This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

South Dakota Agreement to Extend Debt Payment

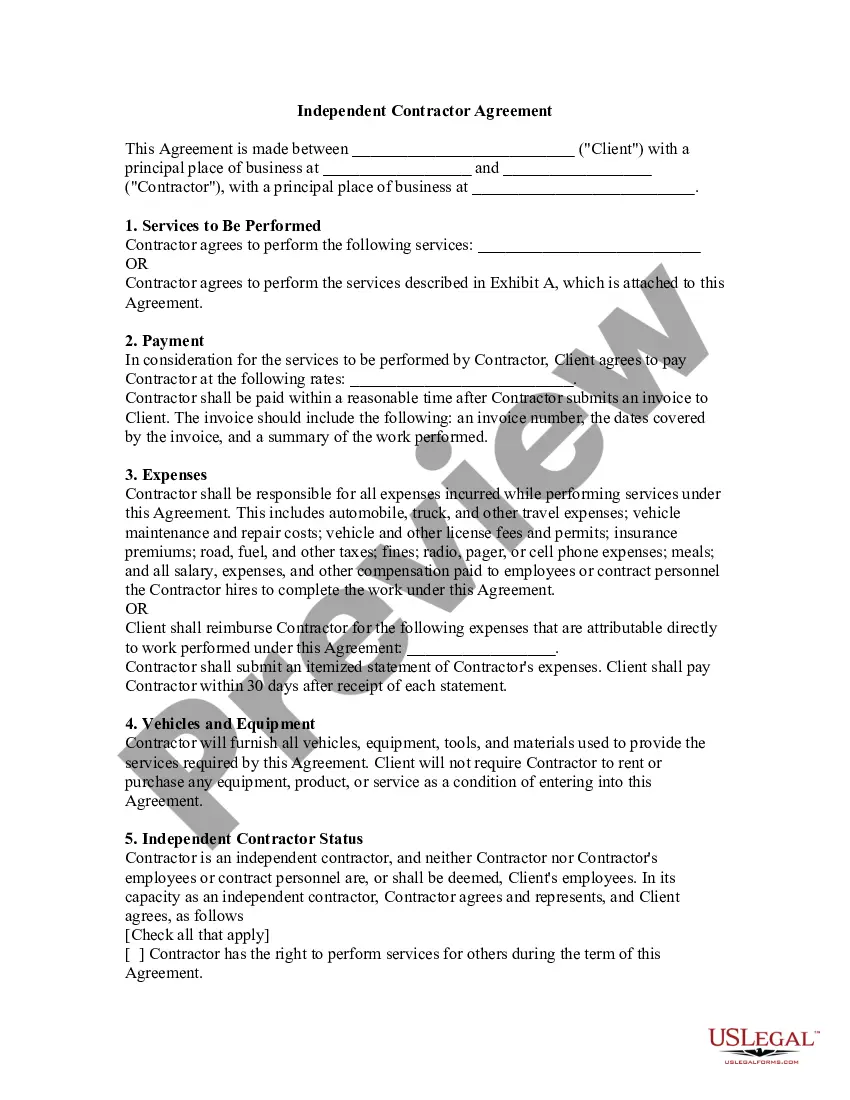

Description

How to fill out Agreement To Extend Debt Payment?

US Legal Forms - one of the most prominent collections of legal documents in the USA - offers a vast selection of legal document templates that you can download or print.

By using the website, you can access thousands of documents for business and personal purposes, organized by categories, states, or keywords.

You can find the latest versions of documents such as the South Dakota Agreement to Extend Debt Payment within minutes.

Check the document summary to confirm that you have selected the correct form.

If the document does not fulfill your needs, use the Search field at the top of the screen to find the one that does.

- If you already possess a subscription, Log In and access South Dakota Agreement to Extend Debt Payment within the US Legal Forms library.

- The Download button will appear on every form you view.

- You have access to all previously obtained documents within the My documents section of your account.

- If you wish to use US Legal Forms for the first time, here are straightforward instructions to get you started.

- Ensure you have selected the correct document for your town/county.

- Review the Preview option to examine the document's content.

Form popularity

FAQ

In South Dakota, creditors can actively pursue debt collection for six years from the date of the last activity. After this period, the debt is deemed uncollectible under state law. Implementing a South Dakota Agreement to Extend Debt Payment can provide structure to your repayment plan, possibly extending timeframes or reducing uncertainty as you repay your obligations.

Debts in South Dakota generally become uncollectible after six years, marking the end of the statute of limitations. During this time, creditors can seek collection efforts, but once this period elapses, they usually cannot take legal action. To avoid confusion, consider formalizing any arrangements with a South Dakota Agreement to Extend Debt Payment, which can clarify your repayment timeline.

In most cases, a debt that is 10 years old is considered uncollectible under South Dakota law. The statute of limitations typically applies, which means creditors may no longer have the legal right to collect that debt. However, if a South Dakota Agreement to Extend Debt Payment was signed, it might affect this status, so it's wise to review any existing agreements or consult legal guidance.

In South Dakota, a debt generally becomes uncollectible after a period of six years from the date of the last payment or activity. This timeline falls under the statute of limitations, which outlines the period creditors have to pursue debt collection. However, if you enter a South Dakota Agreement to Extend Debt Payment, this may reset the clock, giving you more time to manage your obligations.