South Dakota Sample Letter for New Business with Credit Application

Description

How to fill out Sample Letter For New Business With Credit Application?

You can spend hours online searching for the legal document template that meets the federal and state requirements you are seeking.

US Legal Forms offers thousands of legal forms that have been reviewed by experts.

You can easily download or print the South Dakota Sample Letter for New Business with Credit Application from their service.

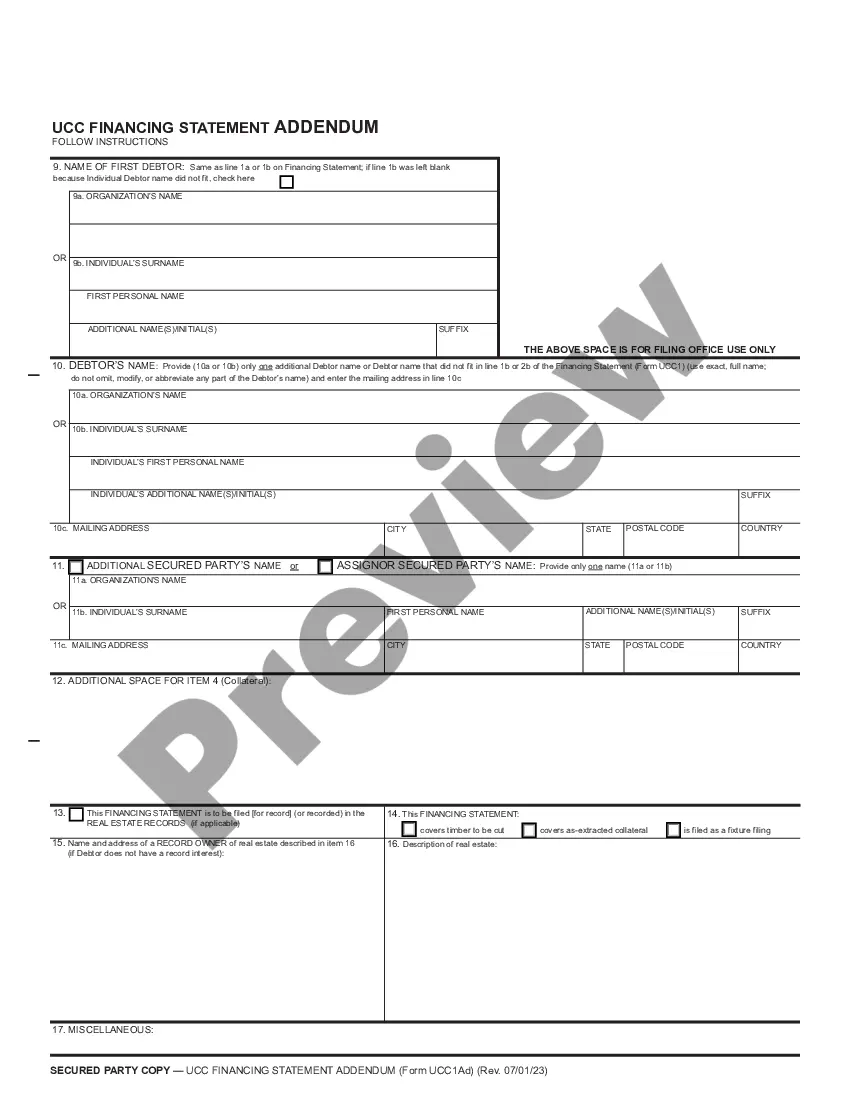

Check the form description to confirm you have chosen the proper document. If available, utilize the Preview button to review the document template as well.

- If you already possess a US Legal Forms account, you can Log In and click on the Download button.

- Subsequently, you can complete, modify, print, or sign the South Dakota Sample Letter for New Business with Credit Application.

- Each legal document template you acquire is yours permanently.

- To obtain an additional version of the acquired form, navigate to the My documents tab and click the relevant button.

- If this is your first time using the US Legal Forms website, follow the simple guidelines below.

- First, ensure that you have selected the correct document template for the region/city of your preference.

Form popularity

FAQ

Setting up a sole proprietorship in South Dakota involves selecting a business name, registering it, and acquiring any necessary licenses for your specific industry. You also want to open a separate bank account for your business finances to keep things organized. Remember, using the South Dakota Sample Letter for New Business with Credit Application from uslegalforms can simplify your setup and ensure you meet all legal requirements efficiently.

To establish yourself as a sole proprietorship, first choose a business name that reflects your services. Next, you will need to register this name with the state if it differs from your personal name. Additionally, ensure you have the appropriate licenses and permits. For a streamlined approach, check out the South Dakota Sample Letter for New Business with Credit Application available on uslegalforms to help you manage your paperwork.

You qualify as a sole proprietor if you own and operate a business individually without forming a separate legal entity like an LLC. As a sole proprietor, you are responsible for all business debts and obligations. This means that any profits or losses from your business will be reported on your personal tax return. For further clarity on your responsibilities, remember the South Dakota Sample Letter for New Business with Credit Application can offer important insights.

To register a sole proprietorship in South Dakota, you need to file a business name registration application with the Secretary of State if you choose a name other than your own. Additionally, you may need to obtain necessary licenses depending on your business activities. If you need assistance, consider using the South Dakota Sample Letter for New Business with Credit Application from uslegalforms. This resource can guide you through the registration process.

An S Corp becomes more beneficial as your income increases, especially when it reaches around $50,000 to $100,000. At this level, the tax advantages of an S Corp can provide significant savings compared to other business structures. Additionally, employing a South Dakota Sample Letter for New Business with Credit Application can enhance your financial dealings and support your business growth.

To set up an S Corp in South Dakota, first, you need to form a corporation by filing Articles of Incorporation. After that, you will file Form 2553 to elect S Corporation status. A South Dakota Sample Letter for New Business with Credit Application can aid in the establishment of business credit, which is important for funding and growth.

To start a business in South Dakota, you need to choose a business structure, register your business name, and obtain necessary licenses and permits. A South Dakota Sample Letter for New Business with Credit Application can help you establish credit with suppliers and banks, ensuring you have the resources needed to launch successfully.

Yes, you can set up an S Corporation by yourself in South Dakota. The process involves completing necessary forms, filing them with the state, and paying the required fees. Utilizing a South Dakota Sample Letter for New Business with Credit Application can streamline your process by providing a clear outline for preparing your documentation.

Yes, South Dakota has embraced electronic vehicle titles, streamlining the process of title transfer. This electronic system makes it easier for both buyers and sellers to manage their vehicle ownership electronically. If you are starting a business related to vehicle sales, consider utilizing resources like a South Dakota Sample Letter for New Business with Credit Application to simplify your transactions.

In South Dakota, a bill of sale is often necessary when transferring ownership of personal property, especially in vehicle transactions. This document provides proof of the sale and protects both the buyer and seller. If you're starting a business, consider using a South Dakota Sample Letter for New Business with Credit Application to help outline financial transactions clearly.