South Dakota Underbrush Removal Contract

Description

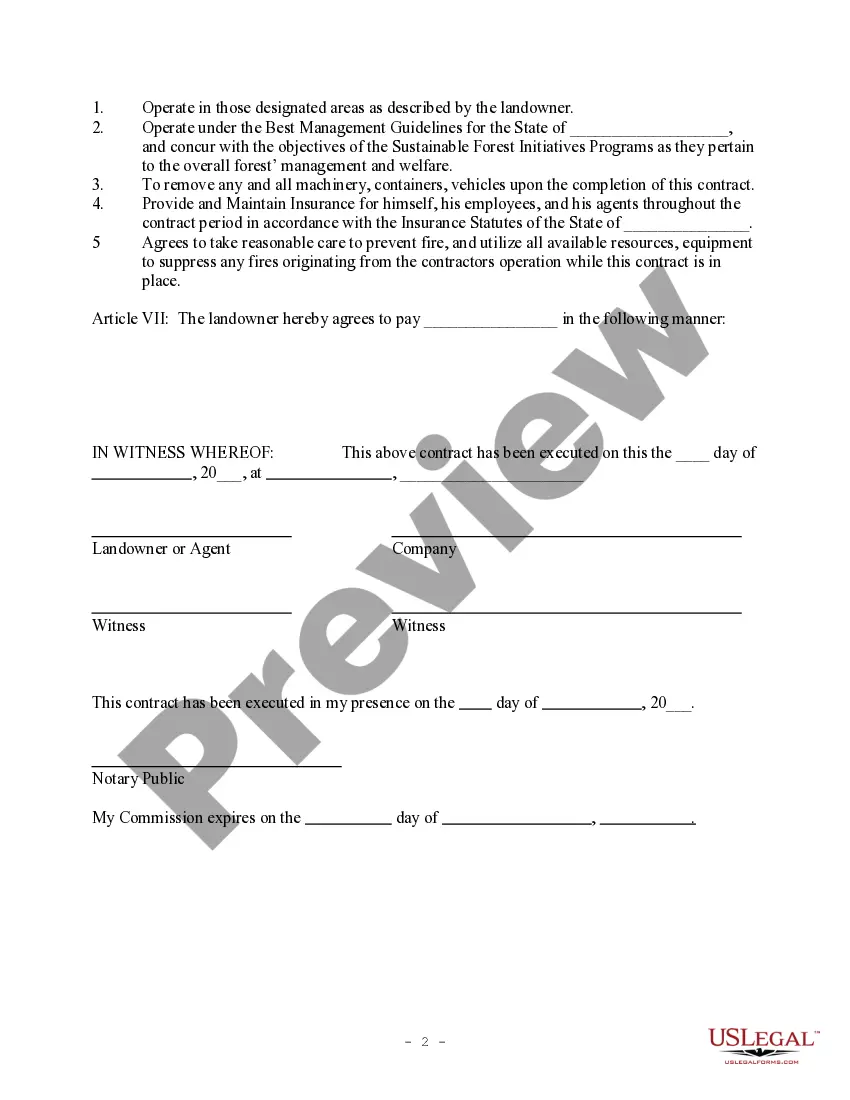

** THIS IS NOT AN UNDERBRUSH REMOVAL CONTRACT. **

How to fill out Underbrush Removal Contract?

If you wish to finalize, obtain, or print legal document templates, utilize US Legal Forms, the largest repository of legal templates accessible online.

Take advantage of the site’s simple and user-friendly search function to find the documents you require.

Numerous templates for business and personal use are categorized by type and state, or by keywords.

Step 4. Once you have located the form you need, click on the Get now button. Select the pricing plan you prefer and enter your information to register for an account.

Step 5. Complete the payment process. You can use your credit card or PayPal account for the transaction.

- Employ US Legal Forms to secure the South Dakota Underbrush Removal Agreement in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click on the Download button to retrieve the South Dakota Underbrush Removal Agreement.

- You can also access forms you have previously obtained from the My documents tab of your account.

- If this is your first time using US Legal Forms, follow the instructions below.

- Step 1. Confirm that you have selected the form for the correct city/state.

- Step 2. Utilize the Review option to inspect the form’s content. Don’t forget to read the description.

- Step 3. If you are dissatisfied with the form, use the Search area at the top of the screen to find alternative versions in the legal form format.

Form popularity

FAQ

In South Dakota, several items and services are not subject to sales tax. These typically include many essential services, certain food items, and the labor associated with most services. When considering a South Dakota Underbrush Removal Contract, understanding what is not taxed can help you budget better and focus on the necessary aspects of your project.

To figure out excise tax in South Dakota, you will need to know the specific rate applicable to your transaction or service. This often varies depending on the product or service type. When evaluating a South Dakota Underbrush Removal Contract, you should research any applicable taxes that may be relevant to your specific services or materials involved.

Labor is typically not taxable in South Dakota, unless it relates to a specific taxable service or product installation. For those looking to understand how this applies to a South Dakota Underbrush Removal Contract, it’s vital to review the specifics of your project. This ensures compliance and helps you avoid unexpected costs.

Generally, labor is not taxed in South Dakota unless it falls under specific taxable services. For example, if your labor is part of a South Dakota Underbrush Removal Contract that involves materials or services that are taxable, the labor component may also be taxable. It's crucial to clarify this with a reliable source or consult an expert.

In South Dakota, most services are not subject to sales tax, except for specific services like telecommunications and some utilities. However, services related to tangible personal property may incur sales tax, particularly if you engage in a South Dakota Underbrush Removal Contract that includes removing and disposing of physical materials. Always confirm the tax status of your particular service.