South Dakota Warehouse Receipt for Cotton is a legal document issued by a warehouse operator in South Dakota to acknowledge the receipt of cotton stored in their facility. This warehouse receipt serves as proof of ownership and provides important details about the stored cotton, such as quantity, grade, condition, and other relevant information. The South Dakota Warehouse Receipt for Cotton is crucial for cotton producers, sellers, and buyers as it establishes a record of ownership and facilitates smooth transactions in the cotton market. It ensures transparency and accountability in the storage and movement of cotton. Different types of South Dakota Warehouse Receipt for Cotton may include: 1. Standard Warehouse Receipt: This type of receipt is issued for cotton that meets the standard quality criteria specified by the warehouse operator. It contains information about the type of cotton, its quality, and any other relevant details. 2. Grade-Specific Warehouse Receipt: In some cases, warehouse operators may issue separate receipts based on the grade of cotton stored. These receipts provide detailed information about the specific grade, allowing buyers and sellers to make informed decisions based on the quality of the cotton. 3. Commodity-Specific Receipt: South Dakota Warehouse Receipts for Cotton can also be categorized based on the type or variety of cotton stored. This type of receipt provides information specific to the type of cotton stored, allowing parties involved in the cotton trade to identify and differentiate various cotton commodities. 4. Temporary Warehouse Receipt: Sometimes, cotton may be stored temporarily before being transported to another location or processed further. Warehouse operators can issue temporary receipts for such situations, providing information about the temporary storage period and necessary details for identifying the stored cotton. It is important to note that the exact categorization and terminology of South Dakota Warehouse Receipts for Cotton may vary based on the specific warehouse operator and the regulations in place. However, regardless of the type, these receipts play a crucial role in documenting and facilitating the cotton trading process, ensuring trust and accountability among all parties involved.

South Dakota Warehouse Receipt for Cotton

Description

How to fill out Warehouse Receipt For Cotton?

Are you currently in a situation where you require documents for either business or personal purposes almost all the time.

There are numerous authentic document templates accessible online, but locating ones you can rely on is challenging.

US Legal Forms provides thousands of form templates, including the South Dakota Warehouse Receipt for Cotton, designed to comply with federal and state requirements.

If you find the correct form, click Get now.

Choose the payment plan you require, complete the necessary information to create your account, and pay for your order using your PayPal or credit card. Select a convenient document format and download your copy. You can access all the document templates you have purchased in the My documents menu. You may obtain an additional copy of the South Dakota Warehouse Receipt for Cotton at any time by simply following the requisite form to download or print the document template. Utilize US Legal Forms, the most extensive collection of authentic forms, to save time and avoid errors. The service offers properly crafted legal document templates that can be used for a variety of purposes. Create your account on US Legal Forms and begin simplifying your life.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the South Dakota Warehouse Receipt for Cotton template.

- If you do not possess an account and want to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/state.

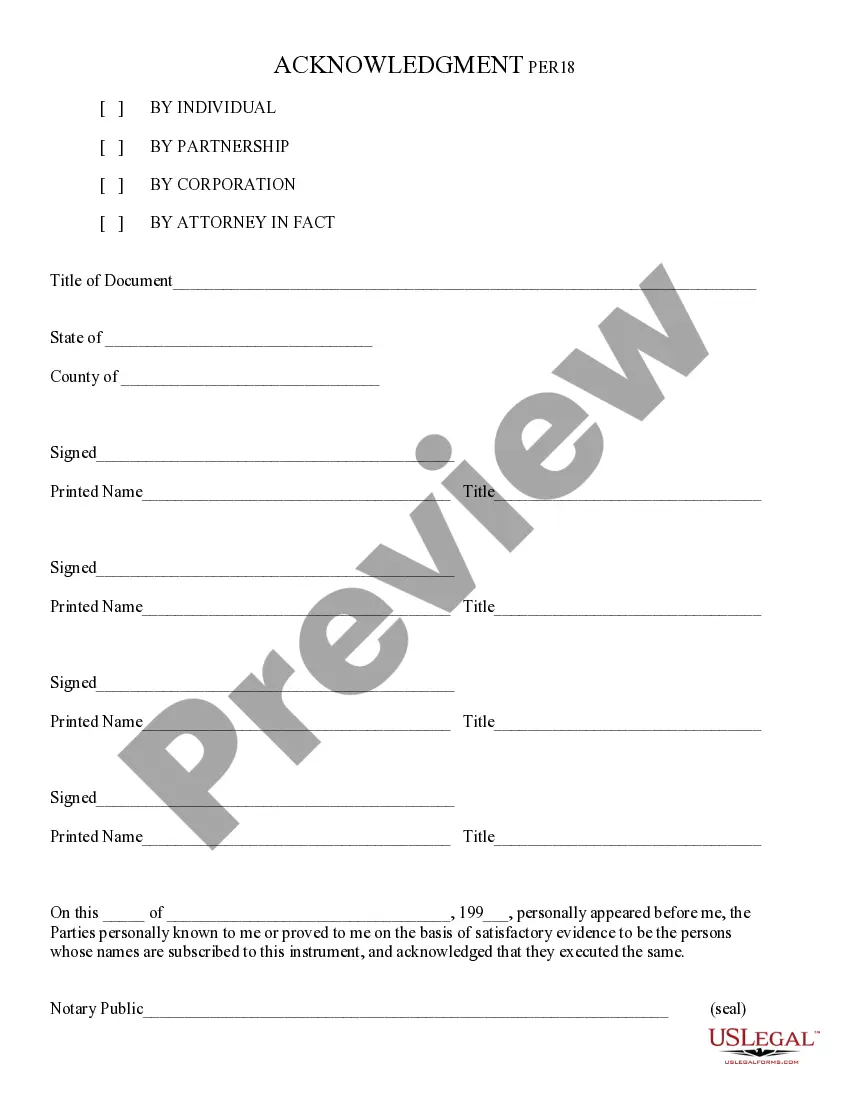

- Utilize the Preview button to examine the form.

- Read the description to confirm you have selected the right form.

- If the form is not what you’re looking for, use the Lookup field to find the form that suits your needs and requirements.

Form popularity

FAQ

Yes, a warehouse receipt can function as a negotiable instrument if it is made to be transferable. When you hold a South Dakota Warehouse Receipt for Cotton, you can easily transfer it to others, which allows for smooth transactions and ownership changes in the cotton market. This characteristic boosts liquidity and is vital for trade.

negotiable warehouse receipt is one that does not allow transfer of the ownership rights. This means the South Dakota Warehouse Receipt for Cotton in nonnegotiable form requires the named party to claim the cotton, and others cannot use it for ownership transfer. While it provides security to the named party, it limits the flexibility in trading.

A warehouse receipt can qualify as a negotiable instrument if it meets specific legal requirements. With the South Dakota Warehouse Receipt for Cotton, holders can transfer the receipt to others, allowing them to claim the cotton stored in a warehouse. This property makes it highly beneficial for commercial transactions.

Yes, a warehouse receipt can be classified as a security under certain circumstances. Specifically, the South Dakota Warehouse Receipt for Cotton acts like a security when it is transferable and entitles the holder to take possession of the cotton. This classification enables easier trading and investments in agricultural products.

A South Dakota Warehouse Receipt for Cotton typically includes vital details such as the name of the warehouse, the date of issuance, a description of the cotton, and the signature of the warehouse operator. It also provides information about the owner's rights and any terms related to the storage of the cotton. All these components work together to create a valid legal document.

To make a warehouse receipt, gather the essential data regarding the cotton, including its weight, type, and storage conditions. You can then format this information into a clear document. For precision and compliance with South Dakota's legal requirements, using a platform like USLegalForms is advisable to ensure your South Dakota Warehouse Receipt for Cotton is accurate and legally enforceable.

Making a homemade warehouse receipt involves starting with a basic template that includes key information. Be sure to add details such as the type and quantity of cotton, the date of issuance, and both parties' signatures. While a homemade receipt may be convenient, consider using a reliable service like USLegalForms for a professionally crafted South Dakota Warehouse Receipt for Cotton.

The two main types of warehouse receipts are negotiable and non-negotiable. A negotiable South Dakota Warehouse Receipt for Cotton allows the holder to transfer ownership of the cotton by simply endorsing the receipt. In contrast, a non-negotiable receipt does not confer transfer rights and is typically used for record-keeping purposes.

A South Dakota Warehouse Receipt for Cotton serves as proof of ownership for the goods stored inside the warehouse. It shows that the holder of the receipt has rights to the specified cotton, which can be important for transactions or disputes. This document is legally binding and provides a clear record of ownership for stakeholders.

To create a South Dakota Warehouse Receipt for Cotton, first, ensure you have all necessary details about the cotton being stored. This includes the type of cotton, quantity, and storage location. Next, fill out the warehouse receipt template with this information, and make sure it complies with South Dakota regulations. Finally, sign the receipt to make it valid.