South Dakota Agreement to Compromise Debt by Returning Secured Property

Description

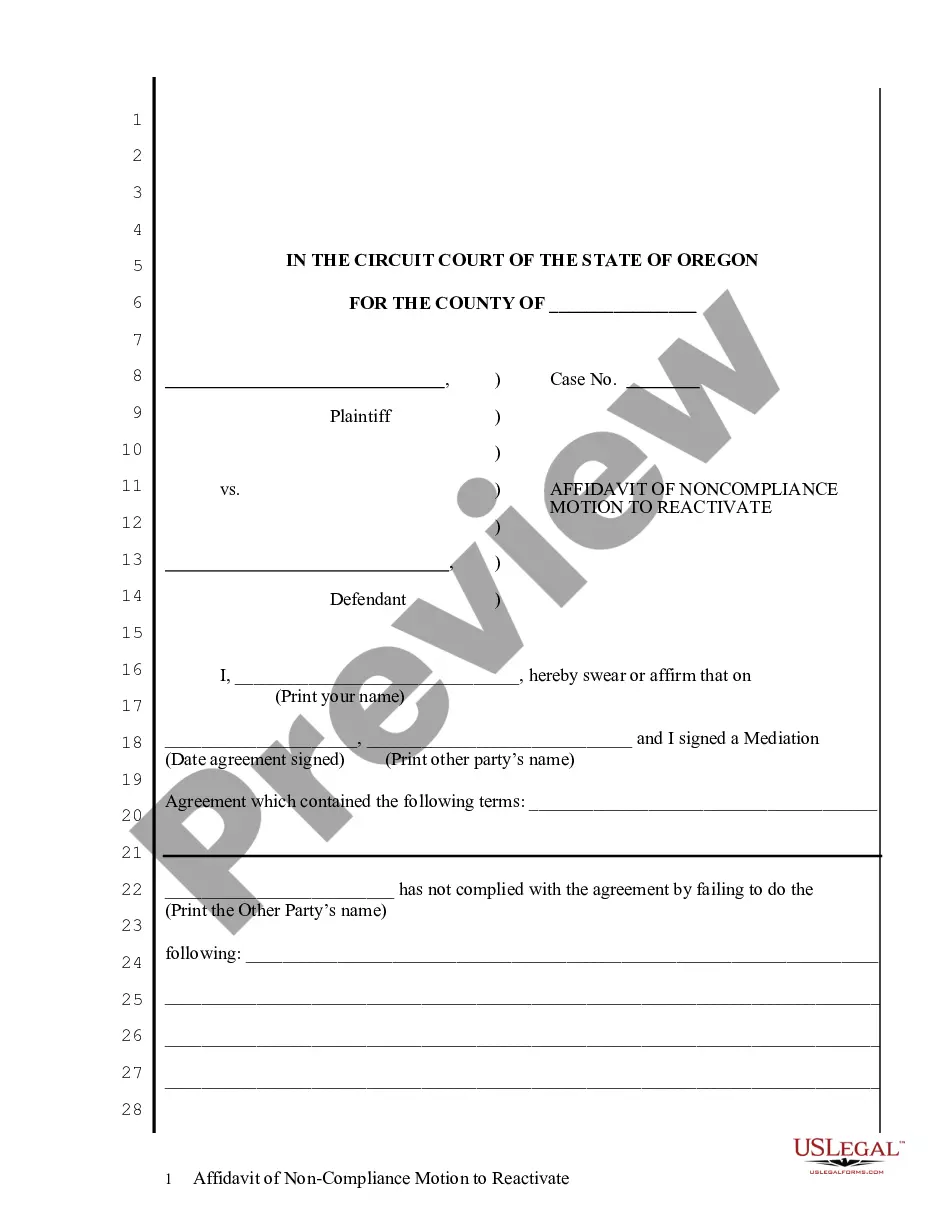

How to fill out Agreement To Compromise Debt By Returning Secured Property?

You might invest time on the web trying to locate the legal document format that fulfills the state and federal requirements you need.

US Legal Forms offers a multitude of legal documents that have been reviewed by specialists.

It is easy to download or print the South Dakota Agreement to Settle Debt by Returning Secured Property from our services.

Review the document description to confirm you have selected the appropriate form. If available, use the Preview button to browse through the document format as well.

- If you possess a US Legal Forms account, you can sign in and click the Download button.

- Then, you can complete, modify, print, or sign the South Dakota Agreement to Settle Debt by Returning Secured Property.

- Every legal document format you acquire is yours to keep forever.

- To obtain another copy of a previously obtained form, navigate to the My documents section and click the corresponding button.

- If this is your first time using the US Legal Forms website, follow the simple instructions below.

- First, ensure you have selected the correct document format for your region/city of choice.

Form popularity

FAQ

To write a debt settlement agreement, start by clearly outlining the terms of the arrangement. Include details such as the amount owed, payment methods, and deadlines. Specify that this agreement relates to the South Dakota Agreement to Compromise Debt by Returning Secured Property. This document should be signed by both parties to create a binding commitment.

In South Dakota, a judgment can be held against you for up to 10 years, as long as the creditor actively maintains it. After this period, if not renewed, the judgment may become dormant, but it can still affect your credit report. The South Dakota Agreement to Compromise Debt by Returning Secured Property may help you address your debt issues before they escalate. Using platforms like US Legal Forms can offer guidance on resolving such matters and achieving financial relief.

In South Dakota, a judgment remains in effect for 10 years and does not automatically fall off after 7 years. While the seven-year mark may be a common belief, the law requires creditors to act on their judgments within that period to avoid them becoming dormant. Utilizing the South Dakota Agreement to Compromise Debt by Returning Secured Property can be advantageous in addressing your financial obligations within this time frame. Seeking assistance from US Legal Forms will give you access to essential resources for managing your judgments.

In South Dakota, judgments do not expire in the traditional sense; however, they can be renewed. A creditor can seek to renew a judgment before it becomes dormant, which typically occurs after 10 years. It's important to note that the South Dakota Agreement to Compromise Debt by Returning Secured Property may provide options for debt resolution, potentially impacting the management of judgments. Considering this, working with a knowledgeable service like US Legal Forms can provide clear steps to handle your judgments effectively.

Debts in South Dakota can typically be collected for up to 20 years. This long period allows creditors ample time to pursue payment through various methods. If you face challenges with longstanding debts, consider the South Dakota Agreement to Compromise Debt by Returning Secured Property. This practical approach can help you find a solution that fits your financial situation while addressing creditors' concerns.

In South Dakota, the statute of limitations on uncollected debt generally lasts 6 years. This timeframe helps determine how long creditors have the right to pursue unpaid debts. If you are dealing with uncollected debt, the South Dakota Agreement to Compromise Debt by Returning Secured Property could provide an effective means of resolution. This option might allow you to settle your debts in a more manageable way.

The statute of limitations on breach of contract in South Dakota is typically 6 years. This means an aggrieved party has that much time to file a lawsuit after the breach occurs. If you find yourself facing a breach of contract issue, exploring the South Dakota Agreement to Compromise Debt by Returning Secured Property may be beneficial. It could help you negotiate a resolution without resorting to lengthy legal battles.

Yes, South Dakota does have a statute of limitations that governs various types of debts. For most debts, the limit is generally 6 years, while for certain contracts, it can extend to 10 years. Understanding these limitations is crucial when considering your options, including the South Dakota Agreement to Compromise Debt by Returning Secured Property. This agreement can offer a pathway to efficiently resolve debt before the statute of limitations fully applies.

In South Dakota, a debt may become uncollectible after 20 years. This timeframe is important, as it affects how long creditors can actively pursue payment. If you find yourself struggling with uncollectible debt, looking into the South Dakota Agreement to Compromise Debt by Returning Secured Property may present a practical solution. This option could help you negotiate a resolution that suits your financial needs.

Yes, a 10-year-old debt can still be collected in South Dakota, depending on the circumstances. While creditors may have limited time to take legal action, they can still pursue other collection methods. By considering the South Dakota Agreement to Compromise Debt by Returning Secured Property, you can potentially resolve such debts more easily. This agreement might offer you a way to satisfy your obligations without lasting repercussions.