South Dakota Invoice Template for Dentist

Description

How to fill out Invoice Template For Dentist?

You can spend hours online looking for the legal document template that meets the federal and state requirements you desire.

US Legal Forms offers countless legal forms that have been evaluated by professionals.

You can easily download or print the South Dakota Invoice Template for Dentist from the service.

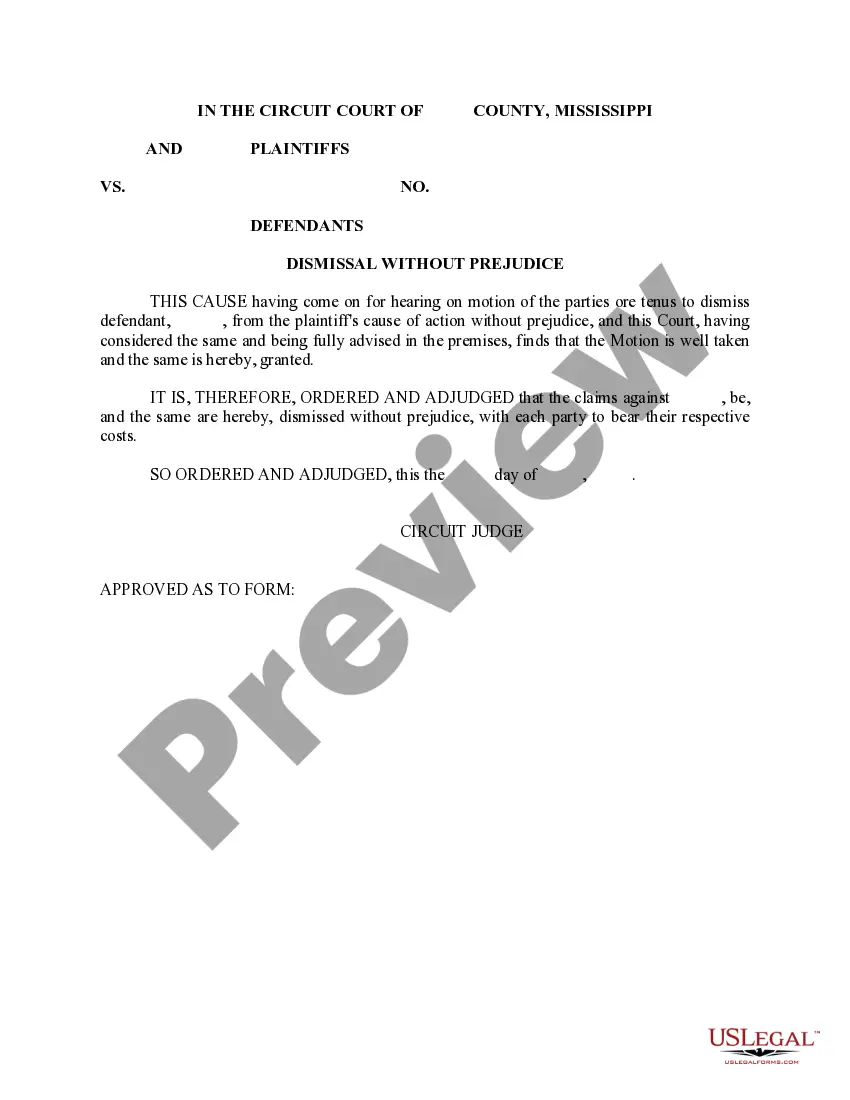

If available, use the Preview button to view the document template as well.

- If you currently hold a US Legal Forms account, you can Log In and then click the Download button.

- After that, you can fill out, edit, print, or sign the South Dakota Invoice Template for Dentist.

- Every legal document template you obtain is yours indefinitely.

- To retrieve another copy of any purchased form, visit the My documents tab and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the straightforward instructions below.

- First, make sure you have chosen the correct document template for the county/city of your selection.

- Review the form details to ensure you have selected the appropriate form.

Form popularity

FAQ

Creating an e-invoice for your services is simple with a South Dakota Invoice Template for Dentist. You can convert your traditional invoice into a digital format by filling in the template and saving it as a PDF or other digital document. Sending e-invoices not only enhances efficiency but also improves record-keeping for both you and your patients.

To create an invoice for services provided, consider starting with a South Dakota Invoice Template for Dentist. Fill in essential details, such as the patient's name, service date, and service descriptions. This way, you ensure that all relevant information is presented clearly, making it easy for patients to understand their payments.

Creating an invoice for your services is straightforward when you utilize a South Dakota Invoice Template for Dentist. Simply input the details of your dental services, including the date, service description, and total amount due. This template streamlines your billing process and ensures consistency with your branding.

To create your own invoice, start by using a South Dakota Invoice Template for Dentist. You can customize it with your practice name, address, and contact information. Make sure to add a description of the services provided, along with the respective charges. This will ensure clarity and transparency in your billing process.

In South Dakota, any business selling tangible goods or certain services that are taxable must obtain a sales tax license. This requirement includes those in professions like dentistry if selling products to patients. Once you have your sales tax license, employing a South Dakota Invoice Template for Dentist can streamline your invoice creation process, ensuring compliance with tax laws.

A sales tax license and an Employer Identification Number (EIN) serve different purposes. The sales tax license allows a business to collect tax on sales, while the EIN is used for tax reporting and identification purposes. When you create invoices with a South Dakota Invoice Template for Dentist, it's crucial to differentiate between the two for accurate record-keeping.

In South Dakota, most professional services are not subject to sales tax. However, it is essential to review the specific regulations as certain services may have different rules. As a dentist, using a South Dakota Invoice Template for Dentist allows you to detail your services correctly and ensures clarity in your billing process.

To acquire a seller's permit in South Dakota, you need to apply through the state’s Department of Revenue. The application can usually be completed online or via mail, depending on your preference. With your seller's permit, utilizing a South Dakota Invoice Template for Dentist helps in applying the proper tax treatments on your invoices.

Applying for a South Dakota sales tax license is a straightforward process. You can fill out the application online through the South Dakota Department of Revenue website. After securing your sales tax license, make sure to incorporate this into your billing processes using a South Dakota Invoice Template for Dentist for accurate sales tax reporting.

To obtain a tax ID number in South Dakota, visit the IRS website. You can complete the online application for an Employer Identification Number (EIN) which typically serves as your tax ID. Once you have your EIN, you can efficiently create invoices using a South Dakota Invoice Template for Dentist, ensuring your billing is compliant and professional.