South Dakota Revocable Trust for Grandchildren

Description

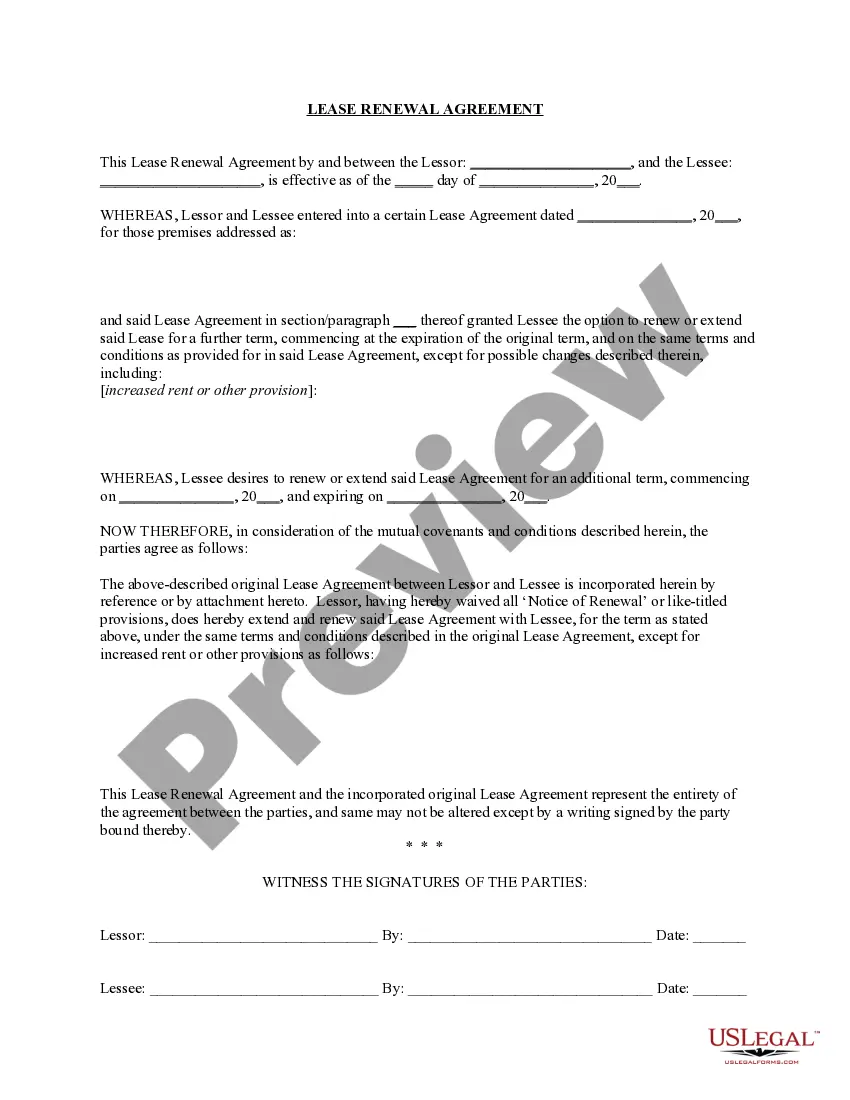

How to fill out Revocable Trust For Grandchildren?

US Legal Forms - one of the largest collections of legal forms in the United States - provides a variety of legal document templates that you can either download or print.

By using the website, you can discover thousands of forms for business and personal purposes, categorized by types, states, or keywords. You can find the most recent forms like the South Dakota Revocable Trust for Grandchildren in just a few moments.

If you already have an account, Log In and download the South Dakota Revocable Trust for Grandchildren from the US Legal Forms library. The Download button will appear on every form you view. You can access all previously saved forms in the My documents section of your profile.

Proceed with the transaction. Use your credit card or PayPal account to finalize the purchase.

Select the format and download the form to your device. Make edits. Complete, modify, and print and sign the downloaded South Dakota Revocable Trust for Grandchildren. Every template saved in your account has no expiration date and is yours indefinitely. Therefore, if you wish to download or print another copy, simply go to the My documents section and click on the form you need. Access the South Dakota Revocable Trust for Grandchildren with US Legal Forms, the most extensive library of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal needs and requirements.

- Ensure that you have selected the correct form for your city/state.

- Click the Preview button to review the contents of the form.

- Read the description of the form to confirm that you have chosen the right one.

- If the form does not fit your requirements, use the Search box at the top of the screen to locate the suitable form.

- If you are satisfied with the form, confirm your selection by clicking the Buy now button.

- Next, select the payment plan you prefer and provide your credentials to create a profile.

Form popularity

FAQ

South Dakota offers a significant tax advantage as it does not impose a state income tax on trusts. This means that any income generated by a South Dakota Revocable Trust for Grandchildren will not be taxed at the state level. As a result, the full value of your trust can be preserved for your heirs, maximizing their financial benefit.

Inheritance laws in South Dakota dictate how assets are distributed upon a person's death. In the absence of a will or trust, South Dakota law follows intestate succession statutes to determine inheritance. By creating a South Dakota Revocable Trust for Grandchildren, you can circumvent these laws and ensure your grandchildren receive your intended assets directly and efficiently.

Yes, South Dakota is widely regarded as a great place to create a trust. Its attractive legal framework for trusts, low taxation, and administrative ease make it an ideal choice for those seeking to establish a South Dakota Revocable Trust for Grandchildren. Plus, the state's commitment to protecting trust assets provides peace of mind for grantors and beneficiaries alike.

Establishing a trust in South Dakota comes with several advantages, including privacy, flexibility, and favorable tax treatment. A South Dakota Revocable Trust for Grandchildren can protect your family's wealth while allowing you to modify the trust as your circumstances change. This flexibility, combined with South Dakota's strong asset protection laws, ensures that your grandchildren will benefit from your thoughtful planning.

A South Dakota trust operates by allowing you to place assets into a trust for the benefit of your chosen beneficiaries, like your grandchildren. With a South Dakota Revocable Trust for Grandchildren, you retain control over the assets during your lifetime and decide how and when the assets will be distributed. After your passing, the trust allows for a smoother transfer of wealth to your grandchildren, often bypassing lengthy probate processes.

When considering where to establish your trust, many people find that South Dakota is an excellent choice. This state offers flexible trust laws and minimal taxation, making it highly appealing for those interested in the South Dakota Revocable Trust for Grandchildren. Additionally, South Dakota does not impose state income tax on trust income, which can enhance your beneficiaries' financial picture.

To open a trust account in South Dakota, you should begin by selecting a reliable financial institution that offers trust services. Once you choose a bank or trust company, gather the necessary documentation, including identification and information regarding the assets you wish to include in your South Dakota Revocable Trust for Grandchildren. After this, complete the application process, setting guidelines for the trust's management and distribution. If you seek expert guidance, consider using US Legal Forms to simplify the process and ensure compliance with South Dakota laws.

One of the biggest mistakes parents make when setting up a South Dakota Revocable Trust for Grandchildren is not fully understanding how the trust will operate and benefit their children. Many parents overlook the importance of clearly defining the terms and conditions of the trust, which can lead to confusion and disputes later on. It's essential to communicate openly with all involved parties and consider various scenarios that may arise. Using a reliable platform like US Legal Forms can help you navigate this process effectively and ensure your South Dakota Revocable Trust for Grandchildren meets your family's needs.

Setting up a revocable trust in South Dakota involves a few straightforward steps. Begin by drafting a revocable trust agreement, specifying the terms and conditions of the trust, particularly focusing on your grandchildren’s future needs. Once your trust document is in place, transfer your assets into the trust to fund it. Utilizing services like uslegalforms can provide helpful resources to guide you through this process efficiently and effectively.

A South Dakota Revocable Trust for Grandchildren can be an excellent choice for securing their financial future. This type of trust allows you to maintain control over your assets during your lifetime while providing flexibility in asset distribution. You can stipulate specific terms for when and how your grandchildren receive their inheritance, ensuring that it aligns with your wishes. This approach can also help in avoiding probate, protecting the assets from potential creditors.