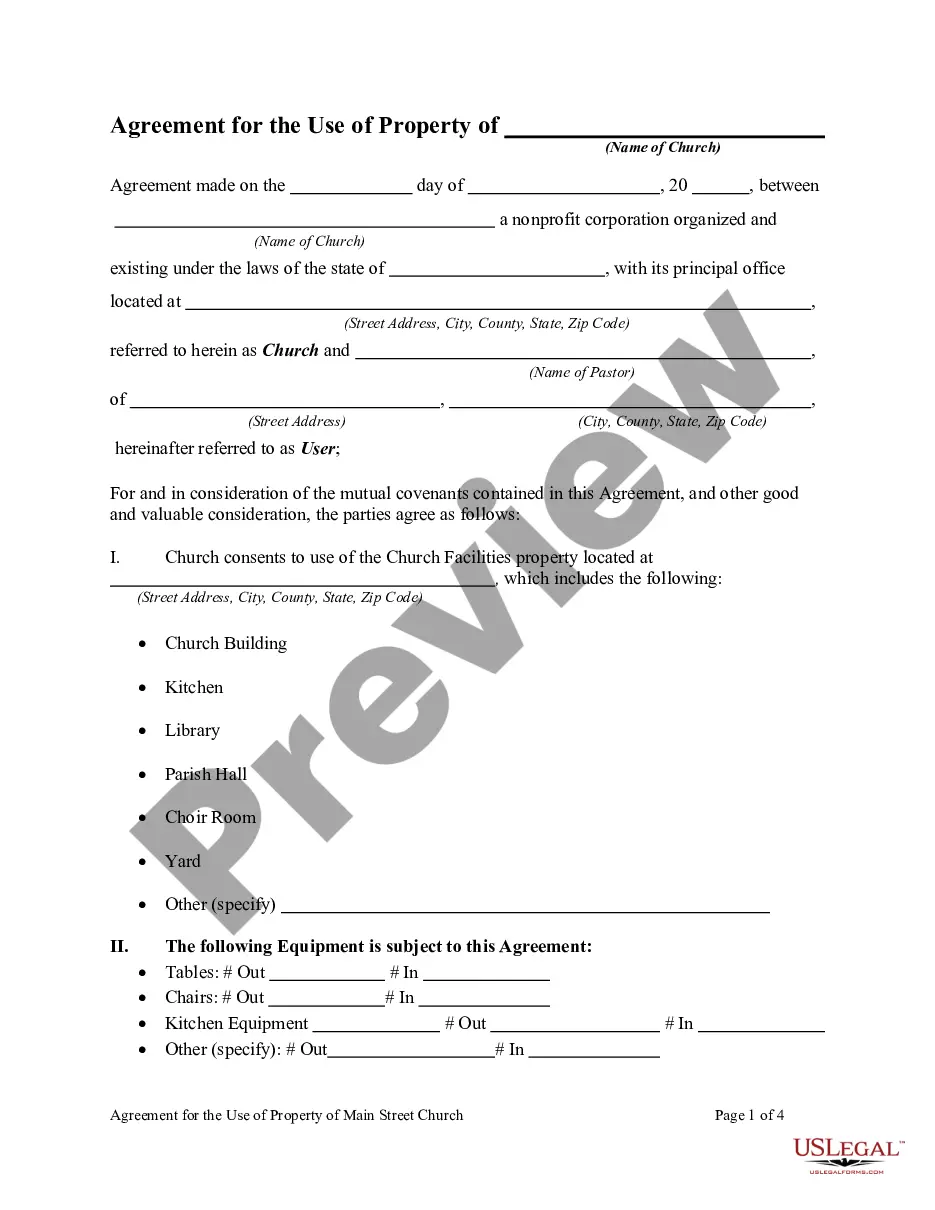

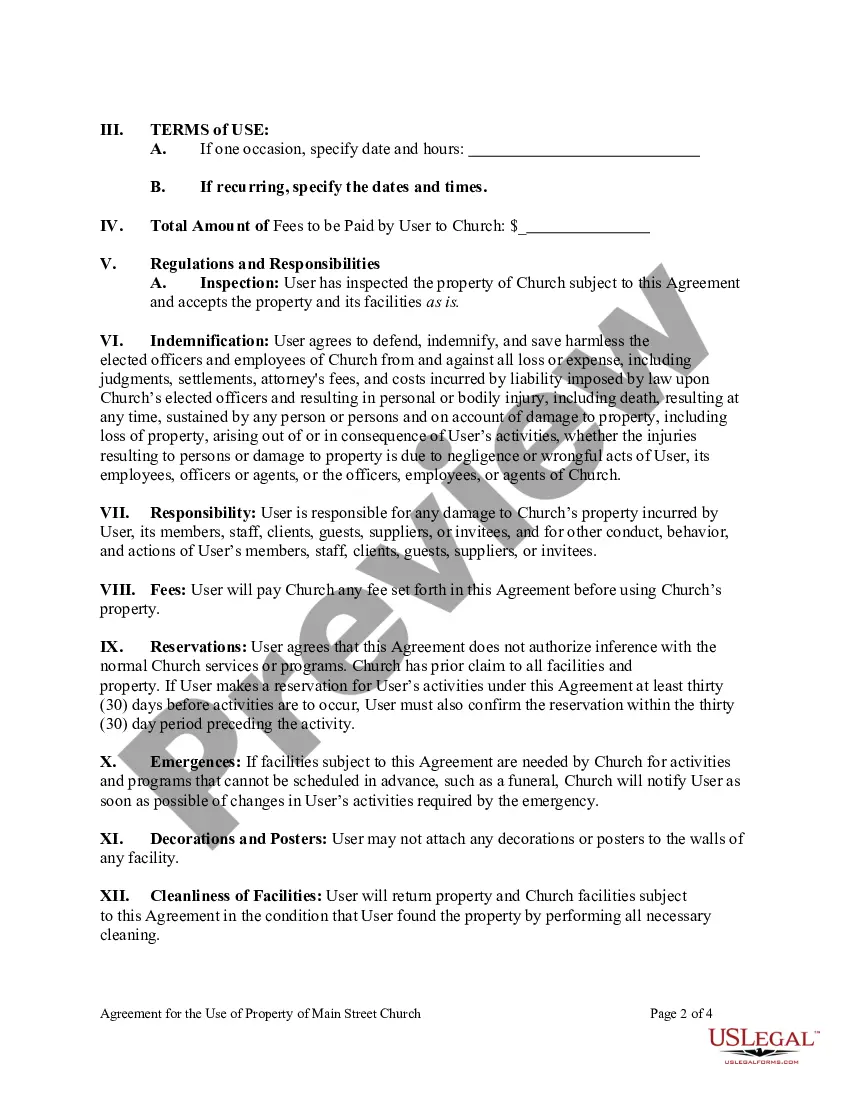

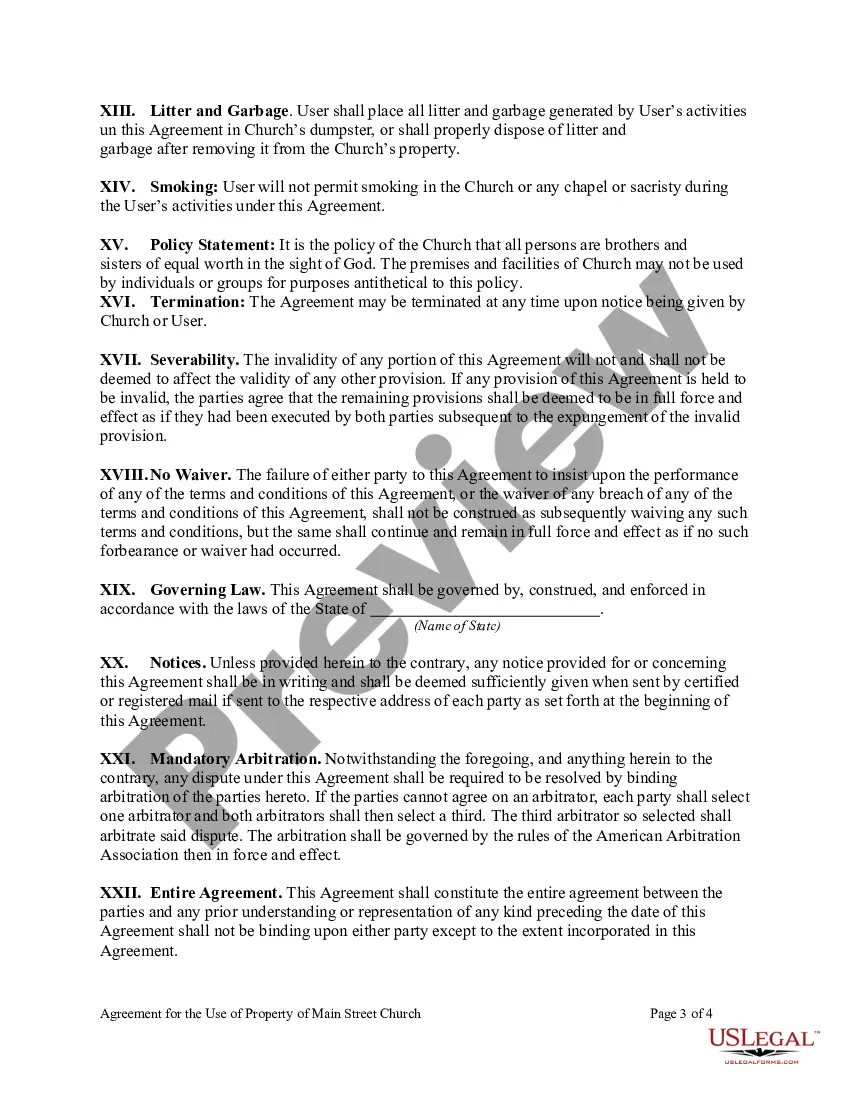

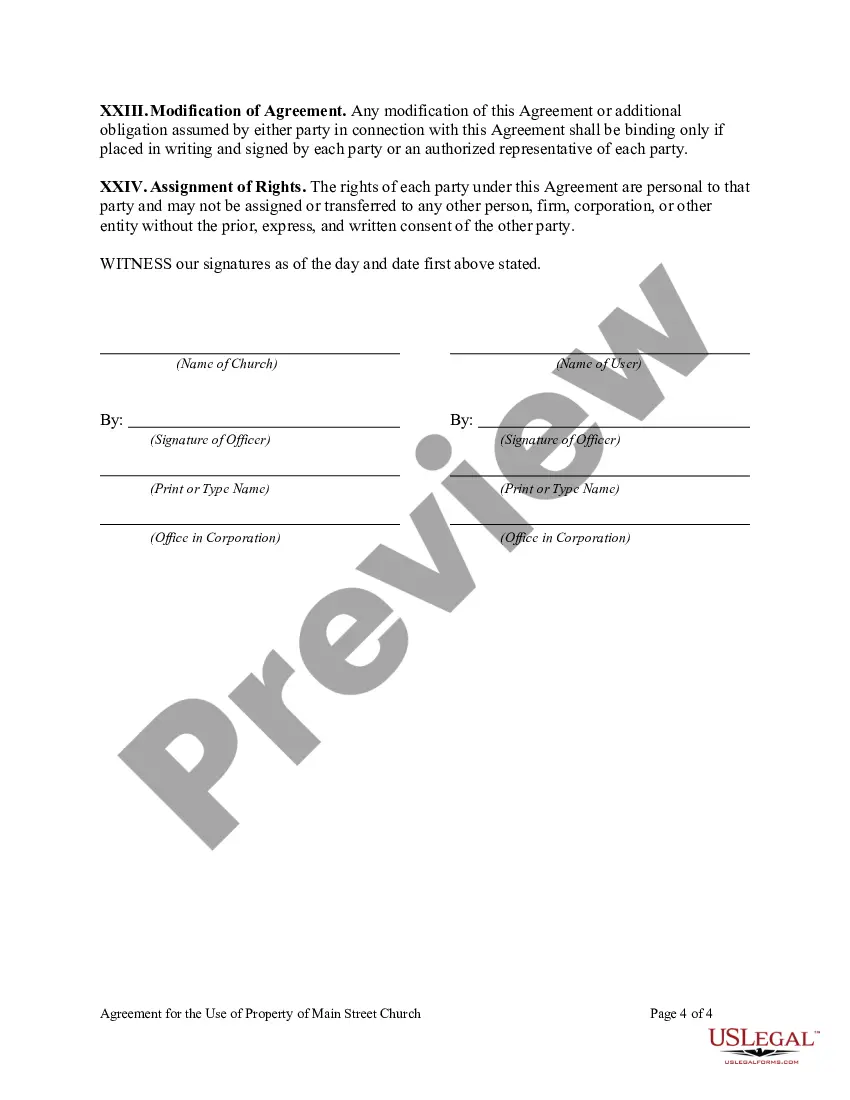

South Dakota Agreement for the Use of Property of a Named Church

Description

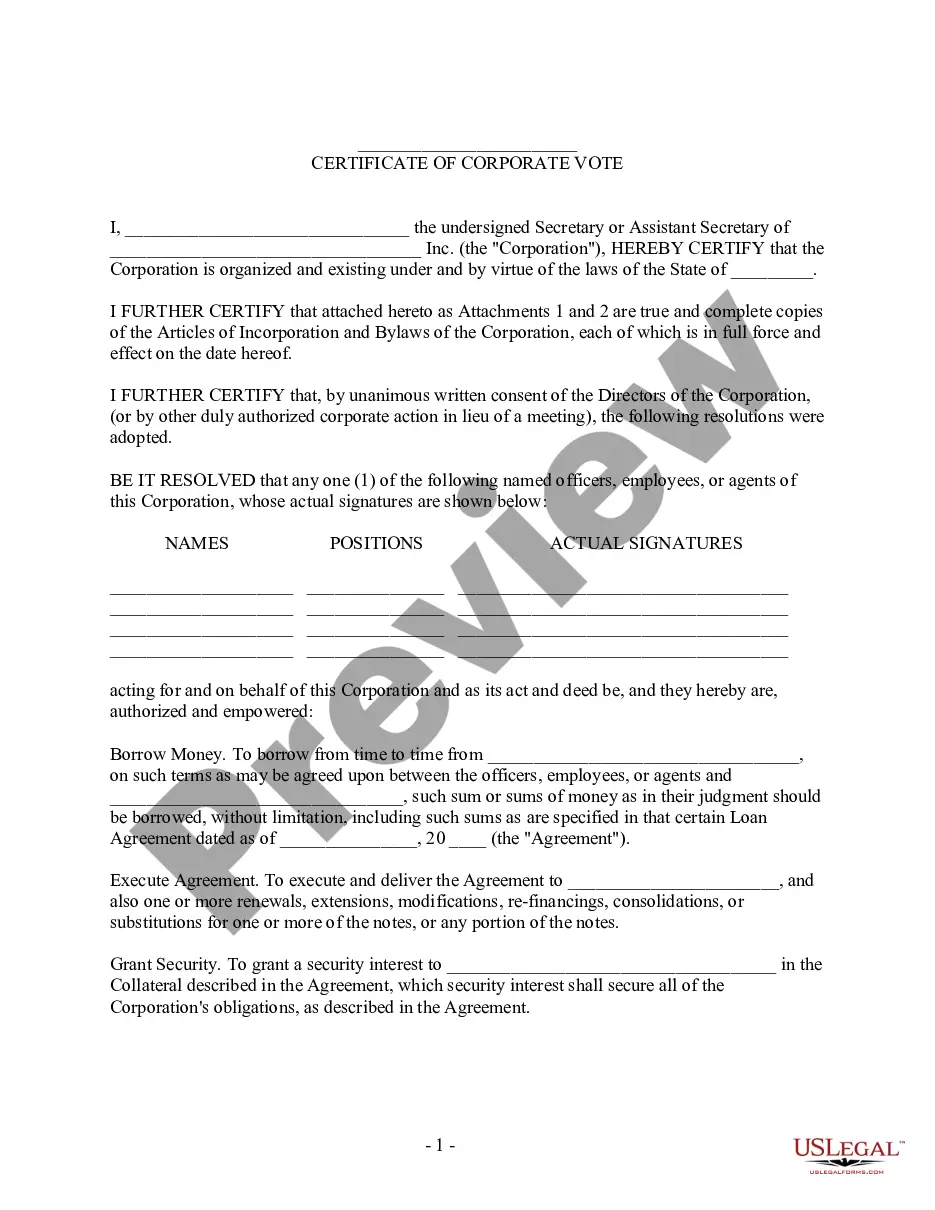

How to fill out Agreement For The Use Of Property Of A Named Church?

Selecting the optimal legal document template can be a challenge. Clearly, there are numerous templates accessible online, but how will you find the legal form you require.

Utilize the US Legal Forms website. This service offers a vast array of templates, including the South Dakota Agreement for the Use of Property of a Named Church, which you can employ for both business and personal purposes.

All of the forms are reviewed by experts and meet federal and state requirements.

US Legal Forms is the largest repository of legal forms where you can find various document templates. Utilize the service to obtain professionally crafted documents that comply with state requirements.

- If you are already registered, Log In to your account and click the Obtain option to download the South Dakota Agreement for the Use of Property of a Named Church.

- Use your account to browse through the legal forms you have previously acquired.

- Go to the My documents tab of your account and obtain another copy of the document you need.

- If you are a new user of US Legal Forms, here are straightforward instructions for you to follow.

- First, ensure you have selected the correct form for your city/county.

- You can browse the form using the Review option and read the form details to confirm it is the correct one for you.

- If the form does not meet your needs, use the Search field to find the appropriate form.

- Once you are confident that the form is suitable, click on the Purchase now option to obtain the form.

- Select the pricing plan you prefer and enter the necessary information.

- Create your account and make a payment for the order using your PayPal account or credit card.

- Choose the file format and download the legal document template to your device.

- Complete, modify, print, and sign the obtained South Dakota Agreement for the Use of Property of a Named Church.

Form popularity

FAQ

In South Dakota, property can be considered abandoned when the owner has not occupied or used the property for a specified period, typically around one to five years, depending on the situation. This timeline can vary based on the type of property and any existing agreements, such as the South Dakota Agreement for the Use of Property of a Named Church, which may outline specific terms for property use. If you are concerned about property abandonment, consulting a legal expert can help clarify your rights and responsibilities. Using a platform like uslegalforms can provide you with the necessary documents to ensure compliance with South Dakota laws.

The 22-42-5 law in South Dakota outlines the framework for tax exemptions for nonprofit organizations, including churches. This law ensures that established religious organizations, as guided by the South Dakota Agreement for the Use of Property of a Named Church, retain their tax-exempt status. This helps churches manage their finances more effectively, allowing them to focus on their missions. For clarity on specific provisions, consulting legal resources or platforms like USLegalForms can be beneficial.

In South Dakota, various organizations, including religious institutions, are exempt from sales tax under specific conditions. Churches and other nonprofit entities can apply for and receive sales tax exemption to support their charitable activities, as noted in the South Dakota Agreement for the Use of Property of a Named Church. This exemption allows churches to allocate more resources toward programs serving their communities. It’s wise for churches to familiarize themselves with the application process to benefit fully.

Churches have enjoyed tax-exempt status since the founding of the United States, rooted in the First Amendment. However, formal laws solidifying this exemption have evolved over time, significantly influenced by the South Dakota Agreement for the Use of Property of a Named Church. These laws protect religious institutions from taxation, allowing them to focus on their mission. Understanding historical context provides insight into current tax policies affecting churches in South Dakota.

Yes, churches in South Dakota often enjoy exemptions from local taxes, including property taxes. This exemption stems from their status as nonprofit organizations dedicated to religious purpose, as highlighted in the South Dakota Agreement for the Use of Property of a Named Church. Local governments recognize the community service that churches provide. It's prudent for churches to maintain proper documentation to ensure their exemptions are upheld.

In the United States, church pastors generally qualify for tax exemption under specific conditions. The South Dakota Agreement for the Use of Property of a Named Church often influences these conditions. Typically, pastors receive a parsonage allowance and are exempt from self-employment tax on their ministerial income. However, it's essential for each church and pastor to consult a tax advisor to confirm their specific tax status.

In South Dakota, truancy is taken seriously, with potential penalties including fines for parents and mandatory attendance in educational programs for students. Schools may involve the legal system if families do not comply with attendance requirements. Understanding the implications of truancy is important for community members, especially when considering agreements like the South Dakota Agreement for the Use of Property of a Named Church, which may involve youth activities. For comprehensive legal solutions, UsLegalForms offers resources to help understand these local laws.

The religious exemption law in South Dakota allows certain organizations, including churches, to operate under unique legal parameters that respect their religious beliefs. This law can impact property use and management under a South Dakota Agreement for the Use of Property of a Named Church. By understanding these exemptions, churches can better navigate legal challenges and promote their religious practices. For tailored guidance on this matter, consider utilizing platforms like UsLegalForms.

In South Dakota, there is no legal requirement to disclose a death that occurred in a house unless it was a homicide or involved significant health concerns. However, transparency is often encouraged, especially when selling a property, to maintain trust with potential buyers. A South Dakota Agreement for the Use of Property of a Named Church may also involve discussions around property disclosures if applicable. It's wise to consult legal resources like UsLegalForms to navigate these requirements effectively.

The codified law 43 4 38 in South Dakota pertains to the use and enjoyment of property designated for religious purposes, such as churches. This law outlines the conditions under which a South Dakota Agreement for the Use of Property of a Named Church may be created and enforced. Understanding this law is crucial for churches that aim to secure their property rights effectively. Legal clarity in this area can foster stronger community engagement and secure the church's mission.