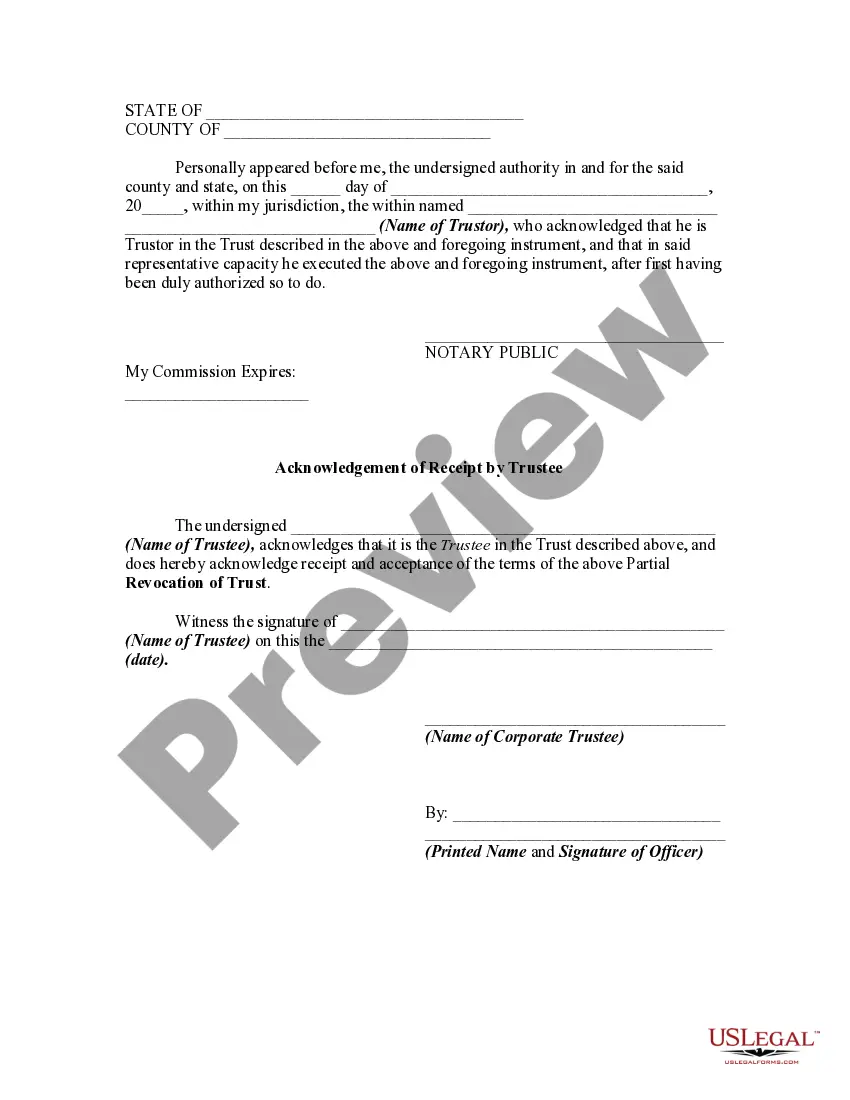

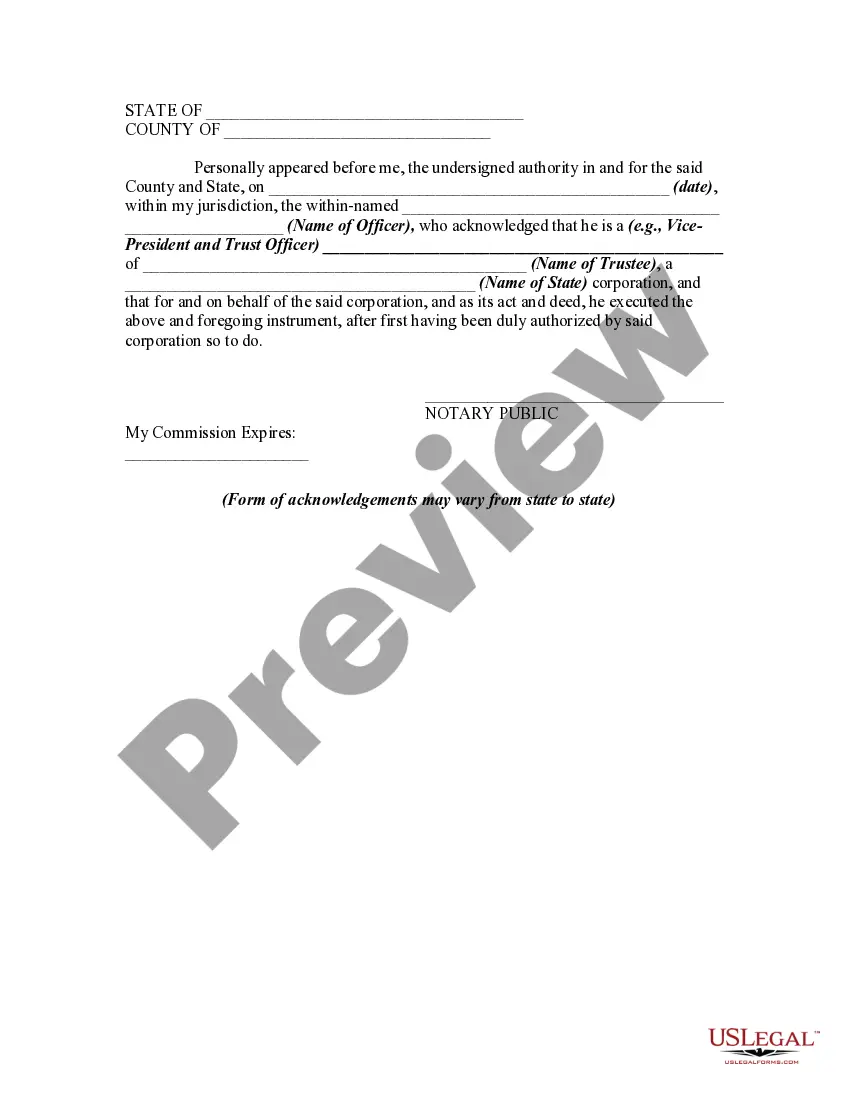

Whether a trust is to be revocable or irrevocable is very important, and the trust instrument should so specify in plain and clear terms. This form is a partial revocation of a trust (as to specific property) by the trustor pursuant to authority given to him/her in the trust instrument. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

South Dakota Partial Revocation of Trust and Acknowledgment of Receipt of Notice of Partial Revocation by Trustee

Description

How to fill out Partial Revocation Of Trust And Acknowledgment Of Receipt Of Notice Of Partial Revocation By Trustee?

You can spend hours online searching for the valid document template that fits the state and federal requirements you need.

US Legal Forms offers thousands of valid forms that are reviewed by experts.

You can indeed obtain or print the South Dakota Partial Revocation of Trust and Acknowledgment of Receipt of Notice of Partial Revocation by Trustee from my service.

Read the form description to ensure you have selected the correct type. If available, use the Preview button to view the document template as well.

- If you already have a US Legal Forms account, you are able to Log In and click the Download button.

- Then, you can complete, modify, print, or sign the South Dakota Partial Revocation of Trust and Acknowledgment of Receipt of Notice of Partial Revocation by Trustee.

- Every valid document template you acquire is yours indefinitely.

- To obtain another copy of any purchased form, go to the My documents tab and click the corresponding button.

- If you are visiting the US Legal Forms site for the first time, follow the simple instructions below.

- First, ensure that you have selected the right document template for the state/area of your choice.

Form popularity

FAQ

Decanting statutes allow a trustee to modify an existing trust by transferring assets to a new trust with different terms. Many states have adopted these statutes, including South Dakota, making it important to understand the various laws. This knowledge can enhance the effectiveness of the South Dakota Partial Revocation of Trust and Acknowledgment of Receipt of Notice of Partial Revocation by Trustee. If you seek clarity on trusts, Uslegalforms can help you find the right legal documents tailored to your state’s requirements.

Statute 22 18 35 in South Dakota addresses issues related to fiduciary duties and the responsibilities of trustees regarding trust revocations. This statute is significant as it helps clarify the legal landscape for those dealing with the South Dakota Partial Revocation of Trust and Acknowledgment of Receipt of Notice of Partial Revocation by Trustee. If you need help navigating these complexities, Uslegalforms offers comprehensive resources to guide you through the process.

Statute 55 2 15 in South Dakota outlines the procedures for a partial revocation of a trust. This statute specifies the requirements that a trustee must follow, ensuring proper acknowledgment of the receipt of notice from the beneficiaries. Understanding this statute is crucial for anyone involved in the South Dakota Partial Revocation of Trust and Acknowledgment of Receipt of Notice of Partial Revocation by Trustee process. For detailed documentation and assistance, consider using Uslegalforms, which provides the necessary legal forms.

A dynasty trust in South Dakota can last for an impressive duration, allowing it to benefit multiple generations. The state does not impose a maximum duration for such trusts, providing an opportunity for asset protection over time. Structuring your dynasty trust effectively can be facilitated through the South Dakota Partial Revocation of Trust and Acknowledgment of Receipt of Notice of Partial Revocation by Trustee, ensuring longevity and adaptability.

Statute 55 2 13 addresses issues related to the revocation of a trust and outlines the process for making such changes. This law ensures that everyone involved clearly understands their rights and responsibilities during a revocation. By incorporating the South Dakota Partial Revocation of Trust and Acknowledgment of Receipt of Notice of Partial Revocation by Trustee, you can navigate these legal requirements effectively.

South Dakota trusts operate by allowing a trustee to manage assets on behalf of beneficiaries according to the terms of the trust. Trusts can specify when and how assets are distributed, providing clear instructions for management. The South Dakota Partial Revocation of Trust and Acknowledgment of Receipt of Notice of Partial Revocation by Trustee is vital for ensuring that any modifications to the trust comply with state regulations.

South Dakota trust laws are designed to provide robust protections for both trustees and beneficiaries. The state offers a flexible regulatory environment that supports various trust types. Understanding these laws, including the South Dakota Partial Revocation of Trust and Acknowledgment of Receipt of Notice of Partial Revocation by Trustee, can help you make informed decisions about how to structure your trust.

Setting up a trust in South Dakota offers several benefits, including asset protection and ease of management. With favorable laws and no state income tax, South Dakota is an attractive option for trust creation. Additionally, the South Dakota Partial Revocation of Trust and Acknowledgment of Receipt of Notice of Partial Revocation by Trustee can enhance your trust's effectiveness, allowing for necessary adjustments without starting anew.

Revocation of trust refers to the process of canceling a trust so that the assets can be returned to the grantor or changed in their allocations. This process is crucial when circumstances change, making it necessary to adjust the trust's directives. Utilizing the South Dakota Partial Revocation of Trust and Acknowledgment of Receipt of Notice of Partial Revocation by Trustee ensures that any changes you make are valid and properly documented.

The maximum length of time that a trust can exist in South Dakota is 125 years. This timeframe gives you the flexibility to set long-term goals for your beneficiaries. However, keep in mind that with the South Dakota Partial Revocation of Trust and Acknowledgment of Receipt of Notice of Partial Revocation by Trustee, you can adjust the terms as necessary to meet changing needs.