South Dakota Certificate of Trust for Mortgage

Description

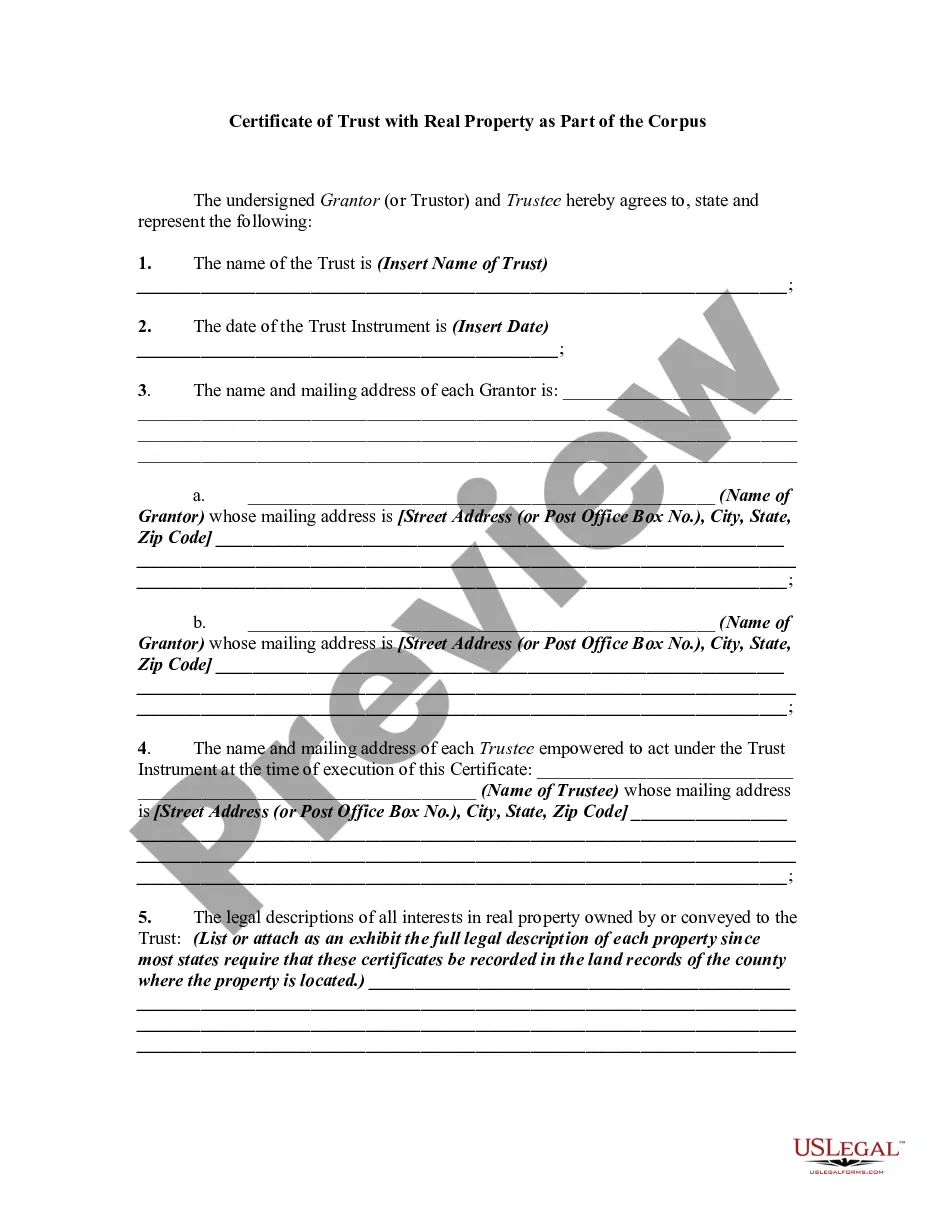

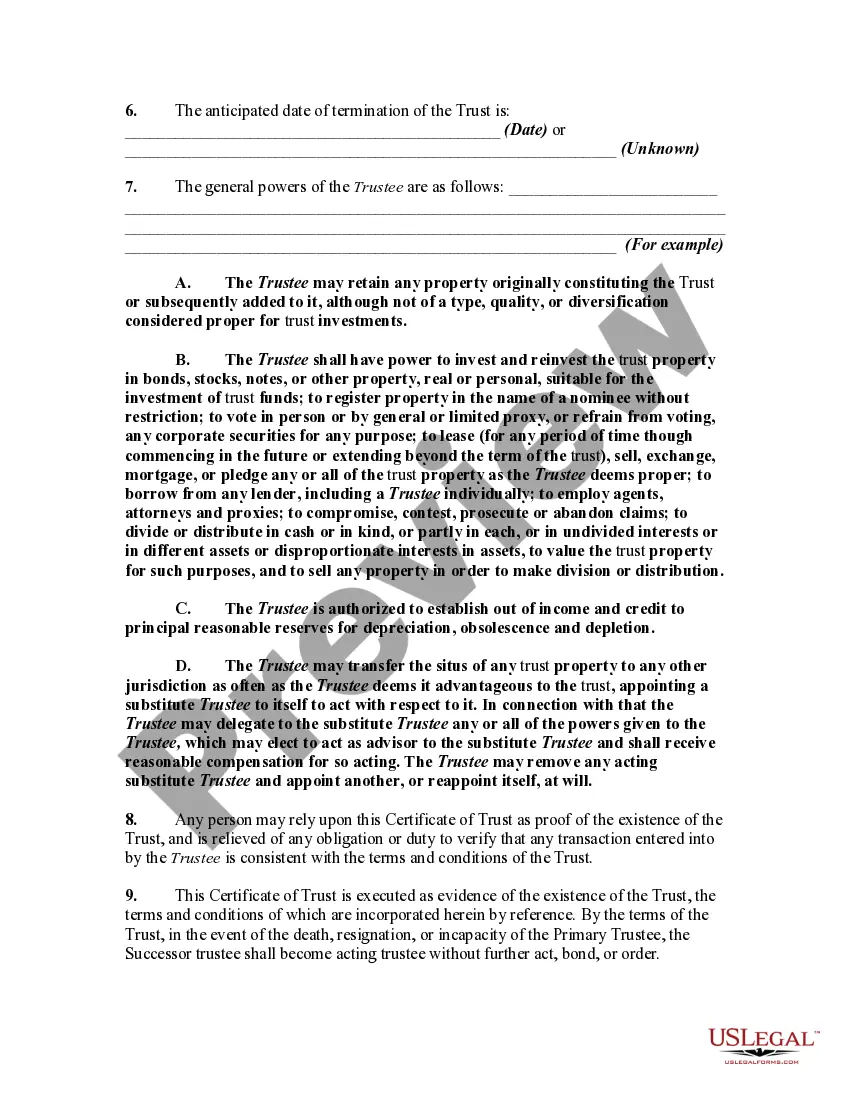

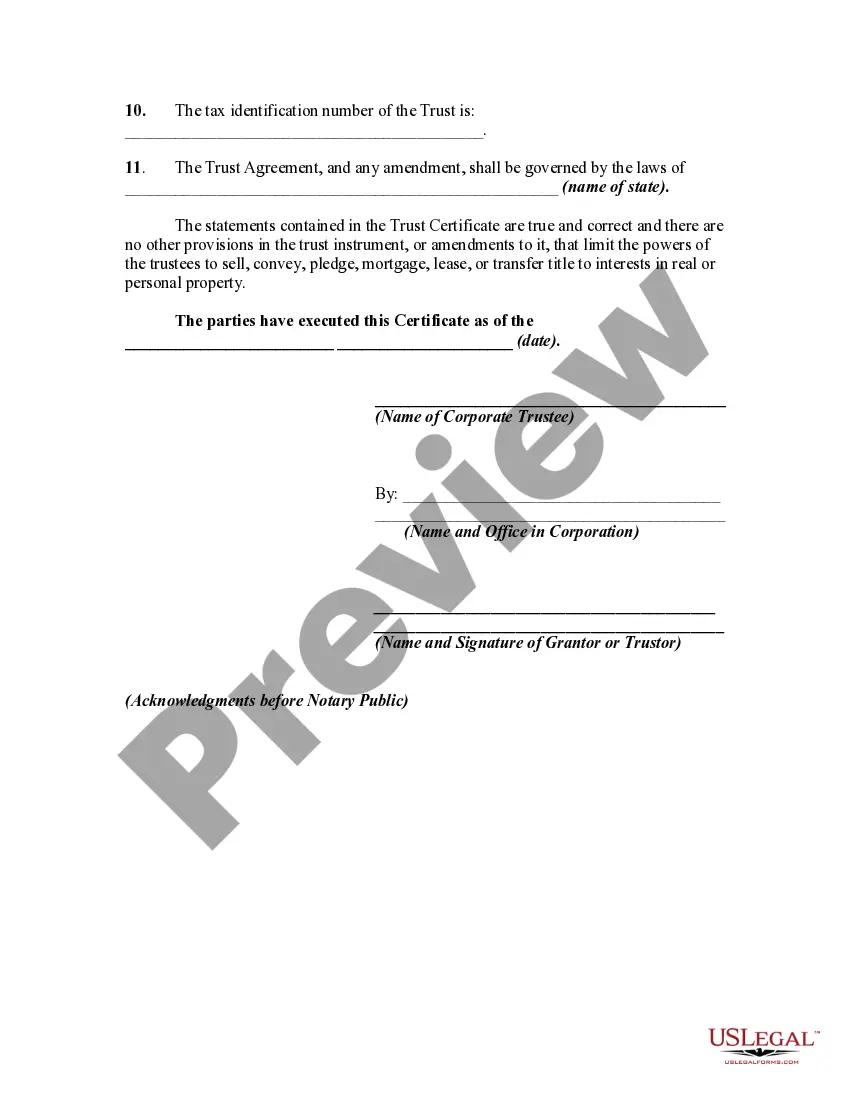

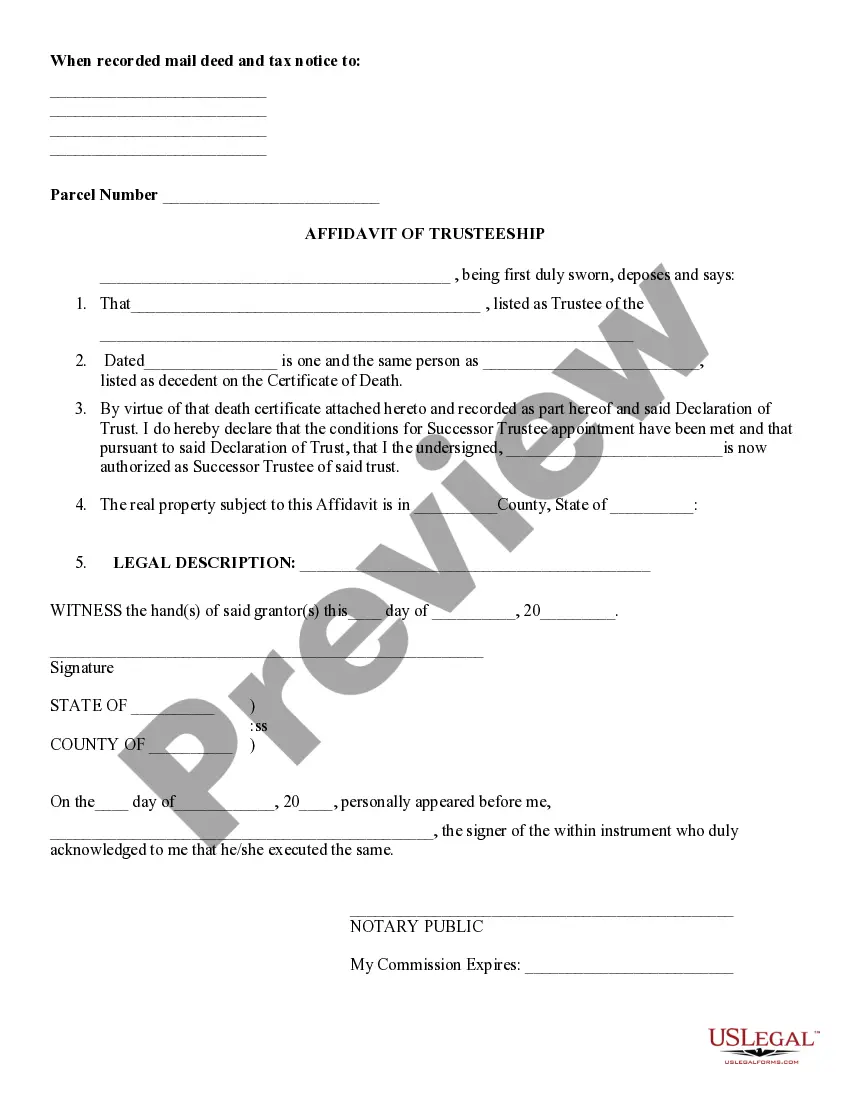

How to fill out Certificate Of Trust For Mortgage?

US Legal Forms - one of many biggest libraries of lawful forms in the States - gives a variety of lawful papers web templates you are able to obtain or print out. Utilizing the web site, you can find thousands of forms for business and person functions, categorized by groups, says, or key phrases.You will find the latest types of forms much like the South Dakota Certificate of Trust for Mortgage in seconds.

If you have a membership, log in and obtain South Dakota Certificate of Trust for Mortgage through the US Legal Forms catalogue. The Acquire key will appear on every single develop you view. You gain access to all previously acquired forms inside the My Forms tab of the profile.

If you want to use US Legal Forms the very first time, allow me to share easy instructions to help you get began:

- Make sure you have picked out the best develop for your personal town/county. Click the Review key to review the form`s articles. Look at the develop outline to actually have selected the appropriate develop.

- If the develop does not satisfy your requirements, utilize the Research field on top of the display to discover the one who does.

- If you are pleased with the form, verify your decision by clicking the Get now key. Then, select the costs strategy you prefer and provide your accreditations to register for the profile.

- Approach the financial transaction. Make use of credit card or PayPal profile to complete the financial transaction.

- Choose the format and obtain the form on the device.

- Make alterations. Complete, modify and print out and sign the acquired South Dakota Certificate of Trust for Mortgage.

Every format you put into your account lacks an expiration time and is yours eternally. So, if you wish to obtain or print out an additional duplicate, just proceed to the My Forms section and click on the develop you will need.

Gain access to the South Dakota Certificate of Trust for Mortgage with US Legal Forms, one of the most substantial catalogue of lawful papers web templates. Use thousands of specialist and status-certain web templates that meet your company or person demands and requirements.

Form popularity

FAQ

A South Dakota trust typically costs anywhere between $900 and $3,450. At Snug, any member can create a Power of Attorney and Health Care Directive for free. A Will costs $195 and a Trust costs $500. For many families, this is a great option to get you fully covered and save some money while doing it.

South Dakota has no state income, capital gains, dividend/interest, or intangible tax. South Dakota also has no state inheritance or estate tax.

If you would like to create a living trust in South Dakota, you need to create a written trust agreement and sign it before a notary public. To make the trust effective, you must transfer your assets into it. A revocable living trust is a popular estate planning option. It may be an option that will work for you.

A South Dakota trust typically costs anywhere between $900 and $3,450. At Snug, any member can create a Power of Attorney and Health Care Directive for free. A Will costs $195 and a Trust costs $500. For many families, this is a great option to get you fully covered and save some money while doing it.

South Dakota offers unlimited duration for Dynasty Trusts. The South Dakota statute basically codified the Murphy case allowing for unlimited duration trusts which the IRS acquiesced.

Unparalleled Tax Efficiency South Dakota has no state income, capital gains, dividend/interest, or intangible tax. South Dakota also has no state inheritance or estate tax. As such, assets held in a South Dakota trust are taxed under South Dakota tax law and not subject to other state's high tax rates.

Nonresident individuals who wish to take advantage of South Dakota's favorable trust laws may do so by naming a South Dakota resident trustee (whether an individual or a corporate trustee) and allowing the assets to be administered in the state.