South Dakota Agreement to Incorporate as an S Corp and as Small Business Corporation with Qualification for Section 1244 Stock

Description

How to fill out Agreement To Incorporate As An S Corp And As Small Business Corporation With Qualification For Section 1244 Stock?

Finding the appropriate legal document format can be challenging. Clearly, there are numerous templates available online, but how do you obtain the legal form you need.

Utilize the US Legal Forms website. This service offers thousands of templates, including the South Dakota Agreement to Incorporate as an S Corp and as a Small Business Corporation with Qualification for Section 1244 Stock, which you can utilize for both business and personal purposes. All templates are verified by experts and comply with federal and state regulations.

If you are already registered, Log In to your account and then click the Download button to acquire the South Dakota Agreement to Incorporate as an S Corp and as a Small Business Corporation with Qualification for Section 1244 Stock. Use your account to view the legal forms you have previously purchased. Visit the My documents tab in your account to obtain another copy of the form you need.

US Legal Forms is the largest collection of legal templates where you can find various document formats. Leverage this service to acquire professionally-crafted documents that comply with state regulations.

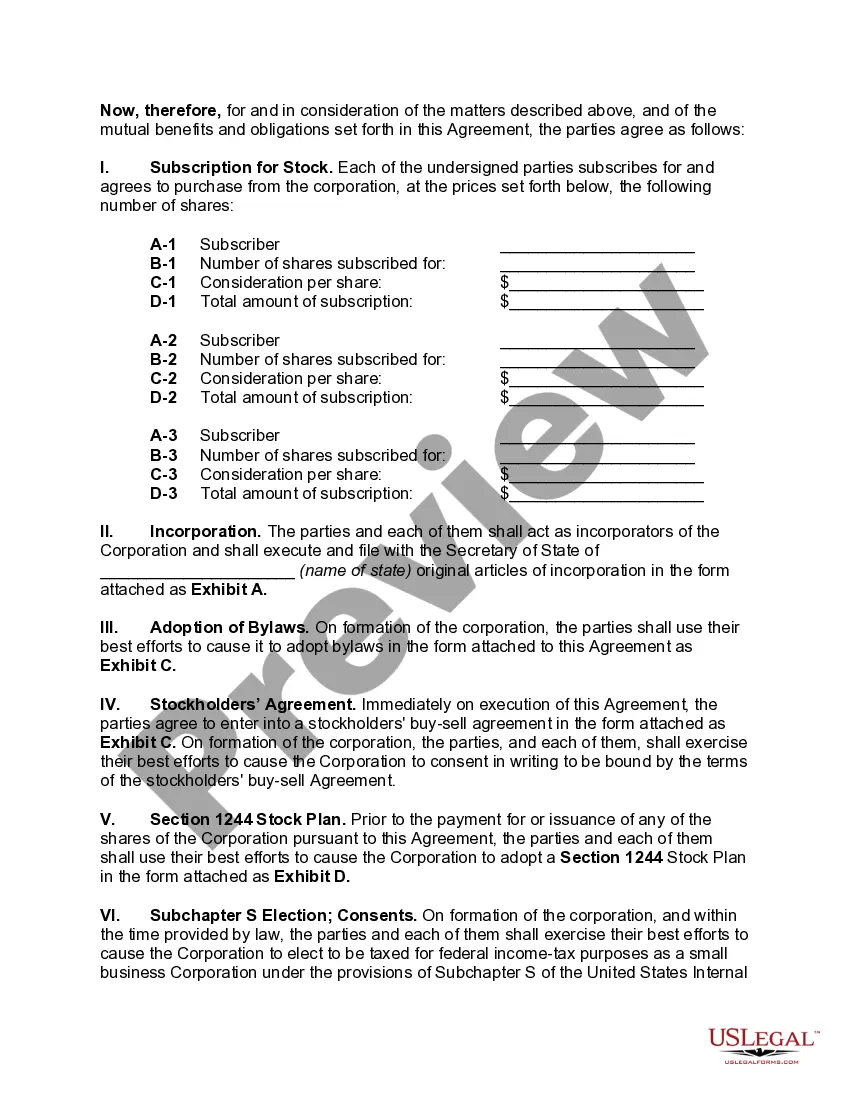

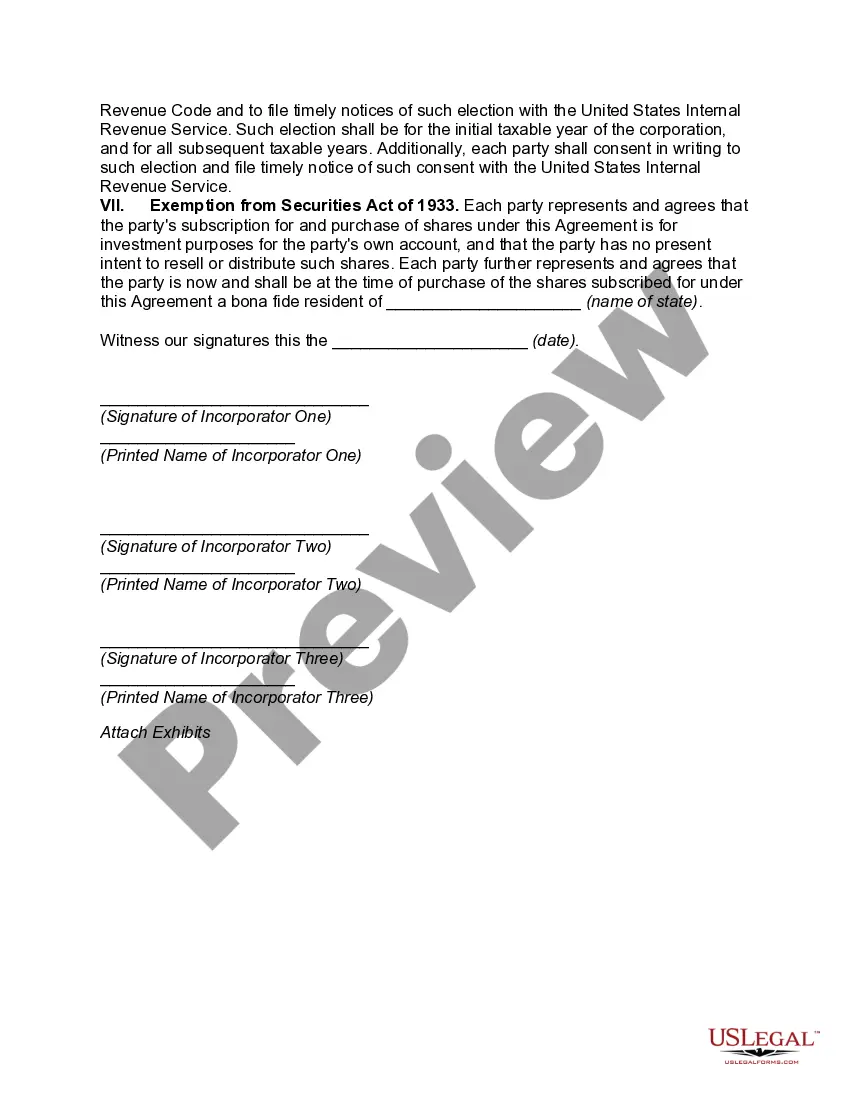

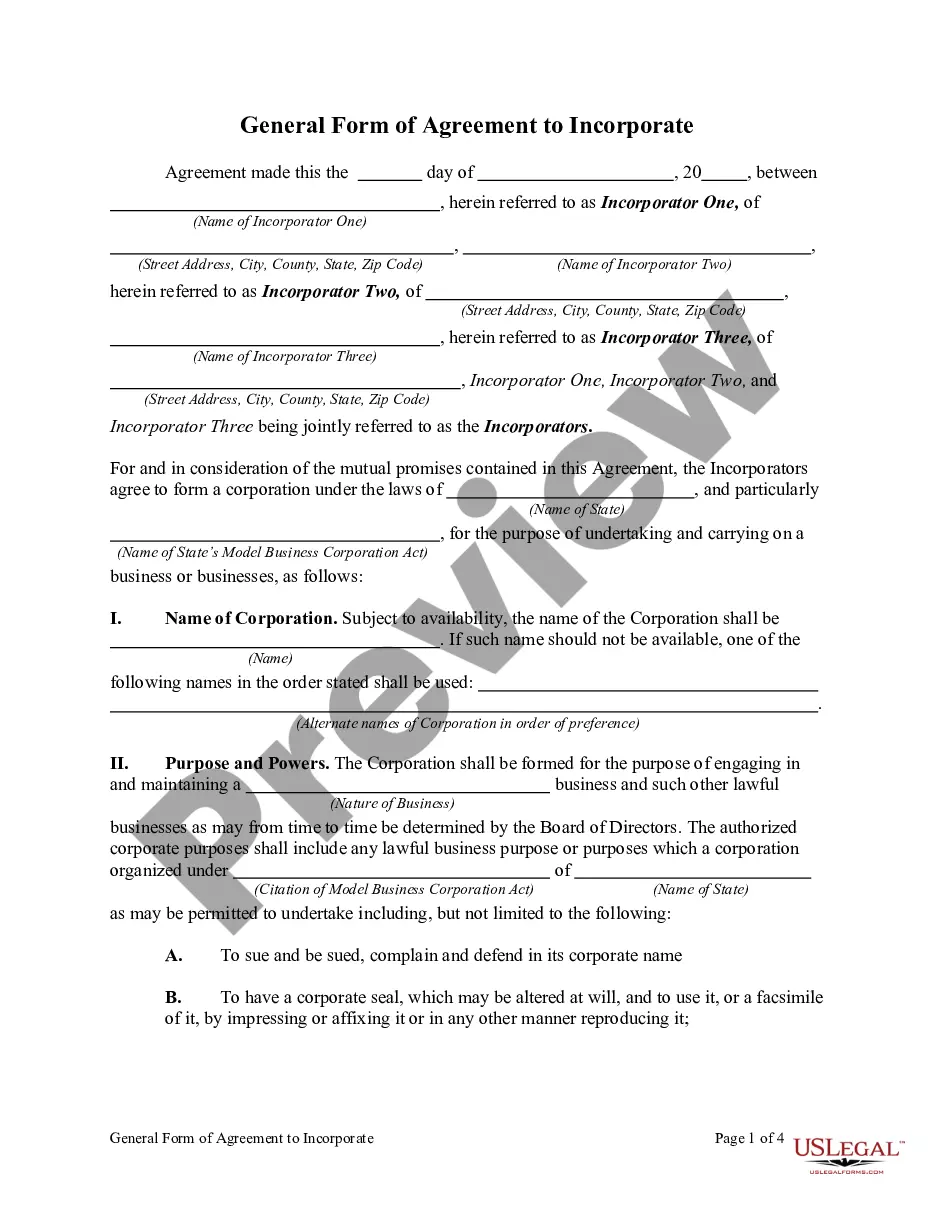

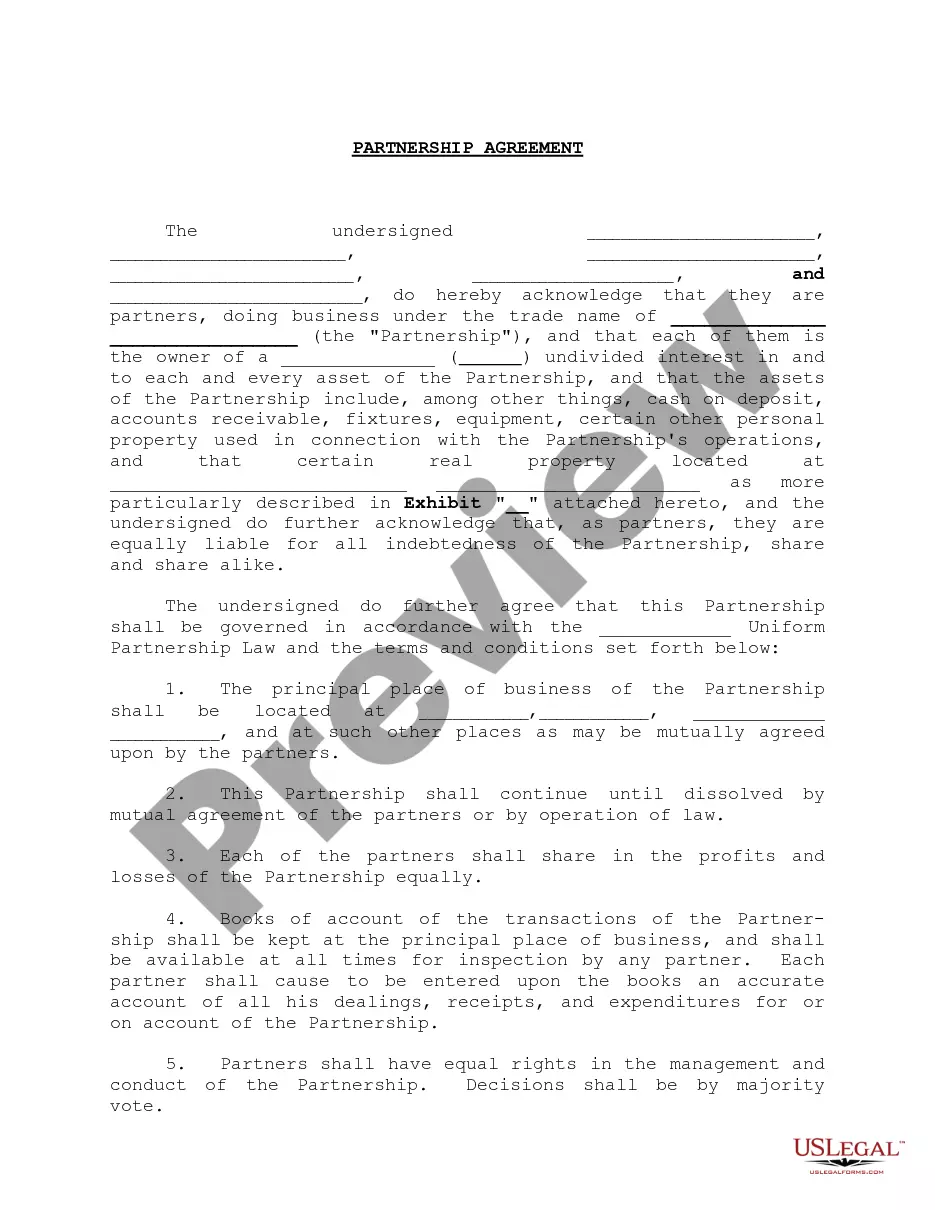

- First, ensure you have selected the correct form for your city/state. You can browse the form using the Review button and read the form description to confirm it is suitable for you.

- If the form does not meet your requirements, utilize the Search field to find the correct form.

- Once you are certain that the form is appropriate, click the Purchase now button to acquire the form.

- Choose the pricing plan you want and enter the required information. Create your account and pay for your order using your PayPal account or credit card.

- Select the file format and download the legal document template to your device.

- Complete, amend, print, and sign the received South Dakota Agreement to Incorporate as an S Corp and as a Small Business Corporation with Qualification for Section 1244 Stock.

Form popularity

FAQ

There are several advantages to becoming a corporation, including the limited personal liability, easy transfer of ownership, business continuity, better access to capital and (depending on the corporation structure) occasional tax benefits.

How are S corps taxed? S corps don't pay corporate income taxes, so there is not really an S corp tax rate. Instead, the company's individual shareholders split up the income (or losses) amongst each other and report it on their own personal tax returns.

According to the IRS: Generally, an S corporation is exempt from federal income tax other than tax on certain capital gains and passive income. It is treated in the same way as a partnership, in that generally taxes are not paid at the corporate level.

South Dakota does not impose a corporate income tax.

For federal tax purposes, you can simply make an election for the LLC to be taxed as an S-Corporation. All you need to do is fill out a form and send it to the IRS. Once the LLC is classified for federal tax purposes as a Corporation, it can file Form 2553 to be taxed as an S-Corporation.

S corporation advantages include: Protected assets. An S corporation protects the personal assets of its shareholders. Absent an express personal guarantee, a shareholder does not have personal liability for the business debts and liabilities of the corporation.

Starting a South Dakota LLC and electing S corp tax status is easy....Step 1: Name Your LLC.Step 2: Choose Your South Dakota Registered Agent.Step 3: File the South Dakota LLC Articles of Organization.Step 4: Create an LLC Operating Agreement.Step 5: Get an EIN and Complete Form 2553 on the IRS Website.

How are S corps taxed? Generally speaking, S corps don't pay federal corporate taxes. Instead, the US government exacts those taxes from distributions the corporation pays to shareholders, who report it on their personal tax returns.

5 Reasons an S Corporation Might Be Right for Your BusinessProvides Personal Asset Protection.Lowers Your Tax Liability.Prioritizes Your Privacy.Offers Limited Liability to Unlimited Managers.100% of Your Business Profits Go to Earnings.07-Feb-2019

South Dakota S corporations enjoy pass-through taxation so shareholders avoid so-called double taxation. South Dakota S corporations file informational tax returns, but pays no income tax itself.