This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

South Dakota Petition to Determine Distribution Rights of the Assets of a Decedent

Description

How to fill out Petition To Determine Distribution Rights Of The Assets Of A Decedent?

If you wish to full, acquire, or printing legitimate papers web templates, use US Legal Forms, the most important selection of legitimate forms, which can be found on the web. Utilize the site`s basic and handy research to obtain the paperwork you will need. Different web templates for organization and personal functions are sorted by categories and suggests, or search phrases. Use US Legal Forms to obtain the South Dakota Petition to Determine Distribution Rights of the Assets of a Decedent in just a handful of click throughs.

When you are currently a US Legal Forms client, log in to your profile and click the Acquire switch to obtain the South Dakota Petition to Determine Distribution Rights of the Assets of a Decedent . You may also access forms you formerly acquired inside the My Forms tab of the profile.

If you are using US Legal Forms initially, refer to the instructions below:

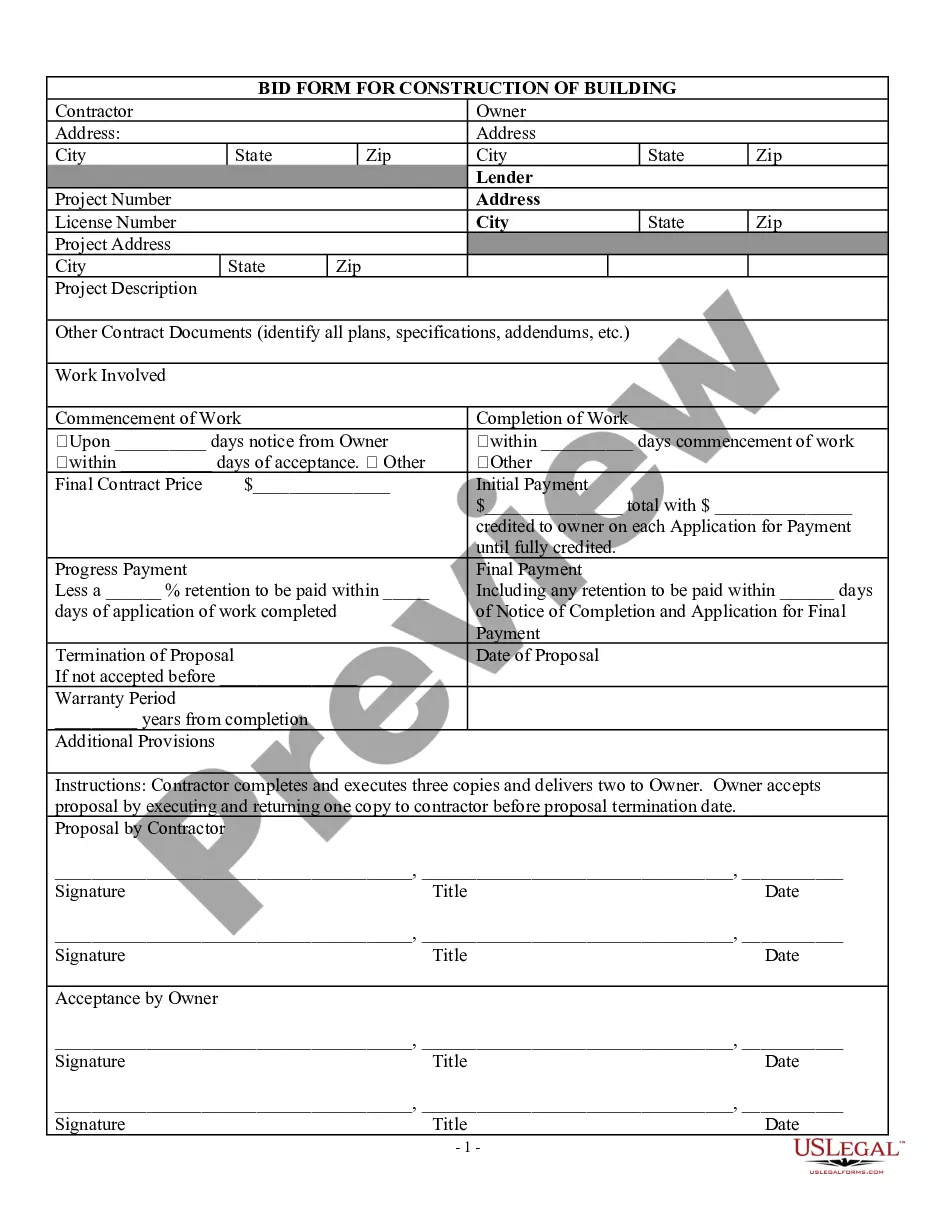

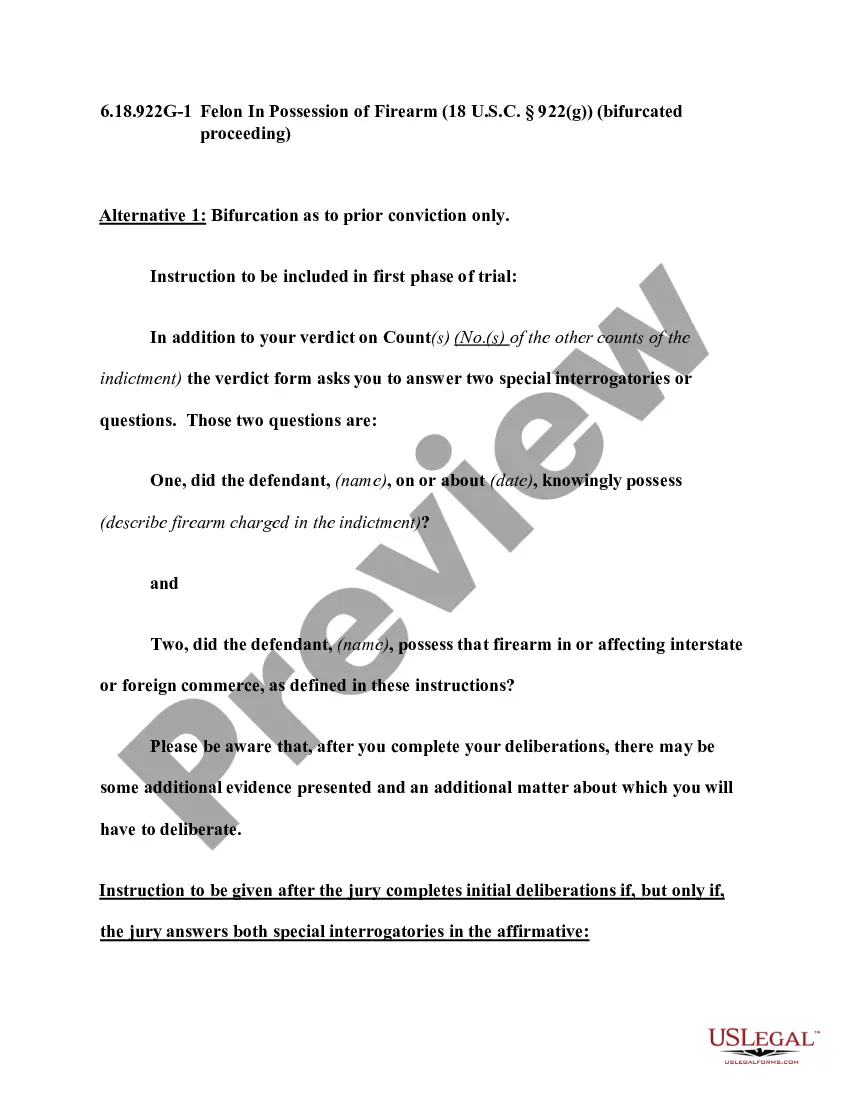

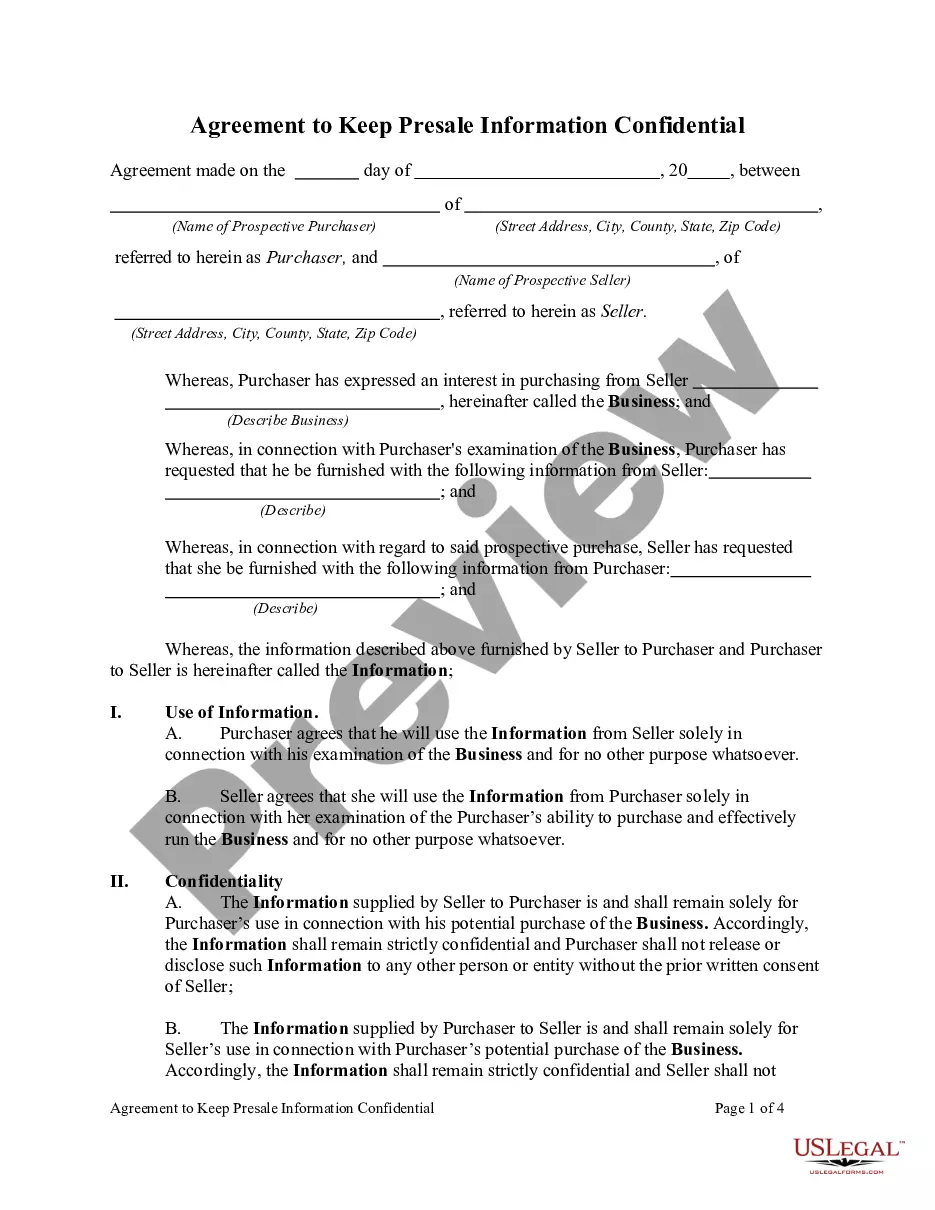

- Step 1. Be sure you have chosen the shape for the proper city/nation.

- Step 2. Use the Review method to check out the form`s articles. Do not forget about to read the information.

- Step 3. When you are unsatisfied together with the develop, use the Research discipline near the top of the monitor to discover other variations in the legitimate develop template.

- Step 4. Once you have found the shape you will need, click the Purchase now switch. Select the costs strategy you choose and include your credentials to register to have an profile.

- Step 5. Process the purchase. You should use your credit card or PayPal profile to complete the purchase.

- Step 6. Choose the format in the legitimate develop and acquire it in your gadget.

- Step 7. Full, change and printing or sign the South Dakota Petition to Determine Distribution Rights of the Assets of a Decedent .

Each legitimate papers template you get is your own forever. You may have acces to every develop you acquired inside your acccount. Click on the My Forms segment and choose a develop to printing or acquire once again.

Contend and acquire, and printing the South Dakota Petition to Determine Distribution Rights of the Assets of a Decedent with US Legal Forms. There are many skilled and express-certain forms you can utilize to your organization or personal requires.

Form popularity

FAQ

If you die intestate in South Dakota without a spouse but you have children, then your estate goes to your children in equal shares. If you don't have children, then your entire estate goes to your parents, if they are living. If you don't have surviving parents, then your siblings inherit everything.

No. In South Dakota, not all your property may have to go through probate. The assets that do go through probate make up your probate estate. These are usually assets that are titled solely in your name and come under the control of your personal representative (formerly known as an executor).

To citizens of South Dakota: SDCL 10-45-10 exempts from sales tax the sale of products and services to the following governmental entities. Government entities must provide an exemption certificate to the vendor or the vendor must keep documentation to show the purchase was paid from government funds.

The court will appoint a personal representative to administer the estate and distribute the property. This person is often a surviving spouse or another beneficiary. Because there is no will, state law will be used to distribute property. Property will usually go to surviving spouses and other heirs.

Small Estate Affidavit If an South Dakota estate has a gross value <$50,000, you can use the small estate process to settle the estate with no court involvement.

It involves proving the will is valid, identifying and inventorying the deceased person's property, having the property appraised, paying debts and taxes, and distributing the remaining property as the will directs. In South Dakota, the cost for probate can range from $2,700 to $6,950 or more.

In South Dakota, estates valued at less than $50,000 can use the Affidavit process. You can also use the ?informal probate? regardless of size.

A formal probate requires additional court intervention and is required if the decedent passed away more than three years before the filing of the probate. An informal probate in South Dakota is often handled by the clerk of courts rather than a judge. A probate can also be testate or intestate.