South Dakota Bill of Sale of Manufactured Home

Description

How to fill out Bill Of Sale Of Manufactured Home?

You can spend time online trying to find the appropriate legal document template that meets the state and federal regulations you need.

US Legal Forms offers a vast array of legal documents that can be reviewed by experts.

You can easily download or print the South Dakota Bill of Sale for Manufactured Home from their service.

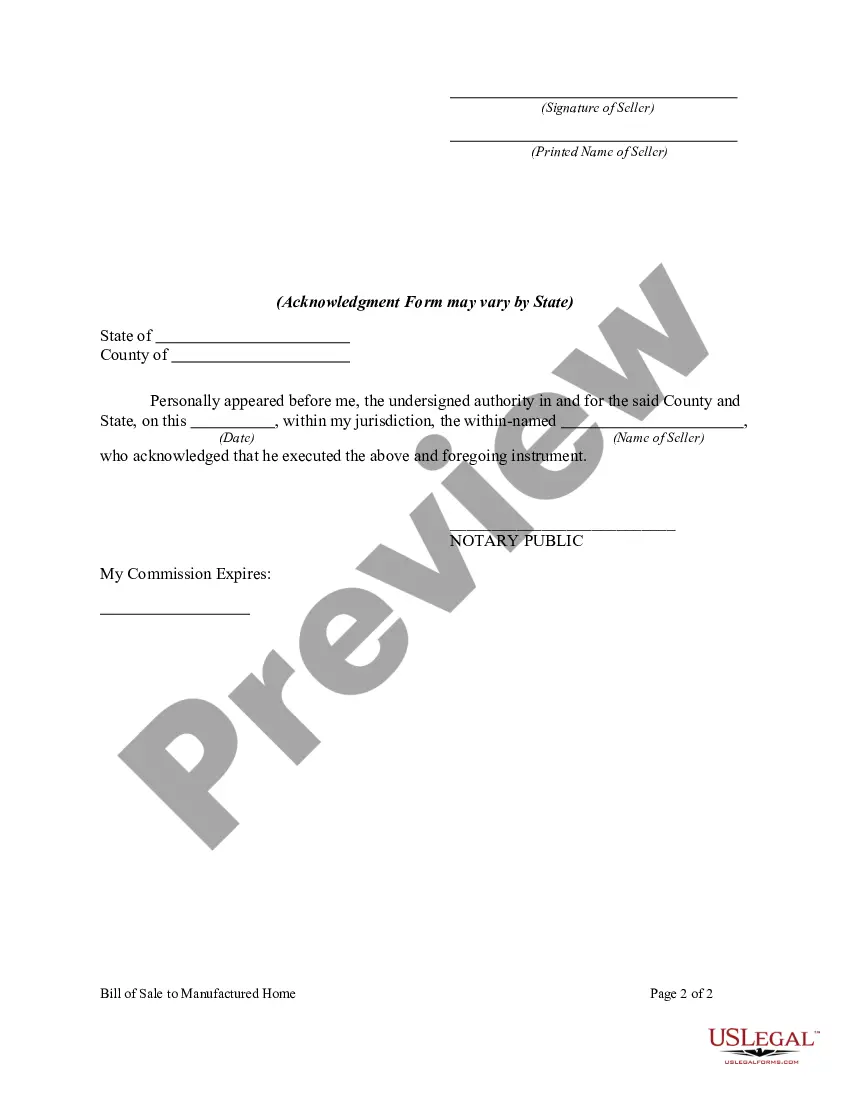

If available, utilize the Review button to examine the document template as well.

- If you already possess a US Legal Forms account, you may Log In and click on the Acquire button.

- After that, you can complete, modify, print, or sign the South Dakota Bill of Sale for Manufactured Home.

- Every legal document template you purchase is yours to keep permanently.

- To obtain another copy of the purchased form, go to the My documents section and click on the corresponding button.

- If you are visiting the US Legal Forms website for the first time, follow the simple instructions listed below.

- First, ensure that you have selected the correct document template for the county/region of your choosing.

- Read the form description to make sure you have chosen the right document.

Form popularity

FAQ

To locate a manufactured home's serial number, check the HUD tag, usually found on the exterior of the home or inside the unit, often near the main electrical panel. The serial number is crucial for the South Dakota Bill of Sale of Manufactured Home as it ensures you identify the correct model. If you cannot find the number, contacting the manufacturer can also provide assistance.

The primary difference lies in the standards used during construction. Manufactured homes are built according to federal guidelines set by HUD, while mobile homes refer to older units built before these regulations. Understanding this distinction is essential when preparing the South Dakota Bill of Sale of Manufactured Home. This knowledge helps in accurately representing the home’s status during a sale.

Yes, a buyer can back out of a sales contract under certain conditions. If the contract does not include contingencies that protect the buyer, it may be more challenging to withdraw. However, reviewing the terms outlined in the South Dakota Bill of Sale of Manufactured Home can clarify your options. Always consult with a legal professional for personalized advice.

Yes, you generally must report the sale of a home to the IRS if you have a capital gain on the sale. However, if the gain falls below the exclusion limits, you may not owe taxes. If you sell a manufactured home, like with the South Dakota Bill of Sale of Manufactured Home, seeking advice from a tax professional can help ensure compliance with IRS regulations.

In South Dakota, a bill of sale does not need to be notarized to be valid. However, having it notarized can provide extra security and assurance for both the buyer and seller. It is a good practice to keep a clear record of the transaction, which can be beneficial throughout the transfer process.

The manufacturer certificate of origin (MCO) is a vital document that proves the manufactured home is new and was produced by a licensed manufacturer. It contains information such as the home's make, model, and year. This certificate is important for registration and title purposes within South Dakota and complements the South Dakota Bill of Sale of Manufactured Home.

Selling an inherited house does not count as income for tax purposes. Instead, you may use the stepped-up basis, which means the house is valued at its current market value upon the previous owner's death. However, you may have to report any gains over that amount. Understanding your options is important, especially when you prepare the South Dakota Bill of Sale of Manufactured Home.

In South Dakota, the exclusion for the sale of a home typically refers to capital gains exclusions. If you sell your primary residence and meet certain ownership and use tests, you might exclude up to $250,000 of capital gains for individuals and $500,000 for couples. However, selling a manufactured home may have different implications, so consulting with a professional could clarify your situation.

To transfer a title in South Dakota, you will need the current title, a completed South Dakota Bill of Sale of Manufactured Home, and valid identification. If there are multiple owners, all must sign the title. Additionally, if the manufactured home is financed, you might need permission from the lender.

Yes, a bill of sale is required in South Dakota for various transactions, including selling a manufactured home. This document provides legal protection for both the seller and the buyer. It clearly states the terms of the sale and includes necessary information like the property description, making it important for a smooth transfer of ownership.