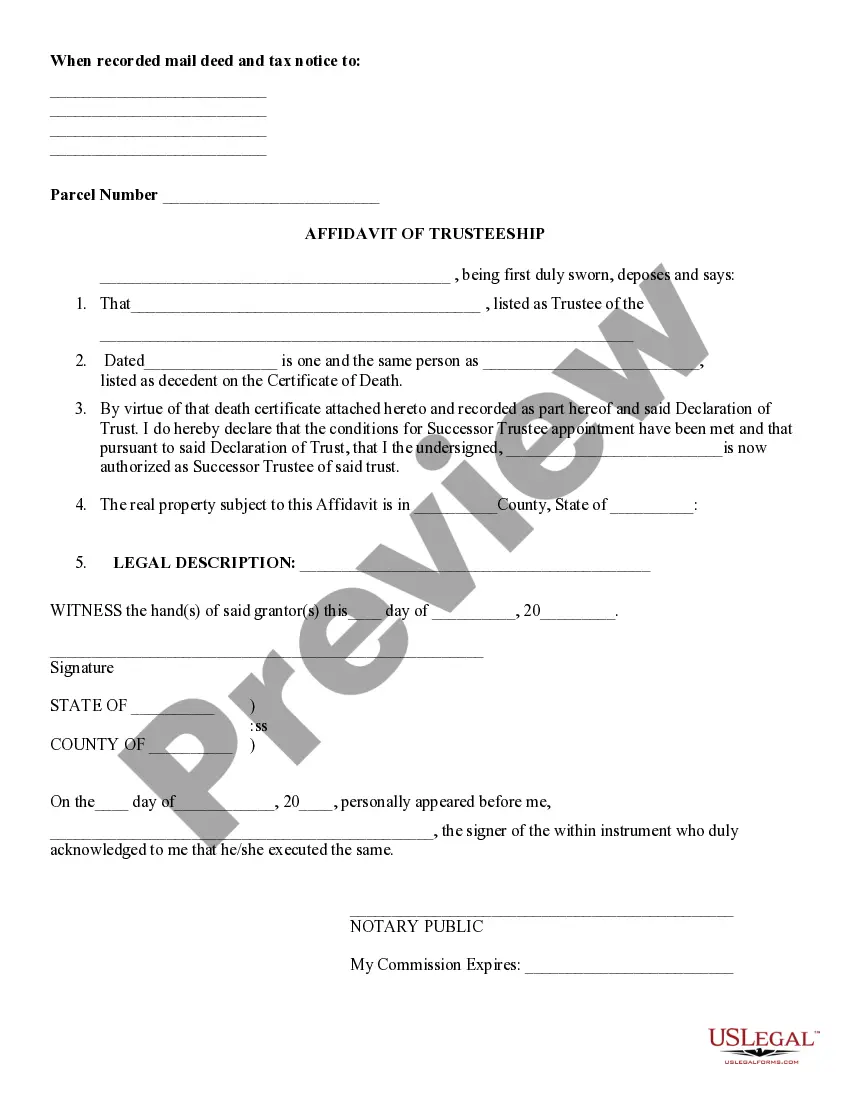

South Dakota Certificate of Trust for Successor Trustee

Description

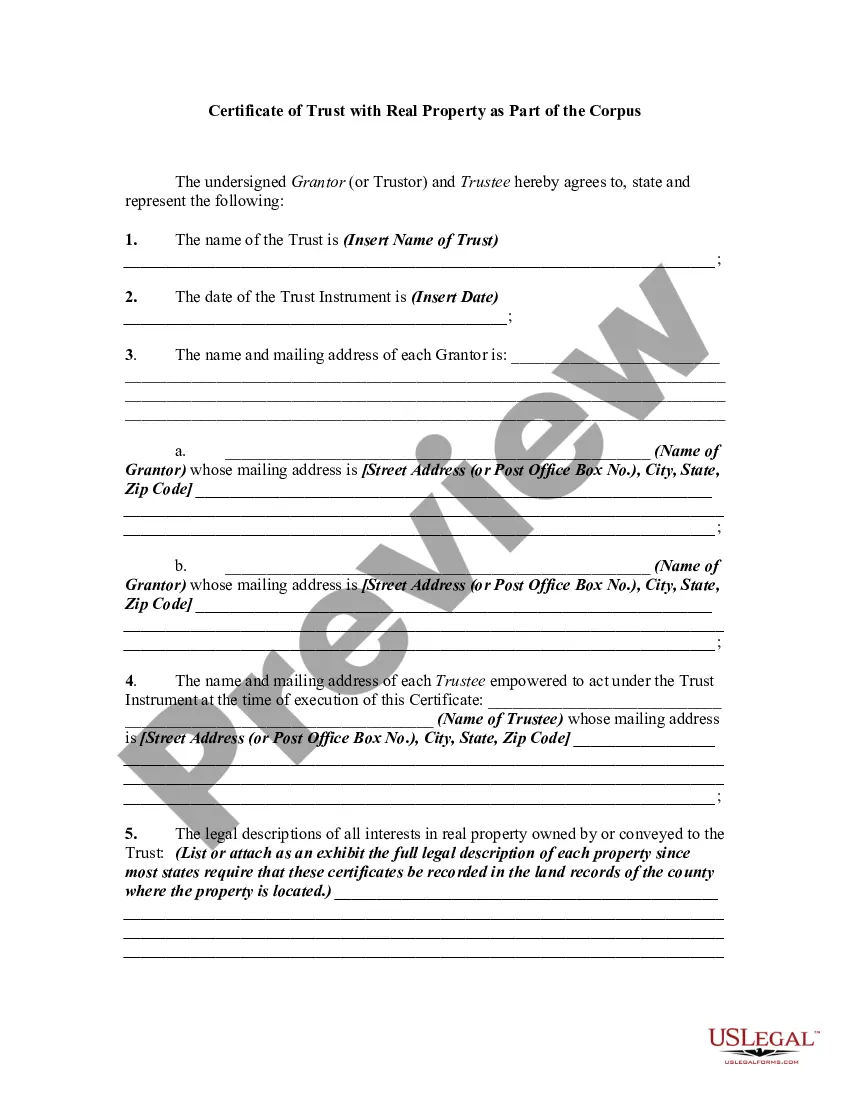

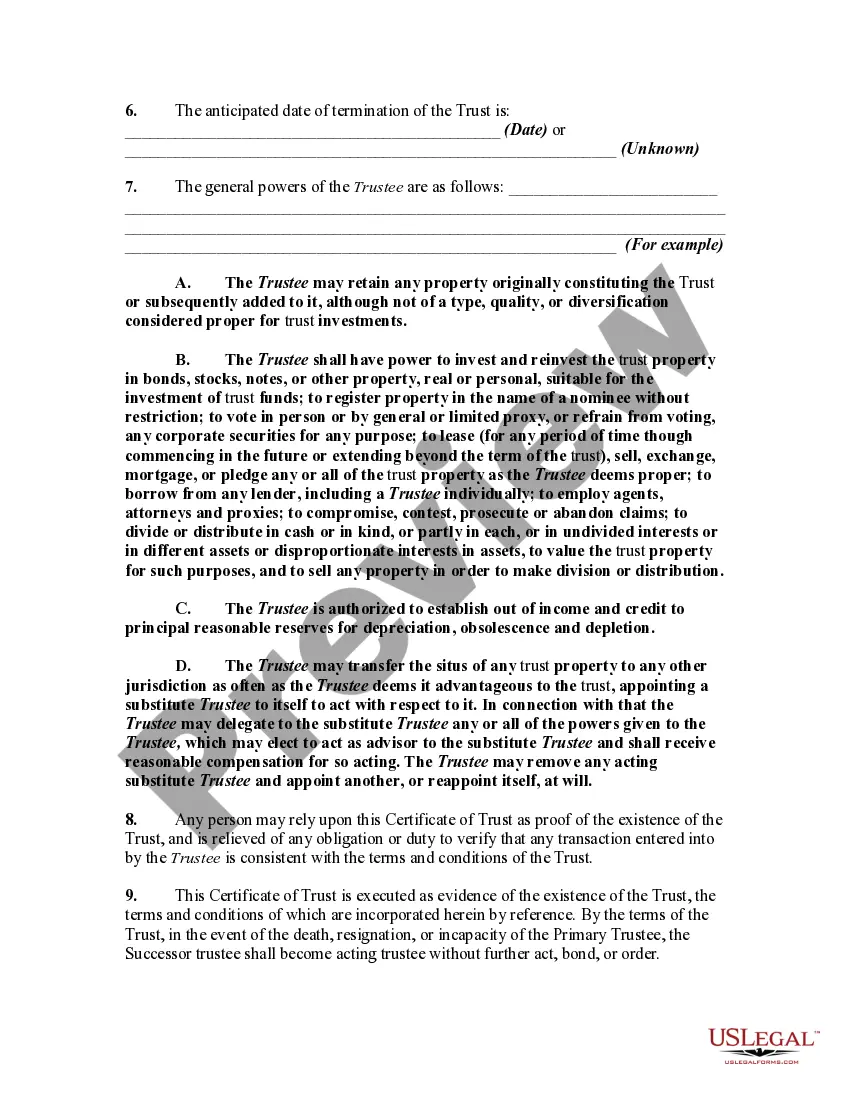

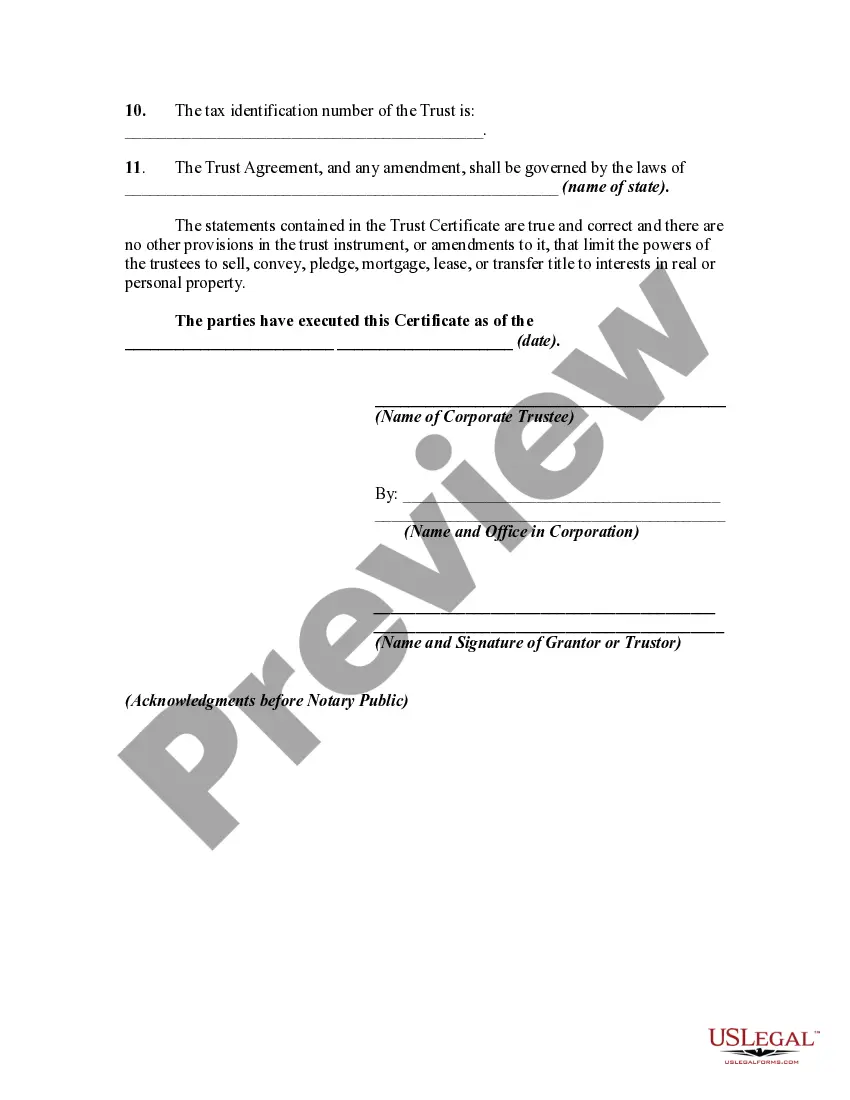

How to fill out Certificate Of Trust For Successor Trustee?

US Legal Forms - among the largest libraries of legitimate forms in the United States - delivers an array of legitimate record themes you can obtain or printing. While using website, you can find a large number of forms for enterprise and individual reasons, sorted by types, suggests, or key phrases.You will find the newest versions of forms like the South Dakota Certificate of Trust for Successor Trustee in seconds.

If you already possess a registration, log in and obtain South Dakota Certificate of Trust for Successor Trustee from the US Legal Forms catalogue. The Down load option will show up on every develop you look at. You have accessibility to all in the past downloaded forms in the My Forms tab of your respective accounts.

If you would like use US Legal Forms initially, here are straightforward directions to obtain started:

- Ensure you have chosen the proper develop for the town/state. Go through the Review option to check the form`s content material. See the develop description to actually have selected the right develop.

- If the develop does not match your needs, take advantage of the Lookup area at the top of the display to get the the one that does.

- In case you are satisfied with the shape, verify your decision by simply clicking the Get now option. Then, select the rates prepare you prefer and give your qualifications to register for an accounts.

- Method the financial transaction. Utilize your bank card or PayPal accounts to accomplish the financial transaction.

- Choose the file format and obtain the shape on your device.

- Make alterations. Load, edit and printing and sign the downloaded South Dakota Certificate of Trust for Successor Trustee.

Each and every template you included with your money lacks an expiry time which is yours permanently. So, if you wish to obtain or printing one more version, just visit the My Forms section and click in the develop you will need.

Get access to the South Dakota Certificate of Trust for Successor Trustee with US Legal Forms, by far the most comprehensive catalogue of legitimate record themes. Use a large number of skilled and express-distinct themes that fulfill your small business or individual requirements and needs.

Form popularity

FAQ

If you would like to create a living trust in South Dakota, you need to create a written trust agreement and sign it before a notary public. To make the trust effective, you must transfer your assets into it.

Unparalleled Tax Efficiency South Dakota has no state income, capital gains, dividend/interest, or intangible tax. South Dakota also has no state inheritance or estate tax. As such, assets held in a South Dakota trust are taxed under South Dakota tax law and not subject to other state's high tax rates.

South Dakota has a comprehensive statutory scheme surrounding its trust laws that promote grantor sovereignty (the grantor's ability to control and benefit from his or her assets over time), privacy, asset protection, and limited tax liability.

South Dakota is a pure no income/capital gains tax state for trusts. However, if income is distributed from the trust to a beneficiary, the distributed income is generally taxed at the beneficiary's personal rates in his/her tax residence jurisdiction.

South Dakota Decanting Statute: South Dakota requires only that a trustee have ?discretionary authority? over income or principal (without requiring that authority to be ?unfettered? or ?absolute?). Any trustee discretion over income or principal is appropriate.

The primary drawbacks to establishing a South Dakota dynastic trust are the restrictions on your financial flexibility once the trust is established and the limited flexibility imposed on beneficiaries.

Because South Dakota has no Rule Against Perpetuities, South Dakota grantors may establish a dynasty trust to retain control over trust assets forever?or at least until a court decides that the burden of administering the trust outweighs the benefit for existing beneficiaries.

Unparalleled Tax Efficiency South Dakota has no state income, capital gains, dividend/interest, or intangible tax. South Dakota also has no state inheritance or estate tax. As such, assets held in a South Dakota trust are taxed under South Dakota tax law and not subject to other state's high tax rates.