This form is a trust used to provide supplemental support for a disabled beneficiary without loss of government benefits. It may be revocable or irrevocable, as the funds are contributed by a third party, and not the beneficiary. The Omnibus Budget Reconciliation Act of 1993 established the supplemental needs trusts.

South Dakota Supplemental Needs Trust for Third Party - Disabled Beneficiary

Description

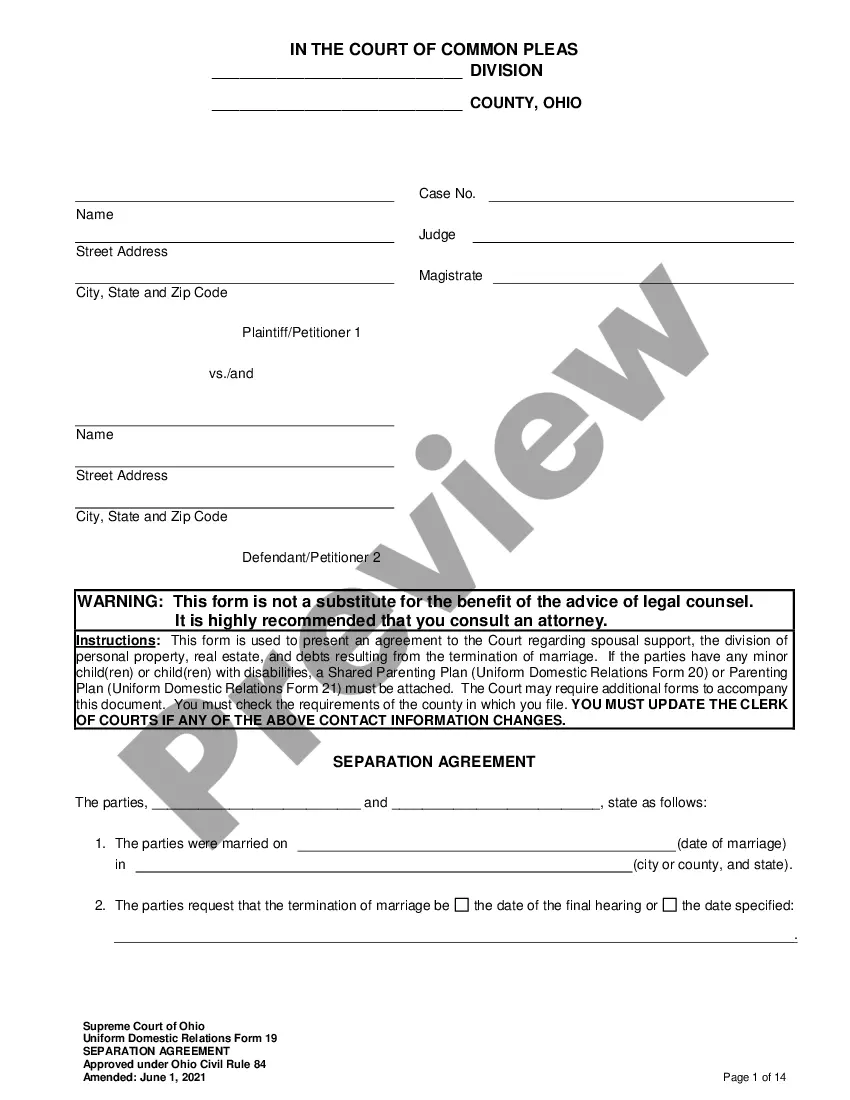

How to fill out Supplemental Needs Trust For Third Party - Disabled Beneficiary?

US Legal Forms - one of the largest collections of legal documents in the USA - offers a variety of legal document templates that you can download or print.

By using the site, you can find thousands of forms for business and personal use, sorted by categories, states, or keywords. You can easily access the latest forms such as the South Dakota Supplemental Needs Trust for Third Party - Disabled Beneficiary in seconds.

If you already have a subscription, Log In and download South Dakota Supplemental Needs Trust for Third Party - Disabled Beneficiary from the US Legal Forms collection. The Download button will be visible on every form you view. You can access all previously saved forms in the My documents section of your account.

Complete the transaction. Use your credit card or PayPal account to finalize the transaction.

Select the format and download the form to your device. Make adjustments. Fill out, edit, and print and sign the saved South Dakota Supplemental Needs Trust for Third Party - Disabled Beneficiary. Each format you add to your account has no expiration date and belongs to you indefinitely. Therefore, if you need to download or print another copy, simply visit the My documents section and click on the form you need. Access the South Dakota Supplemental Needs Trust for Third Party - Disabled Beneficiary with US Legal Forms, the most extensive collection of legal document templates. Utilize thousands of professional and state-specific templates that fulfill your business or personal requirements.

- If you want to use US Legal Forms for the first time, here are simple instructions to get you started.

- Ensure you have selected the right form for your city/state. Click the Preview button to review the form's content.

- Check the form summary to verify that you have selected the correct form.

- If the form isn't suitable, utilize the Search field at the top of the screen to find the one that meets your needs.

- Once you are satisfied with the form, confirm your choice by clicking the Buy Now button.

- Then, choose the pricing plan you prefer and provide your details to register for the account.

Form popularity

FAQ

One disadvantage of a supplemental needs trust is that it can be complex to administer, often requiring ongoing legal and financial oversight. Additionally, there may be limits on how the trust funds can be spent, which may restrict a beneficiary's flexibility. However, when structured properly as a South Dakota Supplemental Needs Trust for Third Party - Disabled Beneficiary, it can offer significant advantages while minimizing these challenges. Consulting with professionals can help navigate these issues effectively.

The primary difference lies in how the trusts are utilized. A special needs trust caters specifically to protecting a disabled beneficiary's eligibility for public assistance without restricting personal benefits. Conversely, a supplemental trust may provide additional financial support without such eligibility concerns. Ultimately, understanding the nuances of a South Dakota Supplemental Needs Trust for Third Party - Disabled Beneficiary can help tailor the estate plan to specific needs.

While both terms relate to managing assets for individuals with disabilities, a special needs trust generally focuses on preserving eligibility for government benefits, whereas a supplemental trust may encompass broader financial planning aspects. A South Dakota Supplemental Needs Trust for Third Party - Disabled Beneficiary specifically ensures that funds can be used without jeopardizing essential benefits. This distinction can impact the trust's structure and usage, so it's essential to choose wisely.

One of the biggest mistakes parents make is failing to consult with a knowledgeable attorney when setting up the trust. Without proper guidance, they may overlook vital protections or create restrictions that could harm a disabled beneficiary in the long run. Instead, understanding the specific needs of the beneficiary and following the guidelines for a South Dakota Supplemental Needs Trust for Third Party - Disabled Beneficiary will ensure better management and benefits.

To set up a third party special needs trust, you first need to define the goals for the trust and appoint a trustee who will manage the assets. Next, consult with an attorney who specializes in trusts to draft the trust document, ensuring it meets all legal requirements for a South Dakota Supplemental Needs Trust for Third Party - Disabled Beneficiary. Finally, fund the trust with assets and inform relevant parties about its existence to ensure compliance and maximize benefits.

The primary beneficiary of a supplemental needs trust is typically an individual with a disability, who can receive additional financial support without affecting their eligibility for government benefits. In the case of the South Dakota Supplemental Needs Trust for Third Party - Disabled Beneficiary, third-party contributors fund the trust, creating a safety net for the disabled person. This arrangement allows for enriched quality of life and independence, ensuring they have access to necessary resources.

Setting up a trust for a disabled person involves several key steps, beginning with choosing the right type of trust, such as the South Dakota Supplemental Needs Trust for Third Party - Disabled Beneficiary. Next, you need to draft the trust document, detailing the terms and guidelines for funding and distribution. Working with an estate planning attorney can streamline this process, ensuring that everything is legally sound and tailored to meet the beneficiary's unique needs.

There is no strict maximum amount you can place into a South Dakota Supplemental Needs Trust for Third Party - Disabled Beneficiary. However, the trust must be managed carefully to ensure it does not affect the beneficiary’s eligibility for government assistance programs. Some funding rules apply, and it's often beneficial to consult with an expert regarding the specifics of your situation. This way, you can maintain compliance while maximizing the trust's benefits.

The best trust for a disabled person often depends on specific needs and circumstances. A South Dakota Supplemental Needs Trust for Third Party - Disabled Beneficiary provides essential benefits while preserving government assistance. This type of trust allows funds to be used for supplemental care, personal needs, and educational opportunities without jeopardizing eligibility for public benefits. Consider evaluating individual situations to determine the best options.

For a disabled beneficiary, a third party special needs trust is often ideal as it allows for additional support without affecting government benefits. This type of trust provides flexibility in managing funds while adhering to legal requirements. Engaging with professionals experienced in the South Dakota Supplemental Needs Trust for Third Party - Disabled Beneficiary will ensure you make the best choice for your loved one's future.