South Dakota Credit Memo Request Form

Description

How to fill out Credit Memo Request Form?

Finding the correct legal document template can be a challenge. Naturally, there are numerous templates accessible online, but how do you locate the legal form you need? Visit the US Legal Forms website. The service provides thousands of templates, including the South Dakota Credit Memo Request Form, which can be utilized for both business and personal purposes.

All of the forms are reviewed by professionals and meet state and federal requirements.

If you are already registered, Log In to your account and click the Download button to obtain the South Dakota Credit Memo Request Form. Use your account to review the legal forms you have previously purchased. Navigate to the My documents section of your account to download another copy of the document you need.

Complete, modify, and print the acquired South Dakota Credit Memo Request Form. US Legal Forms is the largest repository of legal forms where you can find a wide variety of document templates. Use the service to obtain professionally crafted documents that comply with state regulations.

- If you are a new user of US Legal Forms, here are simple steps to follow.

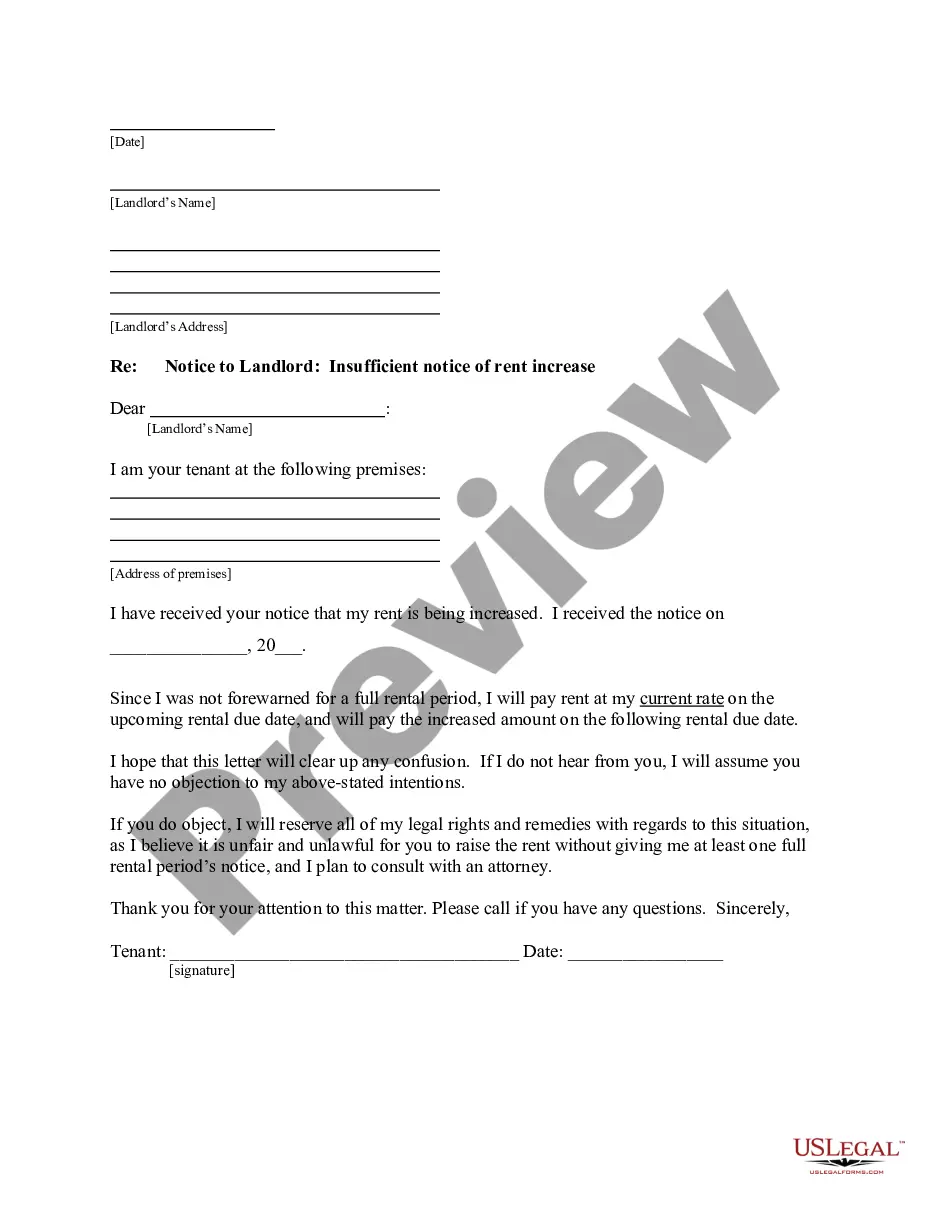

- First, ensure you have selected the correct form for your area/state. You can browse the form using the Preview button and review the form details to confirm this is the right one for you.

- If the form does not meet your needs, use the Search field to find the appropriate form.

- Once you are sure the form is correct, click the Get now button to obtain the form.

- Choose the pricing plan you would like and enter the required information. Create your account and complete the transaction using your PayPal account or credit card.

- Select the file format and download the legal document template to your device.

Form popularity

FAQ

In a buyer's double-entry accounting system, a credit memo is recorded as a debit under Accounts Payable (Creditors) and a credit under the appropriate Expense account, which is the exact opposite of the original purchase entry as the memo reduces the balance that the buyer now owes to the seller.

A credit memo is a posting transaction that can be applied to a customer's invoice as a payment or reduction. A delayed credit is a non-posting transaction that you can include later on a customer's invoice. A refund is a posting transaction that is used when reimbursing a customer's money.

Credit Memo TemplateIndicate the credit memo's number, use the original invoice number, and the required mode of payment. The credit memo requires five columns for the following information: quantity of items, identification number or description, reason for the credit memo, cost of item and total cost.

A credit memo is a contraction of the term "credit memorandum," which is a document issued by the seller of goods or services to the buyer, reducing the amount that the buyer owes to the seller under the terms of an earlier invoice.

A credit memo contains several pieces of important information. Most credit memos feature the purchase order (or PO) number, as well as the terms of payment and billing. The shipping address, a list of items, prices, quantities, and the date of purchase are other significant pieces of data found on a credit memo.

Credit note number. Original invoice reference number. Item descriptions, quantities, and prices. Total amount credited.

A credit memo is a contraction of the term "credit memorandum," which is a document issued by the seller of goods or services to the buyer, reducing the amount that the buyer owes to the seller under the terms of an earlier invoice.

Definition. Credit memo: A sales document created on the basis of a customer complaint. This reduces receivables in Financial Accounting. Debit memo: A sales document created on the basis of a customer complaint. This increases receivables in Financial Accounting.

One of the great things about issuing a credit note is that it allows you to keep all of your finances streamlined and intact. For example, if your first invoice was number 1, then the credit note would be number 2 and the invoice that follows that would be number 3.

Credit memo, credit memorandum or credit note, is a commercial document issued by a seller or a bank: 1. Seller issues a credit memo to reduce the amount that a buyer owes for a previously issued sales invoice. 2.