South Dakota Sample Letter regarding Articles of Incorporation - Election of Sub-S Status

Description

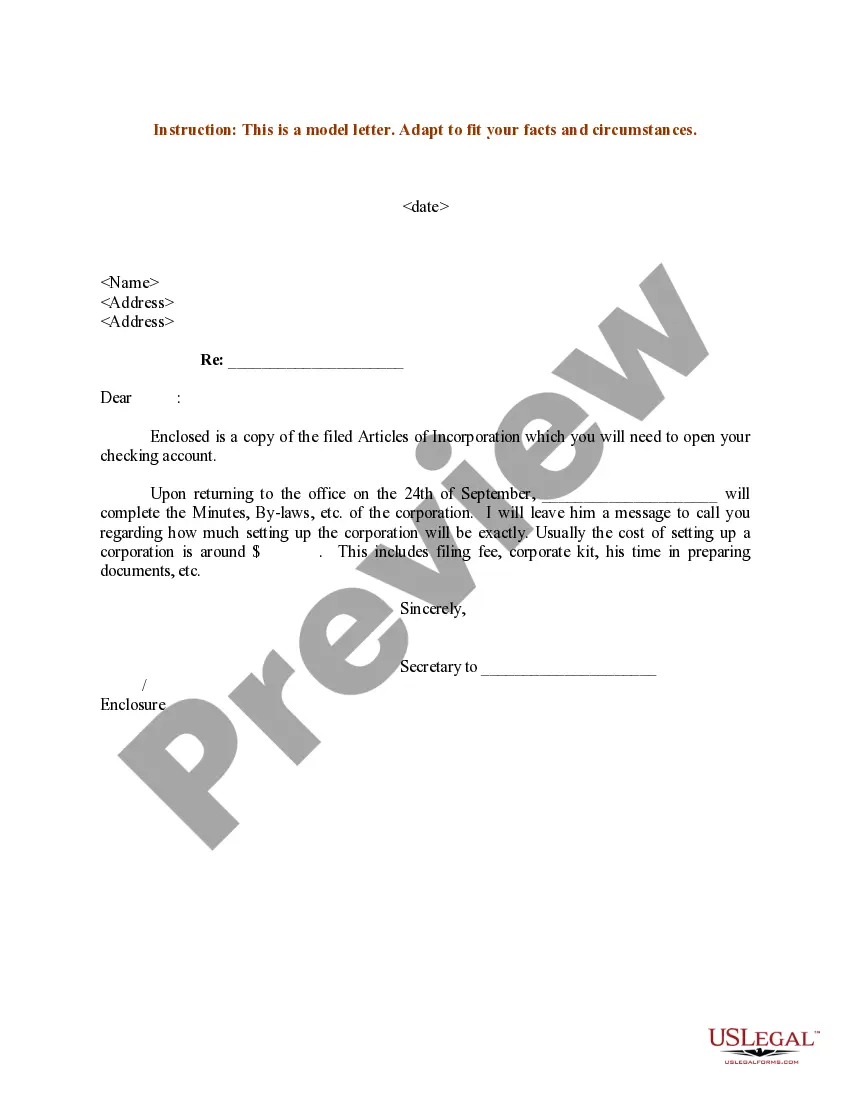

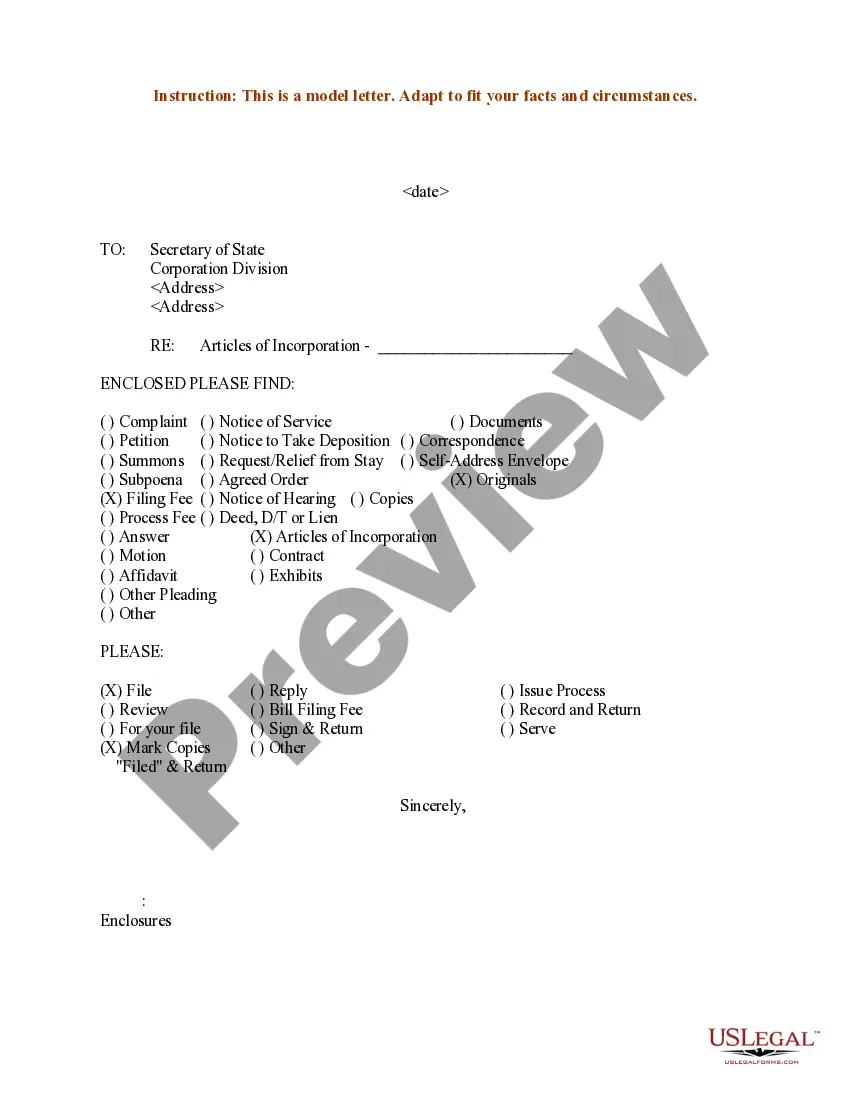

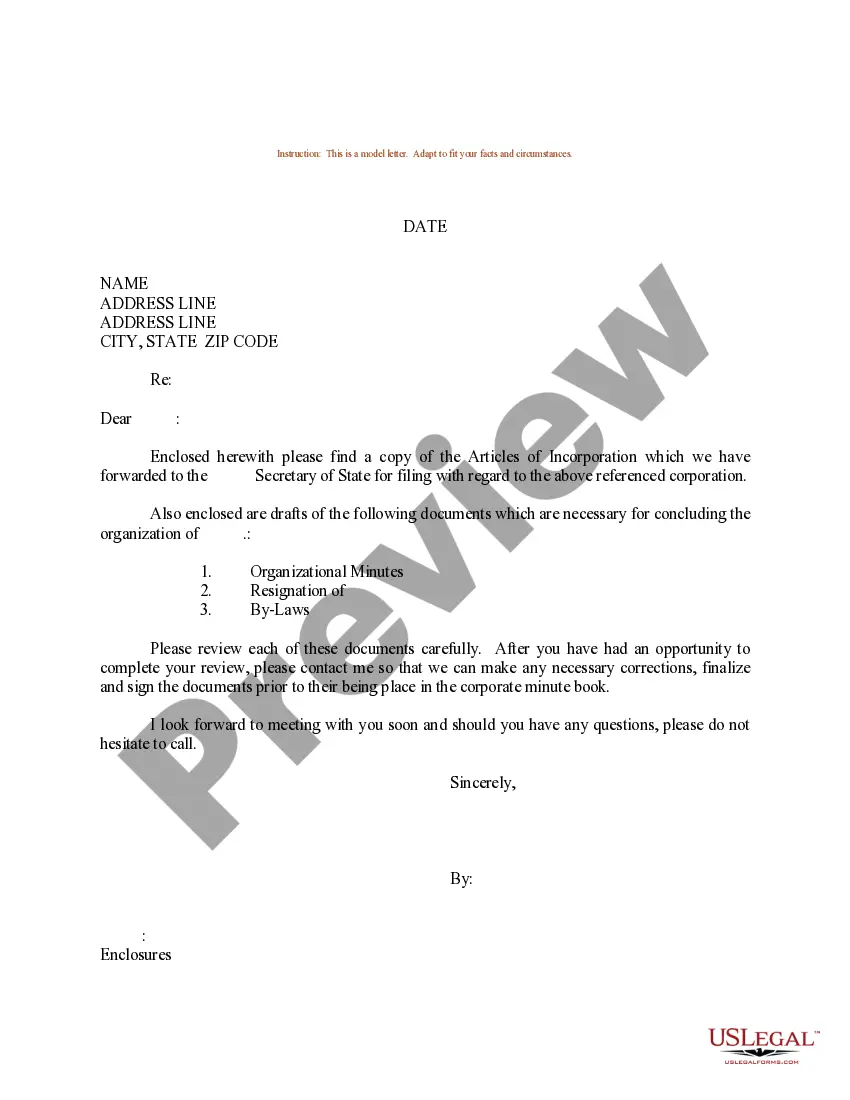

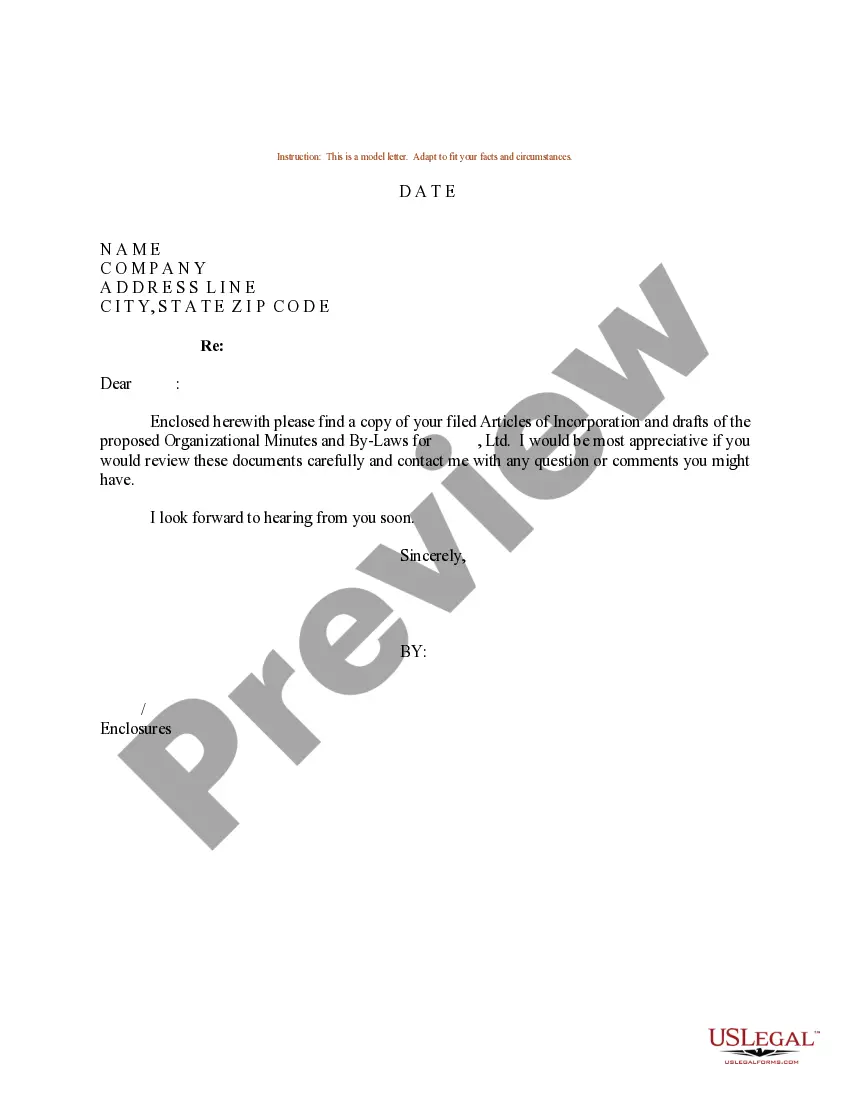

How to fill out Sample Letter Regarding Articles Of Incorporation - Election Of Sub-S Status?

US Legal Forms - one of many largest libraries of authorized kinds in America - gives a variety of authorized papers layouts it is possible to download or print out. Using the website, you may get thousands of kinds for enterprise and specific reasons, sorted by groups, suggests, or search phrases.You can find the latest types of kinds much like the South Dakota Sample Letter regarding Articles of Incorporation - Election of Sub-S Status within minutes.

If you currently have a monthly subscription, log in and download South Dakota Sample Letter regarding Articles of Incorporation - Election of Sub-S Status in the US Legal Forms collection. The Download option will show up on every single kind you view. You get access to all in the past delivered electronically kinds within the My Forms tab of your bank account.

If you want to use US Legal Forms initially, allow me to share easy instructions to get you began:

- Ensure you have picked out the best kind to your city/state. Select the Review option to review the form`s articles. Look at the kind description to ensure that you have selected the proper kind.

- In case the kind doesn`t fit your requirements, use the Search field towards the top of the display screen to get the one who does.

- In case you are satisfied with the shape, affirm your choice by clicking the Purchase now option. Then, opt for the pricing program you favor and supply your references to sign up for an bank account.

- Process the deal. Make use of Visa or Mastercard or PayPal bank account to accomplish the deal.

- Choose the formatting and download the shape on your system.

- Make modifications. Complete, revise and print out and indicator the delivered electronically South Dakota Sample Letter regarding Articles of Incorporation - Election of Sub-S Status.

Every template you added to your bank account does not have an expiry time and is your own permanently. So, in order to download or print out yet another duplicate, just proceed to the My Forms portion and click on in the kind you need.

Get access to the South Dakota Sample Letter regarding Articles of Incorporation - Election of Sub-S Status with US Legal Forms, by far the most extensive collection of authorized papers layouts. Use thousands of specialist and express-particular layouts that fulfill your business or specific needs and requirements.

Form popularity

FAQ

South Dakota doesn't tax personal income, capital gains, or corporate income. Crime rates are low, and energy costs are relatively inexpensive. Among South Dakota's many attractive qualities, the state's reasonable regulations and its balanced budget make South Dakota an attractive start-up proposition.

LLC members' income is taxed at the federal self-employment tax rate of 15.3% (12.4% for social security and 2.9% for Medicare). South Dakota does not levy state personal or corporate income taxes, though the LLC will most likely need to pay state sales and local taxes, as well as industry-specific taxes.

There is no threshold to reach before a license is needed; if you are operating a taxable business, a license is needed. If you are conducting business in South Dakota you need a license even if you do not have a physical location.

Starting an LLC in the Mount Rushmore State comes with its own unique financial dynamics. South Dakota stands out as an attractive option for business owners due to its lack of state income tax.

The first step is to file a form called the Amended Articles of Organization with the Secretary of State and wait for it to be approved. This is how you officially change your LLC name in South Dakota. The filing fee for the Amended Articles of Organization in South Dakota is $60.

While there are no specific laws that make it more suitable for LLCs than other states, Delaware is the state of choice to incorporate because of their business-friendly corporate tax laws. There's a reason why 66.8% of all Fortune 500 companies choose Delaware as their incorporation state.

Dakota's LLCs will protect your personal assets from the creditors of your business. These creditors could be employees, individuals the business has contracted with, or individuals bringing personal liability claims against the business.

How do you dissolve a South Dakota Corporation? To dissolve your corporation in South Dakota, you must submit the completed Articles of Dissolution form by mail or in person, in duplicate, to the Secretary of State along with the filing fee.