federal and state regulations.

If you are already a member, Log In to your account and click the Download button to obtain the South Dakota Purchase Invoice. Use your account to search through the legal forms you have previously purchased. Navigate to the My documents section of your account to retrieve another copy of the document you require.

Select the file format and download the legal document to your device. Lastly, complete, edit, print, and sign the acquired South Dakota Purchase Invoice. US Legal Forms is the largest catalog of legal forms where you can find a variety of document templates. Utilize the service to obtain professionally crafted paperwork that meets state requirements.

- Firstly, ensure that you have selected the correct form for your location/region.

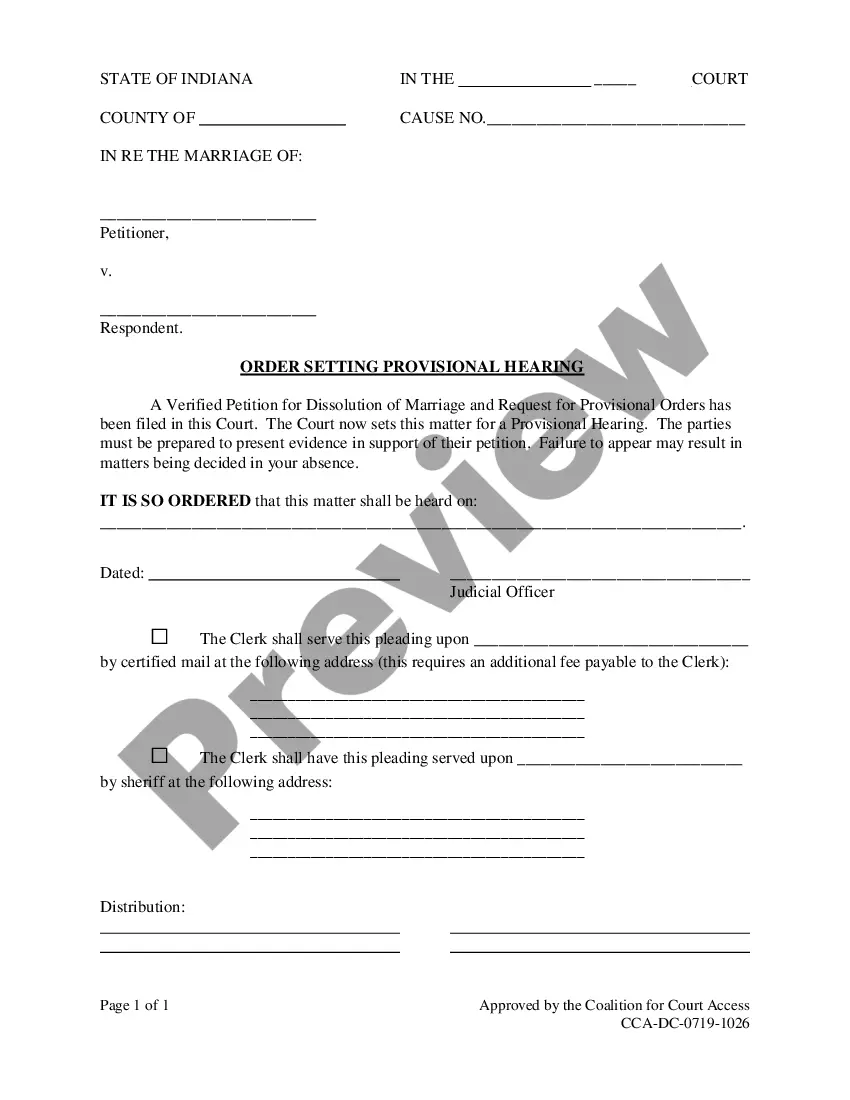

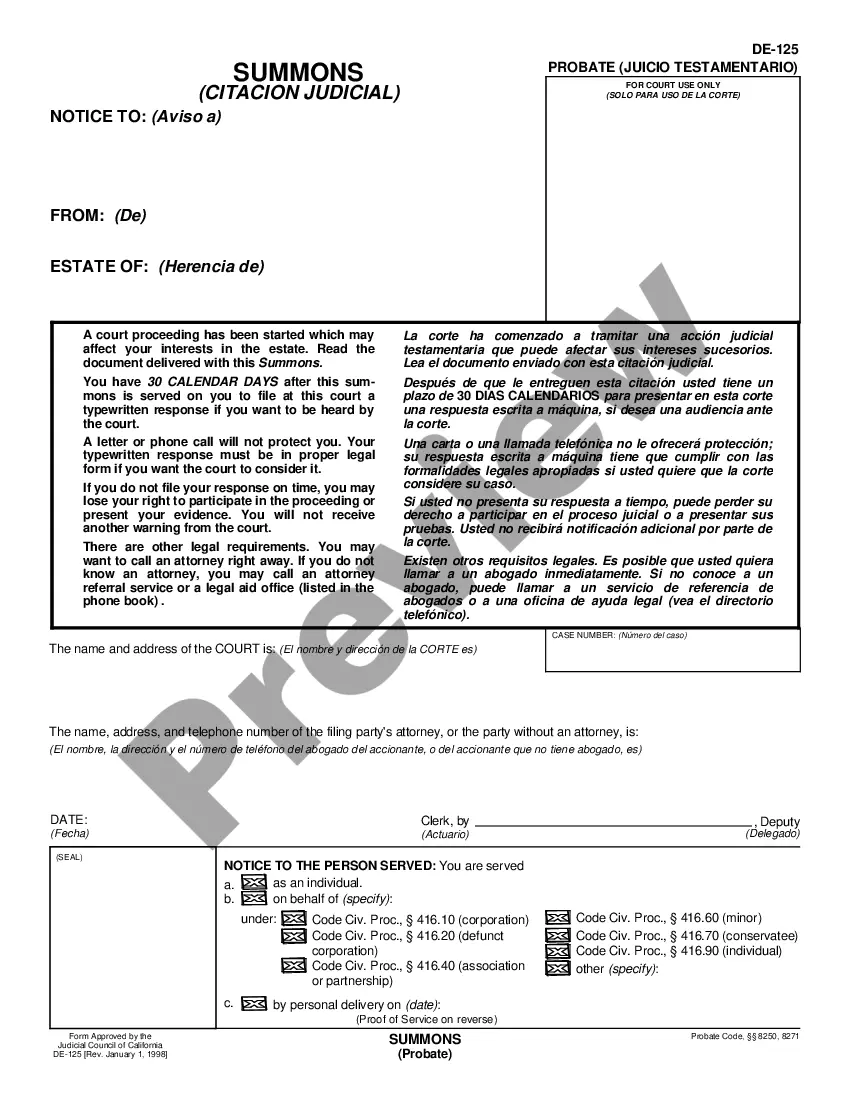

- You can preview the document using the Preview option and read the document description to ensure it is suitable for you.

- If the document does not fulfill your requirements, use the Search field to locate the appropriate form.

- Once you are confident that the form is accurate, click the Purchase Now button to acquire the document.

- Choose the payment plan you prefer and provide the necessary details.

- Create your account and complete the transaction using your PayPal account or credit card.

Form popularity

FAQ

South Dakota has no state income tax primarily due to its reliance on sales tax and other forms of revenue. This approach allows the state government to fund public services without taxing individual income. Consequently, residents benefit from retaining more of their earnings, which is particularly advantageous when managing expenses like those outlined on a South Dakota Purchase Invoice. This financial structure supports economic growth and attracts new businesses.

The primary tax advantages of South Dakota include no state income tax and lower overall tax burdens. This framework supports both personal and business finances, allowing individuals and companies to keep more of their earnings. Additionally, sales and property taxes are manageable, making it easier to navigate economic responsibilities like the South Dakota Purchase Invoice. Such advantages enhance the overall quality of life in the state.

While many states offer various tax benefits, South Dakota is often ranked among the most tax-friendly states. This assessment is largely due to its lack of state income tax, combined with reasonable sales tax rates. Other states may have specific advantages, but South Dakota provides a straightforward fiscal structure that simplifies transactions, including the South Dakota Purchase Invoice.

Yes, South Dakota is known for being tax-friendly. The absence of a state income tax enhances its appeal for both individuals and businesses. This tax structure can result in considerable savings when processing financial documents, such as the South Dakota Purchase Invoice. Overall, residents enjoy the financial flexibility that comes with this favorable taxation policy.

No, South Dakota is generally considered a low tax state. The lack of state income tax is a significant factor that attracts both businesses and residents. Instead of high income taxes, the state relies on sales tax and other fees. This environment is beneficial for those managing their South Dakota Purchase Invoice, as it allows more of your earnings to stay in your pocket.

In South Dakota, $100,000 does not incur state income tax, meaning you keep the full amount. However, if you consider federal taxes, the taxable income will depend on various factors. For most individuals, the effective tax rate on federal income might be around 12-22% depending on deductions and tax brackets. Therefore, it's essential to consider both federal obligations and your specific financial situation when evaluating your South Dakota Purchase Invoice.

South Dakota does not implement a separate gross receipts tax like some other states. Instead, the state has a sales tax applied to the sale of goods and services. Keeping track of your sales tax obligations is vital, particularly when issuing South Dakota Purchase Invoices to ensure compliance with state regulations.

To obtain a tax ID number in South Dakota, you must apply through the South Dakota Department of Revenue. The application can typically be completed online, and you will need to provide your business details. Once approved, your tax ID enables you to manage transactions accurately and generate South Dakota Purchase Invoices seamlessly.

Yes, South Dakota does implement online sales tax for businesses with significant sales activity within the state. If your business sells goods or services online and exceeds the sales threshold, you must collect sales tax and report it. Keeping accurate records through a well-structured South Dakota Purchase Invoice can help you comply with these requirements.

To register for sales tax in South Dakota, you can complete the application process online through the South Dakota Department of Revenue website. The registration requires your business information and details related to your expected sales. After registration, you will receive a sales tax permit, allowing you to collect sales tax and issue correct South Dakota Purchase Invoices.