Whether your will should be in a safe deposit box at a bank or elsewhere, such as with your attorney, depends on what your state law says about who has access to your safe deposit box when you die. The recent trend in many states is to make it relatively easy for family members or the executor to remove the will and certain other documents (such as life insurance policies and burial instructions) from a deceased person's safe deposit box. In those states, it might be a good idea to leave your will in the safe deposit box. However, in some states, it may require a court order to remove the will, which can take time and money.

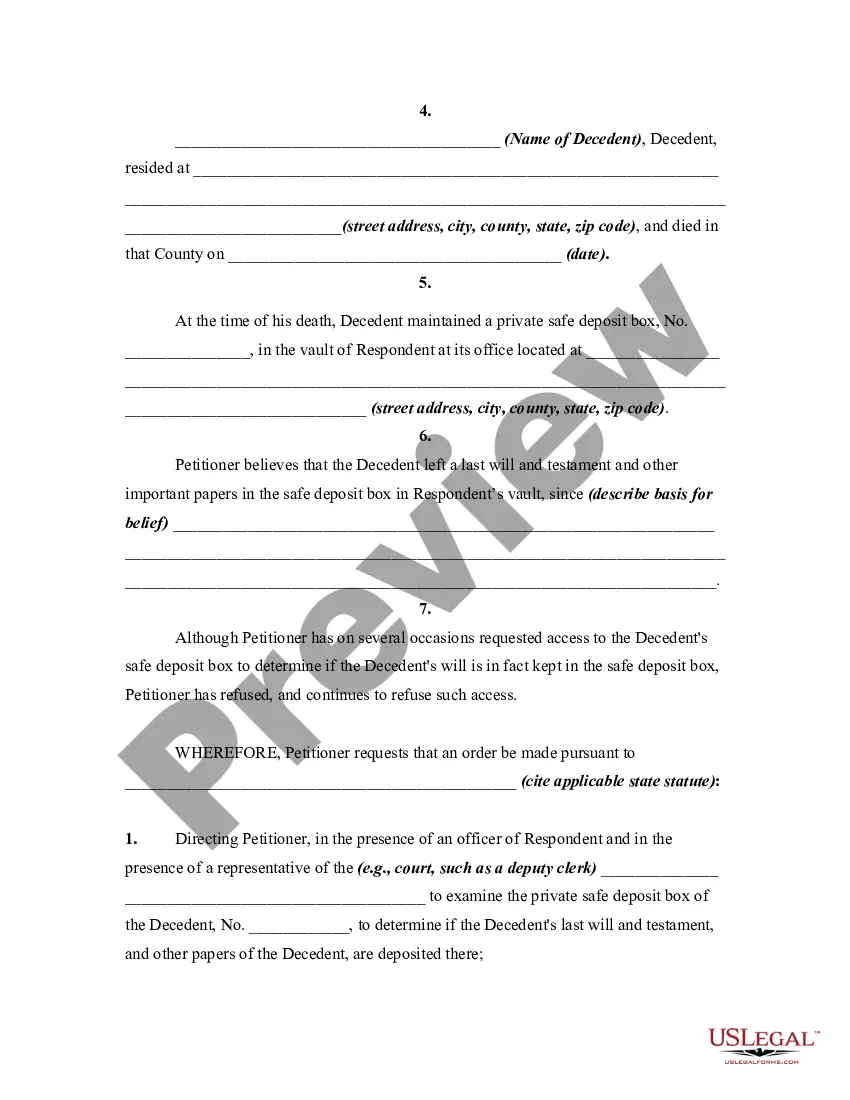

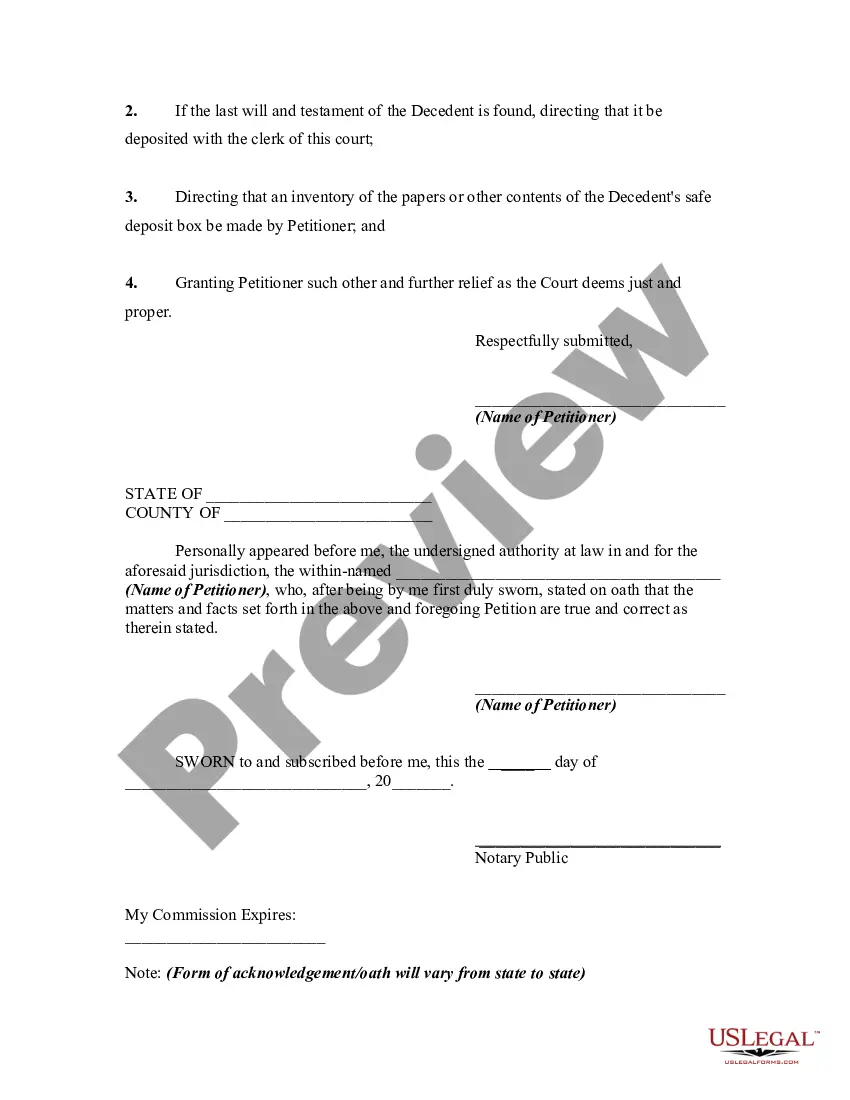

South Dakota Petition For Order to Open Safe Deposit Box of Decedent

Description

How to fill out Petition For Order To Open Safe Deposit Box Of Decedent?

If you wish to comprehensive, acquire, or print out lawful papers web templates, use US Legal Forms, the biggest selection of lawful kinds, that can be found online. Take advantage of the site`s easy and hassle-free look for to get the paperwork you need. Various web templates for company and person reasons are categorized by classes and claims, or keywords. Use US Legal Forms to get the South Dakota Petition For Order to Open Safe Deposit Box of Decedent within a number of click throughs.

When you are currently a US Legal Forms consumer, log in to your bank account and then click the Down load button to find the South Dakota Petition For Order to Open Safe Deposit Box of Decedent. You can also entry kinds you in the past saved from the My Forms tab of the bank account.

If you are using US Legal Forms initially, follow the instructions listed below:

- Step 1. Make sure you have selected the shape for your right town/country.

- Step 2. Take advantage of the Review choice to examine the form`s content. Do not forget about to see the outline.

- Step 3. When you are unsatisfied with the form, utilize the Look for area near the top of the display screen to locate other models of the lawful form template.

- Step 4. Once you have located the shape you need, click on the Buy now button. Select the rates program you like and add your references to register for the bank account.

- Step 5. Process the transaction. You can utilize your bank card or PayPal bank account to complete the transaction.

- Step 6. Find the file format of the lawful form and acquire it on the system.

- Step 7. Comprehensive, change and print out or indication the South Dakota Petition For Order to Open Safe Deposit Box of Decedent.

Each and every lawful papers template you purchase is the one you have eternally. You may have acces to each and every form you saved in your acccount. Click on the My Forms segment and decide on a form to print out or acquire once more.

Contend and acquire, and print out the South Dakota Petition For Order to Open Safe Deposit Box of Decedent with US Legal Forms. There are thousands of skilled and express-particular kinds you may use for your company or person needs.

Form popularity

FAQ

The safe deposit box is a storage space you rent from the bank. Its contents are kept private, and the bank doesn't know what you put in there.

An individual can rent a box in their name only, or they can add other people to the lease. Co-lessors on a safe deposit box will have equal access and rights to the contents of the box. For example, people who have an addiction, financial, marriage, and/or judgment issues may not be ideal candidates.

Nothing Is Safe From the IRS Not much is safe from the taxman. However, when a court order is issued to open or seize the contents of a safe deposit box, the order must specify exactly what is to be seized. If cash is stored in the safe deposit box, this can be seized directly.

(3) Qualified person. ? A person possessing a letter of authority or a person named as a deputy, lessee or cotenant of the safe-deposit box to which the decedent had access.

Items in safe deport boxes are not insured by the bank, so anything you place there should be privately insured if it is valuable. Cash should never be placed in a safe deposit box because it will not be FDIC-protected. You should also make sure that any documents you store there have copies that are kept elsewhere.

If the property remains unclaimed and is classified as abandoned, the bank may be required to transfer the contents of the safe deposit box to the state treasurer or unclaimed-property office in a process called escheat.

Safety deposit boxes have two keyholes, which means you need two keys to open your safe deposit box. The second key, called the guard key, is held by the bank or credit union. You will hold onto the first key. The double key system means that your precious items are extremely secure.

Keeping cash in a safety deposit box is not technically illegal. However, it is not advised for the above aforementioned reasons. Additionally, putting money in a safe deposit box could have the appearance that you are trying to hide that money from the IRS.