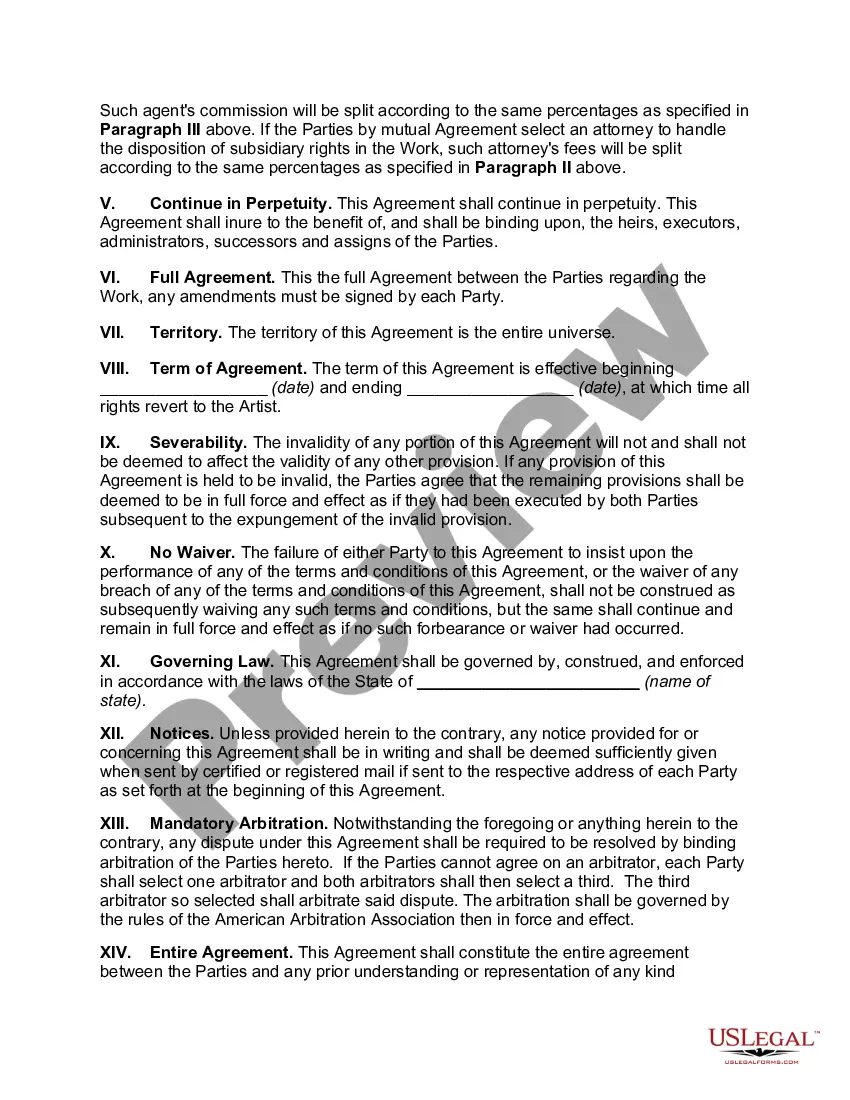

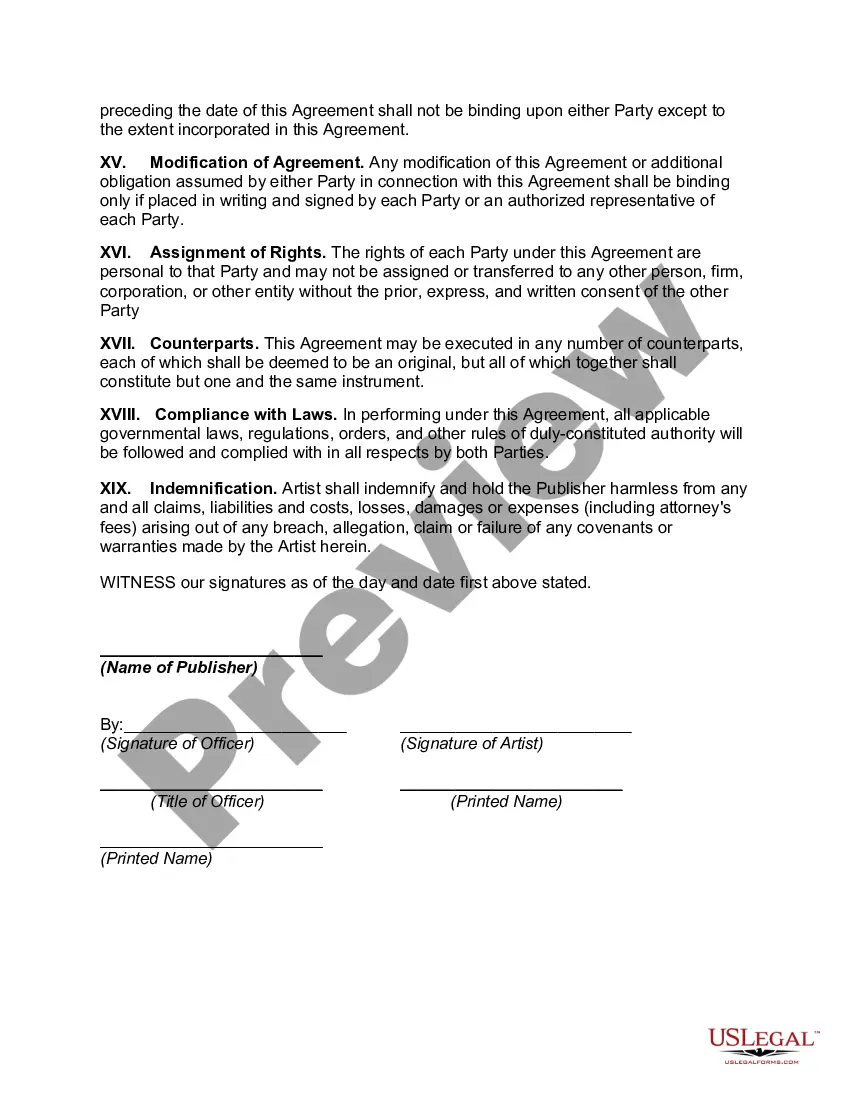

South Dakota Royalty Split Agreement

Description

How to fill out Royalty Split Agreement?

Have you ever been in a situation where you need documentation for both business or personal purposes nearly every business day.

There are numerous legal document templates available online, but finding reliable versions is challenging.

US Legal Forms offers thousands of form templates, including the South Dakota Royalty Split Agreement, that comply with state and federal regulations.

When you find the appropriate form, click Purchase now.

Choose the payment plan you want, fill out the required information to create your account, and pay for your order using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the South Dakota Royalty Split Agreement template.

- If you do not have an account and want to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for the correct city/area.

- Use the Preview button to examine the form.

- Read the description to confirm that you have selected the right form.

- If the form is not what you are looking for, use the Search field to find the form that suits your needs.

Form popularity

FAQ

Call the county where the minerals are located and ask how to transfer mineral ownership after death. They will probably advise you to submit a copy of the death certificate, probate documents (if any), and a copy of the will (or affidavit of heirship if there is no will).

So how do you determine the basis for mineral rights when inherited for tax purposes? It is our opinion, that the best way to value inherited mineral rights is to look at the inflation adjusted average price of oil in the year acquired vs the year you sold.

As a mineral rights value rule of thumb, the 3X cash flow method is often used. To calculate mineral rights value, multiply the 12-month trailing cash flow by 3. For a property with royalty rights, a 5X multiple provides a more accurate valuation (stout.com).

The decimal interest is calculated by dividing the number of acres the landowner has in the unit by the total number of acres in the unit, multiplied by the royalty percentage under the gas lease.

Royalties are calculated as a percentage of the revenue from the minerals extracted from your property. For example, if oil is selling for $60 per barrel and the you negotiated a 1/16th royalty, you would receive $3.75 for every barrel of oil recovered from your land.

Mineral rights have sold for as high as $40,000 per acre, and usually, the average price can be between $250 and $9,000.

Non-producing minerals are typically valued as the number of net mineral acres (NMA) you own multiplied by the typical lease bonus rate.

February 12, 2019The Formula. Decimal Interest = (Net Mineral Acres ÷ Drilling Unit Acres) x Royalty Rate.Finding Your Net Mineral Acres. Your net mineral acreage is found in the Mineral Deeds or other property deed information.Finding the Drilling Unit Acres.Finding Your Royalty Rate.Where to Find More Information.

If you have a property that does not currently produce royalty income and you do not have an active lease, the value is nearly always under $1,000/acre. The average price per acre for mineral rights that are not leased is between $0 and $250/acre.

If you want to transfer the rights to these minerals to another party, you can do so in a variety of ways: by deed, will, or lease. Before you transfer mineral rights, you should confirm that you own the rights that you seek to transfer.