South Dakota Burden of Proof - Physical Evidence Not Produced

Description

How to fill out Burden Of Proof - Physical Evidence Not Produced?

Selecting the optimal legitimate document format can be somewhat challenging. Obviously, there are numerous templates accessible online, but how do you acquire the appropriate type you need? Utilize the US Legal Forms website. The platform offers thousands of templates, including the South Dakota Burden of Proof - Physical Evidence Not Produced, which you can use for business and personal purposes. All of the forms are reviewed by experts and meet state and federal standards.

If you are already registered, Log In to your account and click the Download button to obtain the South Dakota Burden of Proof - Physical Evidence Not Produced. Use your account to browse through the legal forms you have previously acquired. Go to the My documents section of your account and download another version of the document you need.

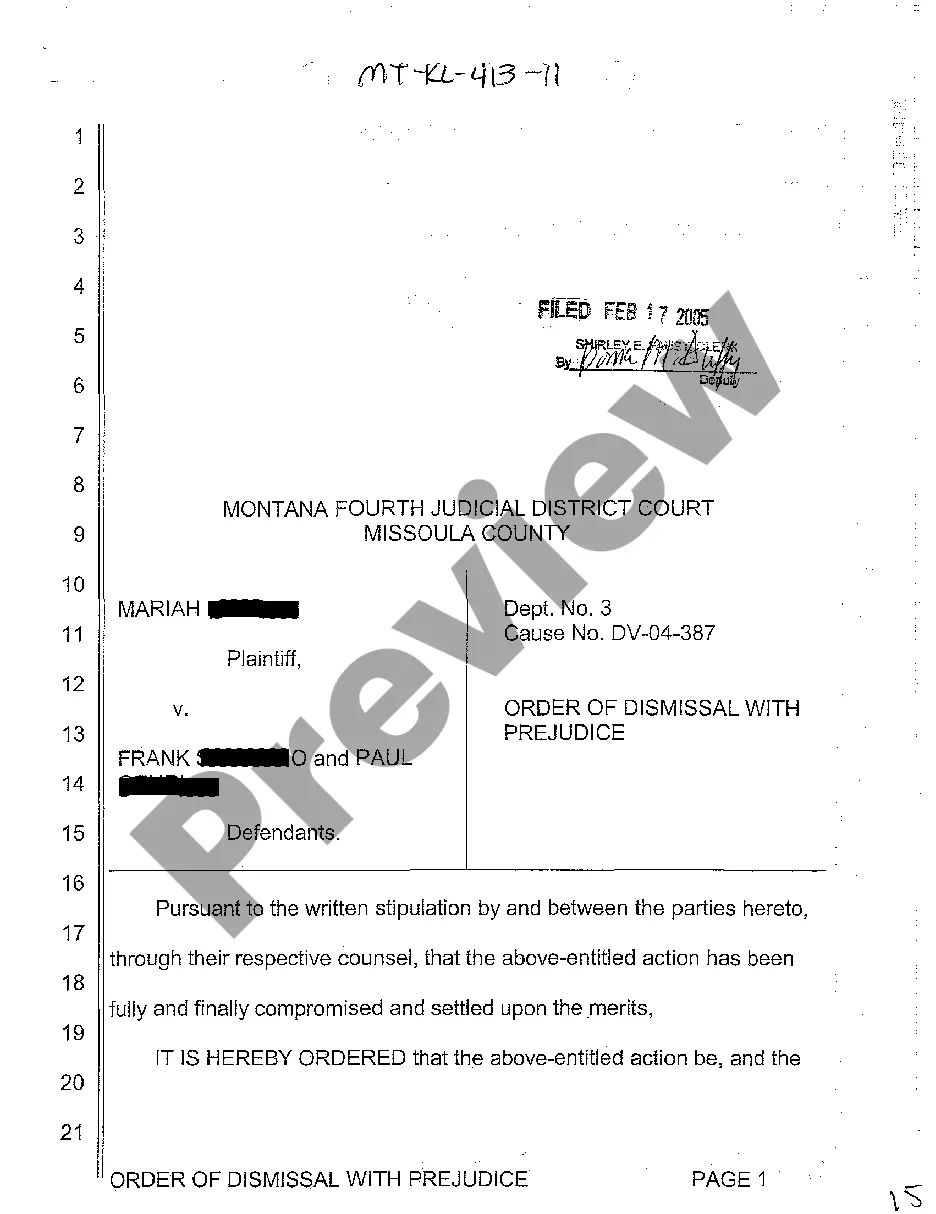

If you are a new user of US Legal Forms, here are some basic guidelines to follow: First, ensure that you have selected the correct form for your area/county. You can review the form using the Review button and examine the form description to confirm it is the suitable one for you. If the form does not meet your requirements, use the Search field to find the appropriate form. Once you are certain that the form is correct, click the Buy now button to obtain the form. Choose the pricing plan you prefer and enter the required information. Create your account and complete the purchase using your PayPal account or credit card. Select the file format and download the legal document to your device. Finally, complete, edit, print, and sign the acquired South Dakota Burden of Proof - Physical Evidence Not Produced.

In summary, US Legal Forms provides a comprehensive resource for obtaining legal templates that are tailored to meet both state and federal requirements.

- US Legal Forms is the largest collection of legal forms where you can find numerous document templates.

- Utilize the service to download properly crafted documents that comply with state regulations.

- Ensure the forms are validated by professionals.

- Access thousands of templates for various needs.

- Check the description of each form before selection.

- Register and manage your documents easily online.

Form popularity

FAQ

19-19-402 Relevant evidence generally admissible--Irrelevant evidence inadmissible. 19-19-403 Excluding relevant evidence for prejudice, confusion, waste of time, or other reasons. 19-19-404 Character evidence--Crimes or other acts. 19-19-405 Methods of proving character.

The primary drawbacks to establishing a South Dakota dynastic trust are the restrictions on your financial flexibility once the trust is established and the limited flexibility imposed on beneficiaries.

Under South Dakota trust law, dynasty trusts offer robust protection against legal claims and financial risks. When assets are transferred into a dynasty trust, they are no longer considered the property of individual beneficiaries.

Except as otherwise provided in § 53-9-11.2, an employee may agree with an employer at the time of employment or at any time during employment not to engage directly or indirectly in the same business or profession as that of the employer for any period not exceeding two years from the date of termination of the ...

34-20G-74. Intentional cannabis sale or transfer to unauthorized person by medical cannabis establishment or agent as felony--Disqualification.

South Dakota allows for a trust to exist in perpetuity, i.e., for an unlimited duration.

What makes South Dakota special? South Dakota has no state income, capital gains, dividend/interest, or intangible tax. South Dakota also has no state inheritance or estate tax. As such, assets held in a South Dakota trust are taxed under South Dakota tax law and not subject to other state's high tax rates.

South Dakota was the first state in the nation to abolish the Rule Against Perpetuities ? which prohibited unlimited-duration trusts ? in 1983, clearing the way for the creation of the Dynasty Trust.