South Dakota Receipt and Withdrawal from Partnership

Description

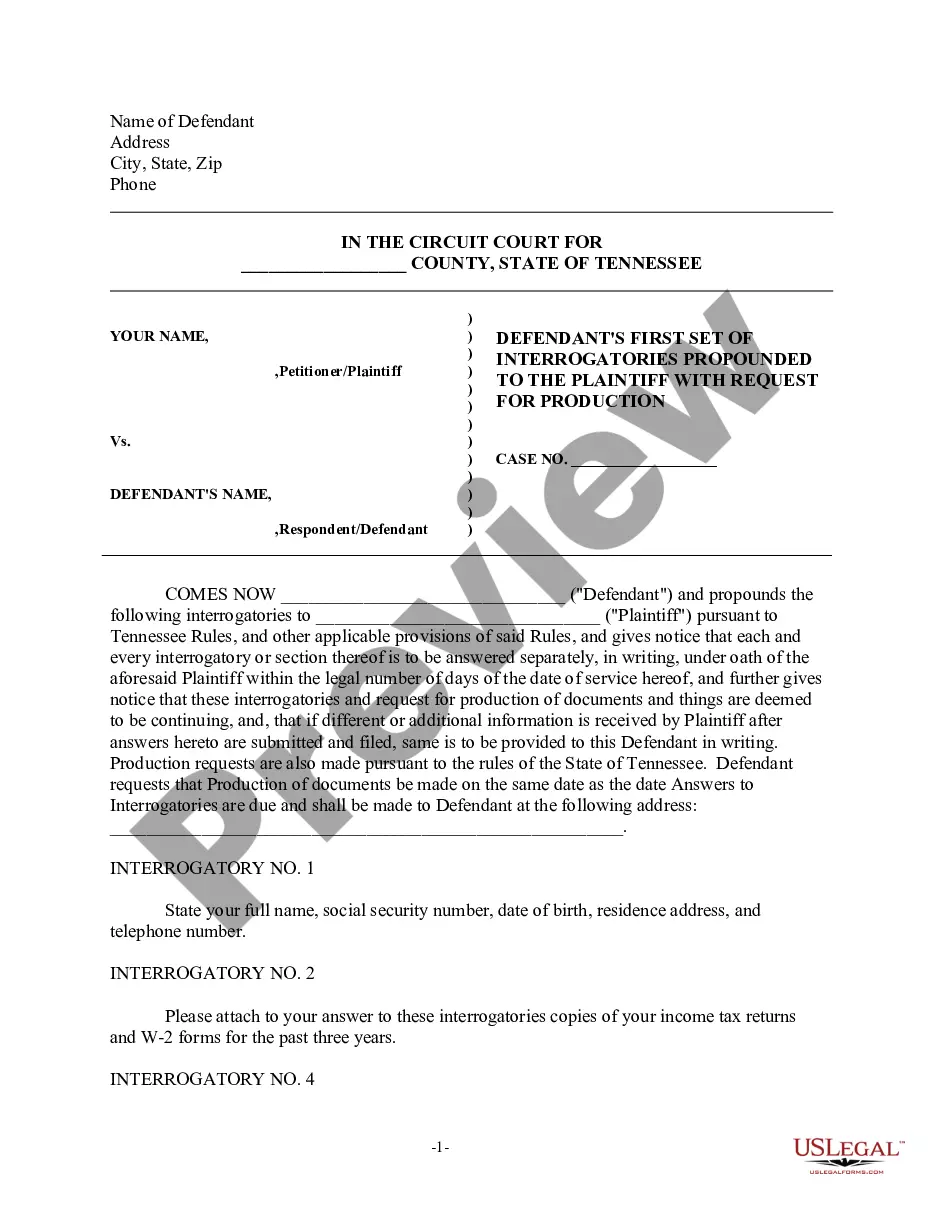

How to fill out Receipt And Withdrawal From Partnership?

You can spend hours online trying to locate the approved document template that meets the federal and state standards you require.

US Legal Forms offers a wide array of legal forms that are evaluated by experts.

You can download or create the South Dakota Receipt and Withdrawal from Partnership through our service.

If available, utilize the Preview button to browse through the document template as well.

- If you already have a US Legal Forms account, you can Log In and click on the Acquire button.

- Then, you can complete, edit, print, or sign the South Dakota Receipt and Withdrawal from Partnership.

- Every legal document template you purchase is yours indefinitely.

- To obtain another copy of the purchased form, go to the My documents tab and click on the corresponding button.

- If you are visiting the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have selected the correct document template for the area/city of your choice.

- Review the form description to confirm that you have chosen the correct form.

Form popularity

FAQ

When A Partner Withdraws From The Partnership The Partnership Dissolves? When one of the partners leaves a partnership, the operation is dissolved, unless the remaining partner decides to form a sole proprietorship instead.

For LLCs, the Beneficial Owner(s) are the LLC's Members.

When one partner wants to leave the partnership, the partnership generally dissolves. Dissolution means the partners must fulfill any remaining business obligations, pay off all debts, and divide any assets and profits among themselves. Your partners may not want to dissolve the partnership due to your departure.

General partners have unlimited liability and have full management control of the business. Limited partners have little to no involvement in management, but also have liability that's limited to their investment amount in the LP.

The term beneficial owner/ultimate beneficial owner was then defined as a person who holds by himself or his nominee, a share or an interest in a share which entitles him to exercise not less than 25 per cent of the aggregate voting power exercisable at a meeting of shareholders.

If you want to remove your name from a partnership, there are three options you may pursue:Dissolve your business. If there is no language in your operating agreement stating otherwise, this will be your only name-removal option.Change your business's name.Use a doing business as (DBA) name.

Removing a partner from a general partnership is the act of removing someone from your business that operates as a partnership. It can happen in several different ways, but the most common option is through a clause in the partnership agreement itself.

Withdrawing from Partnership In a state that follows the Revised Uniform Limited Partnership Act (RULPA), a limited partner has the right to withdraw from the limited partnership only after giving six months' written notice to all general partners.

Form a Limited Partnership Online (LP) Forming an LP (Limited Partnership) offers limited liability protection, pass-through taxes, & more. Form your Limited Partnership with BizFilings today.

In the context of an LLC, a Beneficial Owner is: any person, who directly or indirectly (through any contract, arrangement, understanding, relationship or otherwise) owns 25% or more of the LLC. any person with significant responsibility or authority to control, manage, or direct an LLC.