South Dakota Assignment of Assets

Description

How to fill out Assignment Of Assets?

It is feasible to spend hours online searching for the legal document format that fulfills the state and federal requirements you require.

US Legal Forms offers a wide variety of legal templates reviewed by experts.

You can obtain or print the South Dakota Assignment of Assets from your service.

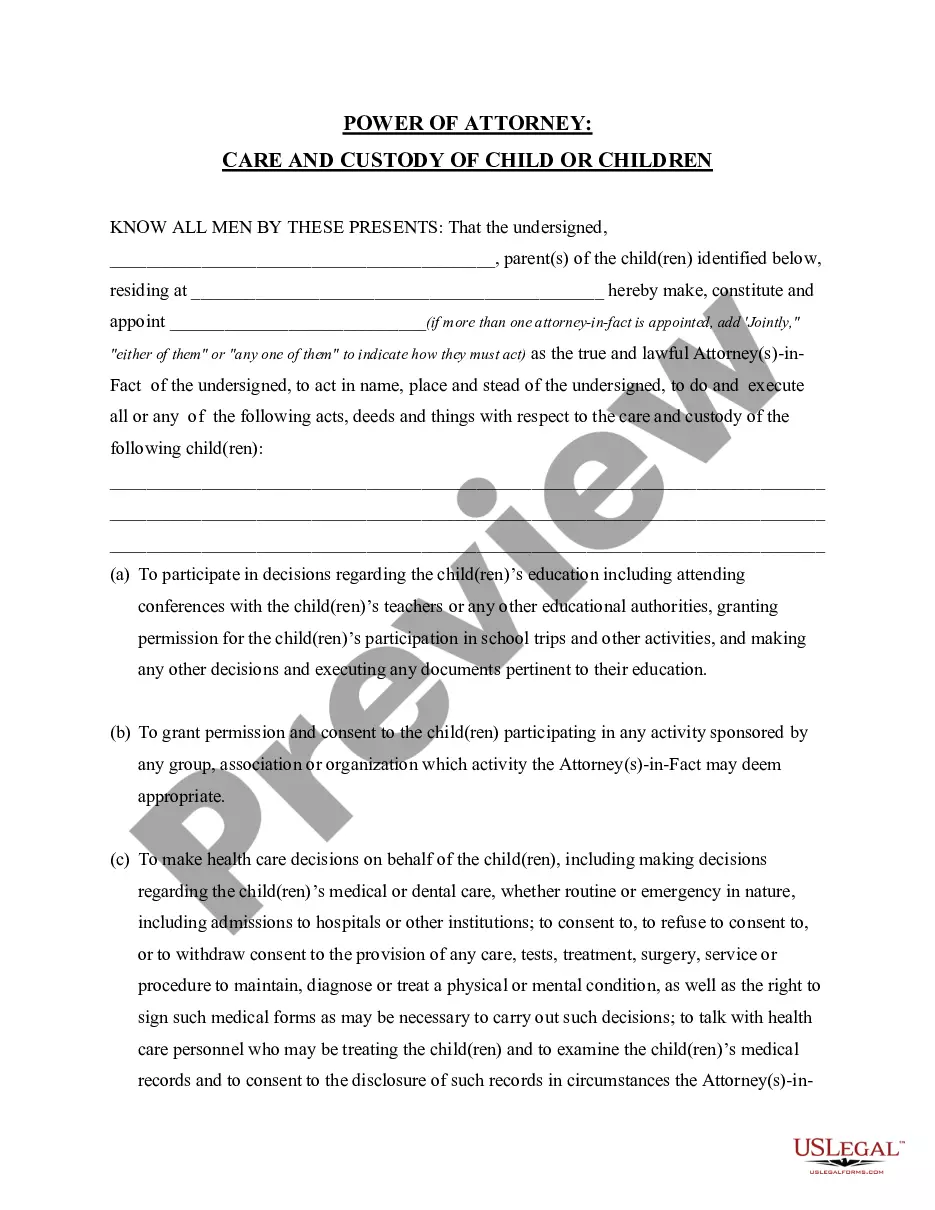

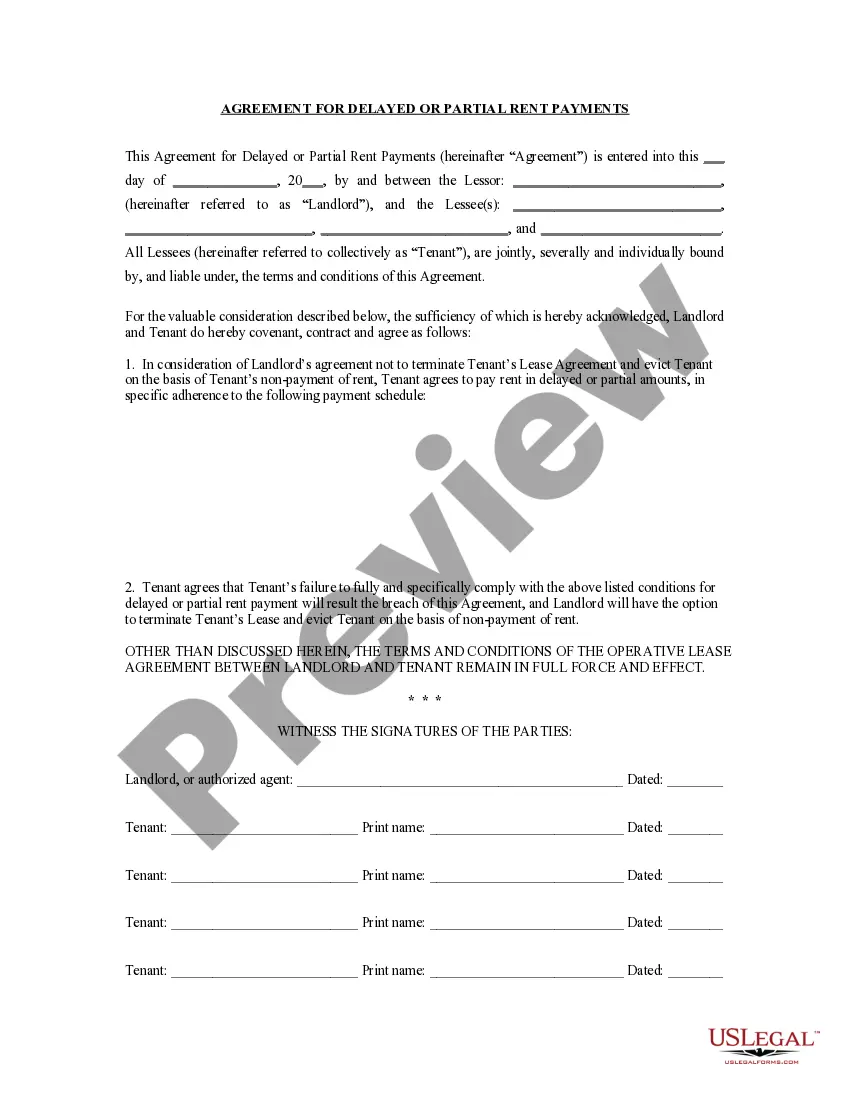

If available, use the Preview button to view the document layout as well.

- If you already have an account with US Legal Forms, you can Log In and then click the Download button.

- After that, you can complete, modify, print, or sign the South Dakota Assignment of Assets.

- Each legal document format you purchase is yours to keep indefinitely.

- To obtain another copy of any purchased form, visit the My documents tab and click the respective button.

- If you are using the US Legal Forms site for the first time, follow the simple instructions below.

- First, ensure you have chosen the correct format for your county/area.

- Read the form description to verify that you have selected the right document.

Form popularity

FAQ

To fill out a South Dakota title transfer, start with the original title document. Complete the seller and buyer sections, providing all required information, including names and signatures. Don't forget to include the odometer reading and the date of sale. US Legal Forms can help simplify this process, ensuring you navigate the South Dakota Assignment of Assets smoothly.

After selling a car, you must complete a title transfer to officially change ownership. Fill in your details as the seller and the buyer's information carefully. Ensure you sign the title and provide necessary details, such as the odometer reading and sale date. For streamlined processes, check out US Legal Forms for assistance with South Dakota Assignment of Assets.

In Mississippi, filling out a title when selling a car requires you to complete several key sections of the document. You need to enter the buyer's details, including their name and address, and sign the title. Additionally, include the odometer reading to meet state requirements. For guidance on similar procedures, explore the tools offered by US Legal Forms, focusing on South Dakota Assignment of Assets.

Filling out a title when selling a car in South Dakota is a straightforward process. First, locate the title document and ensure all sections are complete, including the buyer's name and address. Sign the title in the designated area, and provide the odometer reading to comply with state regulations. For further assistance, consider using resources available through US Legal Forms for seamless South Dakota Assignment of Assets.

Recording someone without their consent can raise legal issues in South Dakota. The state follows a one-party consent rule, meaning that at least one person involved in the conversation must agree to the recording. Understanding the legal framework around consent is essential, particularly when it relates to matters like the South Dakota Assignment of Assets. For detailed insights, resources from US Legal Forms can clarify your rights and obligations.

South Dakota offers various incentives for people considering relocation. While specific amounts may vary, the state promotes economic growth and supports new residents through programs that may include tax benefits. If you plan to utilize the South Dakota Assignment of Assets option, you could enhance your relocation benefits. Consider exploring US Legal Forms for guidance on how to navigate these incentives.

Yes, you can write your own will in South Dakota, provided that you meet specific legal requirements. The will must be in writing, signed by you, and witnessed by at least two people who are not beneficiaries. Creating your own will can be a straightforward process, especially with the right guidance. For templates and legal forms that simplify this task, explore the US Legal resources on South Dakota Assignment of Assets.

The Sunshine law in South Dakota promotes transparency in government by ensuring that meetings and records are open to the public. This law allows citizens to attend public meetings and access governmental documents, which fosters accountability. By being informed, you empower yourself to engage with local governance. If you’re looking for more details about public information and its implications, check out resources available on South Dakota Assignment of Assets through the US Legal platform.

Yes, South Dakota has a stand your ground law that allows individuals to use reasonable force, including deadly force, to defend themselves in certain situations. This law applies when a person believes they are facing an imminent threat of serious harm. Understanding the nuances of this law can help you navigate legal challenges. If you need assistance with legal matters related to self-defense, consider the US Legal platform for resources on South Dakota Assignment of Assets.

The sunshine law in South Dakota refers to regulations that mandate government entities to conduct their business transparently. These laws promote openness by ensuring public access to meetings and documents. While the sunshine law primarily focuses on government transparency, having clarity on the South Dakota Assignment of Assets is equally vital in private transactions.