South Dakota General Form of Assignment as Collateral for Note

Description

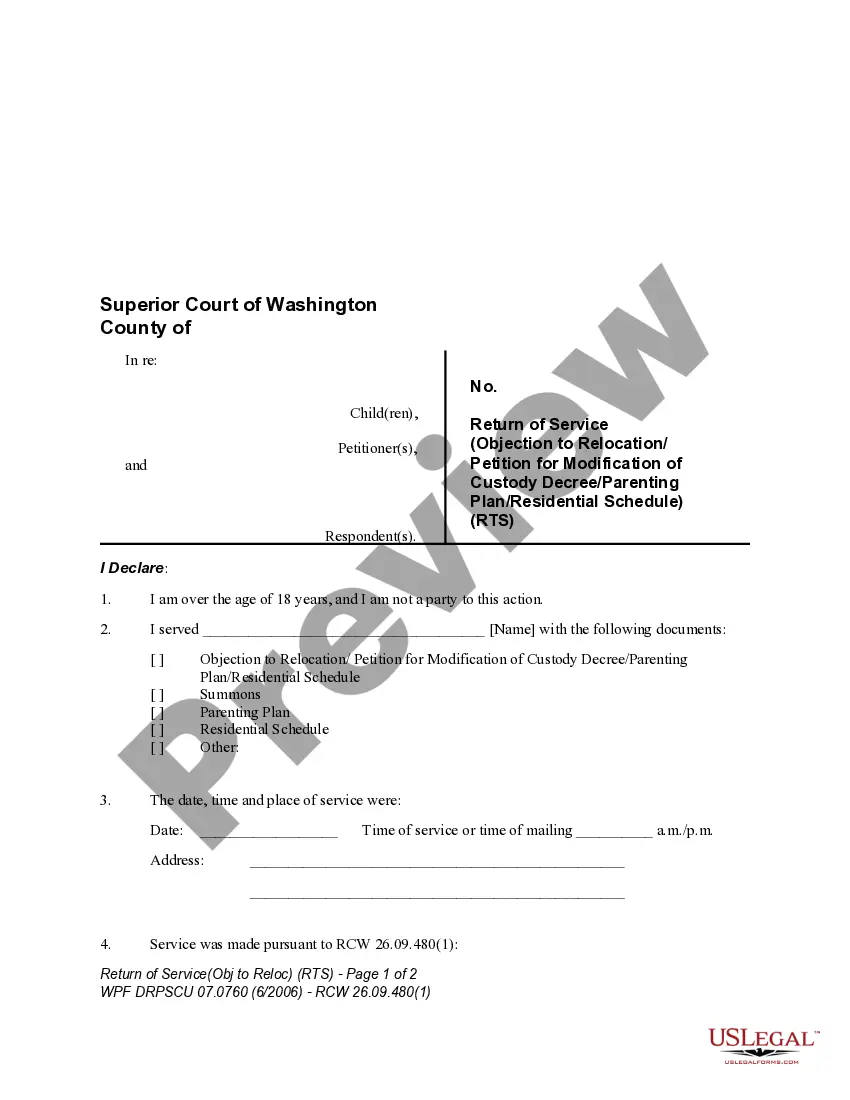

How to fill out General Form Of Assignment As Collateral For Note?

You might spend numerous hours online trying to locate the official document template that fulfills the federal and state standards you require.

US Legal Forms offers an extensive collection of official templates that can be evaluated by professionals.

You can easily download or print the South Dakota General Form of Assignment as Collateral for Note from my assistance.

Use the Preview option if available to review the document layout as well.

- If you already possess a US Legal Forms account, you can sign in and click the Download option.

- Then, you can fill out, modify, print, or sign the South Dakota General Form of Assignment as Collateral for Note.

- Every official document template you purchase is yours to keep indefinitely.

- To obtain another copy of the purchased template, go to the My documents section and select the corresponding option.

- If you are using the US Legal Forms website for the first time, follow the straightforward instructions below.

- First, ensure that you have chosen the correct document template for the jurisdiction/region that you select.

- Check the document details to confirm that you have selected the right template.

Form popularity

FAQ

A collateral note is a financial instrument where repayment is guaranteed by a specific asset. In South Dakota, a collateral note is often linked to the South Dakota General Form of Assignment as Collateral for Note, making it a secure option for lenders. This type of note reduces risk by ensuring that the lender has a claim to the asset if the borrower fails to meet their obligations.

Generally, a valid contract or agreement is required to place a lien on your house in South Dakota. Without a contract, a creditor may face challenges in establishing a legal claim against your property. Utilizing the South Dakota General Form of Assignment as Collateral for Note can help clarify obligations and protect your interests in such situations. For more clarity on lien processes, you may want to explore the tools available on the US Legal Forms website.

To put a lien on property in South Dakota, you must file a lien statement with the county register of deeds. This statement should include details such as the property description, the amount owed, and the names of both the debtor and the creditor. It's important to use the South Dakota General Form of Assignment as Collateral for Note to ensure that the lien is valid and enforceable. For assistance with this process, consider looking into resources on the US Legal Forms platform.

A collateral assignment form is a legal document that outlines the arrangement between a borrower and a lender regarding the use of an asset as collateral. This form specifies the terms of the agreement, including the asset involved, the obligations of each party, and what happens in case of default. The South Dakota General Form of Assignment as Collateral for Note is designed to meet South Dakota laws, providing clarity and security to both parties in the transaction.

Filing a lien in South Dakota begins with gathering necessary documents, including the South Dakota General Form of Assignment as Collateral for Note, which can serve as a basis for your lien claim. You will need to complete the required forms and submit them to the appropriate county office. It's crucial to ensure that all information is accurate to avoid any potential legal issues. Utilizing US Legal Forms can simplify this process and help you stay compliant.

A promissory note can become invalid if it excludes A) the total sum of money the borrower owes the lender (aka the amount of the note) or B) the number of payments due and the date each increment is due.

Transferable . A promissory note must state that it's either payable to order or payable to bearer. These phrases mean the amount owed by the borrower could be payable to some unknown third party in the future. In other words, the note is transferrable from one person to another.

Collateral assignment of life insurance lets you use a life insurance policy as an asset to secure a loan. If you die while the policy is in place and still owe money on the loan, the death benefit goes to pay off the remaining debt. Any money remaining goes to your beneficiaries.

Collateral refers to an asset that a borrower offers as a guarantee for a loan, such as a mortgage. When you obtain the loan, the lender puts a lien on the collateral. The lien stipulates that the lender can seize the collateral if you don't repay the loan under the terms of the contract.

A secured promissory note should clearly identify the collateral backing the loan. For example, if collateral is being secured by business vehicles, the note should provide their vehicle identification numbers. A small business that is extending credit should also verify collateral is worth enough to cover the debt.