Are you presently inside a situation that you will need paperwork for possibly organization or specific uses virtually every day time? There are plenty of legitimate record templates accessible on the Internet, but locating types you can depend on is not straightforward. US Legal Forms offers a large number of type templates, such as the South Dakota Release and Exoneration of Executor on Distribution to Beneficiary of Will and Waiver of Citation of Final Settlement, which can be published in order to meet federal and state requirements.

If you are presently familiar with US Legal Forms website and also have an account, merely log in. Following that, it is possible to acquire the South Dakota Release and Exoneration of Executor on Distribution to Beneficiary of Will and Waiver of Citation of Final Settlement design.

If you do not provide an bank account and wish to begin using US Legal Forms, follow these steps:

- Obtain the type you need and make sure it is for the appropriate metropolis/region.

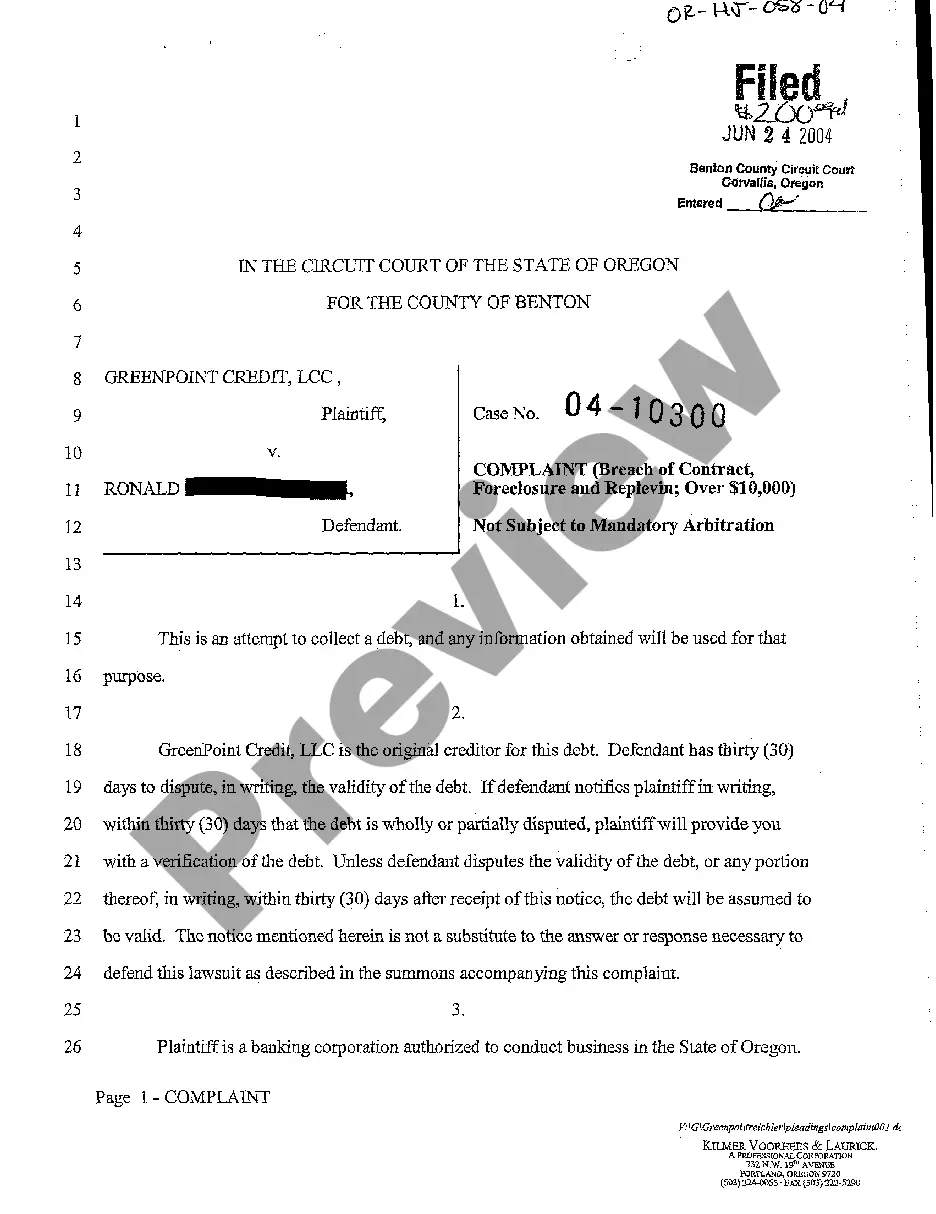

- Utilize the Preview button to review the shape.

- Read the outline to ensure that you have chosen the appropriate type.

- In the event the type is not what you`re seeking, use the Search field to find the type that meets your needs and requirements.

- Once you get the appropriate type, simply click Get now.

- Pick the rates plan you want, fill out the required information and facts to create your money, and buy the order with your PayPal or charge card.

- Select a handy paper format and acquire your copy.

Discover all the record templates you have purchased in the My Forms food selection. You can get a extra copy of South Dakota Release and Exoneration of Executor on Distribution to Beneficiary of Will and Waiver of Citation of Final Settlement any time, if required. Just click the needed type to acquire or produce the record design.

Use US Legal Forms, by far the most comprehensive collection of legitimate forms, to save lots of efforts and avoid errors. The assistance offers expertly made legitimate record templates which can be used for an array of uses. Create an account on US Legal Forms and start creating your lifestyle a little easier.