South Dakota Blind Trust Agreement

Description

How to fill out Blind Trust Agreement?

Are you presently in a scenario where you require documents for either organizational or personal purposes almost every day.

There are countless legal document templates accessible online, but finding ones you can rely on is not simple.

US Legal Forms offers thousands of form templates, such as the South Dakota Blind Trust Agreement, that are crafted to fulfill both state and federal requirements.

Select a convenient document format and download your copy.

Access all the document templates you have purchased from the My documents list. You can acquire an additional copy of the South Dakota Blind Trust Agreement at any time, if needed. Simply click on the desired form to download or print the document template. Utilize US Legal Forms, one of the largest collections of legal forms, to save time and avoid mistakes. The service provides professionally crafted legal document templates for various purposes. Create an account on US Legal Forms and start simplifying your life.

- If you are already acquainted with the US Legal Forms site and possess an account, simply Log In.

- Then, you can download the South Dakota Blind Trust Agreement template.

- If you do not possess an account and wish to begin using US Legal Forms, follow these steps.

- Select the form you need and ensure it is for the correct city/region.

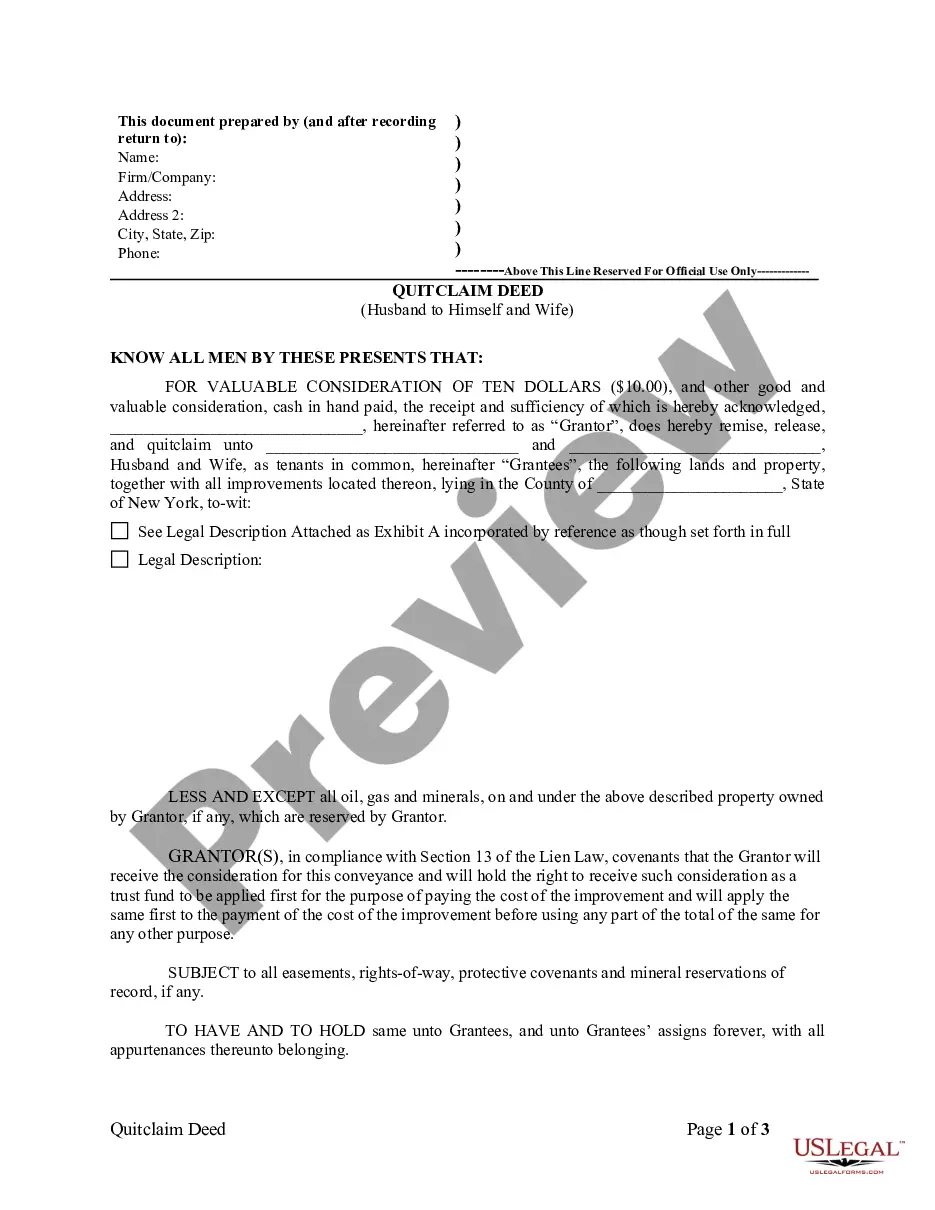

- Utilize the Review button to evaluate the document.

- Examine the description to ensure you have selected the proper form.

- If the form is not what you are looking for, use the Search field to locate the form that fits your requirements.

- Once you find the right form, click on Get now.

- Choose the pricing plan you prefer, enter the necessary information to create your account, and pay for the order using your PayPal or credit card.

Form popularity

FAQ

A trust is worth it when you have substantial assets, complex family dynamics, or specific wishes regarding asset distribution. Establishing a South Dakota Blind Trust Agreement ensures that your intentions are honored and can provide privacy and protection against lengthy probate processes. Evaluate your situation to determine if a trust serves your best interests.

Setting up a trust in South Dakota can be worth it, especially if you have specific goals like protecting assets and ensuring smooth transitions for heirs. A South Dakota Blind Trust Agreement provides flexibility and control over your assets. Consider your personal circumstances and financial objectives to make an informed decision.

The trust tax in South Dakota follows the state's income tax rates, which can vary based on the trust's income. Generally, a South Dakota Blind Trust Agreement may be subject to both federal and state taxes, affecting overall financial planning. Consulting a tax professional can help clarify your obligations and optimize tax efficiency.

One major disadvantage of a trust, including a South Dakota Blind Trust Agreement, is the ongoing administrative fees and expenses associated with managing the trust. These costs can add up over time and reduce the amount beneficiaries ultimately receive. It's essential to weigh these potential costs against the benefits to determine if establishing a trust is the right choice for you.

To fill out a South Dakota Blind Trust Agreement, start by gathering necessary information about the trust, including the name of the grantor, beneficiaries, and trustee. Next, ensure you clearly define terms such as the trust's purpose and distribution instructions. Using a reliable platform like US Legal Forms can simplify this process, offering templates that guide you through each step.

Blind trusts generally involve a third-party trustee who manages the assets without the beneficiary's input. This arrangement protects the beneficiary from conflicts of interest, especially during legal proceedings or financial disclosures. A South Dakota Blind Trust Agreement ensures that the assets are managed according to the terms set forth, providing a layer of security and confidentiality. Consider using a reliable platform like US Legal Forms to create a well-structured agreement.

One of the main drawbacks of a blind trust is the potential lack of transparency. Beneficiaries may feel disconnected from their assets, which can lead to uncertainty about financial situations. Additionally, if a trustee mismanages the assets, the beneficiary may have limited ability to intervene or make changes. Understanding these factors is crucial when considering a South Dakota Blind Trust Agreement.

One common mistake is failing to clearly communicate their intentions and expectations regarding the trust fund. Without a thorough understanding, beneficiaries may not use the funds as intended. Additionally, neglecting to regularly review and update the trust can lead to unintended consequences, making professional guidance essential in drafting your South Dakota Blind Trust Agreement.

Establishing a trust in South Dakota can provide significant benefits, including tax advantages and asset protection. The state has favorable laws, making it an attractive option for many individuals. By utilizing a South Dakota Blind Trust Agreement, you can enhance your financial security and privacy.

Setting up a blind trust involves drafting a South Dakota Blind Trust Agreement with a qualified attorney. You will need to outline the terms of the trust, designate a trustee, and decide which assets will be included. Once the agreement is finalized and signed, the trustee takes over management of the assets according to your wishes.