South Dakota Living Trust with Provisions for Disability

Description

How to fill out Living Trust With Provisions For Disability?

Have you ever been in a location where you require paperwork for either organizational or particular reasons nearly every day.

There are numerous legal document templates accessible online, but locating reliable forms isn’t straightforward.

US Legal Forms offers a vast array of form templates, such as the South Dakota Living Trust with Provisions for Disability, designed to comply with state and federal regulations.

Once you have the appropriate form, click on Buy now.

Select the payment plan you prefer, fill in the necessary information to create your account, and complete your purchase using PayPal or a credit card. Choose a convenient file format and download your version. You can find all the document templates you've purchased in the My documents menu. You can retrieve another copy of the South Dakota Living Trust with Provisions for Disability at any time if necessary. Just select the required form to download or print the template. Utilize US Legal Forms, the most comprehensive collection of legal documents, to save time and avoid mistakes. The service offers professionally crafted legal document templates that can be utilized for a variety of purposes. Create your account on US Legal Forms and start simplifying your life.

- If you're already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the South Dakota Living Trust with Provisions for Disability template.

- If you do not possess an account and wish to start utilizing US Legal Forms, follow these steps.

- Select the form you need and ensure it corresponds to the correct state/region.

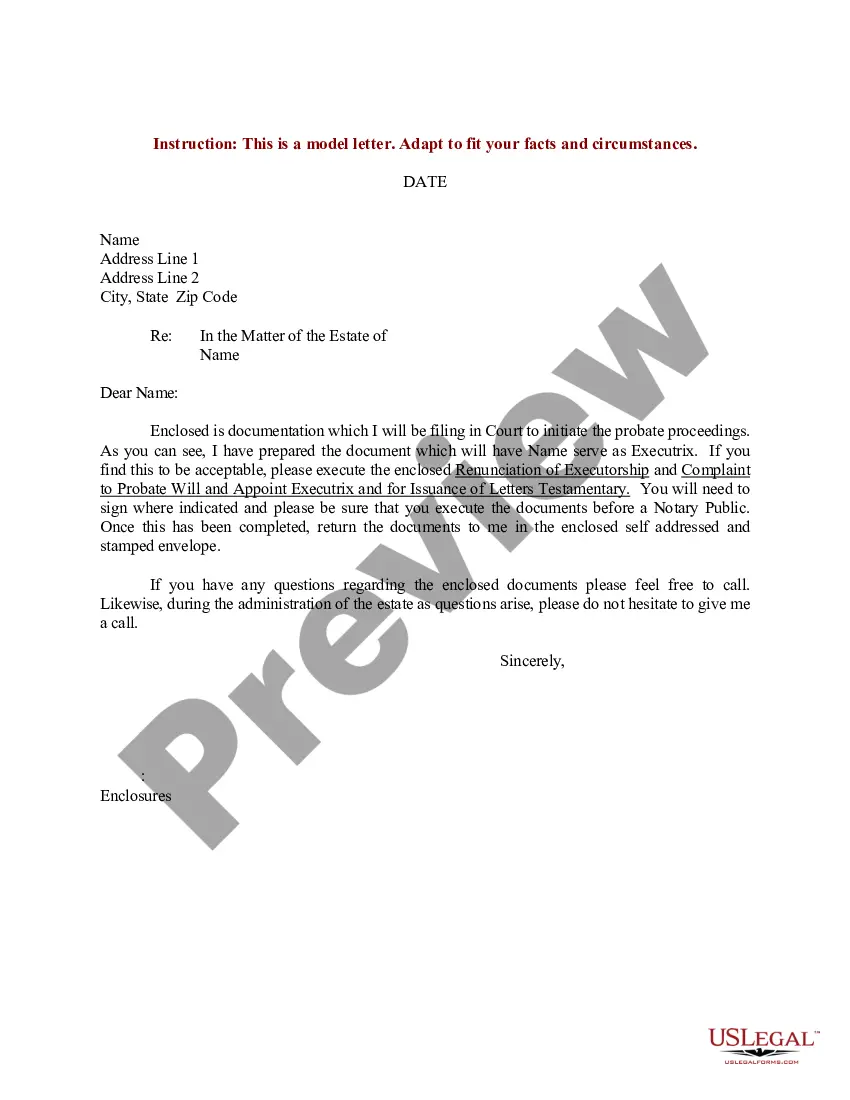

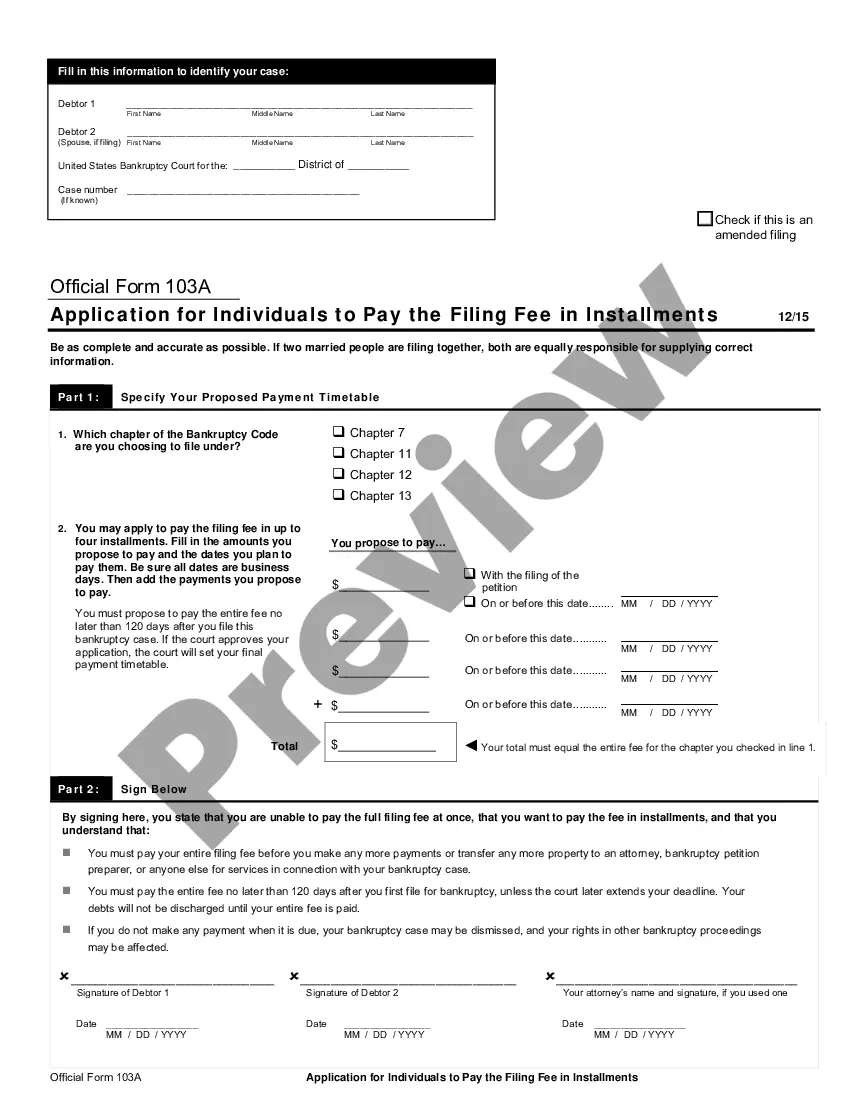

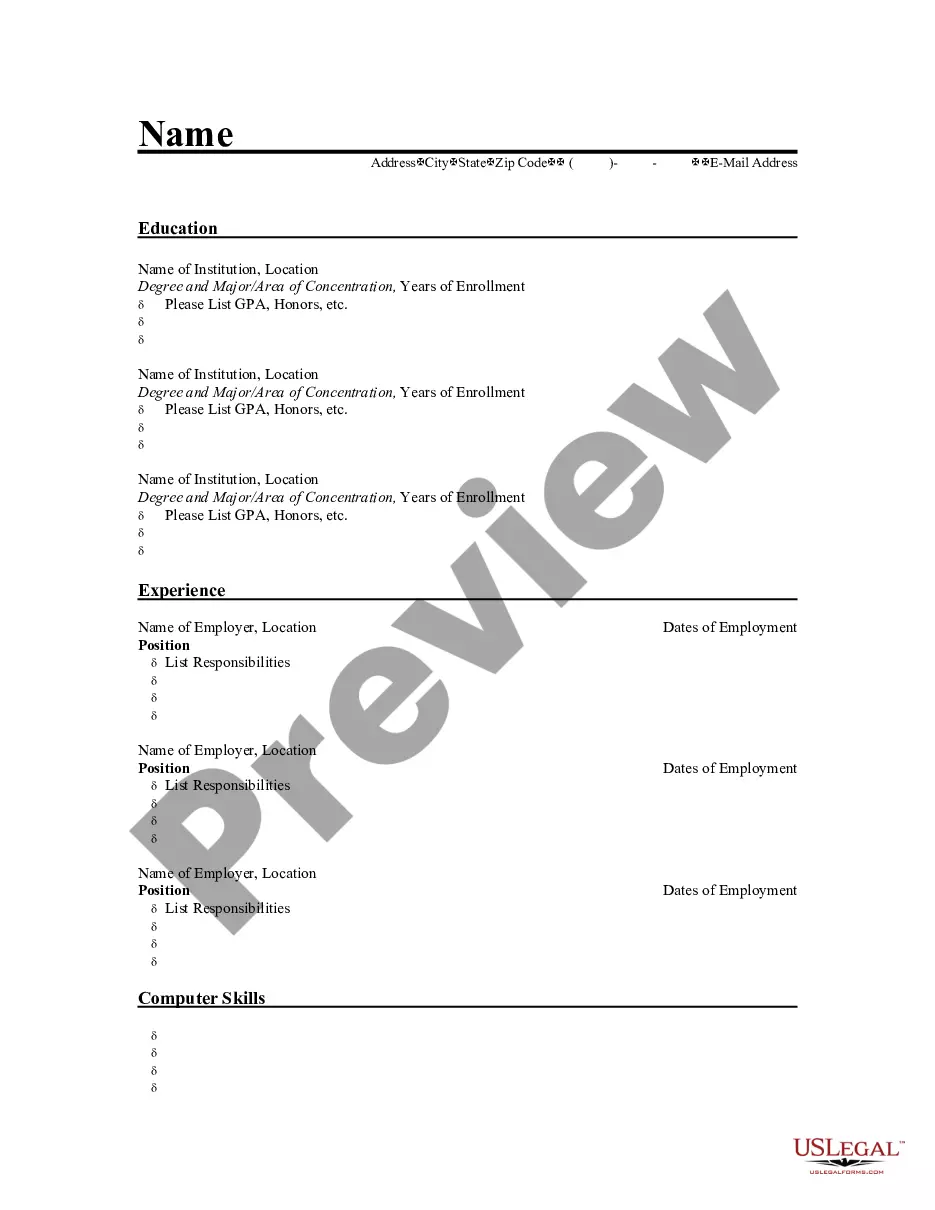

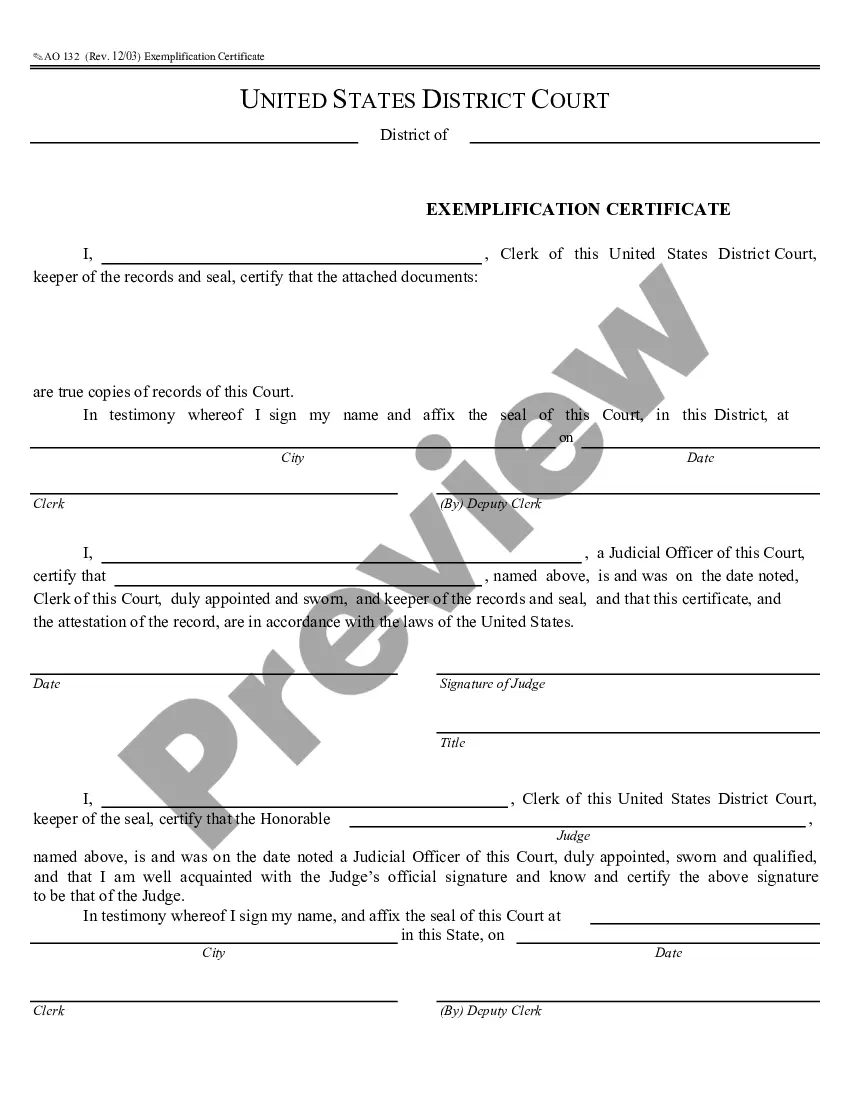

- Use the Preview button to examine the document.

- Review the information to ensure you have chosen the correct form.

- If the form isn’t what you’re looking for, use the Lookup section to find the form that fits your needs and specifications.

Form popularity

FAQ

Assets That Can And Cannot Go Into Revocable TrustsReal estate.Financial accounts.Retirement accounts.Medical savings accounts.Life insurance.Questionable assets.

If a client is concerned about incapacity or wants their assets to transfer to beneficiaries in a particular manner, a trust is a useful tool to make that happen. Another thing to keep in mind is that as useful as trusts are, there are certain things the trust's creator can do to help the process.

In a trust, assets are held and managed by one person or people (the trustee) to benefit another person or people (the beneficiary). The person providing the assets is called the settlor. Different kinds of assets can be put in trust, including: cash.

The South Dakota Trust AdvantageUnparalleled Tax Efficiency. South Dakota has no state income, capital gains, dividend/interest, or intangible tax.No South Dakota Residency Required.Lowest Insurance Premium Tax.Superior Asset Protection.No Required Termination.

The minimum annual fee is $3,750 and the maximum annual fee is $20,000 for private trust companies, while the minimum annual fee is $4,500 and the maximum annual fee is $30,000 for public trust companies.

The minimum annual fee is $3,750 and the maximum annual fee is $20,000 for private trust companies, while the minimum annual fee is $4,500 and the maximum annual fee is $30,000 for public trust companies.

To make a living trust in South Dakota, you:Choose whether to make an individual or shared trust.Decide what property to include in the trust.Choose a successor trustee.Decide who will be the trust's beneficiariesthat is, who will get the trust property.Create the trust document.More items...

South Dakota offers everything a wealthy person setting up a trust could want. There is no state income tax or capital gains tax, so investment gains on assets placed in the trust are tax-free if it's structured correctly. Robust protections provide anonymity and shield assets from creditors.

Assets That Can And Cannot Go Into Revocable TrustsReal estate.Financial accounts.Retirement accounts.Medical savings accounts.Life insurance.Questionable assets.

What Assets Should Go Into a Trust?Bank Accounts. You should always check with your bank before attempting to transfer an account or saving certificate.Corporate Stocks.Bonds.Tangible Investment Assets.Partnership Assets.Real Estate.Life Insurance.